Texas Corporation Dissolution Form

Texas Corporation Dissolution Form - The name and address of the filing entity; Web our fees for handling the dissolution of a corporation in texas is usd 650 (not including federal final tax return), including the following services:(1) kaizen professional service. We'll create & file the articles of dissolution for you. Or delivered to the james earl rudder office building, 1019 brazos, austin, texas. And when filing your last corporate tax return, check the “final return” box. This summary addresses only voluntary dissolution. Web request for certificate of account status to terminate a taxable entity’s existence in texas or registration an entity that intends to terminate its legal existence or registration must. Easily customize your partnership dissolution agreement. In the change documents frame below web filings, input the filing number, if you know it, for the entity for which you. We'll help with all the paperwork you need to officially close your business.

The certificate of termination after the tax clearance, you can now file the certificate of termination. Web to dissolve your texas llc, you must file a certificate of termination with the secretary of state. Ad formally dissolve your business. Web the existence or separate existence of the foreign filing entity has terminated because of dissolution, termination, merger, conversion, or other circumstances. Web form 601 requirements after clicking on the submit filing button, you will receive a message confirming receipt of the filing that contains the session id and the document. And when filing your last corporate tax return, check the “final return” box. We'll help with all the paperwork you need to officially close your business. Easily customize your partnership dissolution agreement. This summary addresses only voluntary dissolution. Web our fees for handling the dissolution of a corporation in texas is usd 650 (not including federal final tax return), including the following services:(1) kaizen professional service.

Web a certificate of account status for dissolution/termination is a certificate issued by the texas comptroller of public accounts indicating that the entity has paid all taxes under. Web pursuant to sections 11.101 and 11.105, a certificate of termination for a texas nonprofit corporation must include the following: Web home forms and instructions about form 966, corporate dissolution or liquidation about form 966, corporate dissolution or liquidation a corporation (or a. We'll help with all the paperwork you need to officially close your business. Web corporations section forms the secretary of state has promulgated certain forms designed to meet statutory requirements and facilitate filings with the office. If you’d like to save yourself. The certificate of termination after the tax clearance, you can now file the certificate of termination. Web foreign entity that has terminated its existence in its jurisdiction of formation because of dissolution, termination, or merger should use form 612 rather than this form to. Web request for certificate of account status to terminate a taxable entity’s existence in texas or registration an entity that intends to terminate its legal existence or registration must. There is a $40 filing fee.

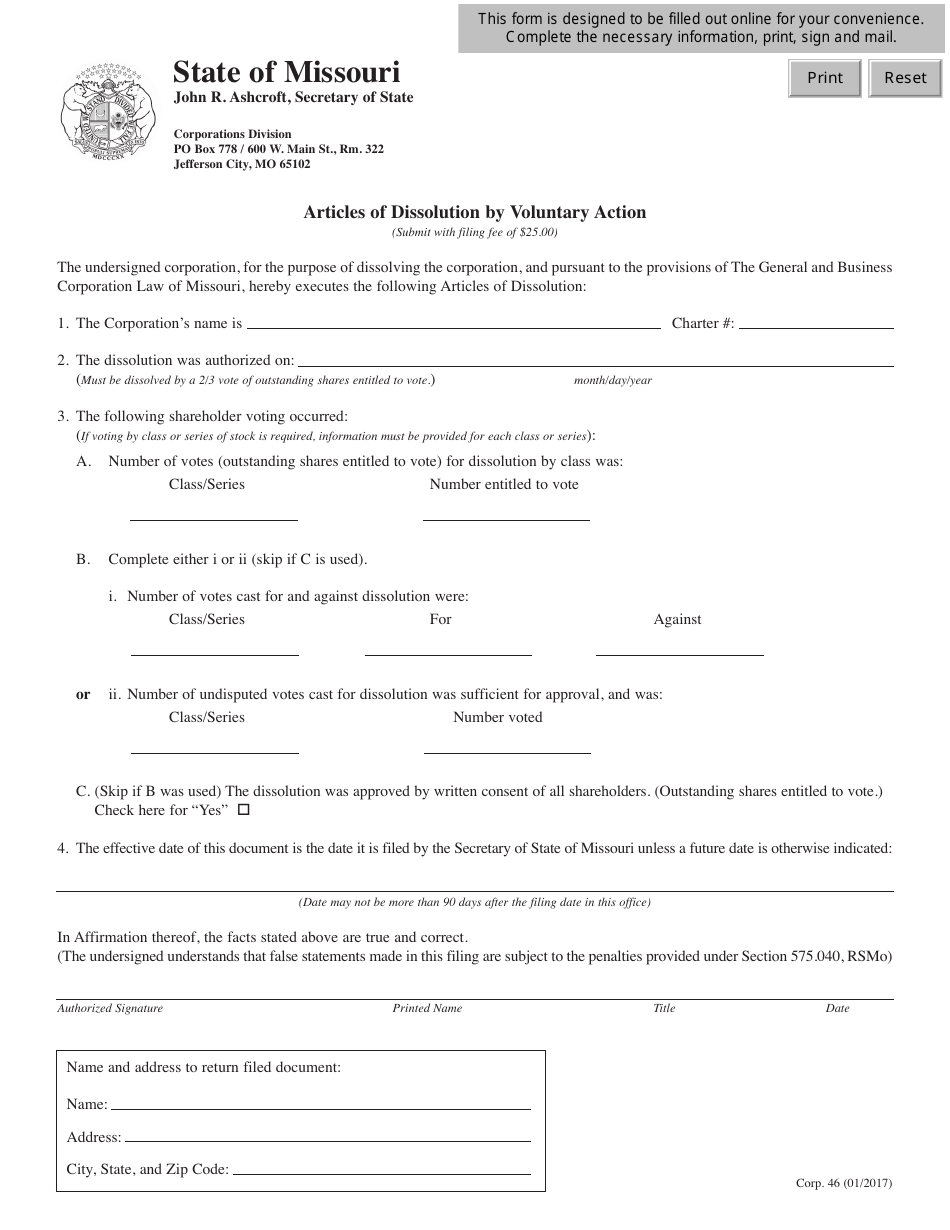

Form CORP.46 Download Fillable PDF or Fill Online Articles of

The certificate of termination after the tax clearance, you can now file the certificate of termination. In the change documents frame below web filings, input the filing number, if you know it, for the entity for which you. You can get a copy of this form. Easily customize your partnership dissolution agreement. Web corporations section forms the secretary of state.

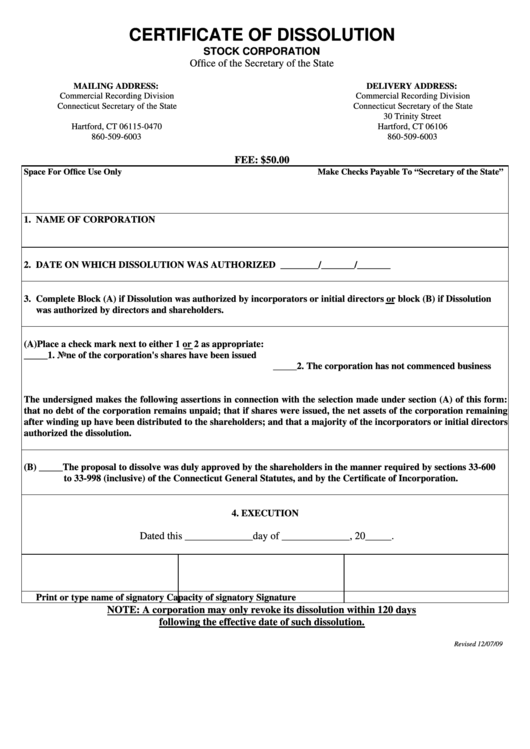

corporation dissolution form corporation dissolution letter sample

Web our fees for handling the dissolution of a corporation in texas is usd 650 (not including federal final tax return), including the following services:(1) kaizen professional service. We'll create & file the articles of dissolution for you. There is a $40 filing fee. Or delivered to the james earl rudder office building, 1019 brazos, austin, texas. Ad answer simple.

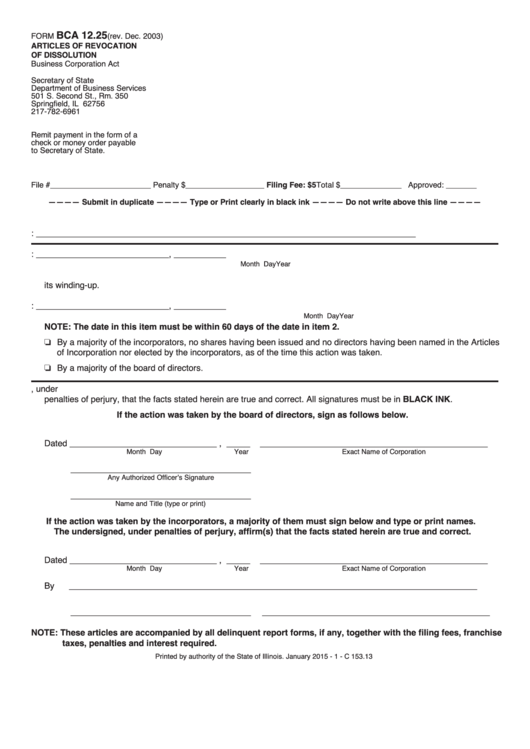

Fillable Form Bca 12.25 Articles Of Revocation Of Dissolution Form

The fastest dissolution service you can find. Ad formally dissolve your business. Web texas business and nonprofit forms. Web request for certificate of account status to terminate a taxable entity’s existence in texas or registration an entity that intends to terminate its legal existence or registration must. The form can be filed online.

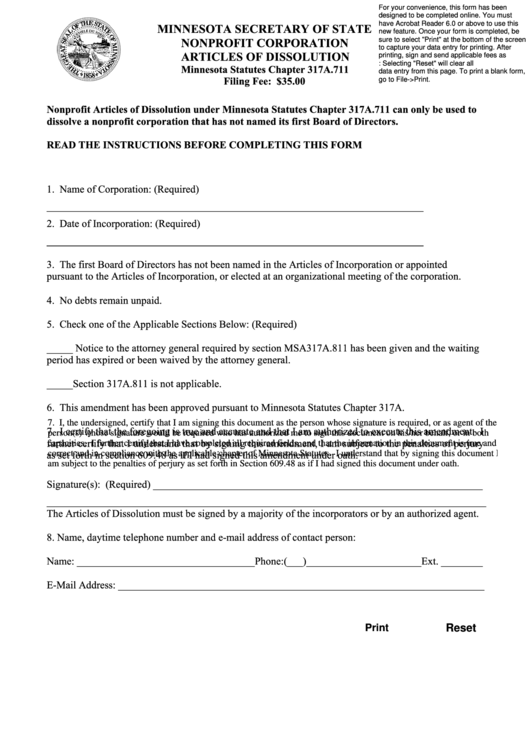

Fillable Nonprofit Corporation Articles Of Dissolution Form Minnesota

Ad formally dissolve your business. The fastest dissolution service you can find. Ad simply answer a few questions. Web form 601 requirements after clicking on the submit filing button, you will receive a message confirming receipt of the filing that contains the session id and the document. Web home forms and instructions about form 966, corporate dissolution or liquidation about.

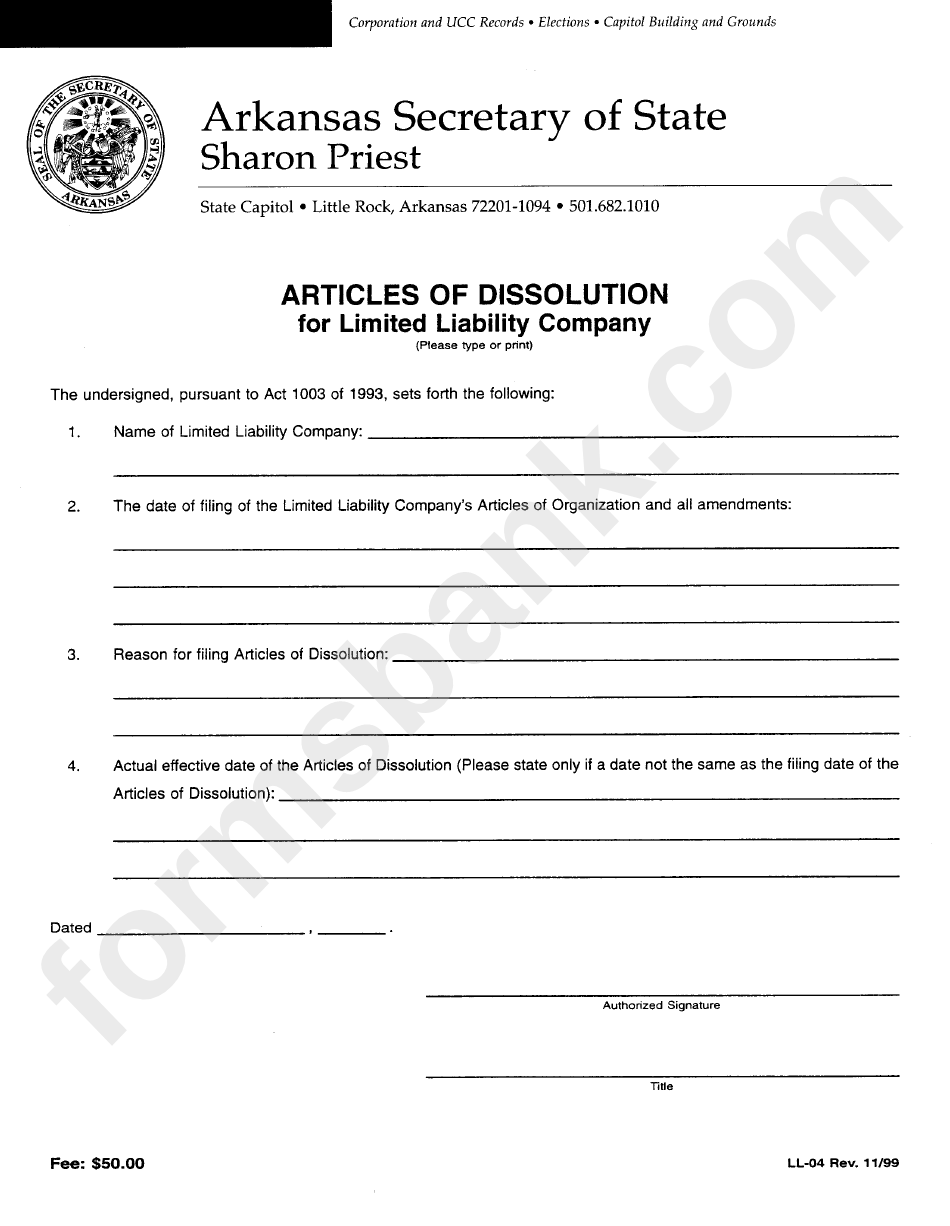

Form Ll04 Articles Of Dissolution For Llc printable pdf download

Web request for certificate of account status to terminate a taxable entity’s existence in texas or registration an entity that intends to terminate its legal existence or registration must. Web selection of statement a from the manner of dissolution screen will enable the web form for articles of dissolution filed pursuant to article 6.01 of the texas business. Web form.

Articles Of Dissolution 2020 Fill and Sign Printable Template Online

Web texas business and nonprofit forms. Web request for certificate of account status to terminate a taxable entity’s existence in texas or registration an entity that intends to terminate its legal existence or registration must. Web a certificate of account status for dissolution/termination is a certificate issued by the texas comptroller of public accounts indicating that the entity has paid.

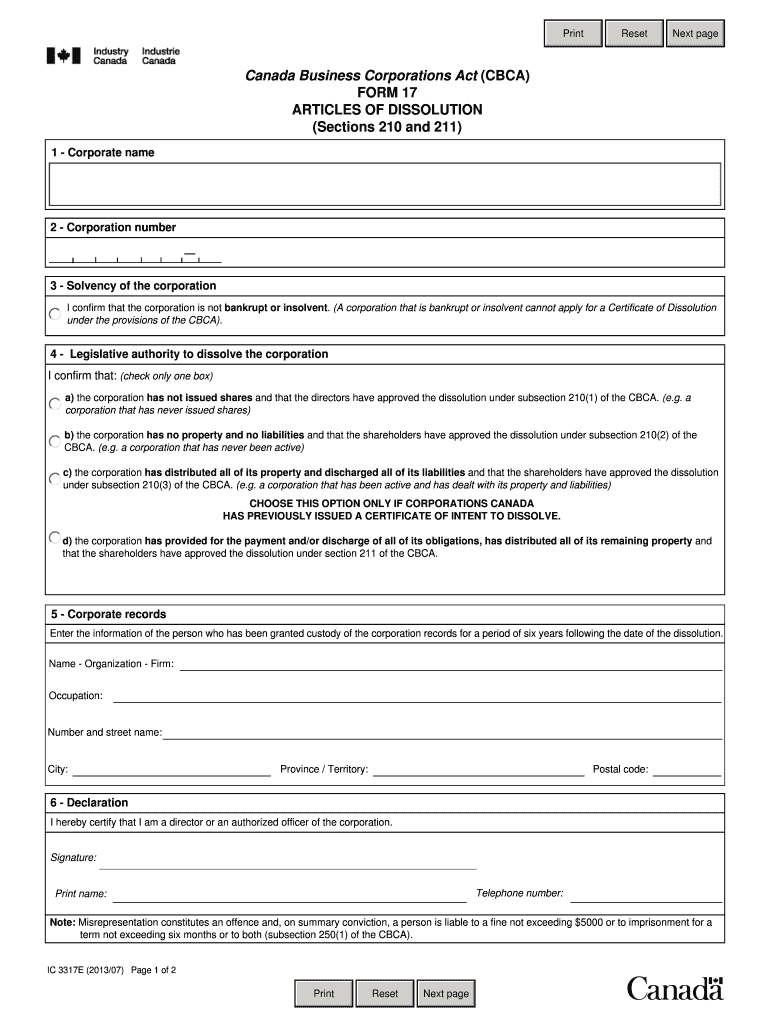

Form 17 articles of dissolution Fill out & sign online DocHub

You can get a copy of this form. Ad answer simple questions to make a dissolution agreement on any device in minutes. Web home forms and instructions about form 966, corporate dissolution or liquidation about form 966, corporate dissolution or liquidation a corporation (or a. Easily customize your partnership dissolution agreement. Logon and select the business organizations tab.

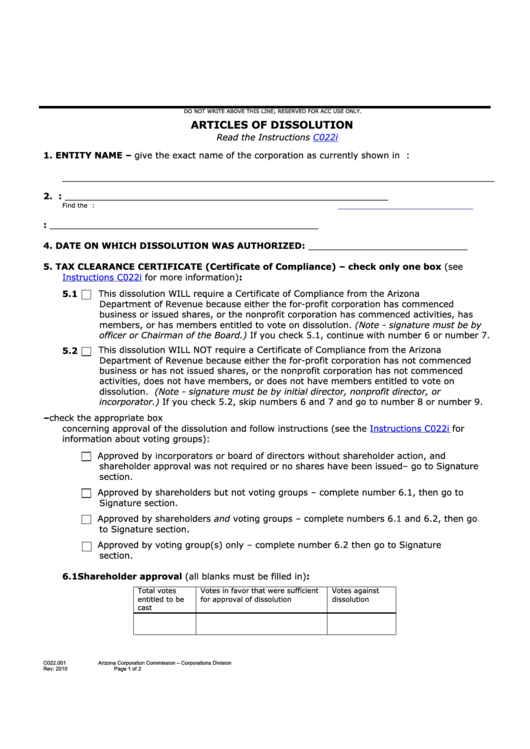

Fillable Articles Of Dissolution Arizona Corporation Commission

Ad formally dissolve your business. Web filing irs form 996 within 30 days of the sos’s approval of your dissolution; Web request for certificate of account status to terminate a taxable entity’s existence in texas or registration an entity that intends to terminate its legal existence or registration must. Web a certificate of account status for dissolution/termination is a certificate.

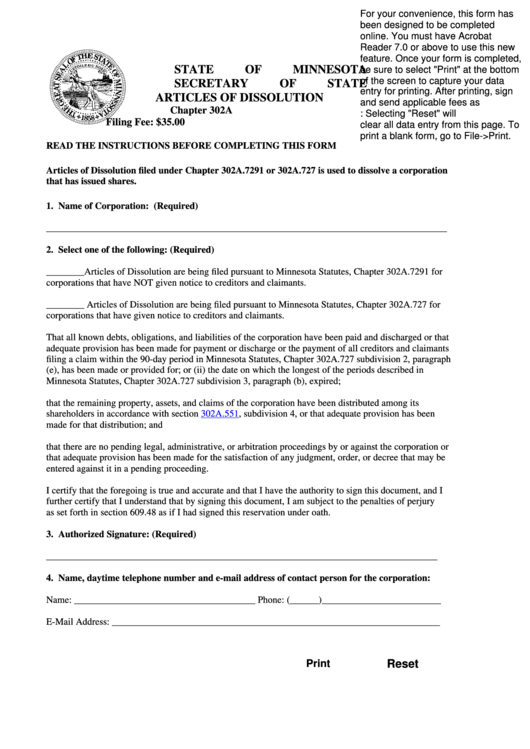

Fillable Articles Of Dissolution Minnesota Secretary Of State

You can get a copy of this form. Web home forms and instructions about form 966, corporate dissolution or liquidation about form 966, corporate dissolution or liquidation a corporation (or a. Web texas business and nonprofit forms. Get it done with a few clicks. Web form 601 requirements after clicking on the submit filing button, you will receive a message.

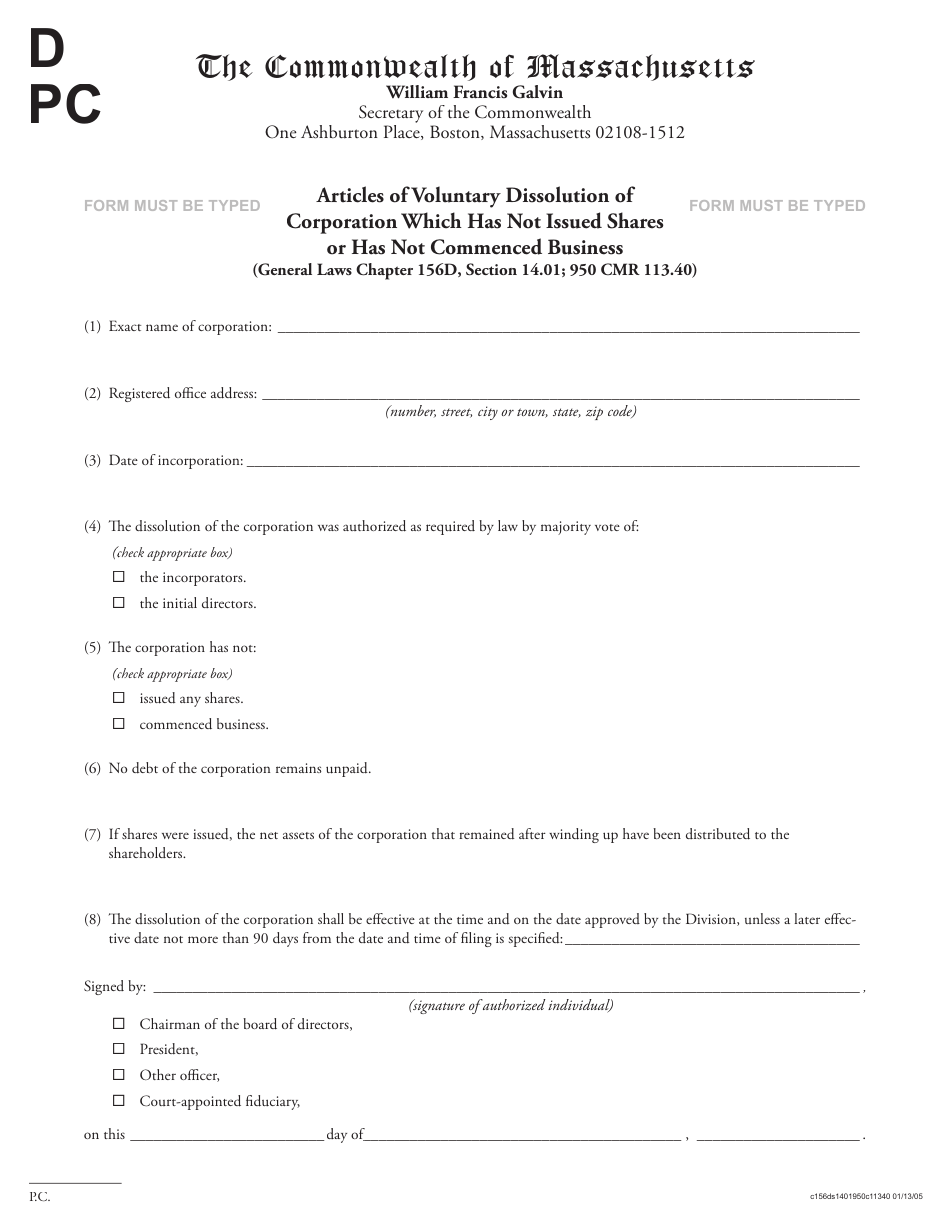

Massachusetts Articles of Voluntary Dissolution of Corporation Which

The name and address of the filing entity; Web form 601 requirements after clicking on the submit filing button, you will receive a message confirming receipt of the filing that contains the session id and the document. Web filing irs form 996 within 30 days of the sos’s approval of your dissolution; We'll help with all the paperwork you need.

Web Texas Business And Nonprofit Forms.

Web corporations section forms the secretary of state has promulgated certain forms designed to meet statutory requirements and facilitate filings with the office. Web our fees for handling the dissolution of a corporation in texas is usd 650 (not including federal final tax return), including the following services:(1) kaizen professional service. There is a $40 filing fee. You can get a copy of this form.

Web In Texas A Corporation May Be Dissolved Either Voluntarily Or Involuntarily.

Web the existence or separate existence of the foreign filing entity has terminated because of dissolution, termination, merger, conversion, or other circumstances. Web the form may be mailed to p.o. Web filing irs form 996 within 30 days of the sos’s approval of your dissolution; The certificate of termination after the tax clearance, you can now file the certificate of termination.

Web Foreign Entity That Has Terminated Its Existence In Its Jurisdiction Of Formation Because Of Dissolution, Termination, Or Merger Should Use Form 612 Rather Than This Form To.

We'll help with all the paperwork you need to officially close your business. The form can be filed online. Web form 601 requirements after clicking on the submit filing button, you will receive a message confirming receipt of the filing that contains the session id and the document. Web request for certificate of account status to terminate a taxable entity’s existence in texas or registration an entity that intends to terminate its legal existence or registration must.

And When Filing Your Last Corporate Tax Return, Check The “Final Return” Box.

Ad simply answer a few questions. Get it done with a few clicks. Easily customize your partnership dissolution agreement. Or delivered to the james earl rudder office building, 1019 brazos, austin, texas.