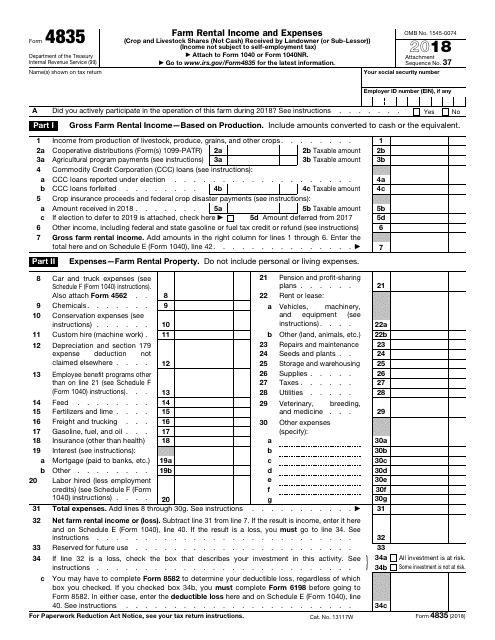

Tax Form 4835

Tax Form 4835 - A go to www.irs.gov/form4835 for the latest information. Use the same format as on schedule e. Web farm rental income and expenses form 4835. You can attach your own schedule (s) to report income or loss from any of these sources. For an estate or trust only, farm rental income and expenses based on crops or livestock produced by the tenant. Web level 1 to enter form 4835 go to federal taxes, income & expenses, then scroll down and find a tab for all income. Do not use form 4835 or schedule f (form 1040) for this purpose. Web supplemental income and loss introduction use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. Web is form 4835 available in the 1041 application? No, per schedule e instructions, use schedule e, part i to report:

Web about form 4835, farm rental income and expenses. A go to www.irs.gov/form4835 for the latest information. January 31, 2021 2:10 pm 0 reply bookmark icon sjc2 level 1 it goes on the same page as farm. Find the topic rentals, royalties, and farm and choose start or update. Web supplemental income and loss introduction use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. Use the same format as on schedule e. For an estate or trust only, farm rental income and expenses based on crops or livestock produced by the tenant. Web level 1 to enter form 4835 go to federal taxes, income & expenses, then scroll down and find a tab for all income. No, per schedule e instructions, use schedule e, part i to report: Web farm rental income and expenses form 4835.

Web what is irs form 4835? Web is form 4835 available in the 1041 application? January 31, 2021 2:10 pm 0 reply bookmark icon sjc2 level 1 it goes on the same page as farm. Web about form 4835, farm rental income and expenses. No, per schedule e instructions, use schedule e, part i to report: Web supplemental income and loss introduction use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. Web farm rental income and expenses form 4835. Use the same format as on schedule e. Find the topic rentals, royalties, and farm and choose start or update. For an estate or trust only, farm rental income and expenses based on crops or livestock produced by the tenant.

Fill Free fillable F5695 2019 Form 5695 PDF form

January 31, 2021 2:10 pm 0 reply bookmark icon sjc2 level 1 it goes on the same page as farm. A go to www.irs.gov/form4835 for the latest information. Web level 1 to enter form 4835 go to federal taxes, income & expenses, then scroll down and find a tab for all income. Web farm rental income and expenses form 4835..

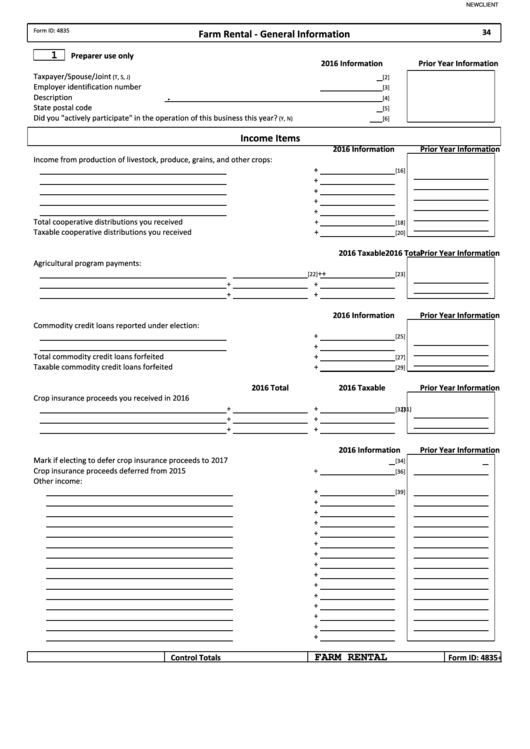

Fill Free fillable F4835 Accessible 2019 Form 4835 PDF form

A go to www.irs.gov/form4835 for the latest information. Web about form 4835, farm rental income and expenses. Use the same format as on schedule e. Web supplemental income and loss introduction use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. Find the topic rentals,.

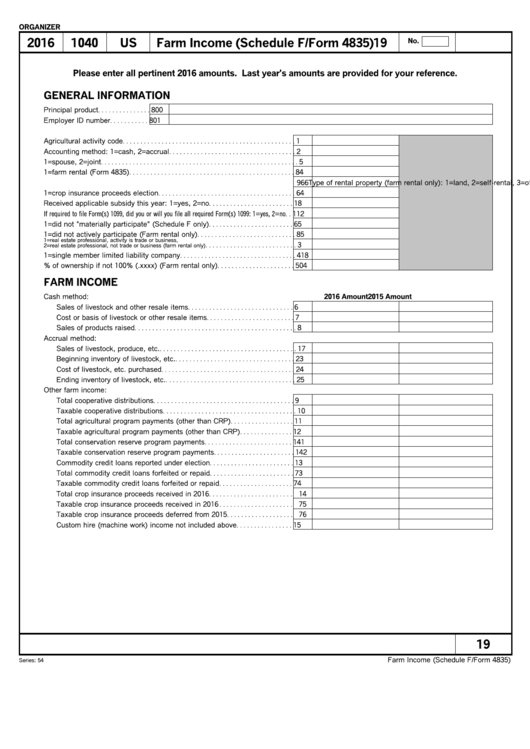

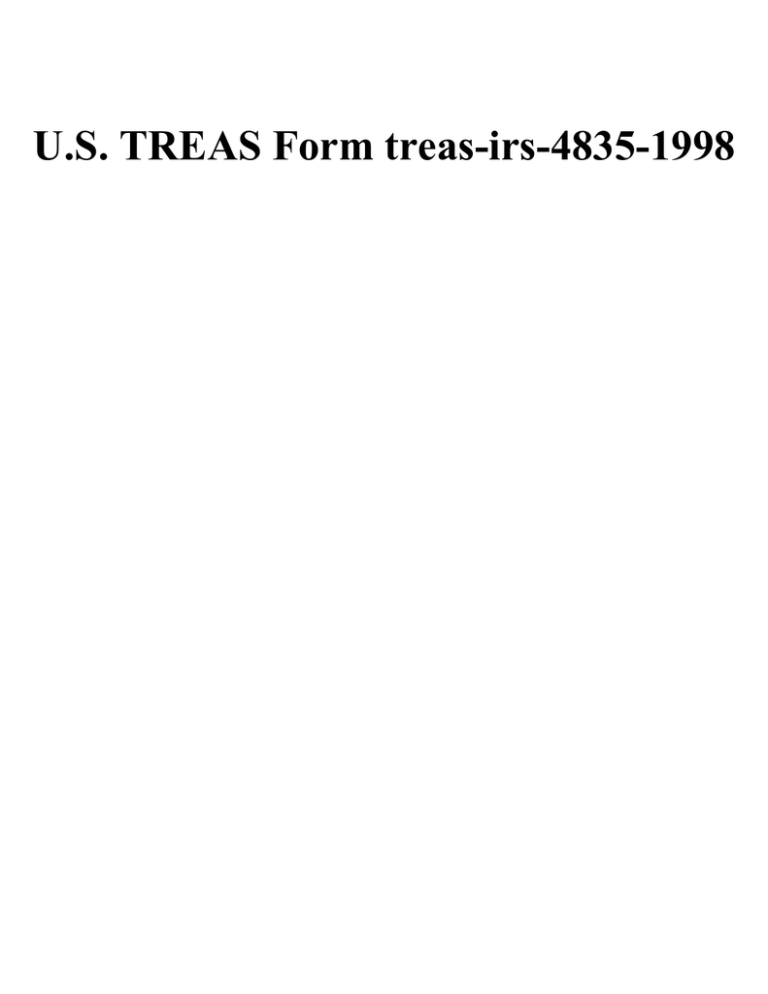

Farm (Schedule F / Form 4835) printable pdf download

A go to www.irs.gov/form4835 for the latest information. Web farm rental income and expenses form 4835. Web is form 4835 available in the 1041 application? Web level 1 to enter form 4835 go to federal taxes, income & expenses, then scroll down and find a tab for all income. Web supplemental income and loss introduction use schedule e (form 1040).

Tax Form 4835 Irs Printable Printable & Fillable Sample in PDF

You can attach your own schedule (s) to report income or loss from any of these sources. Web level 1 to enter form 4835 go to federal taxes, income & expenses, then scroll down and find a tab for all income. Find the topic rentals, royalties, and farm and choose start or update. Do not use form 4835 or schedule.

Top 13 Form 4835 Templates free to download in PDF format

Web level 1 to enter form 4835 go to federal taxes, income & expenses, then scroll down and find a tab for all income. You can attach your own schedule (s) to report income or loss from any of these sources. No, per schedule e instructions, use schedule e, part i to report: Use the same format as on schedule.

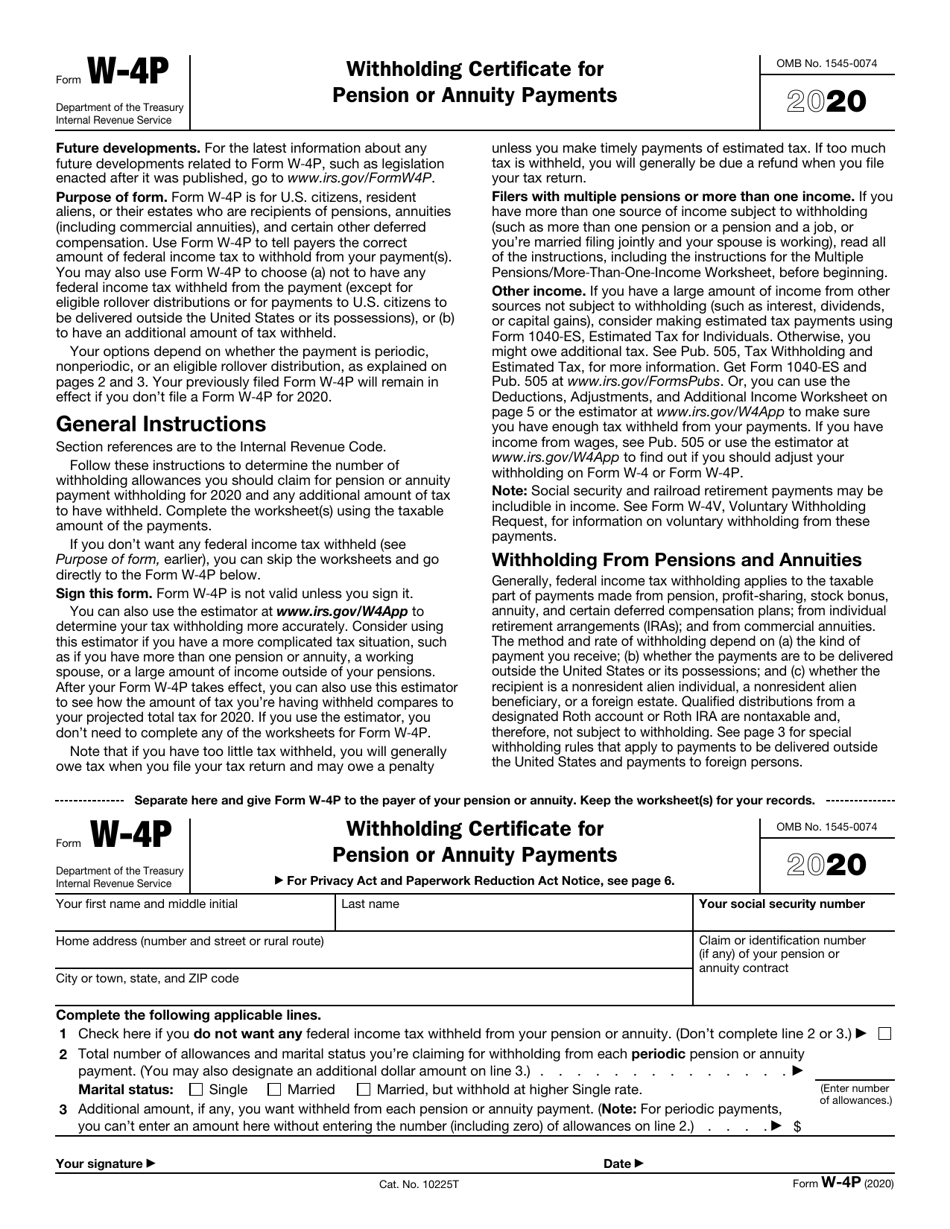

IRS Form W4P Download Fillable PDF or Fill Online Withholding

For an estate or trust only, farm rental income and expenses based on crops or livestock produced by the tenant. Use the same format as on schedule e. A go to www.irs.gov/form4835 for the latest information. Web farm rental income and expenses form 4835. Web what is irs form 4835?

IRS Form 4835 Download Fillable PDF or Fill Online Farm Rental

Web farm rental income and expenses form 4835. You can attach your own schedule (s) to report income or loss from any of these sources. Web level 1 to enter form 4835 go to federal taxes, income & expenses, then scroll down and find a tab for all income. Web supplemental income and loss introduction use schedule e (form 1040).

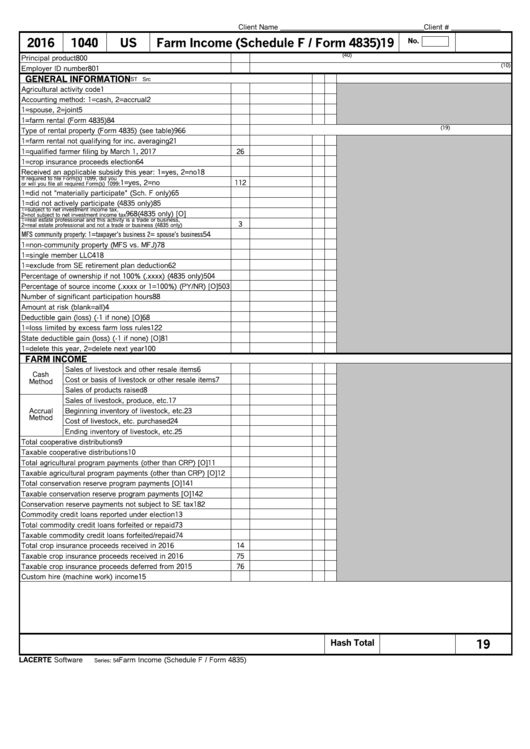

U.S. TREAS Form treasirs48351998

Web farm rental income and expenses form 4835. You can attach your own schedule (s) to report income or loss from any of these sources. Web about form 4835, farm rental income and expenses. Find the topic rentals, royalties, and farm and choose start or update. Web is form 4835 available in the 1041 application?

Farm (Schedule F/form 4835) printable pdf download

Web farm rental income and expenses form 4835. January 31, 2021 2:10 pm 0 reply bookmark icon sjc2 level 1 it goes on the same page as farm. A go to www.irs.gov/form4835 for the latest information. Web what is irs form 4835? Web supplemental income and loss introduction use schedule e (form 1040) to report income or loss from rental.

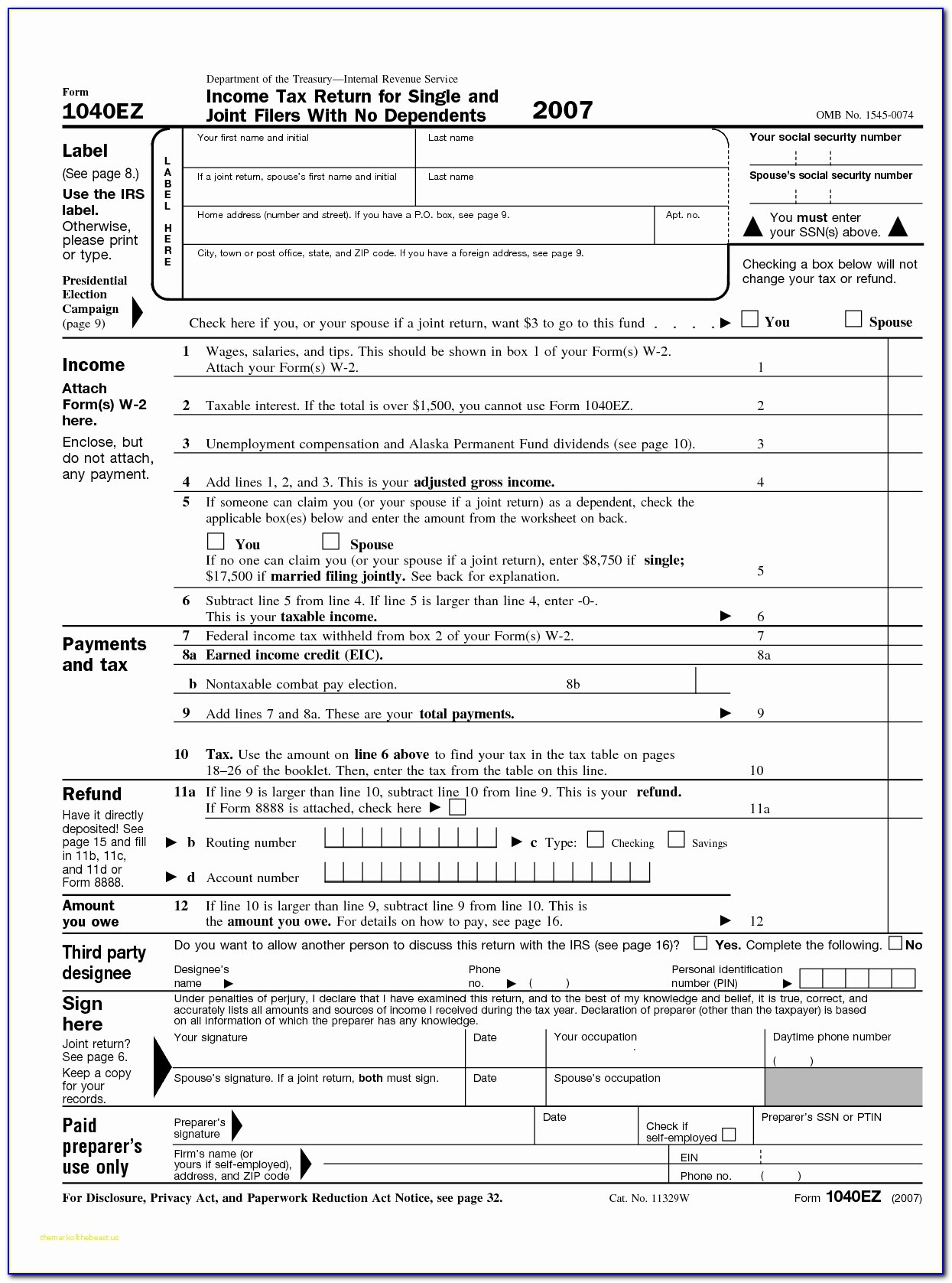

Free Printable Irs Tax Forms Printable Form 2022

Web farm rental income and expenses form 4835. Do not use form 4835 or schedule f (form 1040) for this purpose. Web level 1 to enter form 4835 go to federal taxes, income & expenses, then scroll down and find a tab for all income. You can attach your own schedule (s) to report income or loss from any of.

Web About Form 4835, Farm Rental Income And Expenses.

You can attach your own schedule (s) to report income or loss from any of these sources. Use the same format as on schedule e. Web supplemental income and loss introduction use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in remics. No, per schedule e instructions, use schedule e, part i to report:

January 31, 2021 2:10 Pm 0 Reply Bookmark Icon Sjc2 Level 1 It Goes On The Same Page As Farm.

Web farm rental income and expenses form 4835. Web is form 4835 available in the 1041 application? Do not use form 4835 or schedule f (form 1040) for this purpose. A go to www.irs.gov/form4835 for the latest information.

Find The Topic Rentals, Royalties, And Farm And Choose Start Or Update.

Web level 1 to enter form 4835 go to federal taxes, income & expenses, then scroll down and find a tab for all income. Web what is irs form 4835? For an estate or trust only, farm rental income and expenses based on crops or livestock produced by the tenant.