Td Ameritrade Form 5498

Td Ameritrade Form 5498 - To view and print files properly, please be sure to. What is form 5498 and why did i receive it? This document is for ira’s (both traditional and roth). Ad no hidden fees or minimum trade requirements. The institution that manages your ira is. Fill & download for free get form download the form how to edit the td ameritrade form 5498 conviniently online start on editing, signing and. Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. In january following this calendar year, td ameritrade clearing, inc. Web find, download, and print important brokerage forms, agreements, pdf files, and disclosures from our form library. Web the key to filing your taxes is being prepared.

Web authorization to produce a corrected 5498 tax form for submission to the irs. In january following this calendar year, td ameritrade clearing, inc. Hereby authorize you to correct my 5498 tax form information. The institution that manages your ira is. Web irs form 5498 is an informational form that reports not only your ira contributions to the irs, but any rollovers you might have made as well. Fill & download for free get form download the form how to edit the td ameritrade form 5498 conviniently online start on editing, signing and. Ad no hidden fees or minimum trade requirements. Web incorrect information on form 5498, ira contribution information, may cause taxpayers to make ira reporting errors on their tax returns. Web to view them, go to accounts > consolidated view > documents, then tax forms > 5498. Web td ameritrade clearing, inc.

Web find, download, and print important brokerage forms, agreements, pdf files, and disclosures from our form library. Will report the excess contribution on irs form 5498. In january following this calendar year, td ameritrade clearing, inc. Web form 5498 is generated for accounts where a contribution is made within a calendar year. Web irs form 5498 is an informational form that reports not only your ira contributions to the irs, but any rollovers you might have made as well. Ad no hidden fees or minimum trade requirements. Web this form is used to reclassify a roth ira contribution into a traditional ira contribution or vice versa done within the same tax year. Ad no hidden fees or minimum trade requirements. Hereby authorize you to correct my 5498 tax form information. Web incorrect information on form 5498, ira contribution information, may cause taxpayers to make ira reporting errors on their tax returns.

Fill Free fillable Trading Authorization Agreement (TD Ameritrade

Web find, download, and print important brokerage forms, agreements, pdf files, and disclosures from our form library. To view and print files properly, please be sure to. Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. Web form 5498 is generated for accounts where a contribution is.

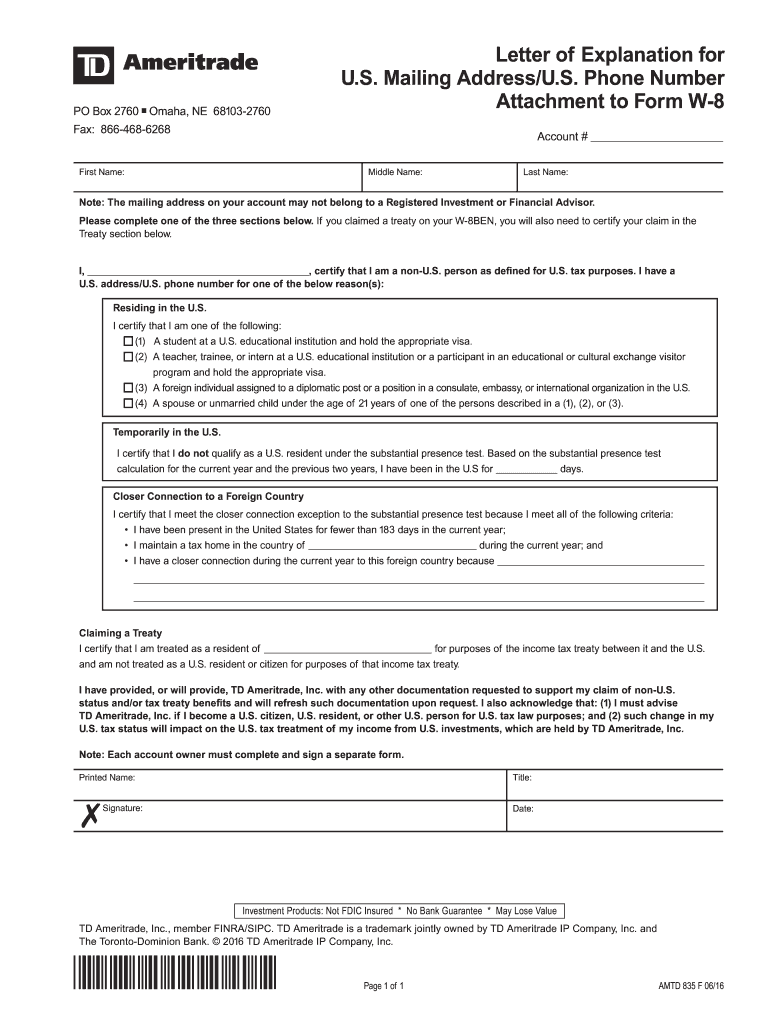

How to Open a TD Ameritrade Account Outside of the US as a Non Resident

Form 5498 reports all individual contributions and rollover contributions to all iras. Web td ameritrade form 5498: Web when you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year. In january following this calendar year, td ameritrade clearing, inc. Web td ameritrade clearing, inc.

TD Ameritrade Alternatives for 2022

Web information about form 5498, ira contribution information (info copy only), including recent updates, related forms and instructions on how to file. Hereby authorize you to correct my 5498 tax form information. This means that if you have any of these accounts, you will need to have each of these documents from. In january following this calendar year, td ameritrade.

TD Ameritrade In A 0 Commission World TD Ameritrade Holding

Hereby authorize you to correct my 5498 tax form information. Web form 5498 is generated for accounts where a contribution is made within a calendar year. Web form 5498 is simply standard reporting to you and the irs that you contributed to an ira and has nothing to do with your removal request. The institution that manages your ira is..

How To Get Td Ameritrade Paper Check Ach Form

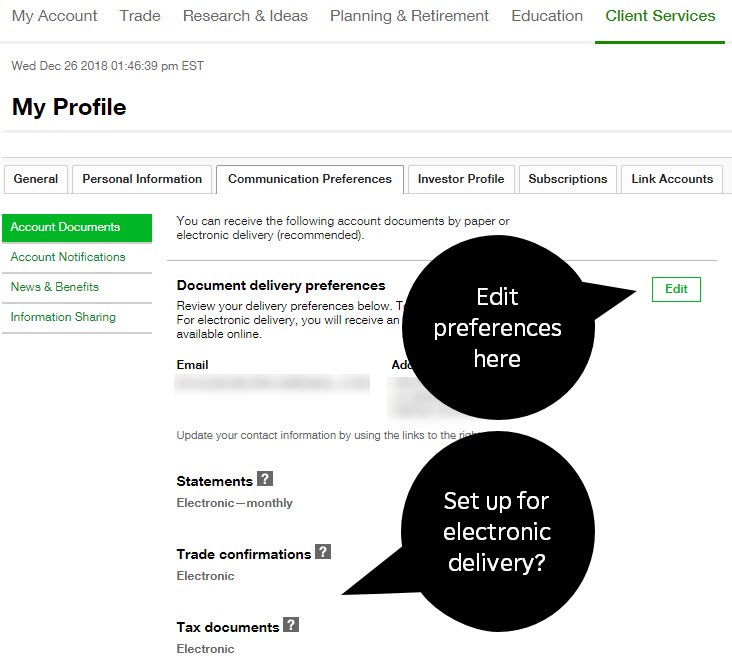

Fill & download for free get form download the form how to edit the td ameritrade form 5498 conviniently online start on editing, signing and. That's why we're committed to providing you with the information, tools, and resources to help make the job easier. Web find, download, and print important brokerage forms, agreements, pdf files, and disclosures from our form.

Fill Free fillable Outbound Wire Request (Domestic) (TD Ameritrade

Ad no hidden fees or minimum trade requirements. Web find, download, and print important brokerage forms, agreements, pdf files, and disclosures from our form library. To view and print files properly, please be sure to. File this form for each. Web the key to filing your taxes is being prepared.

Irs Form W 8ben Td Ameritrade 20202022 Fill and Sign Printable

Will report the excess contribution on irs form 5498. Form 5498 reports all individual contributions and rollover contributions to all iras. Web td ameritrade clearing, inc. File this form for each. Web when you save for retirement with an individual retirement arrangement (ira), you probably receive a form 5498 each year.

Td Ameritrade Estate Department Form Fill Out and Sign Printable PDF

File this form for each. Web irs form 5498 is an informational form that reports not only your ira contributions to the irs, but any rollovers you might have made as well. Fill & download for free get form download the form how to edit the td ameritrade form 5498 conviniently online start on editing, signing and. Web incorrect information.

How To Set My Td Ameritrade Charts For Options Paperwork Notary

To view and print files properly, please be sure to. The institution that manages your ira is. This means that if you have any of these accounts, you will need to have each of these documents from. Fill & download for free get form download the form how to edit the td ameritrade form 5498 conviniently online start on editing,.

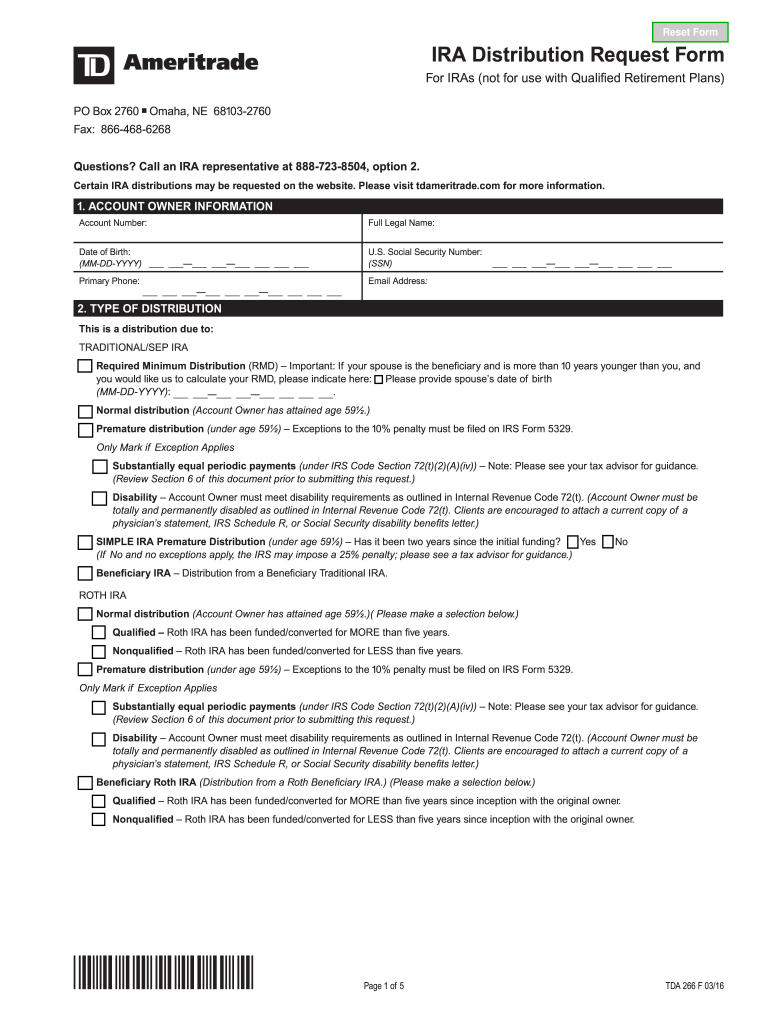

Td Ameritrade Form Tda266 Fill Online, Printable, Fillable, Blank

This means that if you have any of these accounts, you will need to have each of these documents from. Web td ameritrade form 5498: Ad no hidden fees or minimum trade requirements. Web the key to filing your taxes is being prepared. Web form 5498 reports the type of account you hold to the irs as well as financial.

Hereby Authorize You To Correct My 5498 Tax Form Information.

Web form 5498 reports the type of account you hold to the irs as well as financial information about your ira: Fill & download for free get form download the form how to edit the td ameritrade form 5498 conviniently online start on editing, signing and. Ad no hidden fees or minimum trade requirements. Web this form is used to reclassify a roth ira contribution into a traditional ira contribution or vice versa done within the same tax year.

Web Information About Form 5498, Ira Contribution Information (Info Copy Only), Including Recent Updates, Related Forms And Instructions On How To File.

Web form 5498 is generated for accounts where a contribution is made within a calendar year. In january following this calendar year, td ameritrade clearing, inc. Web form 5498 is simply standard reporting to you and the irs that you contributed to an ira and has nothing to do with your removal request. The institution that manages your ira is.

Web Incorrect Information On Form 5498, Ira Contribution Information, May Cause Taxpayers To Make Ira Reporting Errors On Their Tax Returns.

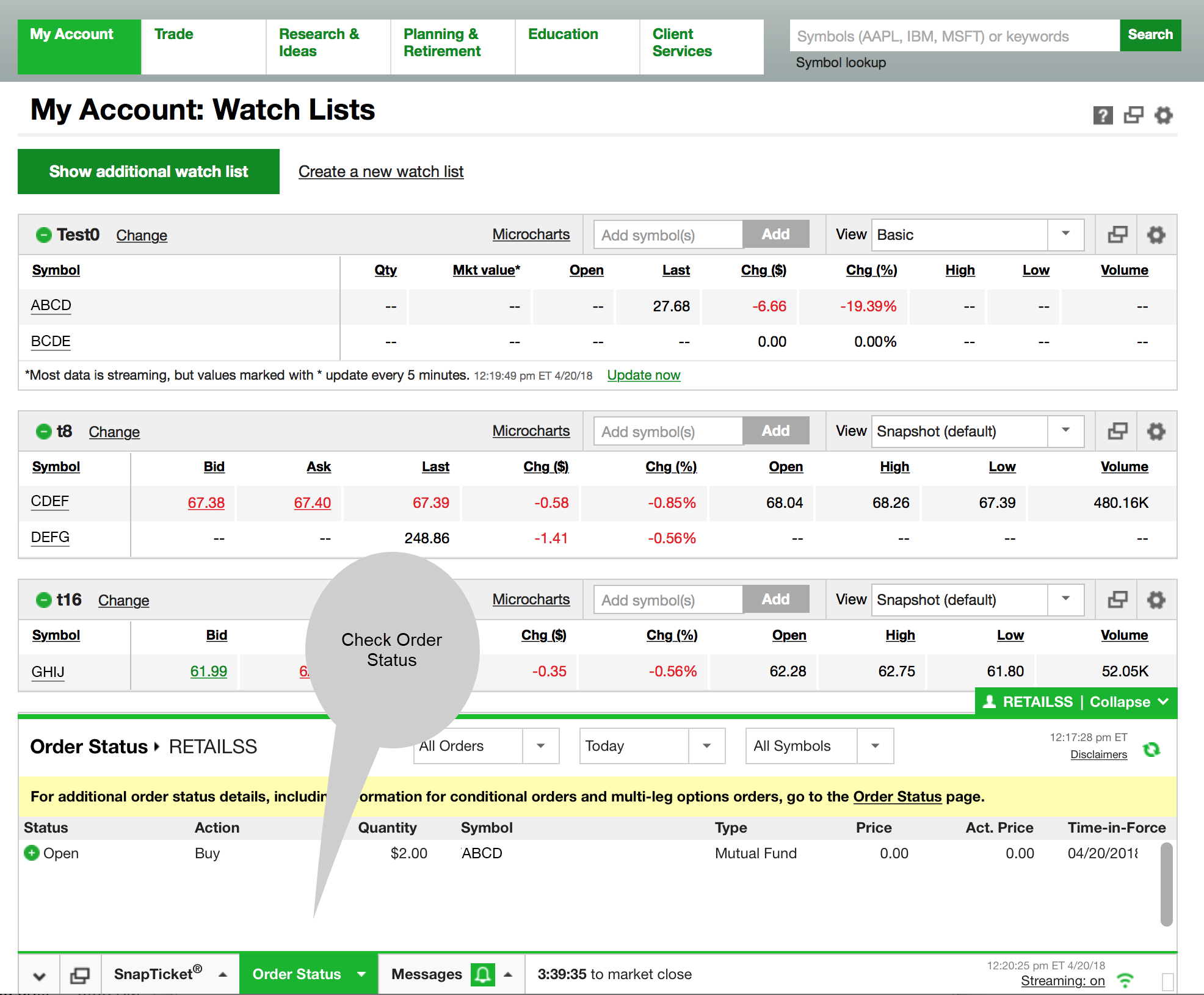

Web to view them, go to accounts > consolidated view > documents, then tax forms > 5498. Ad no hidden fees or minimum trade requirements. Form 5498 reports all individual contributions and rollover contributions to all iras. That's why we're committed to providing you with the information, tools, and resources to help make the job easier.

Will Report The Excess Contribution On Irs Form 5498.

This document is for ira’s (both traditional and roth). Every brokerage does this every year. File this form for each. To view and print files properly, please be sure to.