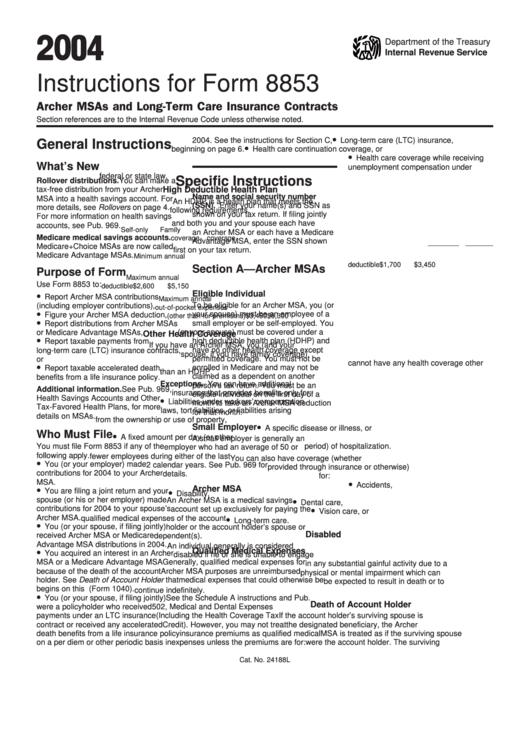

Tax Form 8853

Tax Form 8853 - Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in missouri. Complete, edit or print tax forms instantly. Web find mailing addresses by state and date for filing form 2553. Individual income tax return, and form 8853 must be filed in order to avoid paying taxes on msa account withdrawals. Complete, edit or print tax forms instantly. You don't have to file form 8853 to. Form 8853 is the tax form used for. Ad access irs tax forms. 525 taxable and nontaxable income; Also include this amount in the total on schedule 2 (form 1040), line 8.

Ad access irs tax forms. Check box c on schedule 2 (form 1040), line 8. Also include this amount in the total on schedule 2 (form 1040), line 8. If the corporation's principal business, office, or agency is located in. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in missouri. Complete, edit or print tax forms instantly. You must file form 8853 if any of the following. You don't have to file form 8853 to. Ad complete irs tax forms online or print government tax documents. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software.

Enter “med msa” and the amount on. You don't have to file form 8853 to. Also include this amount in the total on schedule 2 (form 1040), line 8. Web use form 8853 to report archer msa contributions, figure your archer msa deduction, report distributions from archer msas or medicare advantage. Complete, edit or print tax forms instantly. Ad access irs tax forms. Easily sort by irs forms to find the product that best fits your tax. Complete federal form 8853, before completing. Web if the distribution is not used for qualified medical expenses, the taxpayer is subject to the additional 12.5% tax on this distribution. Complete, edit or print tax forms instantly.

Form 8889 Health Savings Accounts (HSAs) (2014) Free Download

Easily sort by irs forms to find the product that best fits your tax. Ad complete irs tax forms online or print government tax documents. Check box c on schedule 2 (form 1040), line 8. If the corporation's principal business, office, or agency is located in. Complete, edit or print tax forms instantly.

IRS Publication Form 8283 Real Estate Appraisal Tax Deduction

525 taxable and nontaxable income; Web to claim an exclusion for accelerated death benefits made on a per diem or other periodic basis, you must file form 8853 with your return. Individual income tax return, and form 8853 must be filed in order to avoid paying taxes on msa account withdrawals. Enter “med msa” and the amount on. Also include.

Form 8889 Health Savings Accounts (HSAs) (2014) Free Download

Download or email irs 8853 & more fillable forms, register and subscribe now! Form 8853 is the tax form used for. Ad complete irs tax forms online or print government tax documents. Complete federal form 8853, before completing. Also include this amount in the total on schedule 2 (form 1040), line 8.

Irs Form 8853 Instructions 2023 Fill online, Printable, Fillable Blank

Also include this amount in the total on schedule 2 (form 1040), line 8. 525 taxable and nontaxable income; Individual income tax return, and form 8853 must be filed in order to avoid paying taxes on msa account withdrawals. You don't have to file form 8853 to. If the corporation's principal business, office, or agency is located in.

What is a 1099 Tax Form? (Guide to IRS Form 1099) MintLife Blog

Complete federal form 8853, before completing. Form 8853 is the tax form used for. 525 taxable and nontaxable income; Web the end of 2019. You don't have to file form 8853 to.

Form 8853 Archer MSAs and LongTerm Care Insurance Contracts (2014

Form 8853 is the tax form used for. Complete federal form 8853, before completing. Ad access irs tax forms. Download or email irs 8853 & more fillable forms, register and subscribe now! Web find mailing addresses by state and date for filing form 2553.

Instructions For Form 8853 Archer Msas And LongTerm Care Insurance

Check box c on schedule 2 (form 1040), line 8. Ad complete irs tax forms online or print government tax documents. Web the end of 2019. Easily sort by irs forms to find the product that best fits your tax. Web if the distribution is not used for qualified medical expenses, the taxpayer is subject to the additional 12.5% tax.

Tax 8853 YouTube

Complete, edit or print tax forms instantly. You must file form 8853 if any of the following. Complete, edit or print tax forms instantly. Ad complete irs tax forms online or print government tax documents. These where to file addresses.

Form 8889 Instructions & Information on the HSA Tax Form

Complete, edit or print tax forms instantly. 525 taxable and nontaxable income; If the corporation's principal business, office, or agency is located in. Individual income tax return, and form 8853 must be filed in order to avoid paying taxes on msa account withdrawals. Ad access irs tax forms.

Web To Claim An Exclusion For Accelerated Death Benefits Made On A Per Diem Or Other Periodic Basis, You Must File Form 8853 With Your Return.

Individual income tax return, and form 8853 must be filed in order to avoid paying taxes on msa account withdrawals. Complete, edit or print tax forms instantly. Form 8853 is the tax form used for. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in missouri.

Easily Sort By Irs Forms To Find The Product That Best Fits Your Tax.

Web the end of 2019. Check box c on schedule 2 (form 1040), line 8. Enter “med msa” and the amount on. Also include this amount in the total on schedule 2 (form 1040), line 8.

If The Corporation's Principal Business, Office, Or Agency Is Located In.

Ad complete irs tax forms online or print government tax documents. Complete federal form 8853, before completing. Web find mailing addresses by state and date for filing form 2553. You don't have to file form 8853 to.

Web If The Distribution Is Not Used For Qualified Medical Expenses, The Taxpayer Is Subject To The Additional 12.5% Tax On This Distribution.

Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Ad access irs tax forms. 525 taxable and nontaxable income; You must file form 8853 if any of the following.