Schedule K1 Form 1065 Instructions

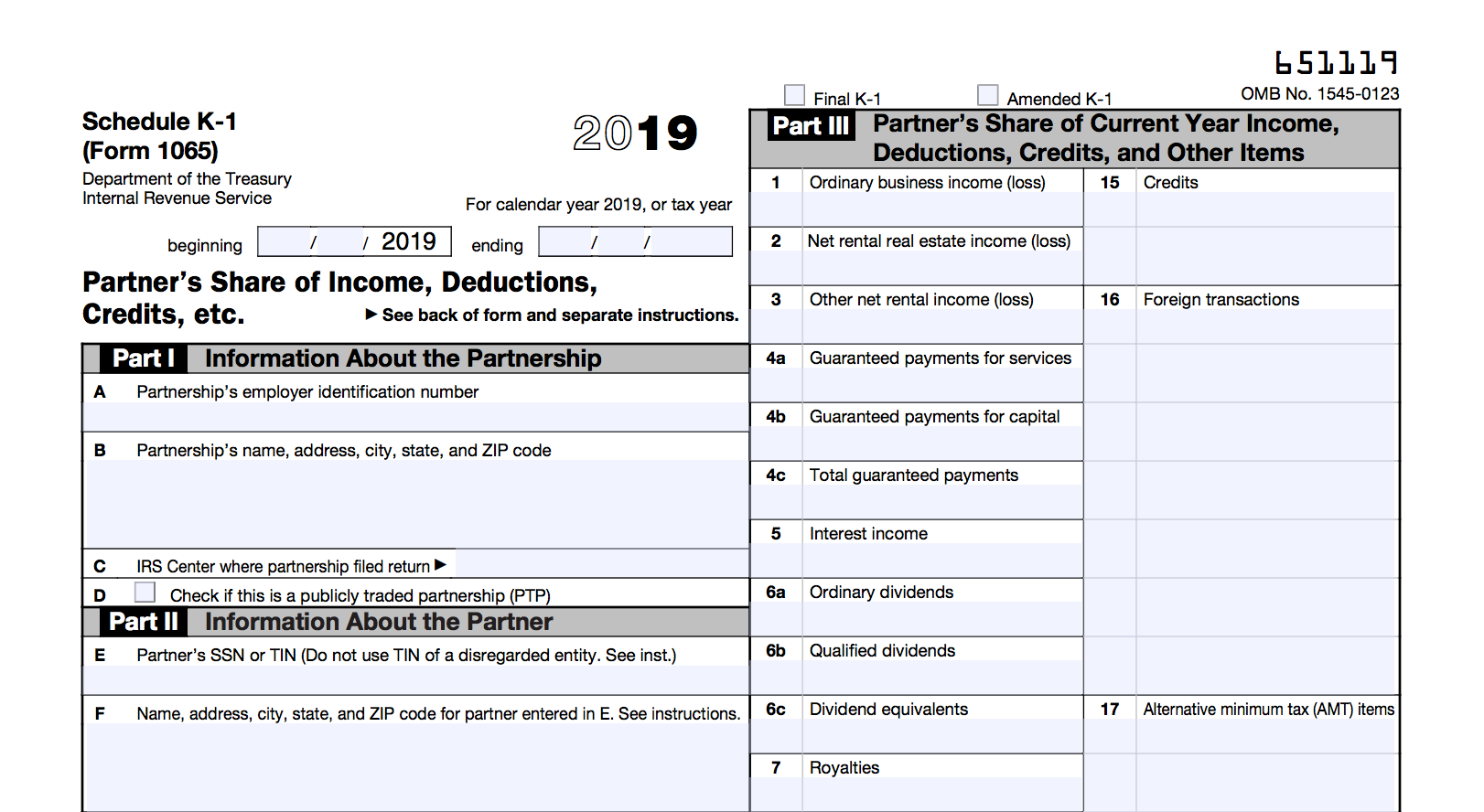

Schedule K1 Form 1065 Instructions - Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. This code will let you know if you should. For calendar year 2022, or tax year beginning / / 2022. Department of the treasury internal revenue service. The new schedules are designed to provide greater clarity for partners on how to compute their u.s. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. For calendar year 2019, or tax year beginning. 4 digit code used to. Income tax liability with respect. Web after completing schedule b, you can move on to schedule k.

For calendar year 2019, or tax year beginning. This code will let you know if you should. Keep it for your records. Income tax liability with respect. Don’t file it with your tax return. Department of the treasury internal revenue service. The new schedules are designed to provide greater clarity for partners on how to compute their u.s. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. Department of the treasury internal revenue service. The difference is that form 1065 is a.

Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. Web after completing schedule b, you can move on to schedule k. This code will let you know if you should. For calendar year 2022, or tax year beginning / / 2022. For calendar year 2019, or tax year beginning. Return of partnership income.the partnership then provides each. Department of the treasury internal revenue service. The new schedules are designed to provide greater clarity for partners on how to compute their u.s. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. 4 digit code used to.

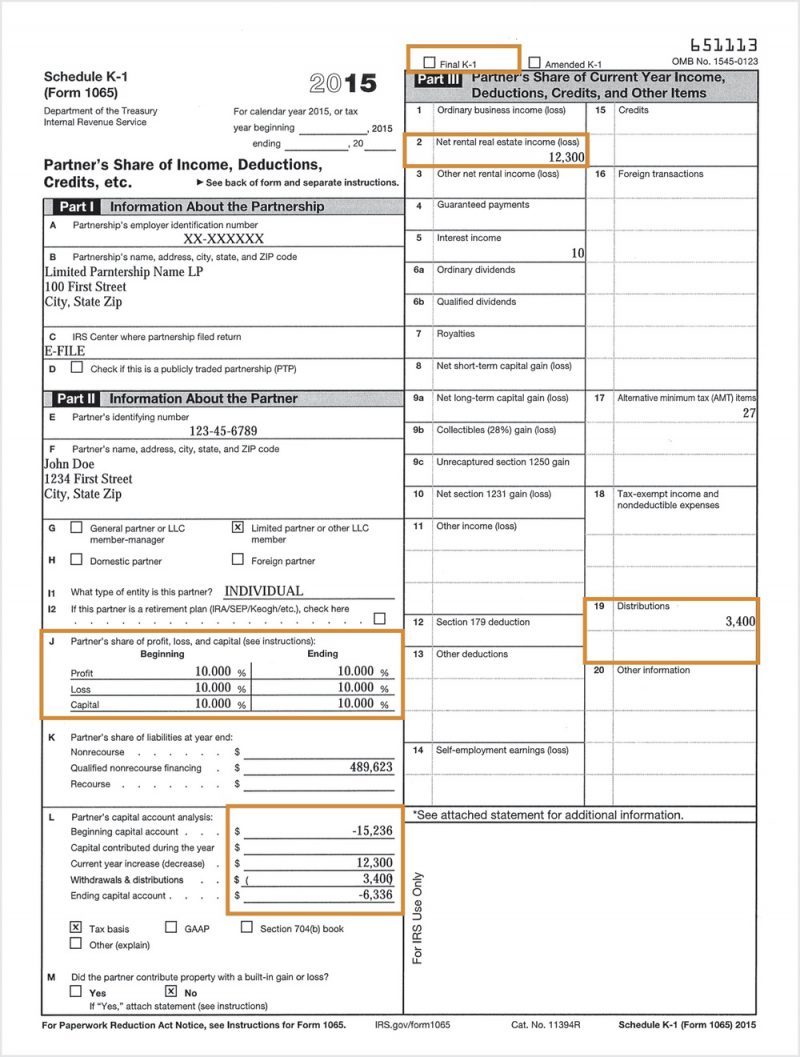

Schedule K1 Tax Form Here’s What You Need to Know LendingTree

Don’t file it with your tax return. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. Web after completing schedule b, you can move on to schedule k. 4 digit code used to. Department of the treasury internal revenue service.

What is a Schedule K1 Tax Form, Meru Accounting

4 digit code used to. The difference is that form 1065 is a. For calendar year 2019, or tax year beginning. Income tax liability with respect. Don’t file it with your tax return.

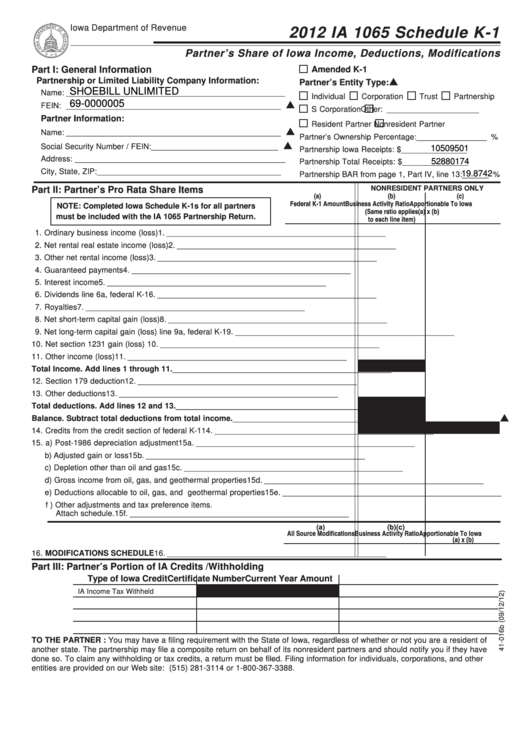

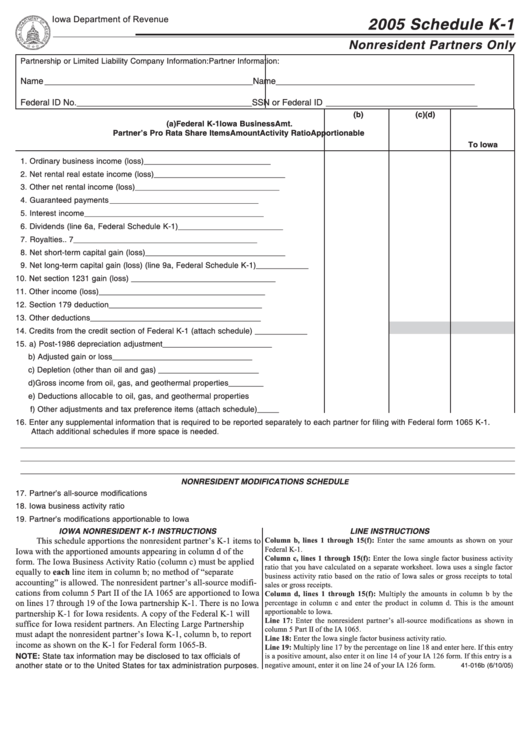

Fillable Form Ia 1065 Schedule K1 Partner'S Share Of Iowa

Don’t file it with your tax return. 4 digit code used to. The difference is that form 1065 is a. For calendar year 2019, or tax year beginning. For calendar year 2022, or tax year beginning / / 2022.

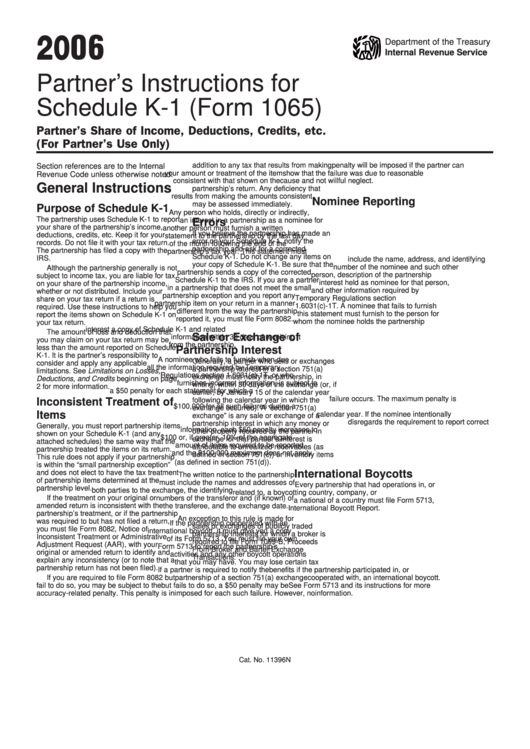

Inst 1065B (Schedule K1)Instructions for Schedule K1 (Form 1065B…

Keep it for your records. This code will let you know if you should. The difference is that form 1065 is a. 4 digit code used to. Don’t file it with your tax return.

Schedule K1 Form 1065 Box 16 Codes Armando Friend's Template

Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Don’t file it with your tax return. For calendar year 2022, or tax year beginning / / 2022. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other.

Form 8865 (Schedule K1) Partner's Share of Deductions and

The difference is that form 1065 is a. This code will let you know if you should. Department of the treasury internal revenue service. Department of the treasury internal revenue service. Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership.

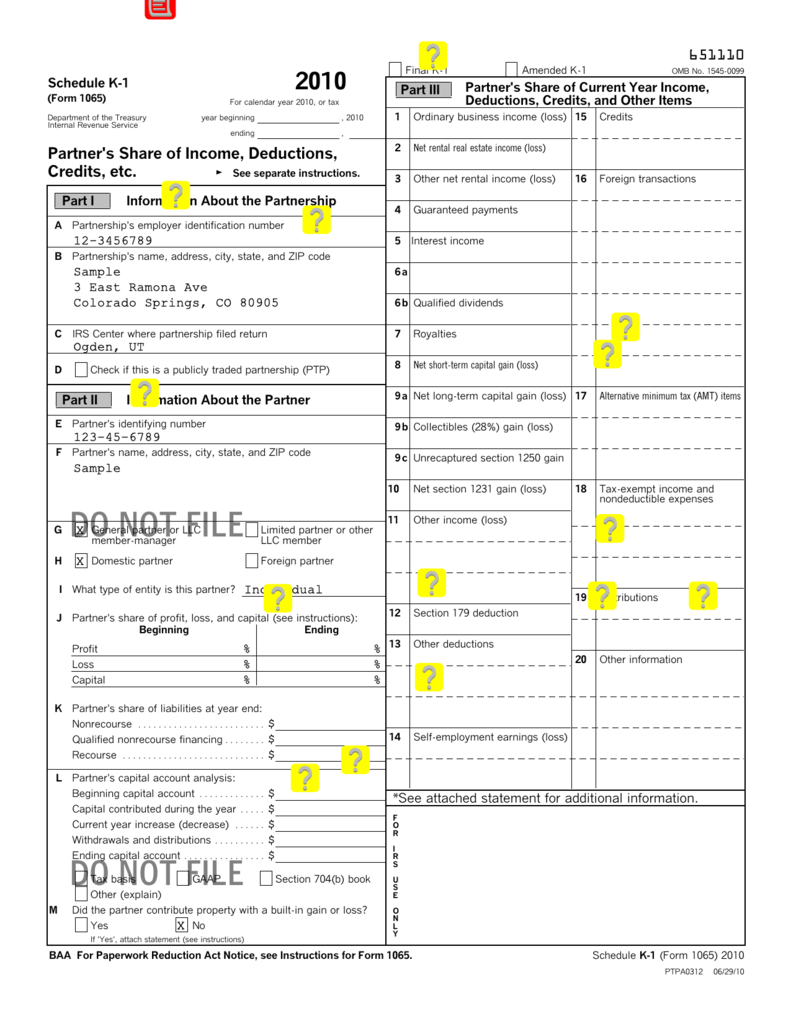

Fillable Schedule K1 (Form 1065) Partner'S Share Of

Ending / / partner’s share of. Don’t file it with your tax return. The difference is that form 1065 is a. Department of the treasury internal revenue service. Income tax liability with respect.

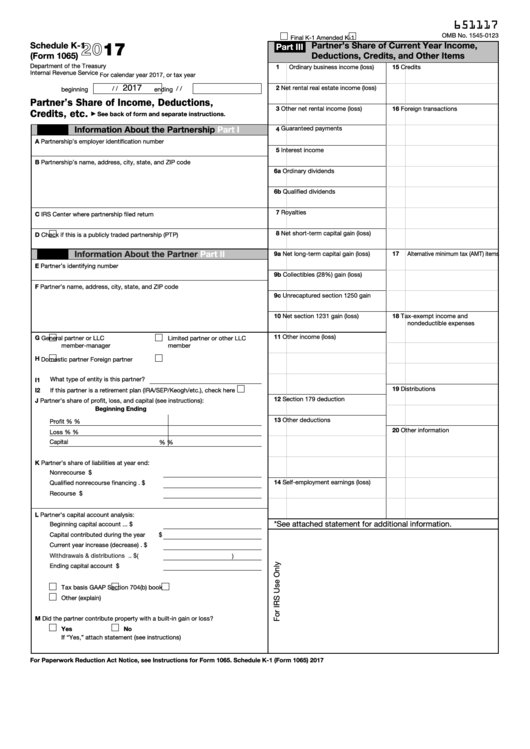

Schedule K1 / 1065 Tax Form Guide LP Equity

The new schedules are designed to provide greater clarity for partners on how to compute their u.s. This code will let you know if you should. For calendar year 2022, or tax year beginning / / 2022. The difference is that form 1065 is a. Keep it for your records.

Fillable Form Ia 1065 Schedule K1 Nonresident Partners Only 2005

Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. The new schedules are designed to provide greater clarity for partners on how to compute their u.s. The difference is that form 1065 is a. 4 digit code used to. Income tax liability with respect.

Instructions For Schedule K1 (Form 1065) Partner'S Share Of

For calendar year 2019, or tax year beginning. For calendar year 2022, or tax year beginning / / 2022. This code will let you know if you should. Department of the treasury internal revenue service. Web after completing schedule b, you can move on to schedule k.

Don’t File It With Your Tax Return.

The difference is that form 1065 is a. Web after completing schedule b, you can move on to schedule k. Return of partnership income.the partnership then provides each. This code will let you know if you should.

4 Digit Code Used To.

Web form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. For calendar year 2019, or tax year beginning. Department of the treasury internal revenue service. The new schedules are designed to provide greater clarity for partners on how to compute their u.s.

Web The Partnership Should Use This Code To Report Your Share Of Income/Gain That Comes From Your Total Net Section 743 (B) Basis Adjustments.

For calendar year 2022, or tax year beginning / / 2022. Income tax liability with respect. Keep it for your records. Ending / / partner’s share of.