Tax Extension Form For Business

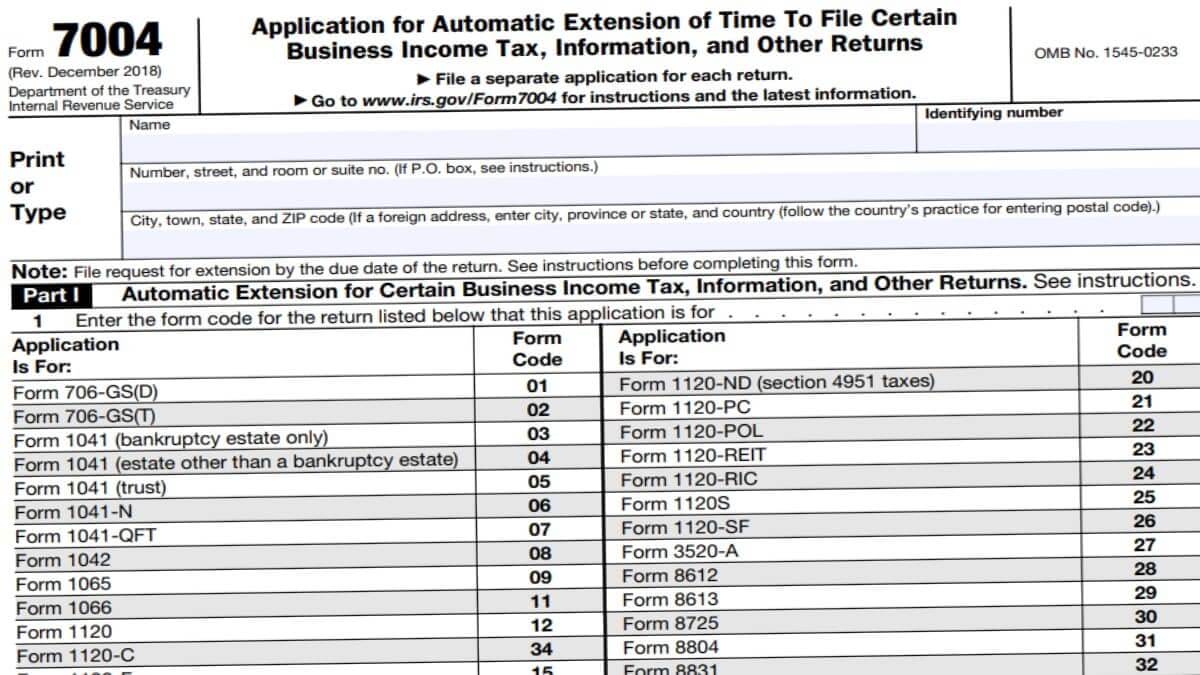

Tax Extension Form For Business - Use form 7004 to apply for an extension for a corporation, s. To get started, once you are. Typically, if you expect a. Select the right extension form. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. How do i file for a business. You can get an extension on filing your tax return, but you can’t delay an irs tax payment. This deadline applies to any individual or small business seeking to file their taxes with the. Submit your extension request form. Web most businesses use form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, to request.

Ad filing your tax extension just became easier! Web the form 7004 does not extend the time for payment of tax. Web tax day for the 2022 tax year falls on tuesday, april 18th, 2023. Ad download or email irs 7004 & more fillable forms, register and subscribe now! Web individuals and families. Filing for an extension is simple and free. Complete the extension request form. Web input your tax data into the online tax software. Since april 15 falls on a saturday, and emancipation day. Refer to the form 7004 instructions for additional information on payment of tax and balance due.

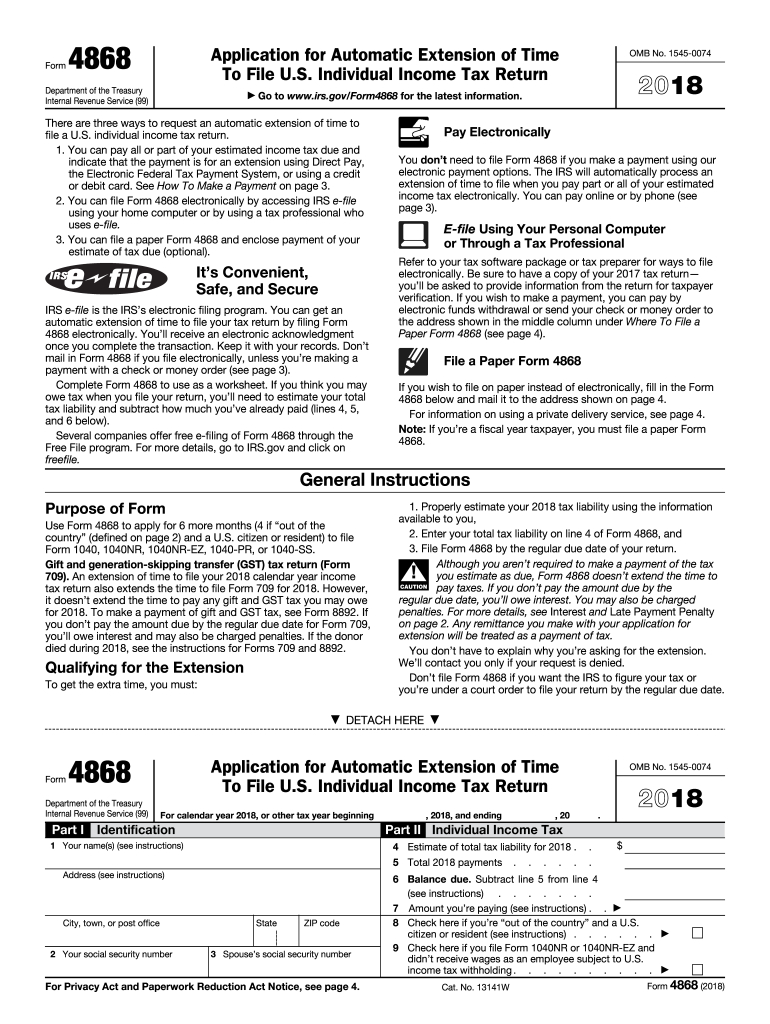

Web most businesses use form 7004 to file for an extension, but others need to file form 4868. Web you can file a paper form 4868 and enclose payment of your estimate of tax due (optional). Web the business tax extension deadline is october 17, 2022. Web use form 4868 to apply for a business tax extension as part of your personal tax return. Ad turbotax has the tax solutions to help, whether you file an extension or not. Web to file a business tax extension, use form 7004, “application for automatic extension of time to file certain business income tax, information, and other. How do i file for a business. Complete, edit or print tax forms instantly. Web 3 changes for the 2022 tax season. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns.

LastMinute Tax Advice for 2021 Wow Gallery eBaum's World

Web 3 changes for the 2022 tax season. Submit your extension request form. Web business and corporations form 7004, application for automatic extension of time to file certain business income tax, information, and other. Web the deadline for filing a business income tax extension request also depends on what kind of business you have: Complete, edit or print tax forms.

Business Tax Extension 7004 Form 2021

Web the form 7004 does not extend the time for payment of tax. Use form 7004 to apply for an extension for a corporation, s. Get ready for tax season deadlines by completing any required tax forms today. Submit your extension request form. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by.

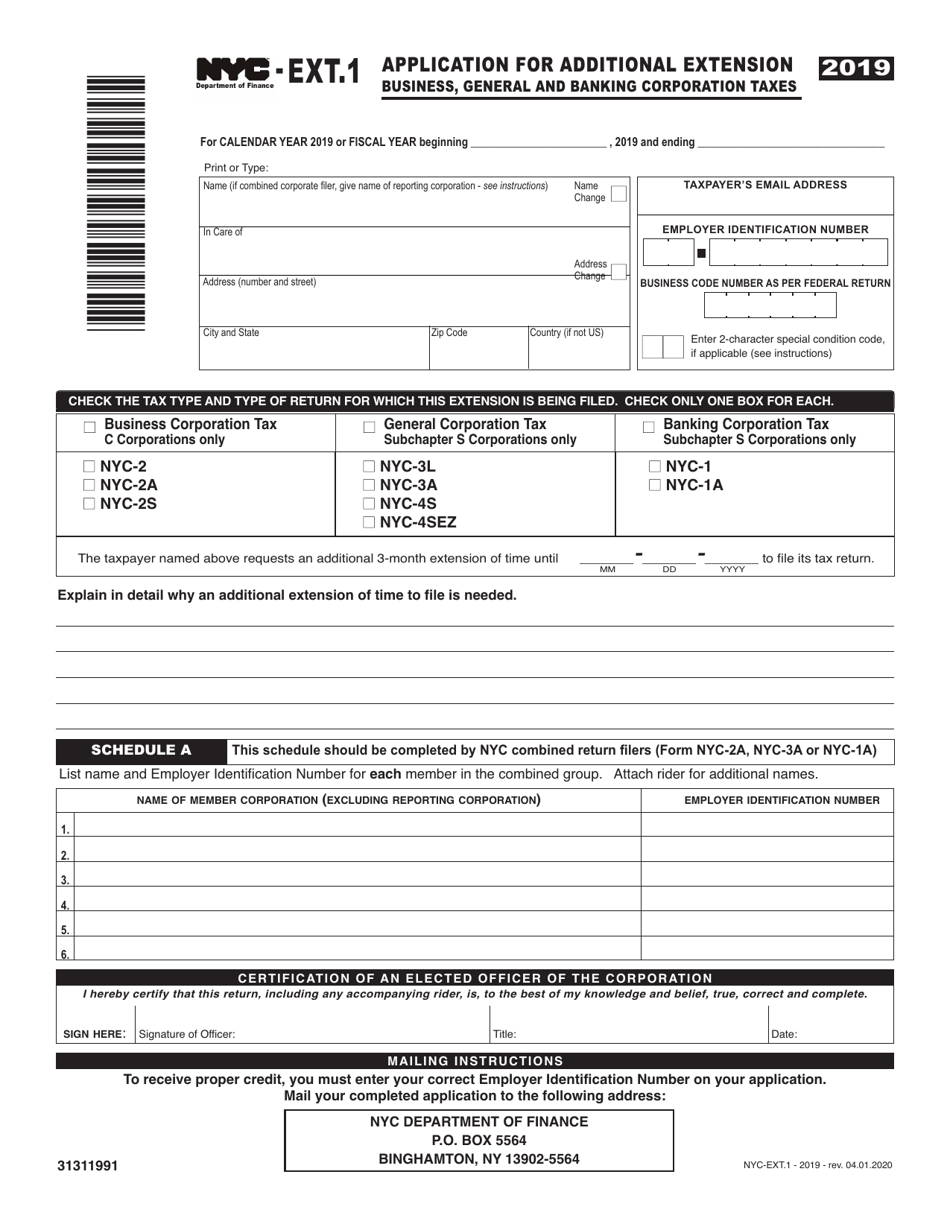

Form NYCEXT.1 Download Printable PDF or Fill Online Application for

Web purpose of form. Filing for an extension is simple and free. You can get an extension on filing your tax return, but you can’t delay an irs tax payment. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. To get started, once you are.

Ny State Tax Extension Form It 201 Form Resume Examples erkKMqB5N8

Complete, edit or print tax forms instantly. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. To get started, once you are. Select the right extension form. Web you can file a paper form 4868 and enclose payment of your estimate of tax due (optional).

IRS Tax Extension Efile Federal Extension

Web the form 7004 does not extend the time for payment of tax. Ad filing your tax extension just became easier! File your business tax return by the. Typically, if you expect a. How do i file for a business.

How To File A Tax Extension A Complete Guide [INFOGRAPHIC]

Ad filing your tax extension just became easier! File your business tax return by the. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Submit your extension request form. Refer to the form 7004 instructions for additional information on payment of tax and balance due.

Business tax extension form 7004

Web to file a business tax extension, use form 7004, “application for automatic extension of time to file certain business income tax, information, and other. Select the right extension form. Refer to the form 7004 instructions for additional information on payment of tax and balance due. Complete, edit or print tax forms instantly. Web revenue secretary sanjay malhotra recently said.

Print Irs Extension Form 4868 2021 Calendar Printables Free Blank

Web there are several ways to submit form 4868. File an extension for free today and extend your tax return through october 16th. Web you can file a paper form 4868 and enclose payment of your estimate of tax due (optional). Web you can use irs free file at irs.gov/freefile to request an automatic filing extension or file form 4868,.

Business tax extension form 7004

Ad filing your tax extension just became easier! Typically, if you expect a. No matter what your tax situation is, turbotax® has you covered. Use form 7004 to apply for an extension for a corporation, s. Web you can file a paper form 4868 and enclose payment of your estimate of tax due (optional).

Learn How to Fill the Form 4868 Application for Extension of Time To

Web to file a business tax extension, use form 7004, “application for automatic extension of time to file certain business income tax, information, and other. Complete, edit or print tax forms instantly. Web you can use irs free file at irs.gov/freefile to request an automatic filing extension or file form 4868, application for automatic extension of time to file. How.

Ad Download Or Email Irs 7004 & More Fillable Forms, Register And Subscribe Now!

Web use form 4868 to apply for a business tax extension as part of your personal tax return. Typically, if you expect a. File an extension for free today and extend your tax return through october 16th. Web input your tax data into the online tax software.

Use Form 7004 To Apply For An Extension For A Corporation, S.

Web business and corporations form 7004, application for automatic extension of time to file certain business income tax, information, and other. Web 3 changes for the 2022 tax season. Web the form 7004 does not extend the time for payment of tax. Web the business tax extension deadline is october 17, 2022.

Make An Estimated Tax Payment I Can’t Stress This Enough:

Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Taxpayers can complete the extension request form through the irs free file. Complete, edit or print tax forms instantly. To get started, once you are.

Filing For An Extension Is Simple And Free.

This deadline applies to any individual or small business seeking to file their taxes with the. Web revenue secretary sanjay malhotra recently said that there have been no considerations for a deadline extension beyond july 31, 2023. Ad filing your tax extension just became easier! Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns.

![How To File A Tax Extension A Complete Guide [INFOGRAPHIC]](https://help.taxreliefcenter.org/wp-content/uploads/2018/03/20190222-Tax-Relief-Center-How-To-File-A-Tax-Extension.jpg)