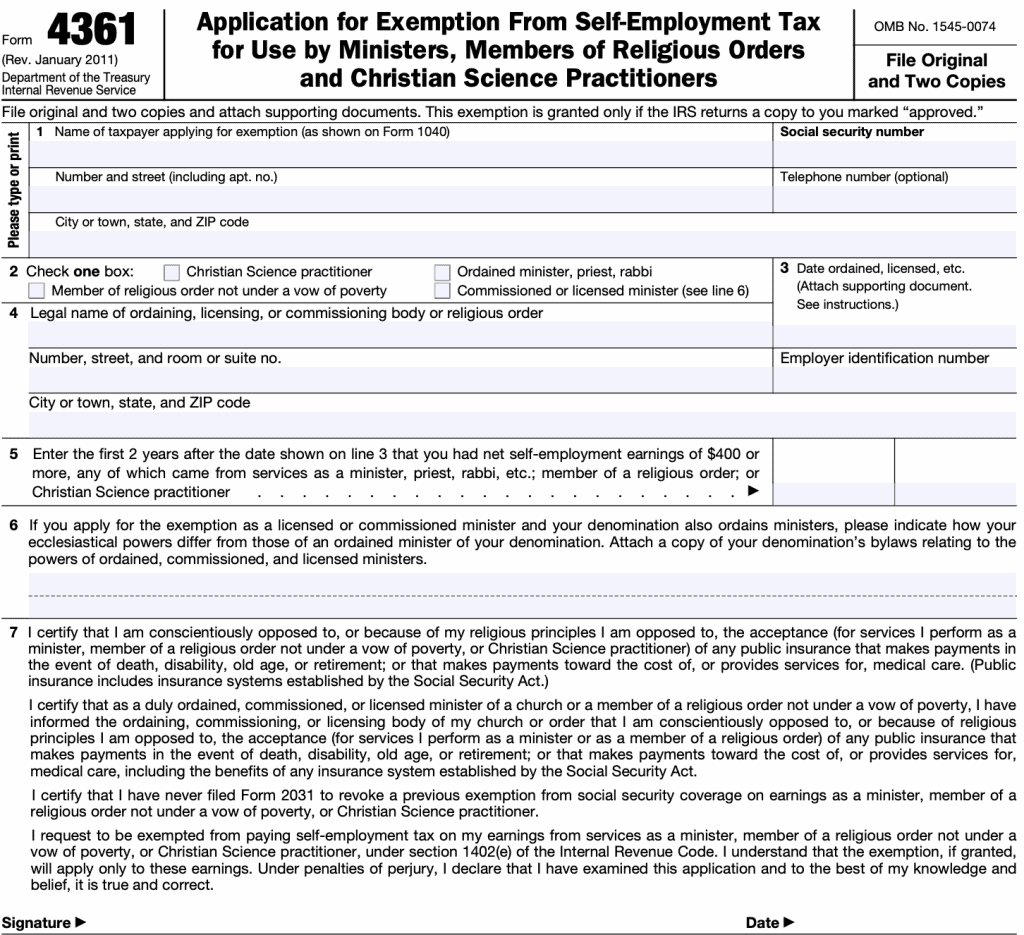

Tax Form 4361

Tax Form 4361 - To indicate you are a clergy member, minister, member of a religious order, or christian science practitioner, and filed form. From within your taxact return (. If using a private delivery service, send your returns to the street. Web for the information on this form to carry out the internal revenue laws of the united states. Web it appears you don't have a pdf plugin for this browser. Web in this article, we’ll walk through irs form 4361 so you can better understand: Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval. Tax years are calendar years and for this situation, they do not have to be consecutive. You are required to give us the information. An ordained, commissioned, or licensedminister of a church;

Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval. Tax years are calendar years and for this situation, they do not have to be consecutive. Request for copy of tax return. An ordained, commissioned, or licensed minister of a. Web the deadline to file form 4361 is based on two tax years. Web it appears you don't have a pdf plugin for this browser. If using a private delivery service, send your returns to the street. You are required to give us the information. Web in this article, we’ll walk through irs form 4361 so you can better understand: Web for the information on this form to carry out the internal revenue laws of the united states.

Before your application can be approved, the irs must verify. Web for the information on this form to carry out the internal revenue laws of the united states. Request for copy of tax return. Tax years are calendar years and for this situation, they do not have to be consecutive. Do not sign this form unless all applicable lines have. We need it to ensure that you are complying. An ordained, commissioned, or licensedminister of a church; Web form 4506 (novmeber 2021) department of the treasury internal revenue service. From within your taxact return (. Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval.

Form 4029 Application for Exemption from Social Security and Medicare

You are required to give us the information. Web the deadline to file form 4361 is based on two tax years. Web form 4506 (novmeber 2021) department of the treasury internal revenue service. Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval. Do not sign this form.

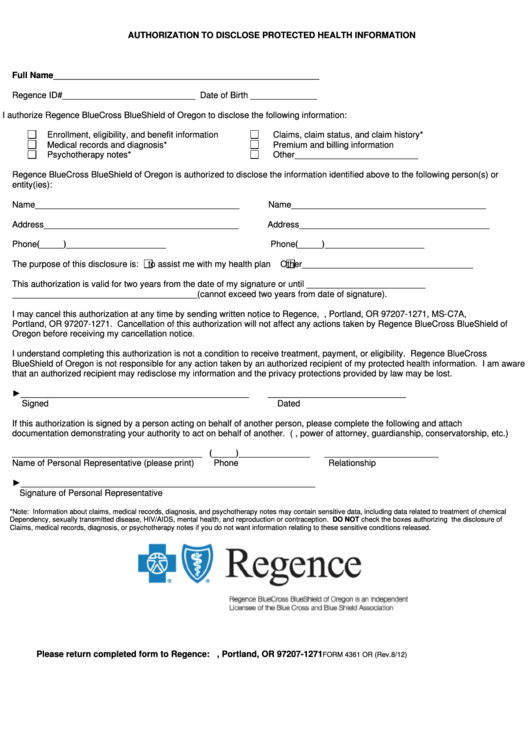

Form 4361 Or Authorization To Disclose Protected Health Information

Web form 4506 (novmeber 2021) department of the treasury internal revenue service. An ordained, commissioned, or licensedminister of a church; Web the deadline to file form 4361 is based on two tax years. From within your taxact return (. Web for the information on this form to carry out the internal revenue laws of the united states.

Form 4361 Application for Exemption from SelfEmployment Tax (2012

An ordained, commissioned, or licensed minister of a. Do not sign this form unless all applicable lines have. Before your application can be approved, the irs must verify. An ordained, commissioned, or licensedminister of a church; Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval.

IRS Form 4361 Exemption From SelfEmployment Tax

From within your taxact return (. Do not sign this form unless all applicable lines have. Before your application can be approved, the irs must verify. Web form 4506 (novmeber 2021) department of the treasury internal revenue service. Web it appears you don't have a pdf plugin for this browser.

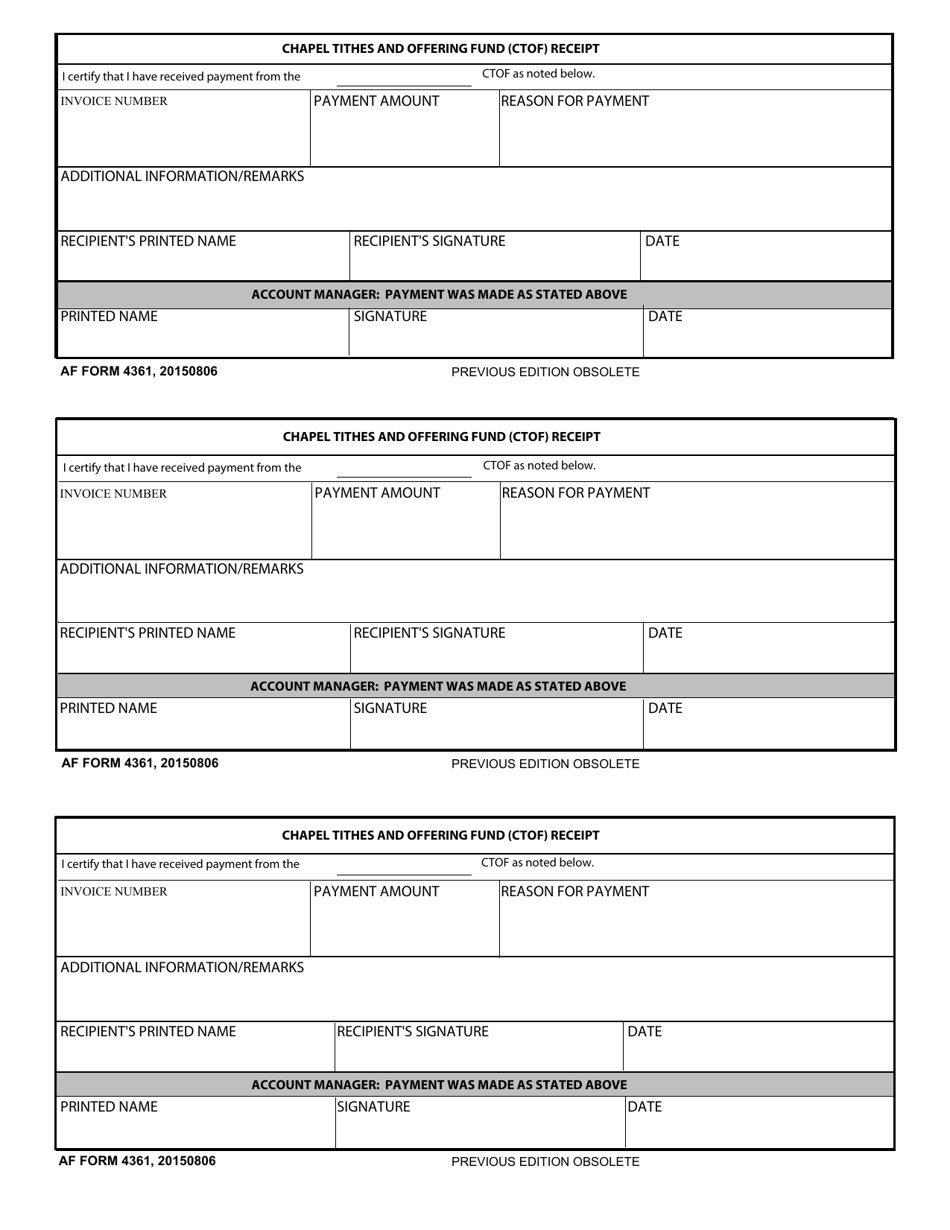

AF Form 4361 Download Fillable PDF or Fill Online Chapel Tithes and

An ordained, commissioned, or licensedminister of a church; From within your taxact return (. Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval. We need it to ensure that you are complying. Do not sign this form unless all applicable lines have.

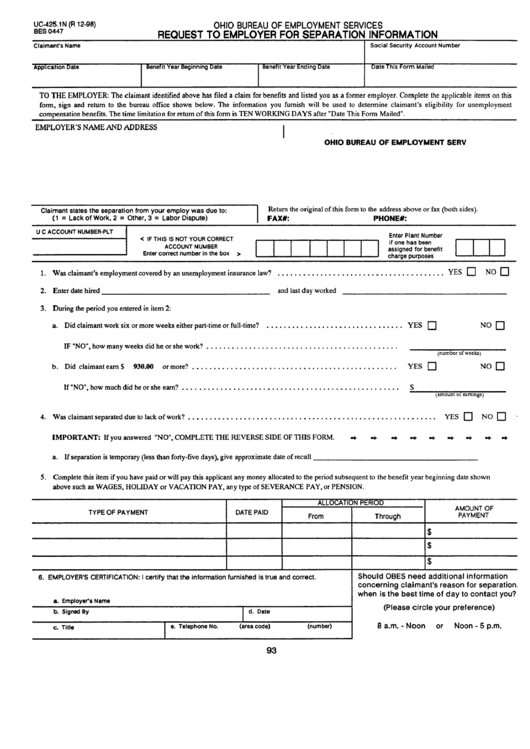

Form Uc425.1n Request To Employer For Separation Information

We need it to ensure that you are complying. Web form 4506 (novmeber 2021) department of the treasury internal revenue service. Tax years are calendar years and for this situation, they do not have to be consecutive. Do not sign this form unless all applicable lines have. To indicate you are a clergy member, minister, member of a religious order,.

Form 4361 Application for Exemption from SelfEmployment Tax (2012

Web in this article, we’ll walk through irs form 4361 so you can better understand: Request for copy of tax return. You are required to give us the information. Web for the information on this form to carry out the internal revenue laws of the united states. From within your taxact return (.

ISU partners with Sprintax News Illinois State

Web general instructions section references are to the internalrevenue code. If using a private delivery service, send your returns to the street. Web the deadline to file form 4361 is based on two tax years. You are required to give us the information. Web in this article, we’ll walk through irs form 4361 so you can better understand:

Form 4029 Application for Exemption from Social Security and Medicare

Web general instructions section references are to the internalrevenue code. Before your application can be approved, the irs must verify. Web form 4506 (novmeber 2021) department of the treasury internal revenue service. An ordained, commissioned, or licensedminister of a church; Request for copy of tax return.

Changes made to Missouri tax form could cost taxpayers money KRCG

Request for copy of tax return. Web the deadline to file form 4361 is based on two tax years. Web in this article, we’ll walk through irs form 4361 so you can better understand: We need it to ensure that you are complying. Do not sign this form unless all applicable lines have.

From Within Your Taxact Return (.

Do not sign this form unless all applicable lines have. Web for the information on this form to carry out the internal revenue laws of the united states. Web general instructions section references are to the internalrevenue code. An ordained, commissioned, or licensed minister of a.

You Are Required To Give Us The Information.

If using a private delivery service, send your returns to the street. Request for copy of tax return. Tax years are calendar years and for this situation, they do not have to be consecutive. Web it appears you don't have a pdf plugin for this browser.

To Indicate You Are A Clergy Member, Minister, Member Of A Religious Order, Or Christian Science Practitioner, And Filed Form.

We need it to ensure that you are complying. Web form 4506 (novmeber 2021) department of the treasury internal revenue service. Before your application can be approved, the irs must verify. Web a minister who wishes to be exempt from social security/medicare tax must file a form 4361 with the irs for approval.

Web In This Article, We’ll Walk Through Irs Form 4361 So You Can Better Understand:

An ordained, commissioned, or licensedminister of a church; Web the deadline to file form 4361 is based on two tax years.