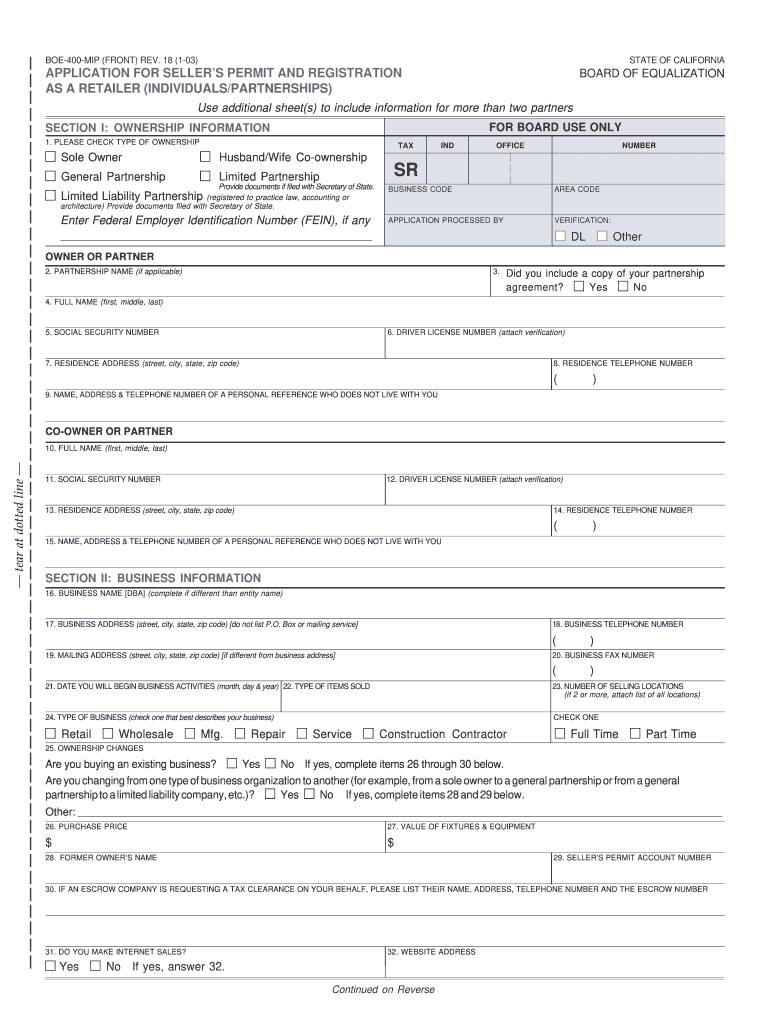

Seller's Permit Form California

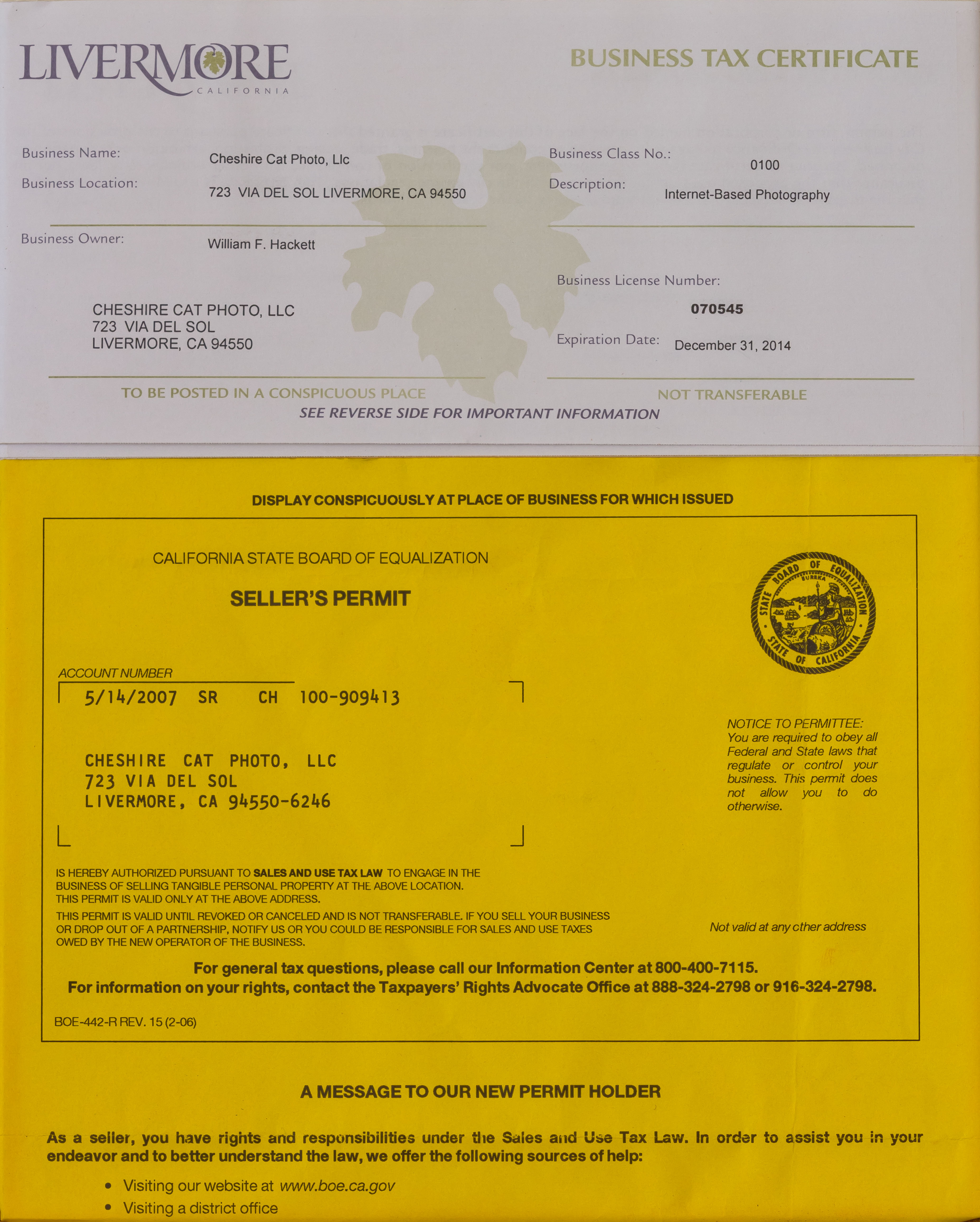

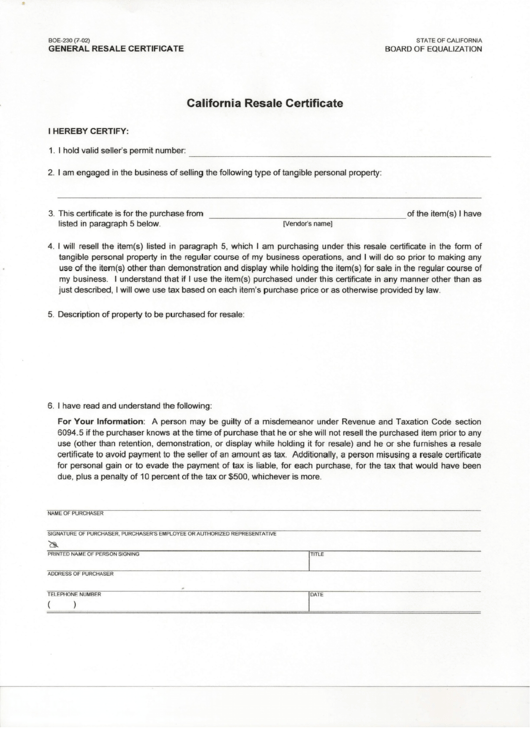

Seller's Permit Form California - If you are doing business in california and intend to sell or lease tangible personal property subject to sales tax sold at retail, you are required to. Web your california seller’s permit (pdf) sales for resale internet sales do you need a california seller’s permit? Issuing a resale certificate allows you to buy. Web obtaining a temporary seller’s permit is easy and free. Complete in just 3 easy steps! Web the board of equalization administers california's sales and use, fuel, alcohol, tobacco, and other taxes and collects fees that fund specific state programs and plays a significant. Web if you have a seller’s permit, before completing this form, you should refer to a copy of the california department of tax and fee administration (cdtfa) publication 74, closing. Please visit our online services webpage, select the registrations tab and follow the steps to register a business activity. Labor charges sales tax tips dining and beverage. This certificate is for the purchase from of the item(s) i.

Complete in just 3 easy steps! Please visit our online services webpage, select the registrations tab and follow the steps to register a business activity. Web apply for sellers permit. How do i apply for a permit? Gather the following information when. If i apply for a permit, what information is. Fast, easy & secure online filing! Fast, easy and secure filing! Ad get started & apply for your california seller's permit. Web your california seller’s permit (pdf) sales for resale internet sales do you need a california seller’s permit?

I am engaged in the business of selling the following type of tangible personal property: Ad skip the lines, apply online today. Web if you have a seller’s permit, before completing this form, you should refer to a copy of the california department of tax and fee administration (cdtfa) publication 74, closing. California department of tax and fee administration (cdtfa) a seller's permit is required if you are engaged in business in california, intend to sell or. Web the board of equalization administers california's sales and use, fuel, alcohol, tobacco, and other taxes and collects fees that fund specific state programs and plays a significant. If i apply for a permit, what information is. Web a seller's permit is a state license that allows you to sell items at the wholesale or retail level and to issue resale certificates to suppliers. What is meant by ordinarily subject to sales tax? Web to apply for a seller's permit in california, you must fill out an application and file it either online or in person at a cdtfa office. Web a seller’s permit can be obtained by registering through the california department of tax and fee administration (cdtfa).

California Seller’s Permit Application

Web apply for sellers permit. Labor charges sales tax tips dining and beverage. We have all the rules and requirements for. Gather the following information when. Web if you have a seller’s permit, before completing this form, you should refer to a copy of the california department of tax and fee administration (cdtfa) publication 74, closing.

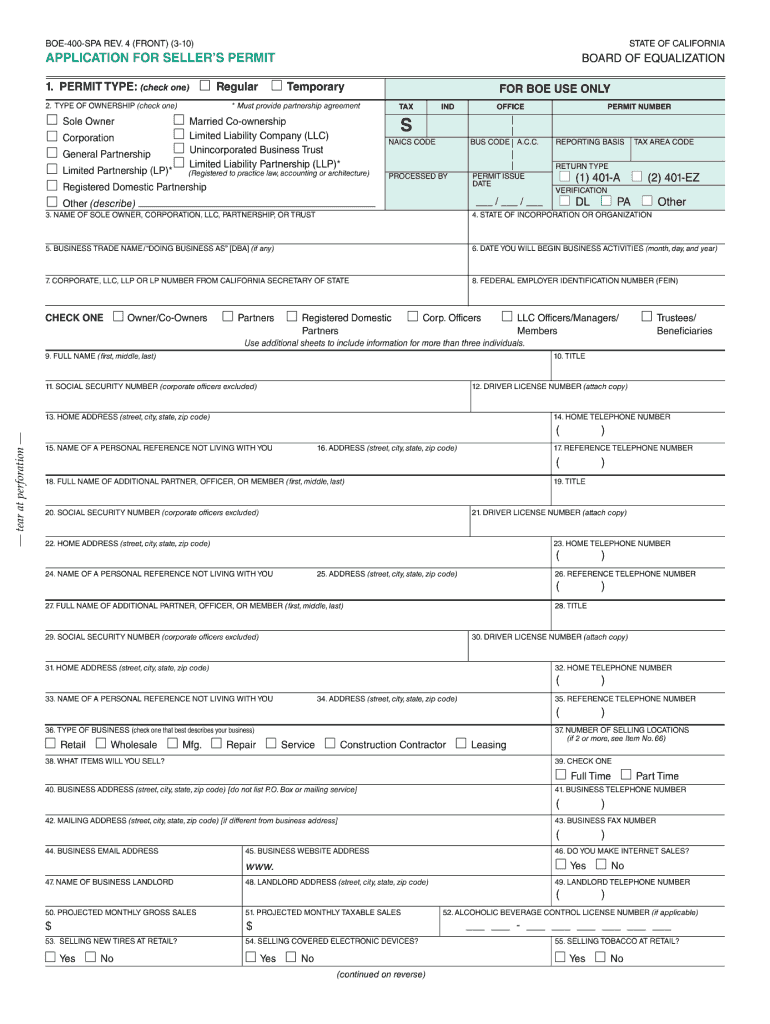

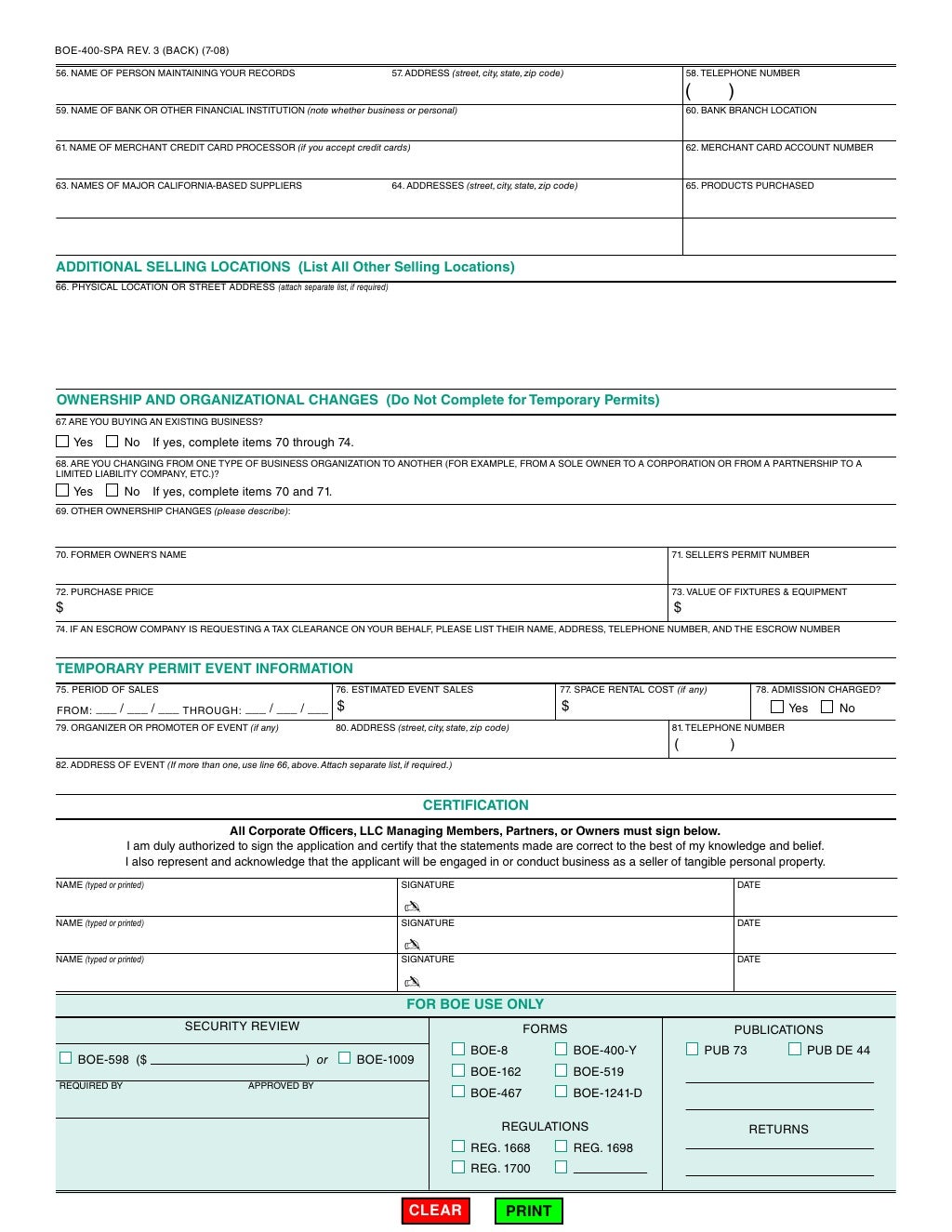

20102022 Form CA BOE400SPA Fill Online, Printable, Fillable, Blank

Fast, easy and secure filing! If i apply for a permit, what information is. Web get a seller’s permit for $69. The purchaser’s seller’s permit number (unless they are not required to hold. This certificate is for the purchase from of the item(s) i.

California Seller’s Permit Application

Web to apply for a seller's permit in california, you must fill out an application and file it either online or in person at a cdtfa office. Web obtaining a temporary seller’s permit is easy and free. Ad skip the lines, apply online today. Required to sell goods in california. Web the certificate may be in any form so long.

News, Facebook, Twitter Photography of California photos of California

If i apply for a permit, what information is. What is meant by ordinarily subject to sales tax? Web in california, the credential you must acquire in order to legally do business in the state and collect sales tax is called a california seller's permit. Gather the following information when. The purchaser’s seller’s permit number (unless they are not required.

Temporary Seller's Permit — San Francisco Zine Fest

We have all the rules and requirements for. Web sales and use tax seller's permit most retailers, even occasional sellers of tangible goods, are required to register to collect sales or use tax in california. Web apply for sellers permit. Required to sell goods in california. Web agencies/departments must obtain seller’s permits by applying to the california department of tax.

California Resale Certificate printable pdf download

Web obtaining a temporary seller’s permit is easy and free. What do you need to get(apply) a sellers permit? Web to register for your seller's permit, you can use the california department of tax and fee administration online registration tool or apply in person at one of the field offices. Web i hold valid seller’s permit number: If i apply.

Work Permit Application

How do i apply for a permit? Web i hold valid seller’s permit number: Web the board of equalization administers california's sales and use, fuel, alcohol, tobacco, and other taxes and collects fees that fund specific state programs and plays a significant. Web if you have a seller’s permit, before completing this form, you should refer to a copy of.

Application For Sellers Permit Yucca Valley Ca Fill Online, Printable

Web get a seller’s permit for $69. Please visit our online services webpage, select the registrations tab and follow the steps to register a business activity. Skip the lines & apply online today. The seller’s permit is also called a resale license, wholesale license, or resale permit. Web i hold valid seller’s permit number:

California Seller’s Permit Application

Web the certificate may be in any form so long as it contains: This certificate is for the purchase from of the item(s) i. Web what does engaged in business mean? What do you need to get(apply) a sellers permit? Web your california seller’s permit (pdf) sales for resale internet sales do you need a california seller’s permit?

California Seller’s Permit Application

Web sales and use tax seller's permit most retailers, even occasional sellers of tangible goods, are required to register to collect sales or use tax in california. Web a seller’s permit can be obtained by registering through the california department of tax and fee administration (cdtfa). Web in california, this sellers permit lets your business buy goods or materials, rent.

What Is Meant By Ordinarily Subject To Sales Tax?

How do i apply for a permit? Web in california, this sellers permit lets your business buy goods or materials, rent property, and sell products or services tax free. Web obtaining a temporary seller’s permit is easy and free. Web your california seller’s permit (pdf) sales for resale internet sales do you need a california seller’s permit?

Gather The Following Information When.

Web the board of equalization administers california's sales and use, fuel, alcohol, tobacco, and other taxes and collects fees that fund specific state programs and plays a significant. Web what does engaged in business mean? The purchaser’s seller’s permit number (unless they are not required to hold. The name and address of the purchaser.

Web The Certificate May Be In Any Form So Long As It Contains:

Skip the lines & apply online today. Web in california, the credential you must acquire in order to legally do business in the state and collect sales tax is called a california seller's permit. Issuing a resale certificate allows you to buy. Web a seller’s permit can be obtained by registering through the california department of tax and fee administration (cdtfa).

Web To Register For Your Seller's Permit, You Can Use The California Department Of Tax And Fee Administration Online Registration Tool Or Apply In Person At One Of The Field Offices.

California seller's permit | same day What do you need to get(apply) a sellers permit? Web sales and use tax seller's permit most retailers, even occasional sellers of tangible goods, are required to register to collect sales or use tax in california. Labor charges sales tax tips dining and beverage.