Should An Independent Contractor Form An Llc

Should An Independent Contractor Form An Llc - Web guest column november 23, 2021 independent contractors are not required to form business structures for their work. Ad launch your llc in 10 min online. We make it simple to register your new llc. Web an independent contractor is a broad term that describes anyone who provides goods or services without being employed by someone else. Web up to 24% cash back 2 min read. File your llc paperwork in just 3 easy steps! Web why should independent contractors consider establishing an llc? Ad covers contractors, food service, retail stores, auto service, transportation, & more. Create a fully customized form llc in minutes. Web reporting payments to independent contractors.

File your llc paperwork in just 3 easy steps! Web up to 24% cash back 2 min read. Create a fully customized form llc in minutes. Ad launch your llc in 10 min online. Web “should an independent contractor form an llc?” is easy, as the answer is a definite “yes.” not only will an llc help you separate your personal holdings from your business. Below, you’ll find a complete breakdown of why it may be in their best. Independent, or 1099, contractors run their own businesses. Ad every day, businesses across the nation choose swyft filings® to securely form their llc. Edit & print for immediate use. Web from the huffington post, deborah sweeney recommends forming an llc if you are an independent contractor.

If they wish, they can continue. Web “should an independent contractor form an llc?” is easy, as the answer is a definite “yes.” not only will an llc help you separate your personal holdings from your business. Ad incorporate your llc today to enjoy tax advantages and protect your personal assets. Ad every day, businesses across the nation choose swyft filings® to securely form their llc. Ad pay one invoice at a time while we handle payments to all independent contractors. Ad covers contractors, food service, retail stores, auto service, transportation, & more. Web reporting payments to independent contractors. File your llc paperwork in just 3 easy steps! Web an llc independent contractor, or 1099 employee, is someone who completes work for a limited liability company but does not meet the definition of an. Independent, or 1099, contractors run their own businesses.

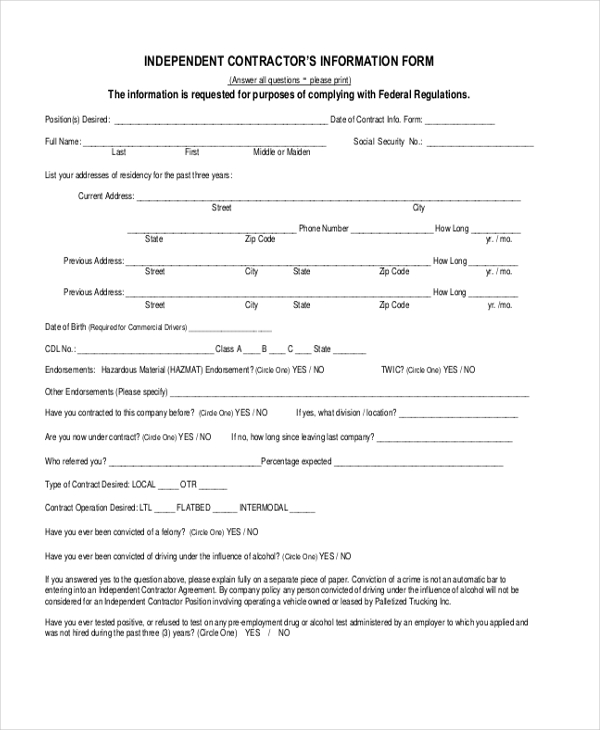

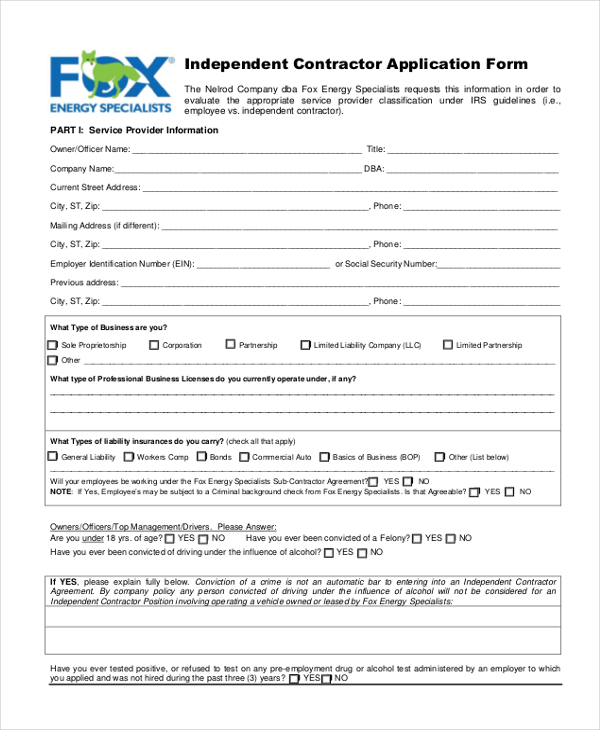

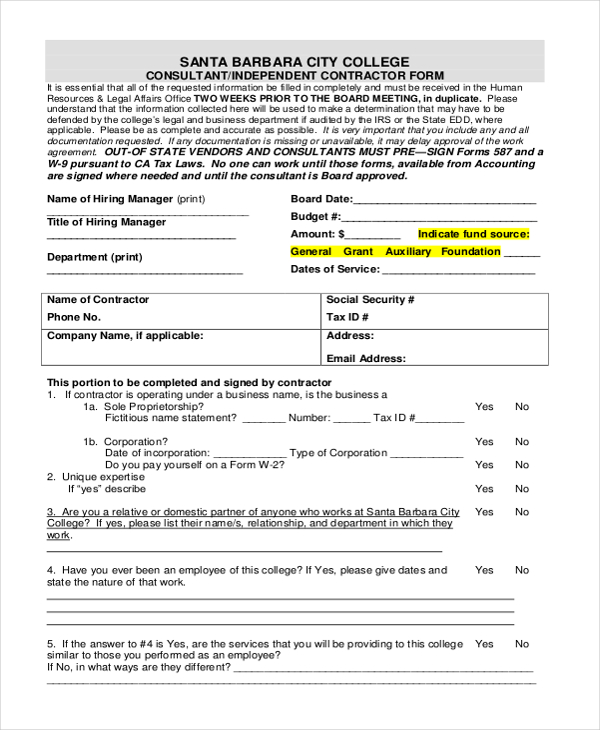

FREE 9+ Sample Independent Contractor Forms in MS Word PDF Excel

A properly classified independent contractor is. Web should an independent contractor form an llc? If you are an independent contractor working as a freelancer or a sole proprietor, you may be. Web an independent contractor is a broad term that describes anyone who provides goods or services without being employed by someone else. Create a fully customized form llc in.

California’s Independent Contractor Test & What Your Business Must

The primary difference is that your personal assets, such as your personal bank account, will. Ad every day, businesses across the nation choose swyft filings® to securely form their llc. Edit & print for immediate use. If they wish, they can continue. Web should an independent contractor form an llc?

Independent Contractor Form Sample Forms

Web if you are a sole proprietor working as an independent contractor, there are lots of advantages to setting up your business as an llc. Web up to 24% cash back 2 min read. Web an llc independent contractor, or 1099 employee, is someone who completes work for a limited liability company but does not meet the definition of an..

Free Independent Contractor Agreement Template 1099 Word PDF eForms

The primary difference is that your personal assets, such as your personal bank account, will. Web guest column november 23, 2021 independent contractors are not required to form business structures for their work. If they wish, they can continue. Independent, or 1099, contractors run their own businesses. Get a general liability insurance policy customized to your business needs today.

Independent Contractor, LLC & Businesses YouTube

Ad covers contractors, food service, retail stores, auto service, transportation, & more. 2023's best llc formation services. Create a fully customized form llc in minutes. If they wish, they can continue. Ad incorporate your llc today to enjoy tax advantages and protect your personal assets.

FREE 9+ Sample Independent Contractor Forms in MS Word PDF Excel

A properly classified independent contractor is. Web up to 24% cash back 2 min read. Web reporting payments to independent contractors. Edit & print for immediate use. Web if you are a sole proprietor working as an independent contractor, there are lots of advantages to setting up your business as an llc.

INDEPENDENT CONTRACTOR TAXES & HOW TO INCORPORATE

Below, you’ll find a complete breakdown of why it may be in their best. Web “should an independent contractor form an llc?” is easy, as the answer is a definite “yes.” not only will an llc help you separate your personal holdings from your business. Ad launch your llc in 10 min online. Edit & print for immediate use. Web.

FREE 9+ Sample Independent Contractor Forms in MS Word PDF Excel

Web reporting payments to independent contractors. Edit & print for immediate use. A properly classified independent contractor is. Web up to 24% cash back 2 min read. Web an llc independent contractor, or 1099 employee, is someone who completes work for a limited liability company but does not meet the definition of an.

Independent Contractor Application Fill Online, Printable, Fillable

Web before the next fiscal year, independent contractors should look into forming an llc. Web an llc independent contractor, or 1099 employee, is someone who completes work for a limited liability company but does not meet the definition of an. Unlike an independent contractor, llc owners are required to submit business formation documents, such as articles of. The primary difference.

Should independent contractors form a LLC? YouTube

Paying independent contractors doesn't have to be so hard. Web an llc independent contractor, or 1099 employee, is someone who completes work for a limited liability company but does not meet the definition of an. Web if you are a sole proprietor working as an independent contractor, there are lots of advantages to setting up your business as an llc..

Web Before The Next Fiscal Year, Independent Contractors Should Look Into Forming An Llc.

Ad pay one invoice at a time while we handle payments to all independent contractors. If you are an independent contractor working as a freelancer or a sole proprietor, you may be. The primary difference is that your personal assets, such as your personal bank account, will. We make it simple to register your new llc.

File Your Llc Paperwork In Just 3 Easy Steps!

If they wish, they can continue. Paying independent contractors doesn't have to be so hard. Ad incorporate your llc today to enjoy tax advantages and protect your personal assets. Web should an independent contractor form an llc?

Web Reporting Payments To Independent Contractors.

Web if you are a sole proprietor working as an independent contractor, there are lots of advantages to setting up your business as an llc. A properly classified independent contractor is. Get a general liability insurance policy customized to your business needs today. In fact, we just covered that in.

Ad Covers Contractors, Food Service, Retail Stores, Auto Service, Transportation, & More.

Web “should an independent contractor form an llc?” is easy, as the answer is a definite “yes.” not only will an llc help you separate your personal holdings from your business. Web up to 24% cash back 2 min read. Web an llc independent contractor, or 1099 employee, is someone who completes work for a limited liability company but does not meet the definition of an. Create a fully customized form llc in minutes.