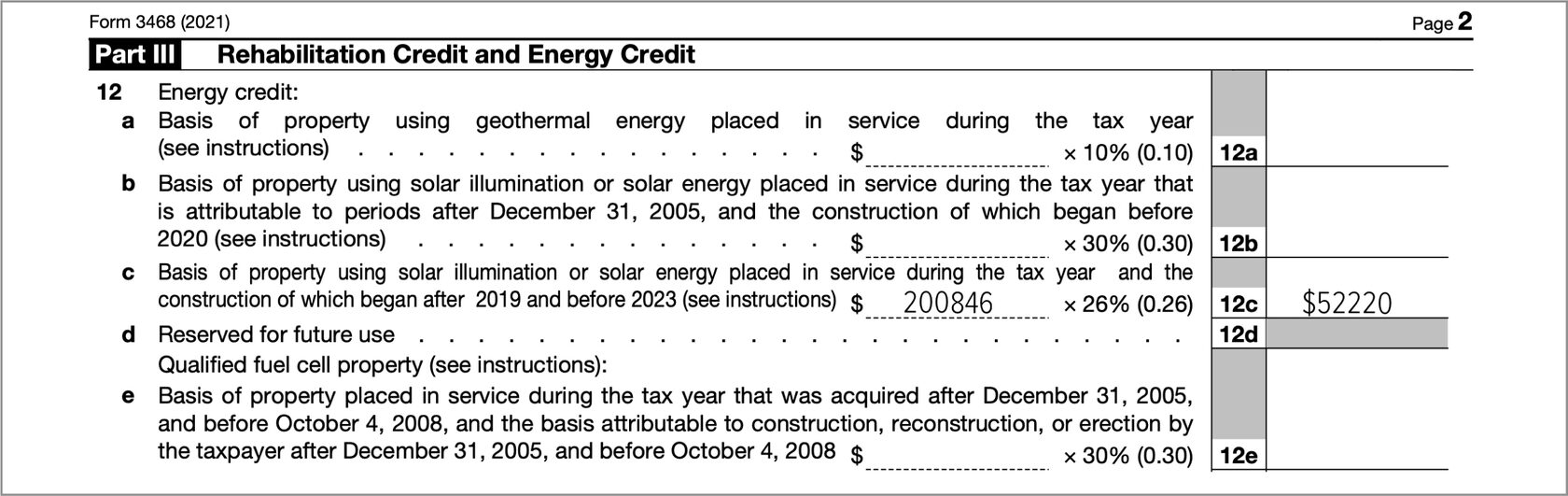

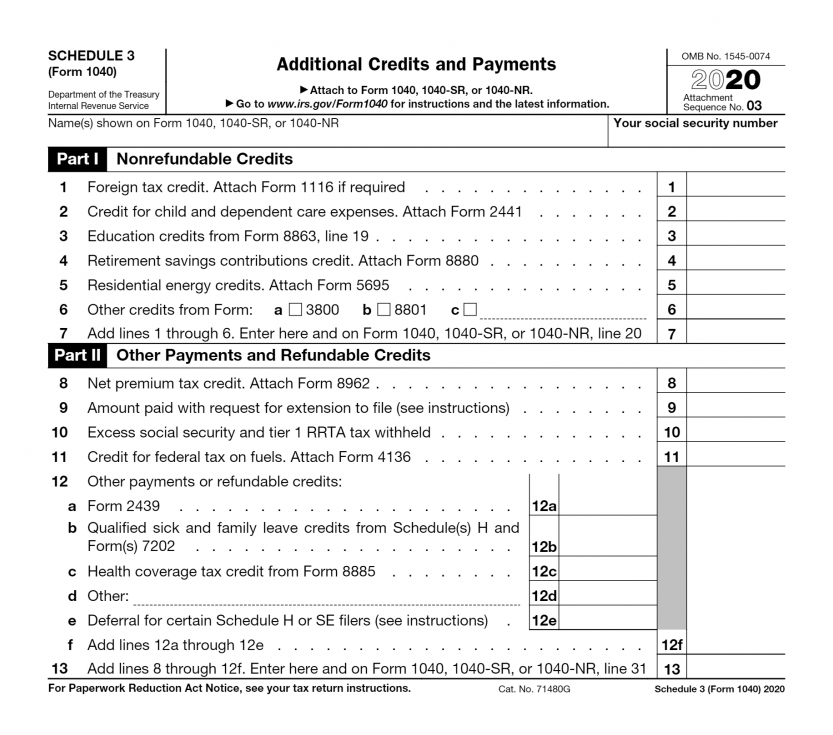

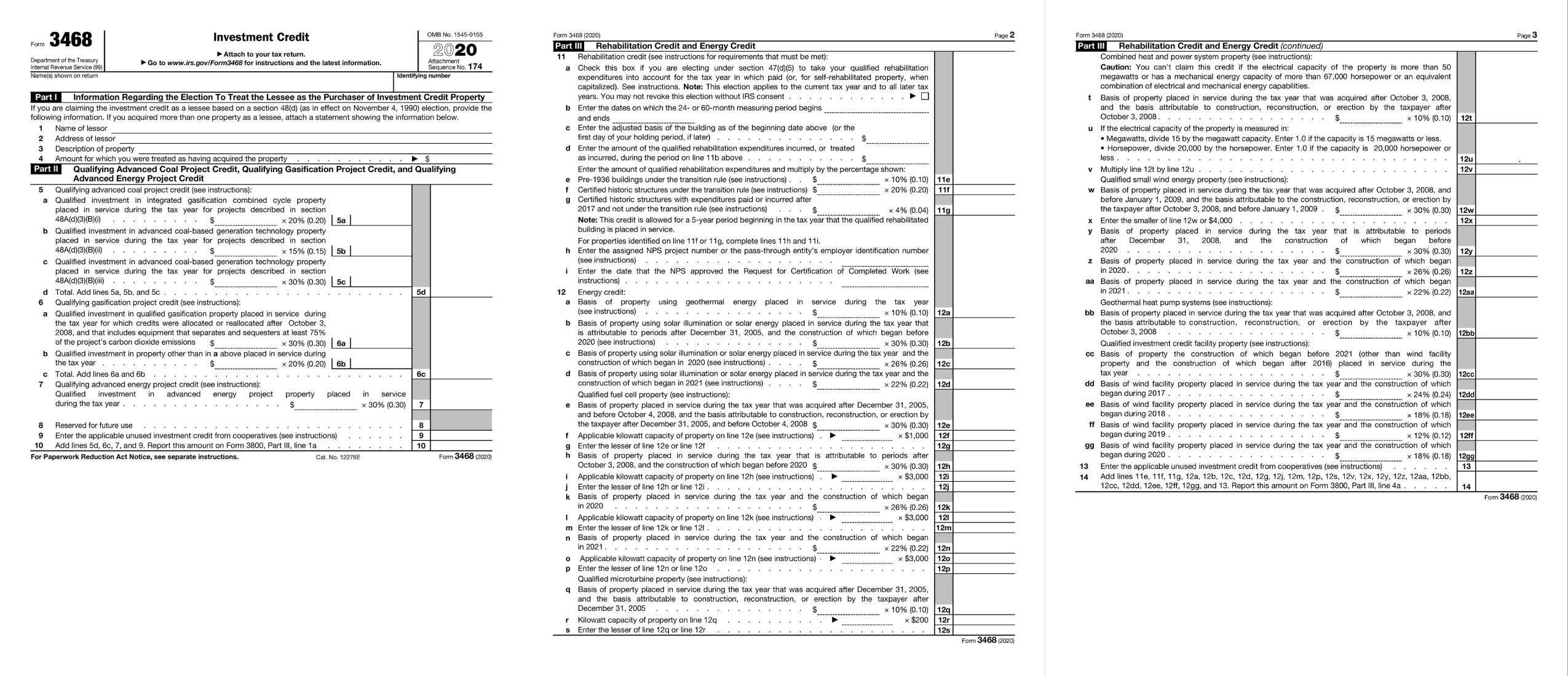

Solar Tax Credit Form 3468

Solar Tax Credit Form 3468 - Web form 3468 is used to compute the investment credit; Web to claim the itc, a taxpayer must complete and attach irs form 3468 to their tax return. Web the total gross cost of your solar energy system after any cash rebates. Web solar incentives in missouri: Insert any additional energy improvements to line 2 4. Ad with the right expertise, federal tax credits and incentives could benefit your business. Estimated dollar amount you can save: Take control of home energy costs & produce your own solar energy. Web these credits for periods in 2023. Web the federal tax code includes a variety of tax credits designed to promote different types of investment.

The total gross cost of your solar energy system after any cash rebates. Get competing solar quotes online how it. Web follow these steps to enter a solar energy credit: Insert any additional energy improvements to line 2 4. Add qualified solar electricity costs to line 1. Estimated dollar amount you can save: Web the federal tax code includes a variety of tax credits designed to promote different types of investment. Web to claim the itc, a taxpayer must complete and attach irs form 3468 to their tax return. If depreciable, enter the asset in screen 16, depreciation (4562). Work with federal tax credits and incentives specialists who have decades of experience.

Ad with the right expertise, federal tax credits and incentives could benefit your business. Web you must attach a statement to form 3468 to claim section 48d advanced manufacturing investment credit that includes the following information. Take control of home energy costs & produce your own solar energy. Ad go solar with sunnova! Add qualified solar electricity costs to line 1. Ira 2022 enacted the following. Web to claim the itc, a taxpayer must complete and attach irs form 3468 to their tax return. Get competing solar quotes online how it. Home solar built just for you. Go to screen 26, credits.

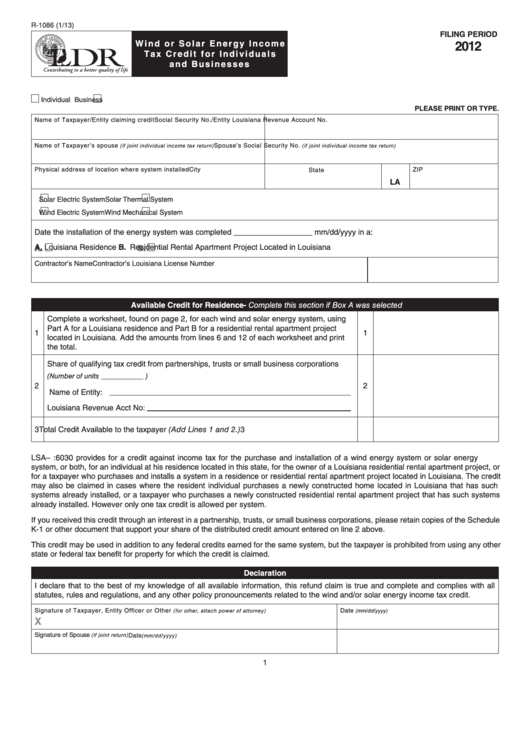

Fillable Form R1086 Wind Or Solar Energy Tax Credit For

Web follow these steps to enter a solar energy credit: Taxpayers claim many of these credits using irs form. Add qualified solar electricity costs to line 1. Work with federal tax credits and incentives specialists who have decades of experience. Federal solar investment tax credit (itc).

Nonbusiness Energy Credit Form Armando Friend's Template

Web commercial entities will follow this guidance and complete irs form 3468. Federal solar investment tax credit (itc). Get competing solar quotes online how it. The specific instructions section of the instructions for form 3468 state the following: Generally, (a) an estate or trust whose entire qualified.

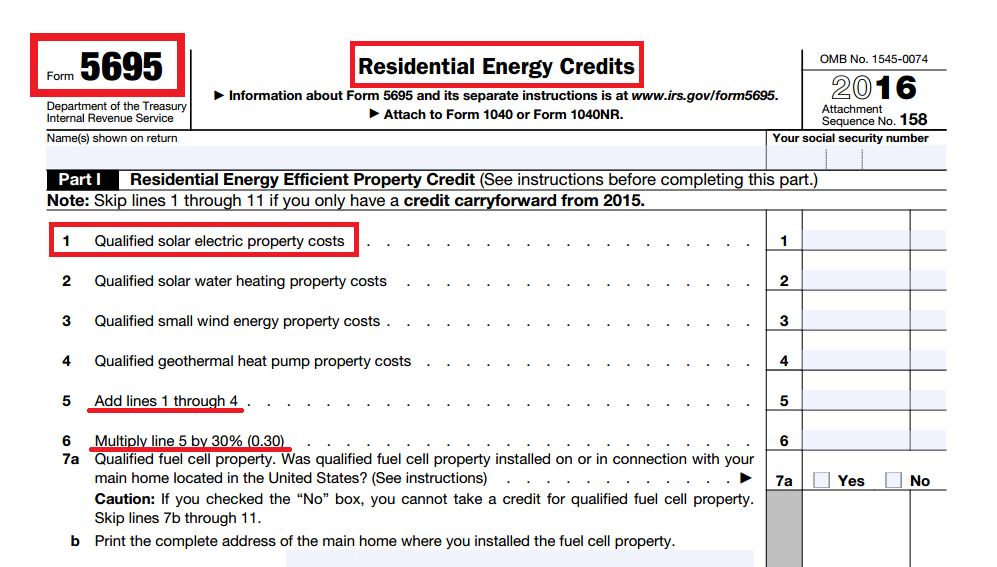

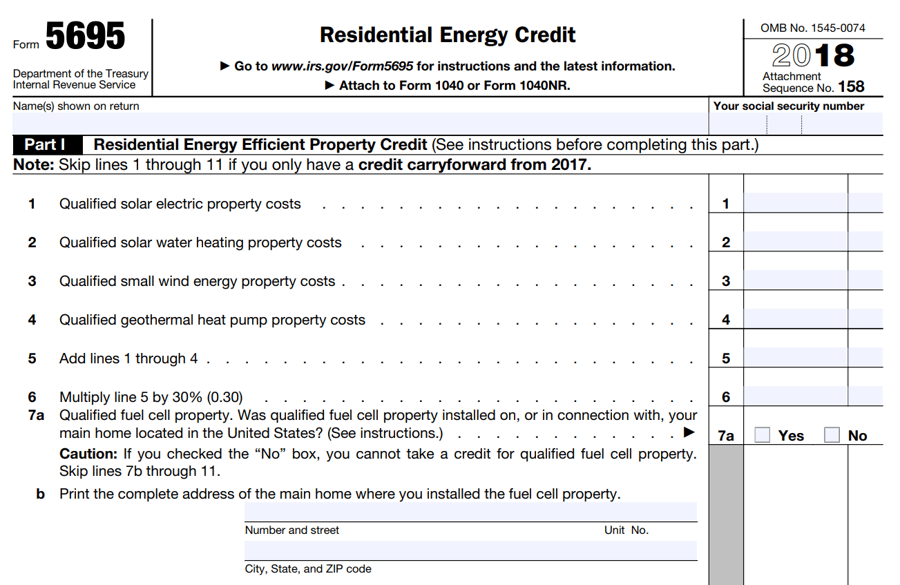

How to Claim the Federal Solar Tax Credit Form 5695 Instructions

Web the solar investment tax credit (itc) is a tax credit that can be claimed on federal corporate income taxes for 30% of the cost of a solar photovoltaic (pv) system. Custom, efficient solar panels tailored to your needs. Generally, (a) an estate or trust whose entire qualified. Web internal revenue code (irc) sections 48 (a) (3) (i) and 48.

How do I claim the solar tax credit? A1 Solar Store

The total gross cost of your solar energy system after any cash rebates. Web june 14, 2017 h&r block the investment tax credit is part of the general business credit. Web the federal tax code includes a variety of tax credits designed to promote different types of investment. Web to claim the itc, a taxpayer must complete and attach irs.

2020 Solar Tax Forms Solar Energy Solutions

Web there are two options for entering the solar credit. Web to claim the itc, a taxpayer must complete and attach irs form 3468 to their tax return. Work with federal tax credits and incentives specialists who have decades of experience. Federal solar investment tax credit (itc). Web the federal tax code includes a variety of tax credits designed to.

How to Get FREE Solar Panels How To Build It

Web solar incentives in missouri: Add qualified solar electricity costs to line 1. Take control of home energy costs & produce your own solar energy. Web form 3468 is used to compute the investment credit; The total gross cost of your solar energy system after any cash rebates.

How to File the Federal Solar Tax Credit A Step by Step Guide

Ad go solar with sunnova! Insert any additional energy improvements to line 2 4. Web solar incentives in missouri: Web internal revenue code (irc) sections 48 (a) (3) (i) and 48 (a) (3) (ii) grant businesses a tax credit for solar equipment as part of the energy credit. Web these credits for periods in 2023.

How Does the Federal Solar Tax Credit Work?

Web the total gross cost of your solar energy system after any cash rebates. The specific instructions section of the instructions for form 3468 state the following: Home solar built just for you. Take control of home energy costs & produce your own solar energy. Web who must complete form 3468?

How To Claim The Solar Tax Credit Alba Solar Energy

Add qualified solar electricity costs to line 1. • established new credits for energy storage technology, qualified biogas property, and microgrid controllers. Go to screen 26, credits. Get competing solar quotes online how it. Estimated dollar amount you can save:

Federal Investment Tax Credit (ITC) Form 3468/3468i, Eligible

The investment credit is composed of various credits including the business energy credit. Web you must attach a statement to form 3468 to claim section 48d advanced manufacturing investment credit that includes the following information. The federal tax credit falls to 26% starting in 2033. Federal solar investment tax credit (itc). Web internal revenue code (irc) sections 48 (a) (3).

Web Form 3468 Is Used To Compute The Investment Credit;

Ad with the right expertise, federal tax credits and incentives could benefit your business. Home solar built just for you. After seeking professional tax advice and ensuring you are eligible for the credit, you can complete and attach irs form 5695 to. Go to screen 26, credits.

Web Who Must Complete Form 3468?

Now, pv magazine usa is not a tax advisor, so seek professional advice before filling out. Web follow these steps to enter a solar energy credit: The specific instructions section of the instructions for form 3468 state the following: Web the total gross cost of your solar energy system after any cash rebates.

The Federal Tax Credit Falls To 26% Starting In 2033.

Ira 2022 enacted the following. Web form 3468 calculates tax credits for a number of qualified commercial energy improvements, including solar systems. The investment credit is composed of various credits including the business energy credit. Work with federal tax credits and incentives specialists who have decades of experience.

Web You Must Attach A Statement To Form 3468 To Claim Section 48D Advanced Manufacturing Investment Credit That Includes The Following Information.

Web june 14, 2017 h&r block the investment tax credit is part of the general business credit. Custom, efficient solar panels tailored to your needs. Insert any additional energy improvements to line 2 4. Add qualified solar electricity costs to line 1.