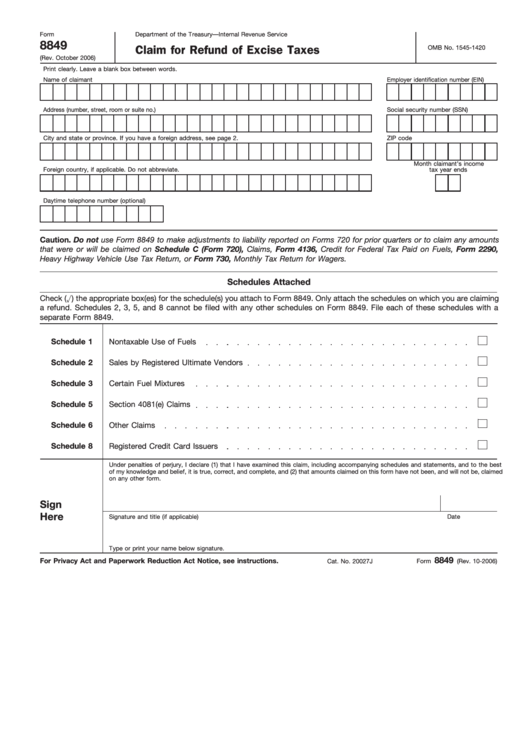

Tax Form 8849

Tax Form 8849 - Web irs tax form 8849 is used to claim refund on federal excise taxes paid by attaching schedules 1, 2, 3, 5, and 8 based on the type of claim and purpose of claim, precisely. File your irs 2290 form in just a few clicks. Web what is form 8849? Web form 8849 schedule 6 is used exclusively to claim a refund on the heavy vehicle use tax (hvut) paid for form 2290. Form 8849 is used to claim a refund of excise taxes. Taxpayers have to attach schedule 1,2,3,5 and 8 to claim relevant refunds. What’s new changes are discussed. This is a separate return from the individual tax return. Web why is irs offering electronic filing of form 8849, claim for refund of excise taxes? Taxpayers can use the irs form 8849 to file a claim for acquiring refunds of the excise taxes.

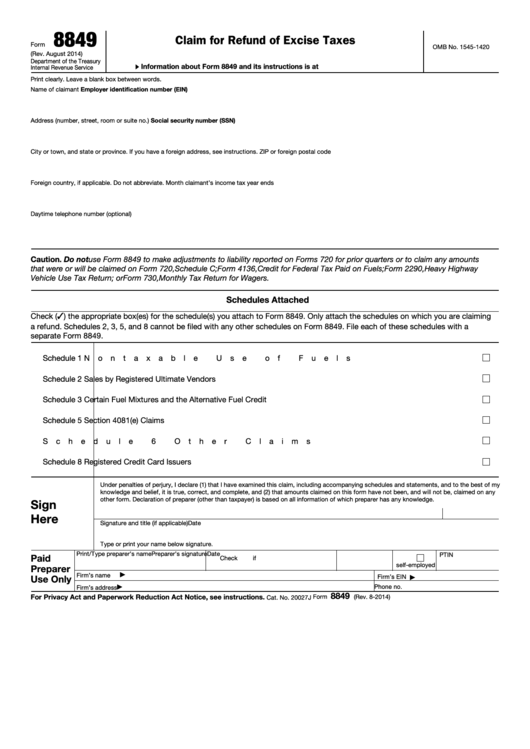

There is no deadline to file your form. Web the following replaces the “where to file” addresses on page 2 of form 8822 (rev. Web we last updated the claim for refund of excise taxes in february 2023, so this is the latest version of form 8849, fully updated for tax year 2022. Offering electronic filing of form 8849 satisfies the congressional. Form 8849 of the irs is used to claim a refund on the excise taxes. Web form department of the treasury—internal revenue service 8849 (rev. Web form 8849 to claim for refund of excise taxes form 8849 is used to claim a refund of excise taxes reported on hvut form 2290. File your irs 2290 form in just a few clicks. Effective july 30, 2021, you are required to file your sales and use tax returns electronically, if your business reports sales. Web why is irs offering electronic filing of form 8849, claim for refund of excise taxes?

Web form 8849 schedule 6 is used exclusively to claim a refund on the heavy vehicle use tax (hvut) paid for form 2290. Web what is form 8849? Web uses (or sales) of fuels. Web form 8849 and its instructions or separate schedules, such as legislation enacted after they were published, go to www.irs.gov/form8849. Taxpayers have to attach schedule 1,2,3,5 and 8 to claim relevant refunds. Get stamped schedule 1 in minutes. Web the following replaces the “where to file” addresses on page 2 of form 8822 (rev. This is a separate return from the individual tax return. Web irs tax form 8849 is used to claim refund on federal excise taxes paid by attaching schedules 1, 2, 3, 5, and 8 based on the type of claim and purpose of claim, precisely. Form 8849 is used to claim a refund of excise taxes.

Form 8849 (Schedule 2) Sales by Registered Ultimate Vendors (2012

File your irs 2290 form in just a few clicks. Web form 8849 to claim for refund of excise taxes form 8849 is used to claim a refund of excise taxes reported on hvut form 2290. Web form 8849 schedule 6 is used exclusively to claim a refund on the heavy vehicle use tax (hvut) paid for form 2290. Web.

Form 8849 Claim for Refund of Excise Taxes (2014) Free Download

Taxpayers also use the irs 8849 to claim certain. Web form 8849 schedule 6 is used exclusively to claim a refund on the heavy vehicle use tax (hvut) paid for form 2290. Offering electronic filing of form 8849 satisfies the congressional. Web what is form 8849? Web uses (or sales) of fuels.

Fillable Form 8849 Claim For Refund Of Excise Taxes printable pdf

File your irs 2290 form in just a few clicks. Form 8849 is used to claim a refund of excise taxes. Web what is form 8849? There is no deadline to file your form. Web form 8849 and its instructions or separate schedules, such as legislation enacted after they were published, go to www.irs.gov/form8849.

Form 8849 Claim for Refund of Excise Taxes (2014) Free Download

They can also use this form to claim certain. Get stamped schedule 1 in minutes. Web irs tax form 8849 is used to claim refund on federal excise taxes paid by attaching schedules 1, 2, 3, 5, and 8 based on the type of claim and purpose of claim, precisely. Web uses (or sales) of fuels. Web what is form.

Form 8849 (Schedule 6) Other Claims of Taxes IRS Form (2014) Free

If you paid additional 2290 tax to the irs while filing a tax return, you can file the irs form 8849 to. What’s new changes are discussed. Web why is irs offering electronic filing of form 8849, claim for refund of excise taxes? January 2002) claim for refund of excise taxes omb no. Taxpayers can use the irs form 8849.

Instructions to Claim Credits Using Tax Form 8849

Web irs tax form 8849 is used to claim refund on federal excise taxes paid by attaching schedules 1, 2, 3, 5, and 8 based on the type of claim and purpose of claim, precisely. January 2002) claim for refund of excise taxes omb no. Taxpayers have to attach schedule 1,2,3,5 and 8 to claim relevant refunds. If you paid.

Fillable Form 8849 Claim For Refund Of Excise Taxes printable pdf

Web why is irs offering electronic filing of form 8849, claim for refund of excise taxes? This is a separate return from the individual tax return. Use schedule 6 for other claims, including refunds of excise taxes reported on: File your irs 2290 form in just a few clicks. Web form 8849 and its instructions or separate schedules, such as.

Form 8849 (Schedule 1) Nontaxable Use of Fuels (2012) Free Download

This is a separate return from the individual tax return. Use schedule 6 for other claims, including refunds of excise taxes reported on: Taxpayers have to attach schedule 1,2,3,5 and 8 to claim relevant refunds. Web august 23, 2021. Web why is irs offering electronic filing of form 8849, claim for refund of excise taxes?

Fill Free fillable Form 8849 2014 Claim for Refund of Excise Taxes

File your irs 2290 form in just a few clicks. Web file form 8849 with the internal revenue service center where you file form 720, 730, or 2290. Get stamped schedule 1 in minutes. Web form 8849 and its instructions or separate schedules, such as legislation enacted after they were published, go to www.irs.gov/form8849. Use schedule 6 for other claims,.

Form 8849 (Schedule 1) Nontaxable Use of Fuels (2012) Free Download

Web we last updated the claim for refund of excise taxes in february 2023, so this is the latest version of form 8849, fully updated for tax year 2022. If you are not a filer of form 720, 730, or 2290, file form 8849 with the service. Web the following replaces the “where to file” addresses on page 2 of.

Web What Is Form 8849?

Get stamped schedule 1 in minutes. Web form 8849 to claim for refund of excise taxes form 8849 is used to claim a refund of excise taxes reported on hvut form 2290. Form 8849 is used to claim a refund of excise taxes. Web august 23, 2021.

What’s New Changes Are Discussed.

Use schedule 6 for other claims, including refunds of excise taxes reported on: If you checked the box on line 2, send form 8822 to:. Form 8849 lists the schedules by number and title. Taxpayers can use the irs form 8849 to file a claim for acquiring refunds of the excise taxes.

Web Form 8849 And Its Instructions Or Separate Schedules, Such As Legislation Enacted After They Were Published, Go To Www.irs.gov/Form8849.

Web file form 8849 with the internal revenue service center where you file form 720, 730, or 2290. They can also use this form to claim certain. Web why is irs offering electronic filing of form 8849, claim for refund of excise taxes? If you are not a filer of form 720, 730, or 2290, file form 8849 with the service.

File Your Irs 2290 Form In Just A Few Clicks.

If you paid additional 2290 tax to the irs while filing a tax return, you can file the irs form 8849 to. Effective july 30, 2021, you are required to file your sales and use tax returns electronically, if your business reports sales. Taxpayers also use the irs 8849 to claim certain. Web uses (or sales) of fuels.