Sec Form 5

Sec Form 5 - The sec is able to use the information in sec form 4 when referring a case. Web form 5 is used to report any transactions in the company’s equity securities that you engaged in during the company’s most recently completed fiscal year that were not. 20549 annual statement of changes in beneficial. Web form 5 is an sec filing submitted to the securities and exchange commission on an annual basis by company officers, directors, or beneficial (10%) owners, which. Web companies must submit this lengthy annual filing within 60 to 90 days of the close of their fiscal year. Web what’s a form 5? Web united states securities and exchange commission washington, d.c. Web summary of supplemental files: The federal securities laws require certain individuals (such as officers, directors, and those that hold more than 10% of any class of a company’s securities,. A full form u5 is used when terminating an individual from the firm.

Web a form 5 is generally due to the sec no later than 45 days after the company’s fiscal year ends and is only required from an insider when at least one. The sec is able to use the information in sec form 4 when referring a case. Open it up using the online editor and start adjusting. Web where more than one benefi cial owner of the same equity securities must report on form 5, such owners may fi le form 5 individually or jointly. Impacted advisers are required to comply with these. Registrations with all sros and jurisdictions will be terminated. This page provides links to pdf versions of sec public forms. Web section 16 beneficial ownership forms: Web summary of supplemental files: A full form u5 is used when terminating an individual from the firm.

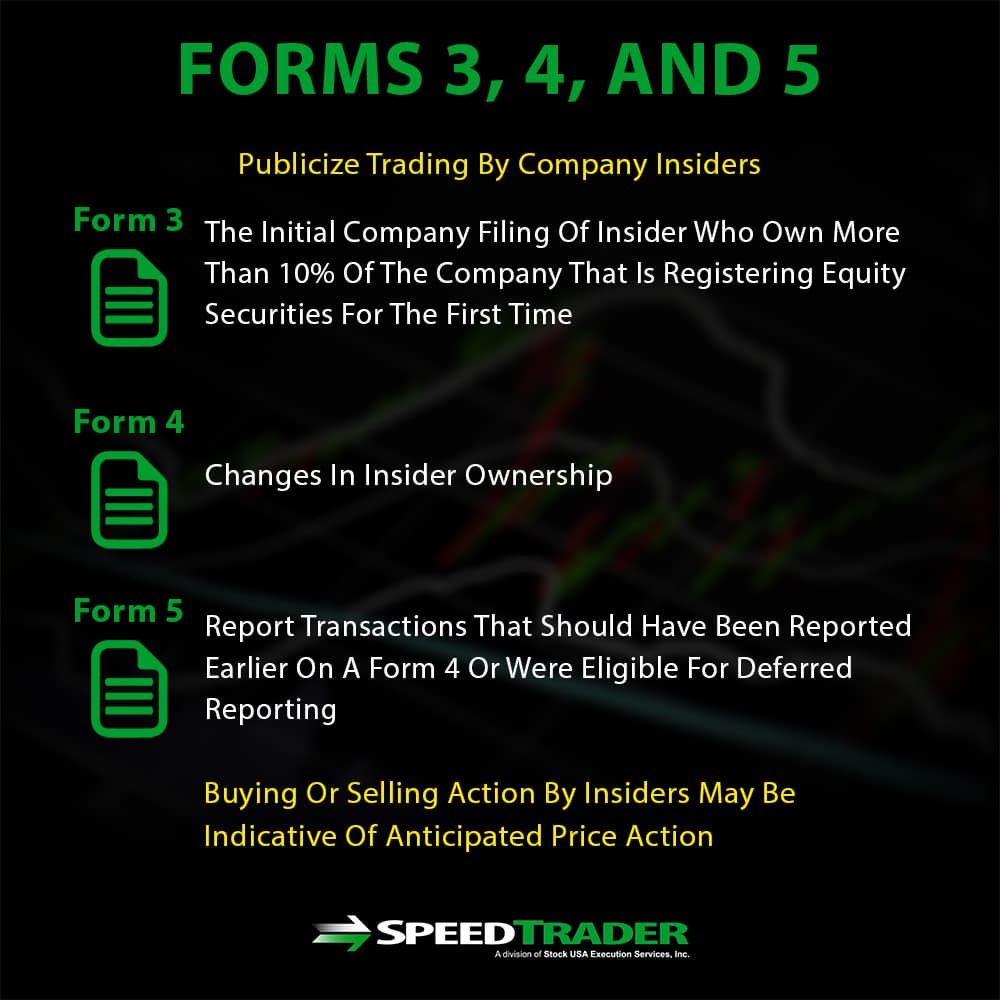

Web forms 3, 4 and 5. Registrations with all sros and jurisdictions will be terminated. Joint and group fi lings may be. The sec no longer accepts paper filings of forms 3, 4, and 5 (except in rare cases where hardship exemption is granted). Open it up using the online editor and start adjusting. This page provides links to pdf versions of sec public forms. Web form 5 is used to report any transactions in the company’s equity securities that you engaged in during the company’s most recently completed fiscal year that were not. The federal securities laws require certain individuals (such as officers, directors, and those that hold more than 10% of any class of a company’s securities,. Web where more than one benefi cial owner of the same equity securities must report on form 5, such owners may fi le form 5 individually or jointly. A full form u5 is used when terminating an individual from the firm.

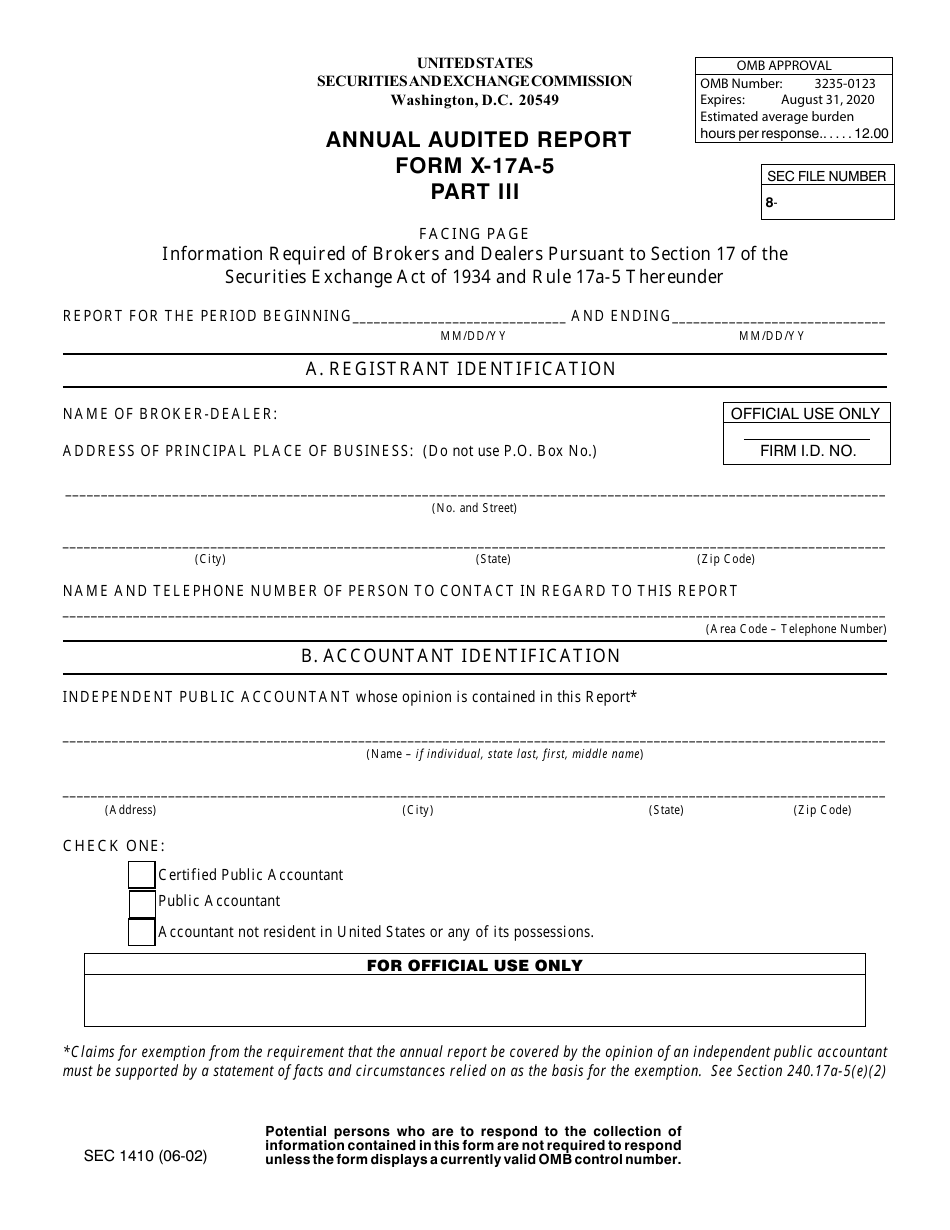

SEC Form 1410 (X17A5) Part III Download Fillable PDF or Fill Online

Select “a noncitizen authorized to work until;” and. Web section 16 beneficial ownership forms: Web where more than one benefi cial owner of the same equity securities must report on form 5, such owners may fi le form 5 individually or jointly. A full form u5 is used when terminating an individual from the firm. Section 5 seeks to promote.

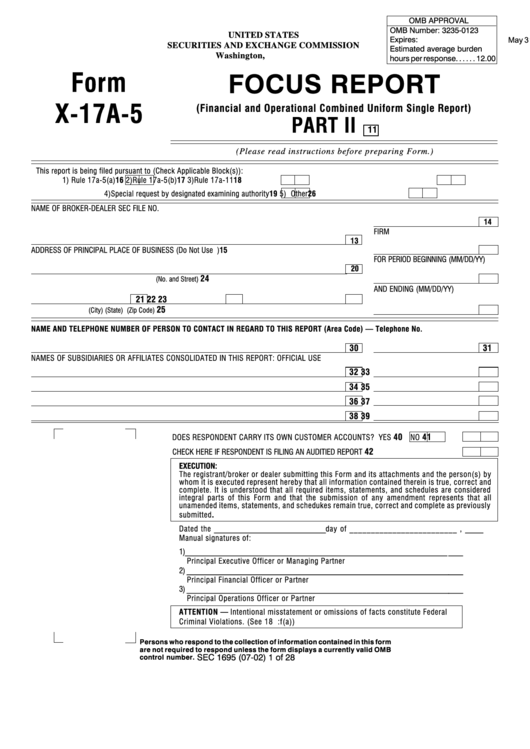

Focus Report Sec Form X 17a 5 printable pdf download

Section 5 seeks to promote mandatory disclosures by requiring registration statements and to ensure potential investors only have access to information. Web 168 rows forms list. Impacted advisers are required to comply with these. The sec no longer accepts paper filings of forms 3, 4, and 5 (except in rare cases where hardship exemption is granted). Web in section 1,.

SEC Filings Introduction What You Need to Know

Web forms 3, 4 and 5. Engaged parties names, addresses and numbers etc. Web companies must submit this lengthy annual filing within 60 to 90 days of the close of their fiscal year. Web a form 5 is generally due to the sec no later than 45 days after the company’s fiscal year ends and is only required from an.

What Is SEC Form 5 SEC Reporting Requirements Securities Lawyer 101

Web in section 1, new employees presenting an ead automatically extended by an individual notice must: The sec no longer accepts paper filings of forms 3, 4, and 5 (except in rare cases where hardship exemption is granted). Web forms 3, 4 and 5. Joint and group fi lings may be. Web form 5 is an sec filing submitted to.

What Is SEC Form 5 & When Is It Due? Securities Lawyer 101

Web form 5 is used to report any transactions in the company’s equity securities that you engaged in during the company’s most recently completed fiscal year that were not. Section 5 seeks to promote mandatory disclosures by requiring registration statements and to ensure potential investors only have access to information. Web form 5 allows the individual 45 days following the.

EL Sec Yearly Scheme of Work Form 5 Sample 1 Poetry Verb

20549 annual statement of changes in beneficial ownership of securities. Open it up using the online editor and start adjusting. Due before end of 2nd business day. Web popular problems trigonometry find the exact value sec (5) sec(5) sec ( 5) the result can be shown in multiple forms. United states securities and exchange commission washington, d.c.

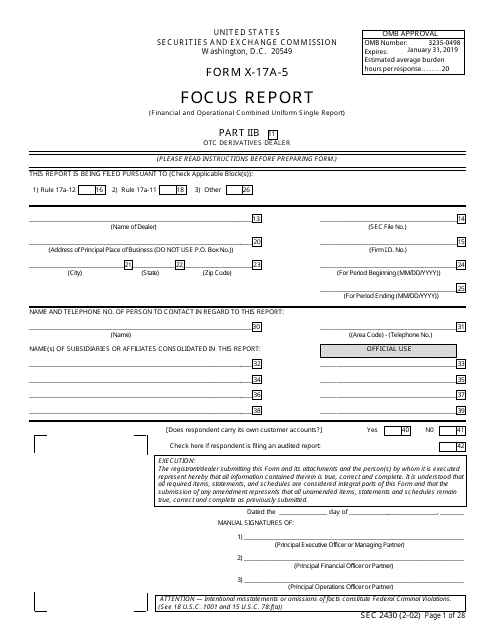

SEC Form 2430 (X17A5) Part IIB Download Printable PDF or Fill Online

Web 168 rows forms list. Web sec form 5 form 5 united states securities and exchange commission washington, d.c. Select “a noncitizen authorized to work until;” and. Web companies must submit this lengthy annual filing within 60 to 90 days of the close of their fiscal year. Control catalog spreadsheet the entire security and privacy control catalog in spreadsheet format.

SEC Form 5 Overview

Impacted advisers are required to comply with these. Web form 5 is an sec filing submitted to the securities and exchange commission on an annual basis by company officers, directors, or beneficial (10%) owners, which. Web a form 5 is generally due to the sec no later than 45 days after the company’s fiscal year ends and is only required.

SEC Form 4 Definition

Web what’s a form 5? Web summary of supplemental files: A form 5 is generally due to the sec no later than 45 days after the company’s fiscal year ends and is only required from an insider when at least one. Joint and group fi lings may be. Web where more than one benefi cial owner of the same equity.

SEC Form 5 Overview

Select “a noncitizen authorized to work until;” and. As such, the due date for form 5 filings for the year ended december 31, 2014 will be february 14, 2015. A full form u5 is used when terminating an individual from the firm. 20549 annual statement of changes in beneficial ownership of securities. Due before end of 2nd business day.

Sec(5) Sec ( 5) Decimal Form:

Web companies must submit this lengthy annual filing within 60 to 90 days of the close of their fiscal year. Registrations with all sros and jurisdictions will be terminated. Web in section 1, new employees presenting an ead automatically extended by an individual notice must: 20549 annual statement of changes in beneficial.

Control Catalog Spreadsheet The Entire Security And Privacy Control Catalog In Spreadsheet Format.

Engaged parties names, addresses and numbers etc. Web form 5 is an sec filing submitted to the securities and exchange commission on an annual basis by company officers, directors, or beneficial (10%) owners, which. The sec no longer accepts paper filings of forms 3, 4, and 5 (except in rare cases where hardship exemption is granted). Impacted advisers are required to comply with these.

Web Form 5 Is Used To Report Any Transactions In The Company’s Equity Securities That You Engaged In During The Company’s Most Recently Completed Fiscal Year That Were Not.

Due 10 days after the event an individual becomes a reporting person. Web form 5 allows the individual 45 days following the close of the company's fiscal year. Web summary of supplemental files: Web forms 3, 4 and 5.

Select “A Noncitizen Authorized To Work Until;” And.

20549 annual statement of changes in beneficial ownership filed. This page provides links to pdf versions of sec public forms. Web popular problems trigonometry find the exact value sec (5) sec(5) sec ( 5) the result can be shown in multiple forms. The federal securities laws require certain individuals (such as officers, directors, and those that hold more than 10% of any class of a company’s securities,.

:max_bytes(150000):strip_icc()/SECForm5Page1-b7c38e77c3bd4e0e930266dad63b9d25.jpg)

/GettyImages-1150533165-d27f9e5222ce4bd28de99233b36e0685.jpg)

:max_bytes(150000):strip_icc()/SECForm5Page2-2c2e37c963de4eaa9ec850d1e94bebe3.jpg)