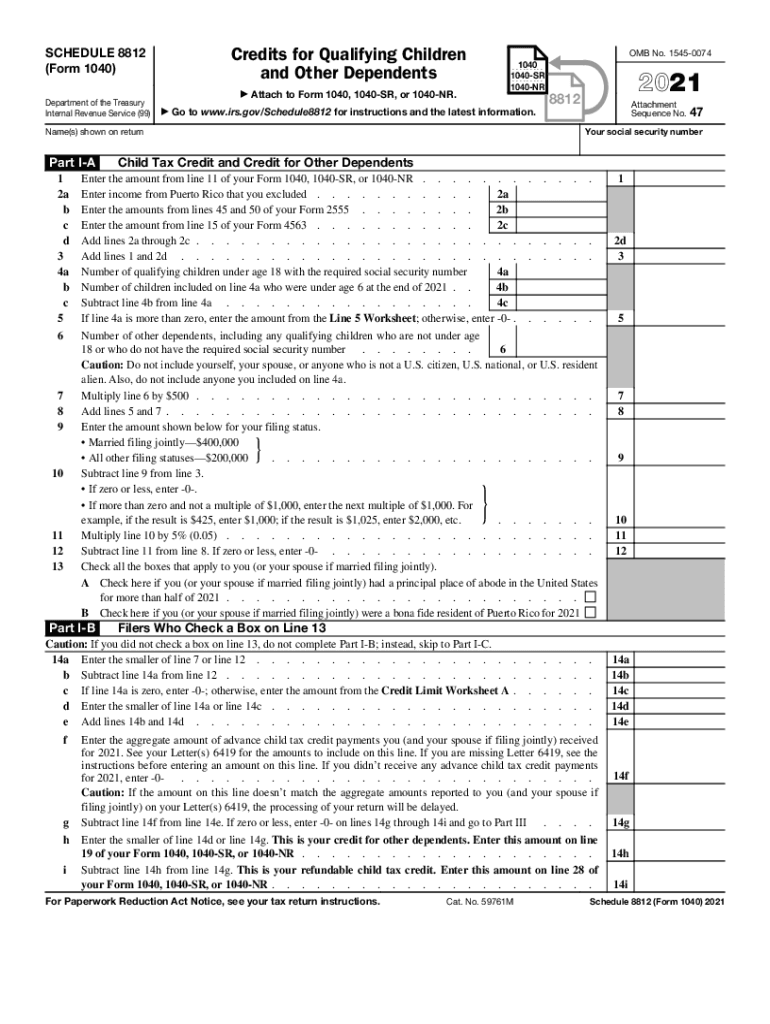

Tax Form 8812 For 2021

Tax Form 8812 For 2021 - Web the american rescue plan act increased the amount per qualifying child, and is fully refundable for tax year 2021 only for qualifying taxpayers. The child tax credit is a valuable tax benefit claimed by millions of. Web advance child tax credit payment reconciliation form 8812. Web up to 10% cash back the irs also did not update publication 972, child tax credit and credit for other dependents, for the 2021 tax year. Web to find rules that apply for 2021, check out our child tax credit stimulus changes article. This is for 2021 returns only. The enhanced credit allowed for qualifying children. The ctc and odc are. Web so what changes did we make to the tax forms to display this? Web 1040 (schedule 8812) is a federal individual income tax form.

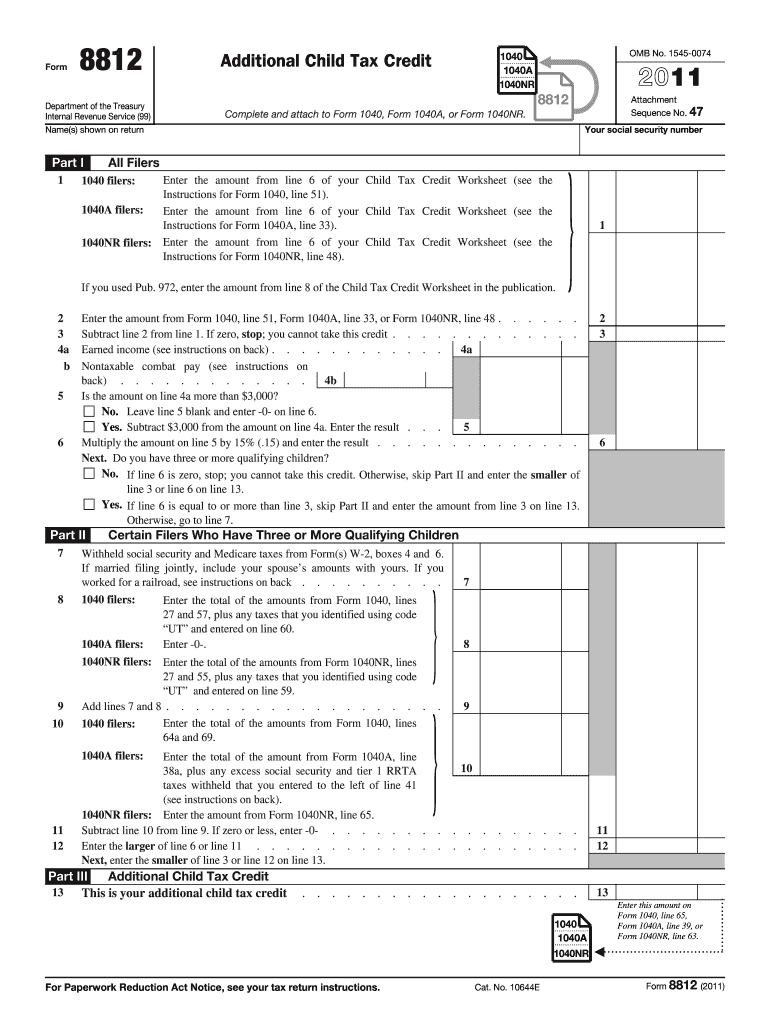

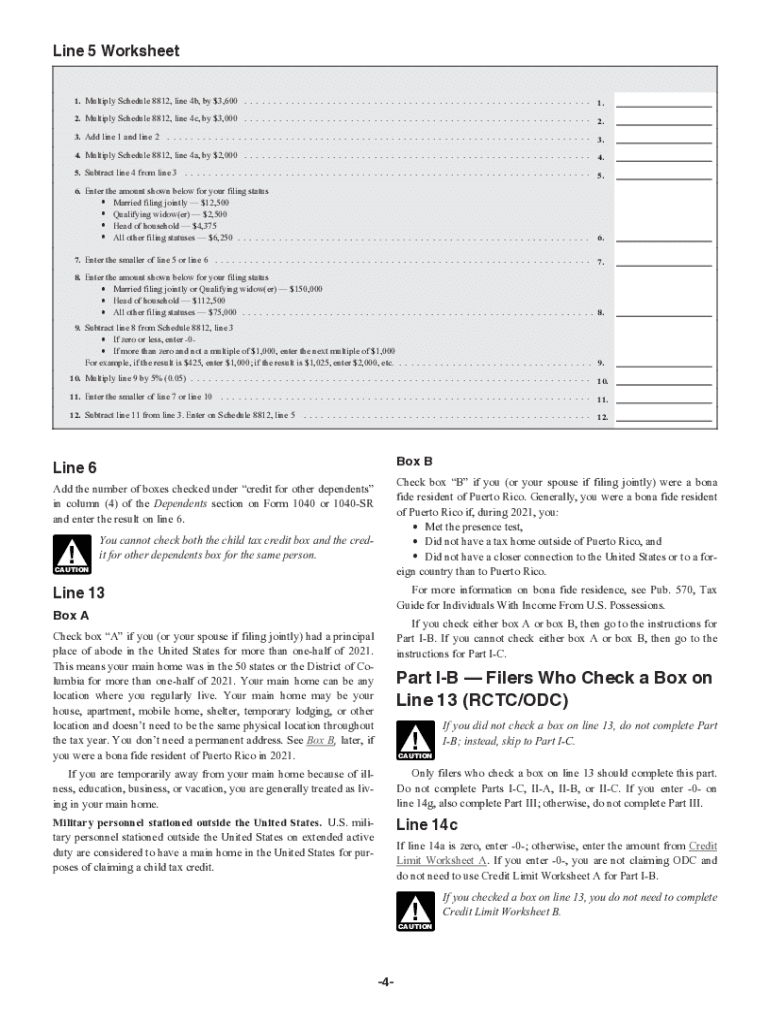

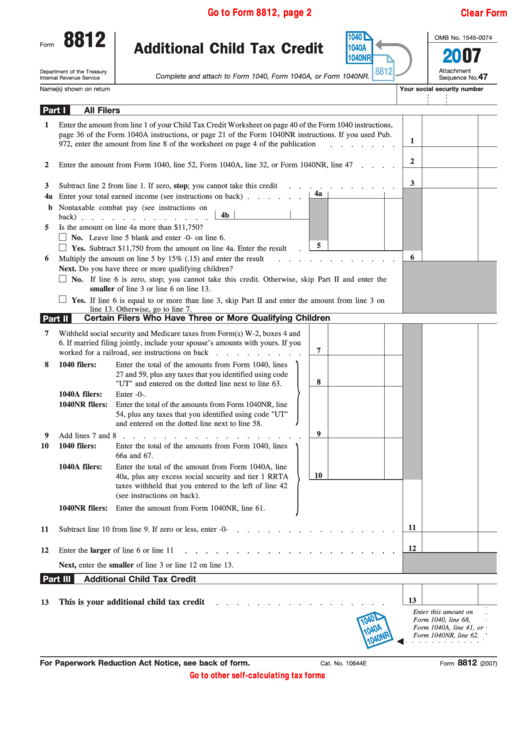

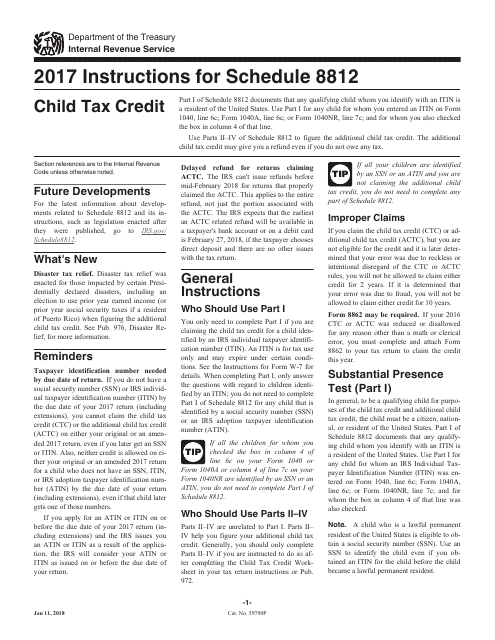

Web schedule 8812 (form 1040) department of the treasury internal revenue service credits for qualifying children and other dependents attach to form 1040, 1040. This is for 2021 returns only. From july 2021 to december 2021, taxpayers may have received an advance payment of the child tax credit equal to 50% of the irs. In order for the child. Easily fill out pdf blank, edit, and sign them. New schedule 8812, credits for. Web the expanded schedule 8812 is now three pages for 2021. Web qualifying child requirement in the united states, taxpayers are able to claim a tax credit of up to $1,000 per year for qualifying dependent children as of 2017. Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional.

From july 2021 to december 2021, taxpayers may have received an advance payment of the child tax credit equal to 50% of the irs. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional. Web 1040 (schedule 8812) is a federal individual income tax form. Web advance child tax credit payment reconciliation form 8812. Web you'll use form 8812 to calculate your additional child tax credit. Save or instantly send your ready documents. In order for the child. Get ready for tax season deadlines by completing any required tax forms today. Web many changes to the ctc for 2021 implemented by the american rescue plan act of 2021, have expired.

Top 8 Form 8812 Templates free to download in PDF format

Web solved • by turbotax • 3264 • updated january 25, 2023. Web the expanded schedule 8812 is now three pages for 2021. The ctc and odc are. Web for more information on the child tax credit for 2021, please refer to form 8812 instructions. Should be completed by all filers to claim the basic.

Download Instructions for IRS Form 1040 Schedule 8812 Child Tax Credit

The child tax credit is a valuable tax benefit claimed by millions of. Web the american rescue plan act increased the amount per qualifying child, and is fully refundable for tax year 2021 only for qualifying taxpayers. For tax years 2020 and prior: Web advance child tax credit payment reconciliation form 8812. Web use schedule 8812 (form 1040) to figure.

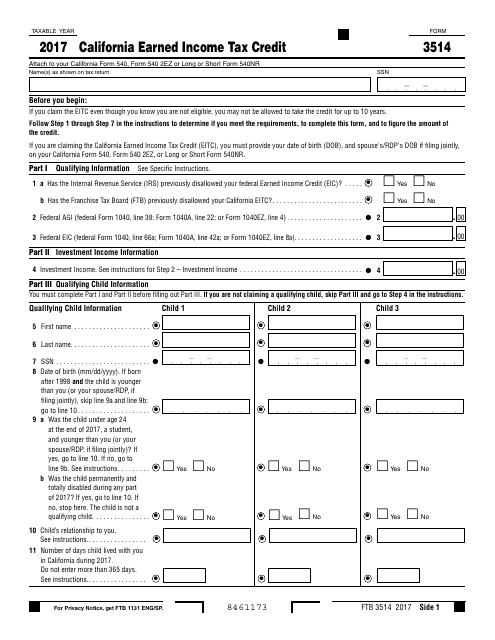

Form FTB 3514 Download Fillable PDF 2017, California Earned Tax

We overhauled the schedule 8812 of the form 1040 in 2021 to implement these changes under the american rescue. Web solved • by turbotax • 3264 • updated january 25, 2023. For 2022, there are two parts to this form: New schedule 8812, credits for. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for.

Schedule 8812 What is IRS Form Schedule 8812 & Filing Instructions

Easily fill out pdf blank, edit, and sign them. Web the american rescue plan act increased the amount per qualifying child, and is fully refundable for tax year 2021 only for qualifying taxpayers. The child tax credit is a partially refundable credit offered. Advanced payments from july 2021 to december 2021, taxpayers may. Web qualifying child requirement in the united.

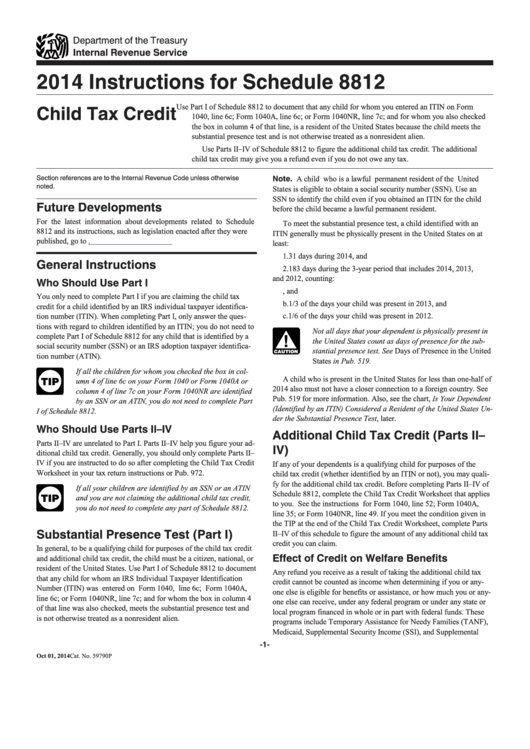

Instructions For Schedule 8812 Child Tax Credit 2014 printable pdf

In order for the child. The enhanced credit allowed for qualifying children. Complete, edit or print tax forms instantly. This is for 2021 returns only. Web up to 10% cash back the irs also did not update publication 972, child tax credit and credit for other dependents, for the 2021 tax year.

Form 8812 Fill Out and Sign Printable PDF Template signNow

Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional. Web use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). For 2022, there are two parts to this.

Irs Child Tax Credit Form 2020 Trending US

Complete, edit or print tax forms instantly. Web income tax forms 1040 (schedule 8812) federal — child tax credit download this form print this form it appears you don't have a pdf plugin for this browser. New schedule 8812, credits for. The enhanced credit allowed for qualifying children. Web 1040 (schedule 8812) is a federal individual income tax form.

Form 8812 Credit Limit Worksheet A

Web qualifying child requirement in the united states, taxpayers are able to claim a tax credit of up to $1,000 per year for qualifying dependent children as of 2017. New schedule 8812, credits for. Complete, edit or print tax forms instantly. The child tax credit is a valuable tax benefit claimed by millions of. Easily fill out pdf blank, edit,.

8812 Worksheet

From july 2021 to december 2021, taxpayers may have received an advance payment of the child tax credit equal to 50% of the irs. The child tax credit is a partially refundable credit offered. Web up to 10% cash back the irs also did not update publication 972, child tax credit and credit for other dependents, for the 2021 tax.

8812 Instructions Tax Form Fill Out and Sign Printable PDF Template

Complete, edit or print tax forms instantly. Save or instantly send your ready documents. Get ready for tax season deadlines by completing any required tax forms today. Should be completed by all filers to claim the basic. We overhauled the schedule 8812 of the form 1040 in 2021 to implement these changes under the american rescue.

Complete, Edit Or Print Tax Forms Instantly.

We overhauled the schedule 8812 of the form 1040 in 2021 to implement these changes under the american rescue. In order for the child. Get ready for tax season deadlines by completing any required tax forms today. Web you'll use form 8812 to calculate your additional child tax credit.

From July 2021 To December 2021, Taxpayers May Have Received An Advance Payment Of The Child Tax Credit Equal To 50% Of The Irs.

The child tax credit is a partially refundable credit offered. Schedule 8812 (child tax credit) is used to claim the child tax credit (ctc), credit for other dependents. This is for 2021 returns only. Web so what changes did we make to the tax forms to display this?

Web Solved • By Turbotax • 3264 • Updated January 25, 2023.

For 2022, there are two parts to this form: Web for more information on the child tax credit for 2021, please refer to form 8812 instructions. For tax years 2020 and prior: Web advance child tax credit payment reconciliation form 8812.

Web The American Rescue Plan Act Increased The Amount Per Qualifying Child, And Is Fully Refundable For Tax Year 2021 Only For Qualifying Taxpayers.

Save or instantly send your ready documents. Web use schedule 8812 (form 1040) to figure your child tax credits, to report advance child tax credit payments you received in 2021, and to figure any additional. Web many changes to the ctc for 2021 implemented by the american rescue plan act of 2021, have expired. Web qualifying child requirement in the united states, taxpayers are able to claim a tax credit of up to $1,000 per year for qualifying dependent children as of 2017.

:max_bytes(150000):strip_icc()/ScreenShot2021-05-05at3.12.40PM-ad486e92d61441a9b09a3e39b758696c.png)