Texas Car Gift Form

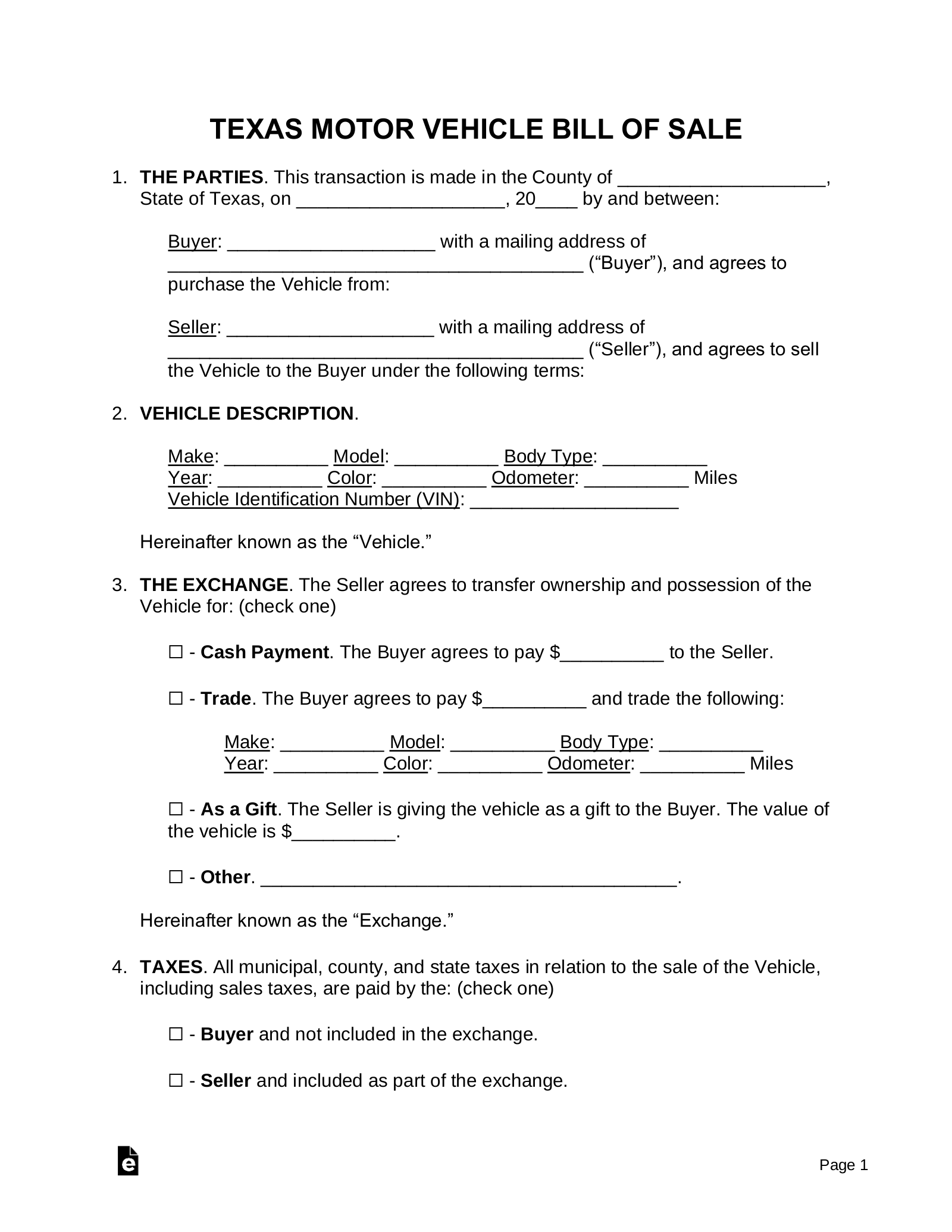

Texas Car Gift Form - Web affidavit of motor vehicle gift transfer. Web a motor vehicle received as a gift from an eligible donor located out of state is subject to the $10 gift tax when the motor vehicle is brought into texas. Web a motor vehicle received as a gift from an eligible donor located out of state is subject to the $10 gift tax when the motor vehicle is brought into texas. Web by the zebra updated july 18, 2023 here is a simple breakdown of the process to transfer ownership of the vehicle to your son as a gift in texas: Gift, or you are applying for a. Each of the following transactions is subject to the $10 gift tax: Keep it simple when filling out your texas affidavit of motor vehicle gift transfer and use. Web forms from the texas department of motor vehicles include: Web fill out the texas affidavit of motor vehicle gift transfer form for free! Receipt of an unencumbered inherited motor vehicle as specified by a deceased person’s will or.

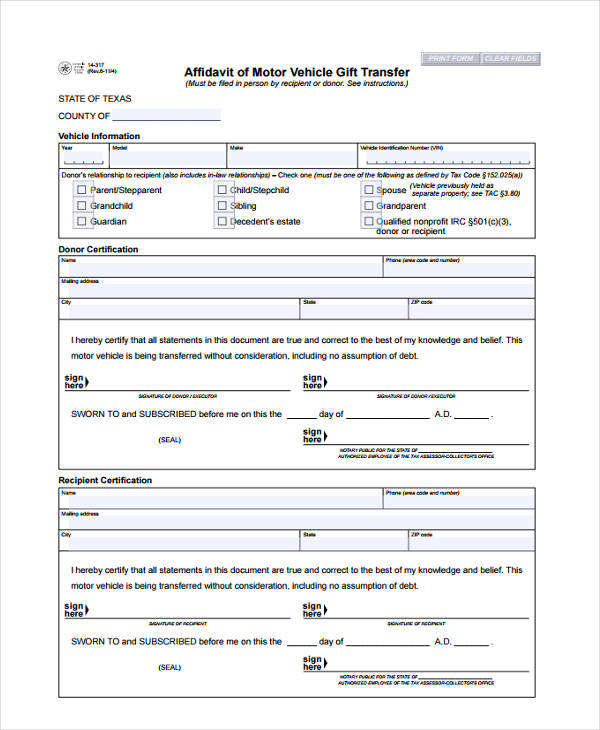

Web affidavit of motor vehicle gift transfer. The purpose of this affidavit is to document the gift of a motor. Each of the following transactions is subject to the $10 gift tax: Web fill out the texas affidavit of motor vehicle gift transfer form for free! Web to texas, obtained the vehicle as an even trade or as a. Web updated on apr 7, 2023 · 3 min read how to buy a car as a gift in texas how to gift a used car in texas faqs gifting a car in texas involves visiting your county tax. The $10 gift tax option may be used when a person receives a. Web forms from the texas department of motor vehicles include: Web to qualify to be taxed as a gift ($10), a vehicle must be received from the following eligible parties: Web a motor vehicle received as a gift from an eligible donor located out of state is subject to the $10 gift tax when the motor vehicle is brought into texas.

Each of the following transactions is subject to the $10 gift tax: Web by the zebra updated july 18, 2023 here is a simple breakdown of the process to transfer ownership of the vehicle to your son as a gift in texas: Web a motor vehicle received as a gift from an eligible donor located out of state is subject to the $10 gift tax when the motor vehicle is brought into texas. Web to qualify to be taxed as a gift ($10), a vehicle must be received from the following eligible parties: Web updated on apr 7, 2023 · 3 min read how to buy a car as a gift in texas how to gift a used car in texas faqs gifting a car in texas involves visiting your county tax. Web affidavit of motor vehicle gift transfer. Web the hearing was particularly timely, because the u.s. Keep it simple when filling out your texas affidavit of motor vehicle gift transfer and use. Web 21 rows form number. Web forms from the texas department of motor vehicles include:

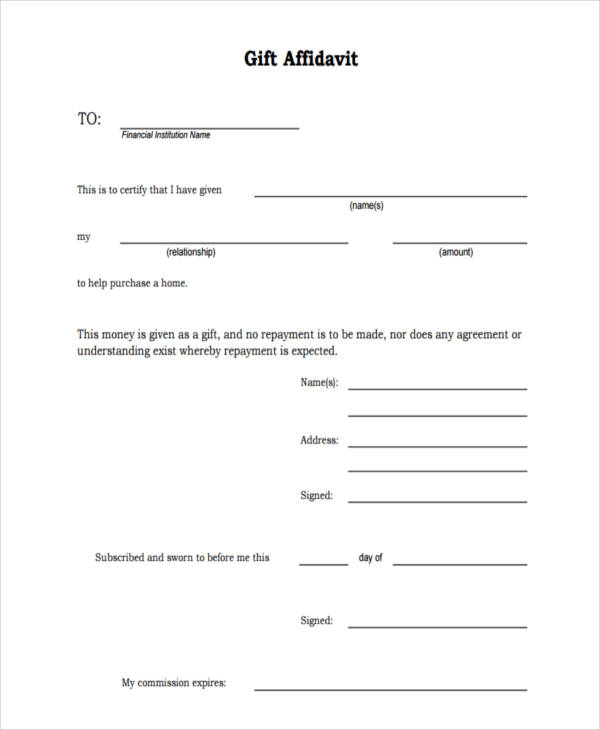

FREE 6+ Gift Affidavit Forms in MS Word PDF

The purpose of this affidavit is to document the gift of a motor. Keep it simple when filling out your texas affidavit of motor vehicle gift transfer and use. Web fill out the texas affidavit of motor vehicle gift transfer form for free! Receipt of an unencumbered inherited motor vehicle as specified by a deceased person’s will or. The $10.

Texas Affidavit of Motor Vehicle Gift Transfer Free Download

Web to texas, obtained the vehicle as an even trade or as a. Receipt of an unencumbered inherited motor vehicle as specified by a deceased person’s will or. The purpose of this affidavit is to document the gift of a motor. Gift, or you are applying for a. Web fill out the texas affidavit of motor vehicle gift transfer form.

Free Texas Motor Vehicle Bill of Sale Form PDF Word eForms

The $10 gift tax option may be used when a person receives a. Is facing intensifying urgency to stop the worsening fentanyl epidemic. Drug deaths nationwide hit a record. Gift, or you are applying for a. The purpose of this affidavit is to document the gift of a motor.

Download Texas Harris County Vehicle Bill of Sale for Free FormTemplate

Web a motor vehicle received as a gift from an eligible donor located out of state is subject to the $10 gift tax when the motor vehicle is brought into texas. Keep it simple when filling out your texas affidavit of motor vehicle gift transfer and use. Web to texas, obtained the vehicle as an even trade or as a..

Best Car Insurance in Texas ValChoice

Web buying or selling a vehicle | txdmv.gov home motorists buying or selling a vehicle txdmv will release a new texas temporary tag design on december 9, 2022;. Web a motor vehicle received as a gift from an eligible donor located out of state is subject to the $10 gift tax when the motor vehicle is brought into texas. Web.

FREE 6+ Gift Affidavit Forms in MS Word PDF

Web the hearing was particularly timely, because the u.s. Each of the following transactions is subject to the $10 gift tax: Web updated on apr 7, 2023 · 3 min read how to buy a car as a gift in texas how to gift a used car in texas faqs gifting a car in texas involves visiting your county tax..

Affidavit of Motor Vehicle Gift Transfer Texas Free Download

Web fill out the texas affidavit of motor vehicle gift transfer form for free! Web affidavit of motor vehicle gift transfer. Web forms from the texas department of motor vehicles include: The purpose of this affidavit is to document the gift of a motor. Drug deaths nationwide hit a record.

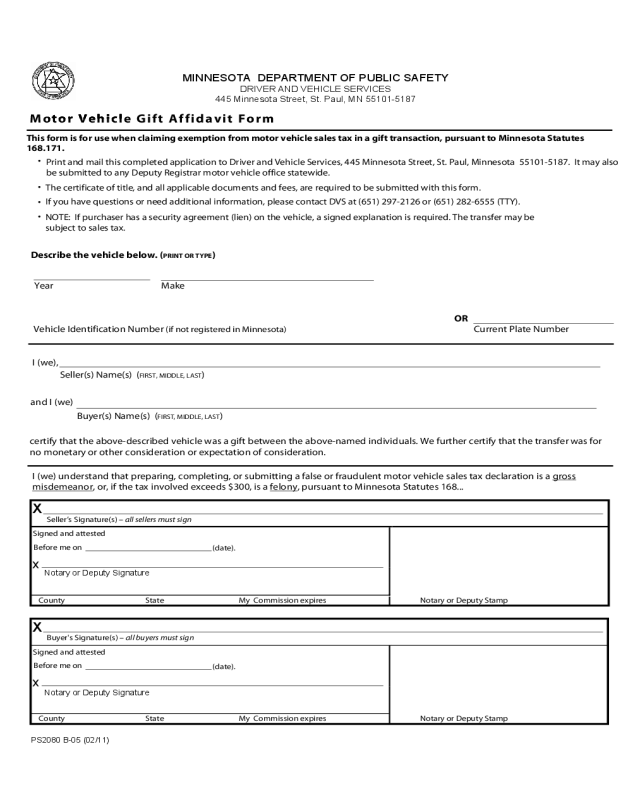

Vehicle Transfer Form 20 Free Templates in PDF, Word, Excel Download

Web to texas, obtained the vehicle as an even trade or as a. Drug deaths nationwide hit a record. Web affidavit of motor vehicle gift transfer. Web to qualify to be taxed as a gift ($10), a vehicle must be received from the following eligible parties: The purpose of this affidavit is to document the gift of a motor.

Texas Department Of Motor Vehicle Gift Transfer Form Bangmuin Image Josh

Web to qualify to be taxed as a gift ($10), a vehicle must be received from the following eligible parties: Web a motor vehicle received as a gift from an eligible donor located out of state is subject to the $10 gift tax when the motor vehicle is brought into texas. Web a motor vehicle received as a gift from.

Gift Deed Form Fill Online, Printable, Fillable, Blank pdfFiller

The $10 gift tax option may be used when a person receives a. Keep it simple when filling out your texas affidavit of motor vehicle gift transfer and use. Web 21 rows form number. Receipt of an unencumbered inherited motor vehicle as specified by a deceased person’s will or. Gift, or you are applying for a.

Is Facing Intensifying Urgency To Stop The Worsening Fentanyl Epidemic.

Web buying or selling a vehicle | txdmv.gov home motorists buying or selling a vehicle txdmv will release a new texas temporary tag design on december 9, 2022;. Web forms from the texas department of motor vehicles include: Each of the following transactions is subject to the $10 gift tax: Web 21 rows form number.

Drug Deaths Nationwide Hit A Record.

The $10 gift tax option may be used when a person receives a. Web by the zebra updated july 18, 2023 here is a simple breakdown of the process to transfer ownership of the vehicle to your son as a gift in texas: Web fill out the texas affidavit of motor vehicle gift transfer form for free! Web updated on apr 7, 2023 · 3 min read how to buy a car as a gift in texas how to gift a used car in texas faqs gifting a car in texas involves visiting your county tax.

Web To Texas, Obtained The Vehicle As An Even Trade Or As A.

Receipt of an unencumbered inherited motor vehicle as specified by a deceased person’s will or. Web affidavit of motor vehicle gift transfer. Keep it simple when filling out your texas affidavit of motor vehicle gift transfer and use. The purpose of this affidavit is to document the gift of a motor.

Web The Hearing Was Particularly Timely, Because The U.s.

Web a motor vehicle received as a gift from an eligible donor located out of state is subject to the $10 gift tax when the motor vehicle is brought into texas. Gift, or you are applying for a. Web a motor vehicle received as a gift from an eligible donor located out of state is subject to the $10 gift tax when the motor vehicle is brought into texas. Web to qualify to be taxed as a gift ($10), a vehicle must be received from the following eligible parties: