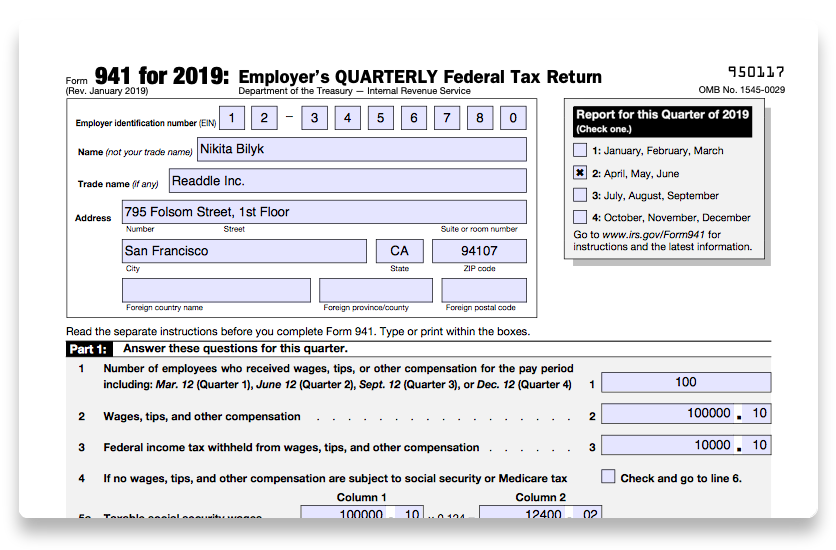

Tax 941 Form 2019

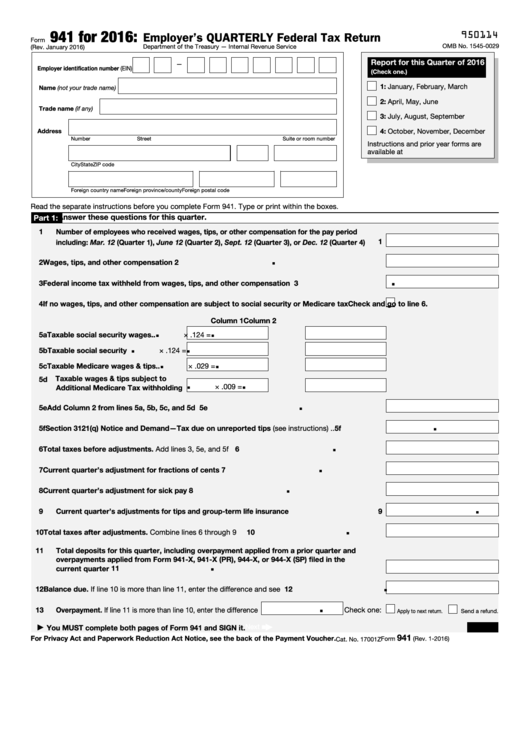

Tax 941 Form 2019 - Ad take control of irs payroll tax penalties and interest and prepare your irs payroll forms. Employers use this form to report. For example, you could be penalized five percent (5%) of the tax due with each. Complete, edit or print tax forms instantly. If your adjusted gross income (agi) was $73,000 or less, review each provider’s offer to make sure you qualify. You must complete all five pages. Certain employers whose annual payroll tax and withholding. Who must file form 941? Web taxes march 28, 2019 form 941 is a internal revenue service (irs) tax form for employers in the u.s. Type or print within the boxes.

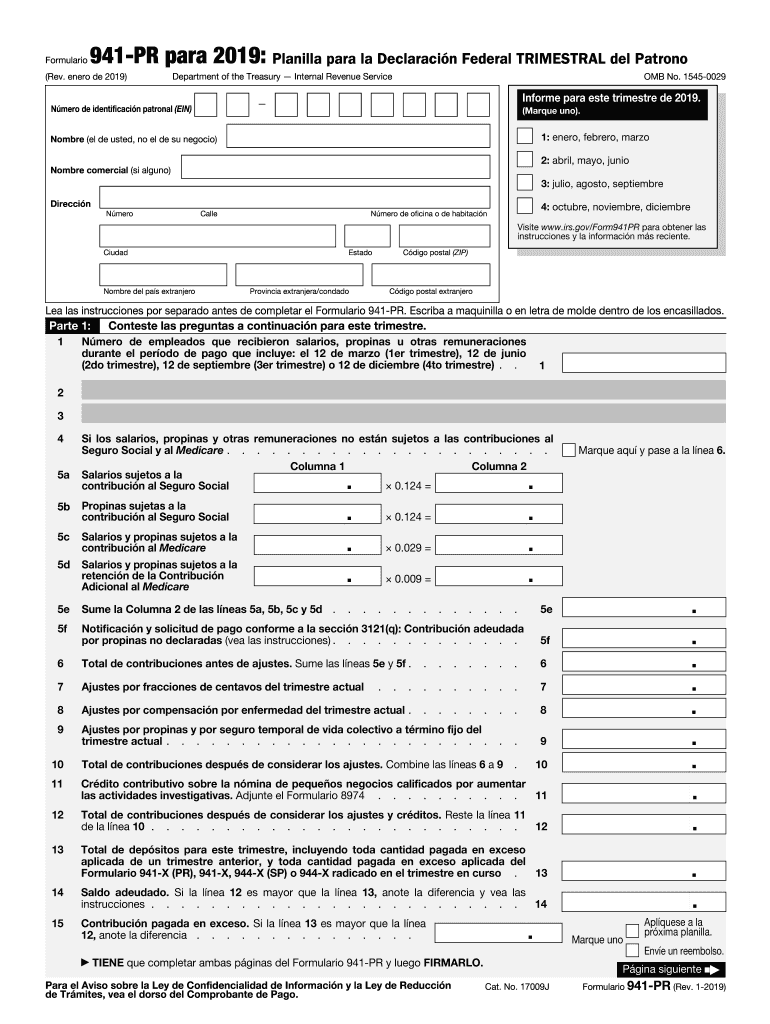

You must complete all five pages. How should you complete form 941? Web payroll tax returns. Web purpose of form 941. If your adjusted gross income (agi) was $73,000 or less, review each provider’s offer to make sure you qualify. January 2019) american samoa, guam, the commonwealth of the northern department of the. Get ready for tax season deadlines by completing any required tax forms today. You must file irs form 941 if you operate a business and have employees working for you. Web mailing addresses for forms 941. Your irs payroll tax penalty and interest solution.

Employers use this form to report. For example, you could be penalized five percent (5%) of the tax due with each. Web the irs revised form 941, employer's quarterly federal tax return, form 943, employer's annual federal tax return for agricultural employees, form 944,. Web mailing addresses for forms 941. Web taxes march 28, 2019 form 941 is a internal revenue service (irs) tax form for employers in the u.s. Ad we simplify complex tasks to give you time back and help you feel like an expert. Type or print within the boxes. If your adjusted gross income (agi) was $73,000 or less, review each provider’s offer to make sure you qualify. How should you complete form 941? January 2019) american samoa, guam, the commonwealth of the northern department of the.

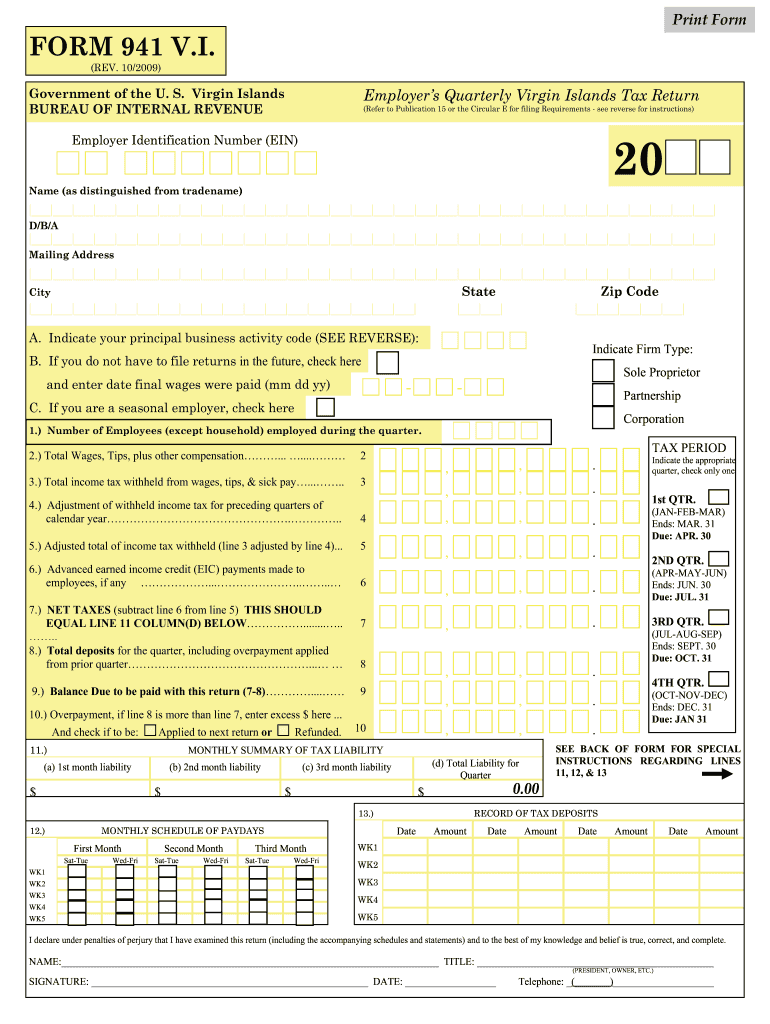

Form 941SS Employer's Quarterly Federal Tax Return (2015) Free Download

Who must file form 941? Sign up & make payroll a breeze. Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31,. Connecticut, delaware, district of columbia, georgia,. If your adjusted gross income (agi) was $73,000 or less, review each provider’s.

How to fill out IRS Form 941 2019 PDF Expert

Web forms filed quarterly with due dates of april 30, july 31, october 31, and january 31 (for the fourth quarter of the previous calendar year) file form 941,. Employers use this form to report. You must file irs form 941 if you operate a business and have employees working for you. Web follow these guidelines to accurately and quickly.

IRS 941PR 2019 Fill out Tax Template Online US Legal Forms

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web taxes march 28, 2019 form 941 is a internal revenue service (irs) tax form for employers in the u.s. Connecticut, delaware, district of columbia, georgia,. Certain employers whose annual payroll tax and withholding. Simply the best payroll service.

2019 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

Sign up & make payroll a breeze. Those returns are processed in. Your irs payroll tax penalty and interest solution. For example, you could be penalized five percent (5%) of the tax due with each. October, november, december go to www.irs.gov/form941 for instructions and the latest.

What Employers Need to Know about 941 Quarterly Tax Return?

If your adjusted gross income (agi) was $73,000 or less, review each provider’s offer to make sure you qualify. Type or print within the boxes. How should you complete form 941? Web payroll tax returns. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of.

Irs Releases Final Instructions For Payroll Tax Form Related To Covid

Web purpose of form 941. How should you complete form 941? Web the irs revised form 941, employer's quarterly federal tax return, form 943, employer's annual federal tax return for agricultural employees, form 944,. Ad we simplify complex tasks to give you time back and help you feel like an expert. Certain employers whose annual payroll tax and withholding.

printable 941 form 2019 PrintableTemplates

Connecticut, delaware, district of columbia, georgia,. Ad take control of irs payroll tax penalties and interest and prepare your irs payroll forms. Who must file form 941? Form 941 is used by employers. Web follow these guidelines to accurately and quickly fill in irs 941.

printable 941 form 2019 PrintableTemplates

Simply the best payroll service for small business. You must file irs form 941 if you operate a business and have employees working for you. January 2019) american samoa, guam, the commonwealth of the northern department of the. Web download or print the 2022 federal form 941 (employer's quarterly federal tax return) for free from the federal internal revenue service..

How To Quickly File Your 941 Form 2019 Blog TaxBandits

Web do your taxes online for free with an irs free file provider. You must complete all five pages. Your irs payroll tax penalty and interest solution. Web mailing addresses for forms 941. Those returns are processed in.

20192022 Form USDA CCC941 Fill Online, Printable, Fillable, Blank

Sign up & make payroll a breeze. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Web taxes march 28, 2019 form 941 is a internal revenue service (irs) tax form for employers in the u.s. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and.

Simply The Best Payroll Service For Small Business.

How should you complete form 941? Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web taxes march 28, 2019 form 941 is a internal revenue service (irs) tax form for employers in the u.s. Sign up & make payroll a breeze.

Click The Button Get Form To Open It And Start Editing.

If your adjusted gross income (agi) was $73,000 or less, review each provider’s offer to make sure you qualify. Web follow these guidelines to accurately and quickly fill in irs 941. Your irs payroll tax penalty and interest solution. Who must file form 941?

Web Do Your Taxes Online For Free With An Irs Free File Provider.

Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31,. Connecticut, delaware, district of columbia, georgia,. Web download or print the 2022 federal form 941 (employer's quarterly federal tax return) for free from the federal internal revenue service. Employers use this form to report.

January 2019) American Samoa, Guam, The Commonwealth Of The Northern Department Of The.

You must file irs form 941 if you operate a business and have employees working for you. October, november, december go to www.irs.gov/form941 for instructions and the latest. Form 941 is used by employers. Complete, edit or print tax forms instantly.