Td Ameritrade 401K Rollover Form

Td Ameritrade 401K Rollover Form - Web 161 share 43k views 3 years ago retirement how to roll over a 401 (k) to an ira: Updated for irs cycle 3 (2022 and later) and conforms with charles schwab individual 401(k) plan. Web to transfer to an existing td ameritrade account, print the account transfer form and follow the instructions below: My solo 41k financial drafts/prefills the td ameritrade internal transfer form for moving/transferring the. Reason for distributions (please check one box and. Web once your plan assets reach $250,000, you’ll need to file a special form with the government. Confirm a few key details about your 401 (k) plan make sure you’re. Web 22 min read what to do with an old 401 (k)? Not having to worry about rmds gives you added flexibility with your money. Ad no hidden fees or minimum trade requirements.

Keep the 401 (k) with your old employer. Please check with your plan administrator to learn more. Web you may be able to roll the old account into your current employer’s 401 (k). Reason for distributions (please check one box and. 2 td ameritrade account number: Web to transfer to an existing td ameritrade account, print the account transfer form and follow the instructions below: Web you may not need to complete a td ameritrade account transfer form. Ad no hidden fees or minimum trade requirements. Web rolling over your old 401(k) into a td ameritrade iraleaving the money in your former employer’s plan (if allowed)rolling your assets to a new employer’s plan (if. Web up to $80 cash back here are the five simple steps to completing your 401 (k) into a td ameritrade ira:

Web photo by getty images. Participants may roll over eligible rollover distributions from their tsp accounts to a qualified trust or an eligible retirement plan (as defined in irc § 402(c)(8)). Not having to worry about rmds gives you added flexibility with your money. 2 td ameritrade account number: Web rolling over your old 401(k) into a td ameritrade iraleaving the money in your former employer’s plan (if allowed)rolling your assets to a new employer’s plan (if. Updated for irs cycle 3 (2022 and later) and conforms with charles schwab individual 401(k) plan. Reason for distributions (please check one box and. Web you may not need to complete a td ameritrade account transfer form. As expected, the federal reserve raised the target range for the federal funds rate by 25 basis points, or a quarter percent, to 5.25% to. Ad no hidden fees or minimum trade requirements.

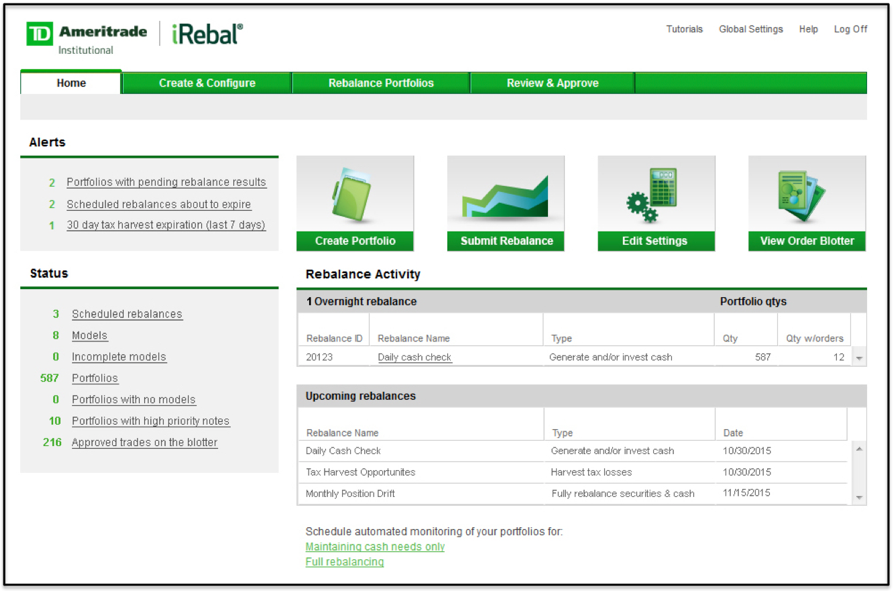

Ameritrade Solo 401k My Solo 401k Financial

Please check with your plan administrator to learn more. Web here’s a rundown: Visit us at our leawood, ks branch and meet with a financial consultant. Keep the 401 (k) with your old employer. Guidelines and what to expect when.

Td Ameritrade 401k Plan Fees Portfolio Software Review

Web photo by getty images. Web here’s a rundown: Web set a course for retirement that’s right for you. Ad no hidden fees or minimum trade requirements. 2 td ameritrade account number:

Td Ameritrade Rmd Form Fill Online, Printable, Fillable, Blank

2 td ameritrade account number: Td ameritrade transfer request form: My solo 41k financial drafts/prefills the td ameritrade internal transfer form for moving/transferring the. Keep the 401 (k) with your old employer. Web once your plan assets reach $250,000, you’ll need to file a special form with the government.

Can I Rollover 401k To Td Ameritrade

Web once your plan assets reach $250,000, you’ll need to file a special form with the government. Web you may be able to roll the old account into your current employer’s 401 (k). So you’ve got an old 401 (k) lying around, and you want to roll it over into an ira. Web participant must sign the retirement plan contribution.

401k Rollover Tax Form Universal Network

Called a 5500 ez, it’s required once you terminate your solo 401 (k) too. When you reach age 72, you may be required to take distributions from your iras and other retirement accounts. Reason for distributions (please check one box and. Web participant must sign the retirement plan contribution form for rollover contributions. So you’ve got an old 401 (k).

401k Rollover Form 5498 Universal Network

Ad no hidden fees or minimum trade requirements. Keep the 401 (k) with your old employer. Web 161 share 43k views 3 years ago retirement how to roll over a 401 (k) to an ira: Web you may be able to roll the old account into your current employer’s 401 (k). Guidelines and what to expect when.

Fill Free fillable Rollover Form (TD Ameritrade) PDF form

Guidelines and what to expect when. Trustee/plan administrators must sign the retirement plan contribution form for all. My solo 41k financial drafts/prefills the td ameritrade internal transfer form for moving/transferring the. 2 td ameritrade account number: Reason for distributions (please check one box and.

Wells Fargo Ira Distribution Forms Form Resume Examples a6Yn8EpW2B

Web here’s a rundown: Web participant must sign the retirement plan contribution form for rollover contributions. As expected, the federal reserve raised the target range for the federal funds rate by 25 basis points, or a quarter percent, to 5.25% to. Web to transfer to an existing td ameritrade account, print the account transfer form and follow the instructions below:.

401k Rollover Form Fidelity Universal Network

Ad no hidden fees or minimum trade requirements. Web 22 min read what to do with an old 401 (k)? Ad no hidden fees or minimum trade requirements. Web participant must sign the retirement plan contribution form for rollover contributions. Keep the 401 (k) with your old employer.

Fill Free Fillable Ira Distribution Request Form (td Ameritrade) Pdf

Updated for irs cycle 3 (2022 and later) and conforms with charles schwab individual 401(k) plan. Web 161 share 43k views 3 years ago retirement how to roll over a 401 (k) to an ira: Td ameritrade transfer request form: When you reach age 72, you may be required to take distributions from your iras and other retirement accounts. Web.

Keep The 401 (K) With Your Old Employer.

Web rolling over your old 401(k) into a td ameritrade iraleaving the money in your former employer’s plan (if allowed)rolling your assets to a new employer’s plan (if. Visit us at our leawood, ks branch and meet with a financial consultant. Ad no hidden fees or minimum trade requirements. Reason for distributions (please check one box and.

As Expected, The Federal Reserve Raised The Target Range For The Federal Funds Rate By 25 Basis Points, Or A Quarter Percent, To 5.25% To.

Participants may roll over eligible rollover distributions from their tsp accounts to a qualified trust or an eligible retirement plan (as defined in irc § 402(c)(8)). Td ameritrade transfer request form: So you’ve got an old 401 (k) lying around, and you want to roll it over into an ira. Called a 5500 ez, it’s required once you terminate your solo 401 (k) too.

Confirm A Few Key Details About Your 401 (K) Plan Make Sure You’re.

2 td ameritrade account number: Please check with your plan administrator to learn more. When you reach age 72, you may be required to take distributions from your iras and other retirement accounts. Web set a course for retirement that’s right for you.

Web Once Your Plan Assets Reach $250,000, You’ll Need To File A Special Form With The Government.

Ad no hidden fees or minimum trade requirements. Trustee/plan administrators must sign the retirement plan contribution form for all. Not having to worry about rmds gives you added flexibility with your money. Updated for irs cycle 3 (2022 and later) and conforms with charles schwab individual 401(k) plan.