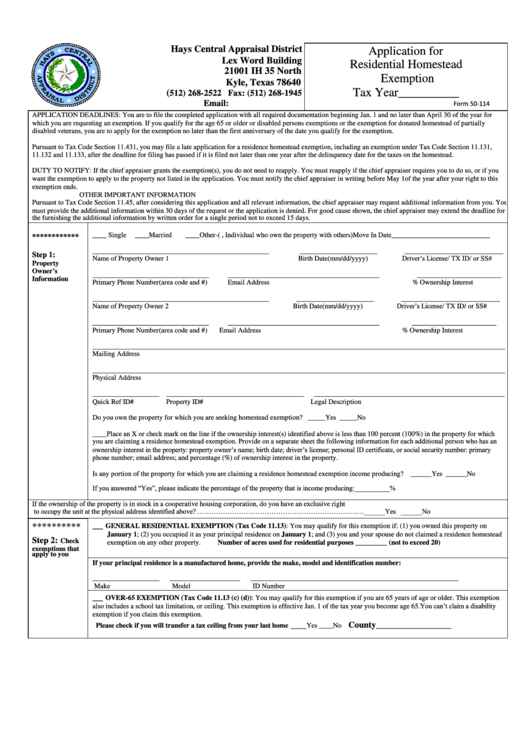

Texas Form 50-114 Instructions

Texas Form 50-114 Instructions - Age 65 or older exemption (tax code section 11.13(c) and (d)) this. Web 2022 report year forms and instructions; Web texas tax forms to expedite the processing of your tax returns, please file electronically or use our preprinted forms whenever possible. Complete, edit or print tax forms instantly. File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between jan. This document must be filed with the. If your address has changed, please update. Instructions for filling out the form are provided in the form itself. 2021 report year forms and instructions; Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each county in.

Web follow the simple instructions below: 2019 report year forms and instructions; 2021 report year forms and instructions; Attach the completed and notarized affidavit to your. Find the template you want in the library of legal form samples. 2020 report year forms and instructions; Click on the get form. With us legal forms the process of completing official documents. Web execute form 50 114 instructions within several clicks following the guidelines listed below: This document must be filed with the.

In a few minutes following the instructions below: File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between jan. Web 2022 report year forms and instructions; 2019 report year forms and instructions; Web follow the simple instructions below: Complete, edit or print tax forms instantly. 2020 report year forms and instructions; With us legal forms the process of completing official documents. Web execute form 50 114 instructions within several clicks following the guidelines listed below: Complete, edit or print tax forms instantly.

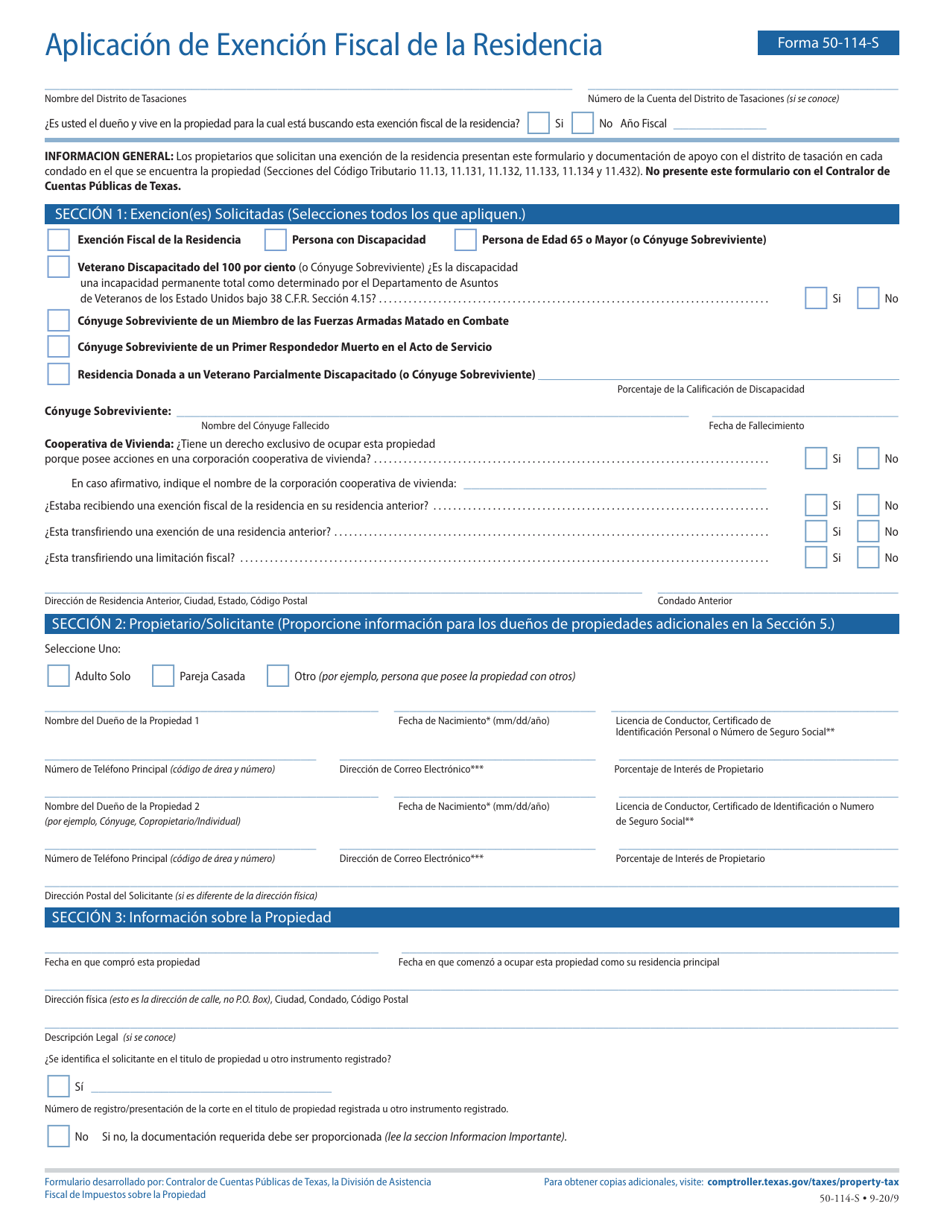

Formulario 50114S Download Fillable PDF or Fill Online Aplicacion De

Web execute form 50 114 instructions within several clicks following the guidelines listed below: Complete, edit or print tax forms instantly. With us legal forms the process of completing official documents. Click on the get form. Choose the template you require from the.

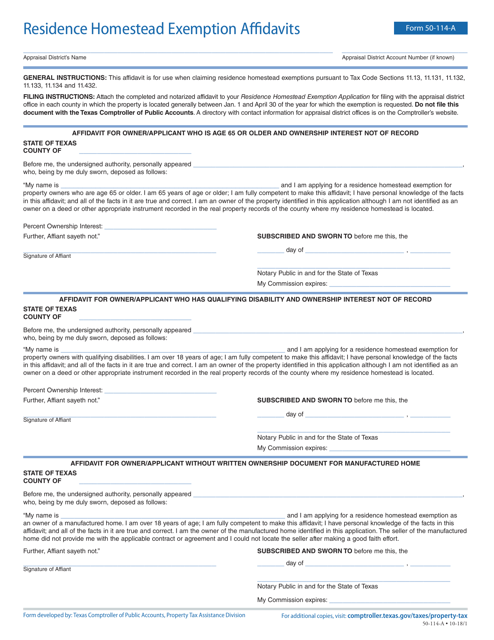

Form 50114A Download Fillable PDF or Fill Online Residence Homestead

With us legal forms the process of completing official documents. The times of distressing complex tax and legal documents are over. This document must be filed with the. Web execute form 50 114 instructions within several clicks following the guidelines listed below: Age 65 or older exemption (tax code section 11.13(c) and (d)) this.

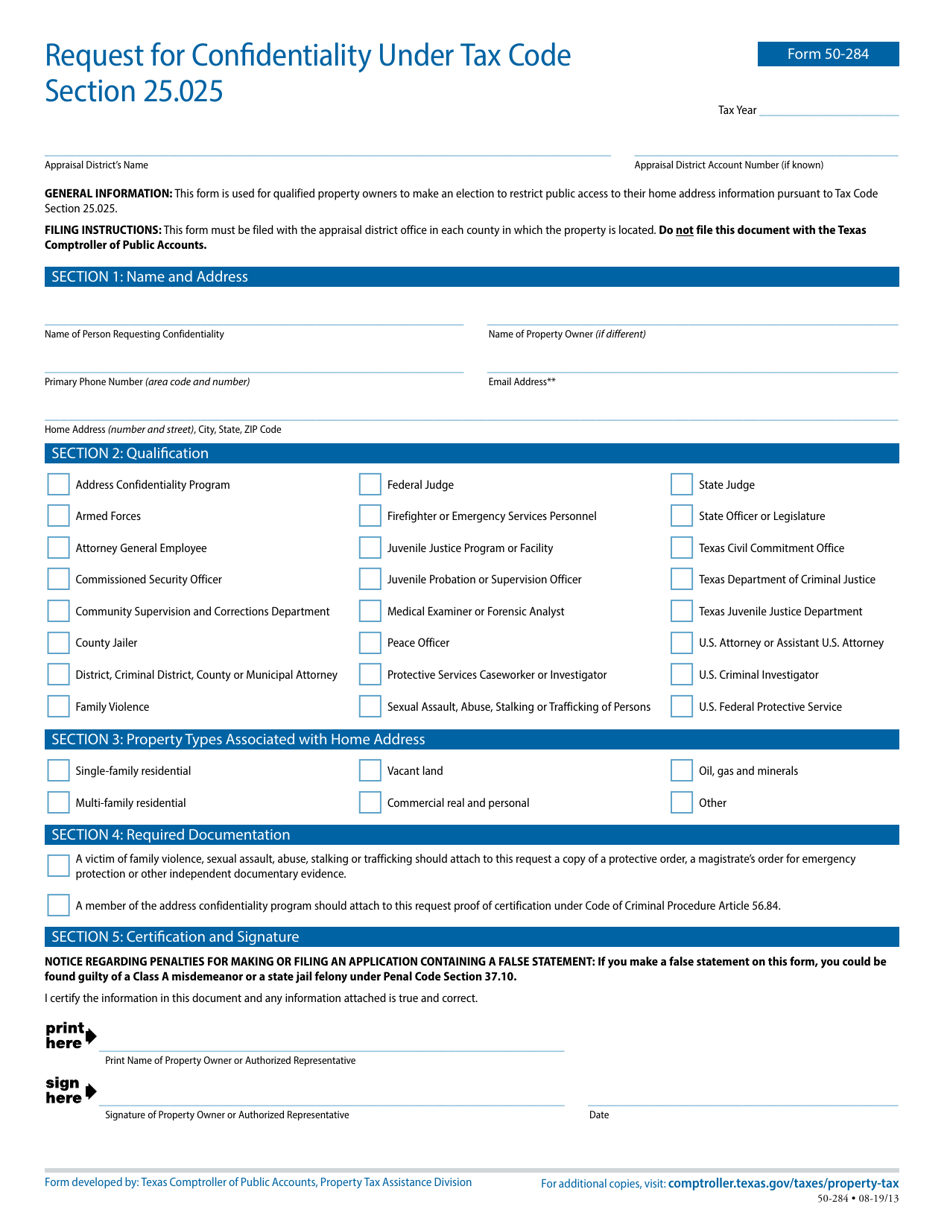

Form 50284 Download Fillable PDF or Fill Online Request for

This document must be filed with the. Instructions for filling out the form are provided in the form itself. Click on the get form. If your address has changed, please update. File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between jan.

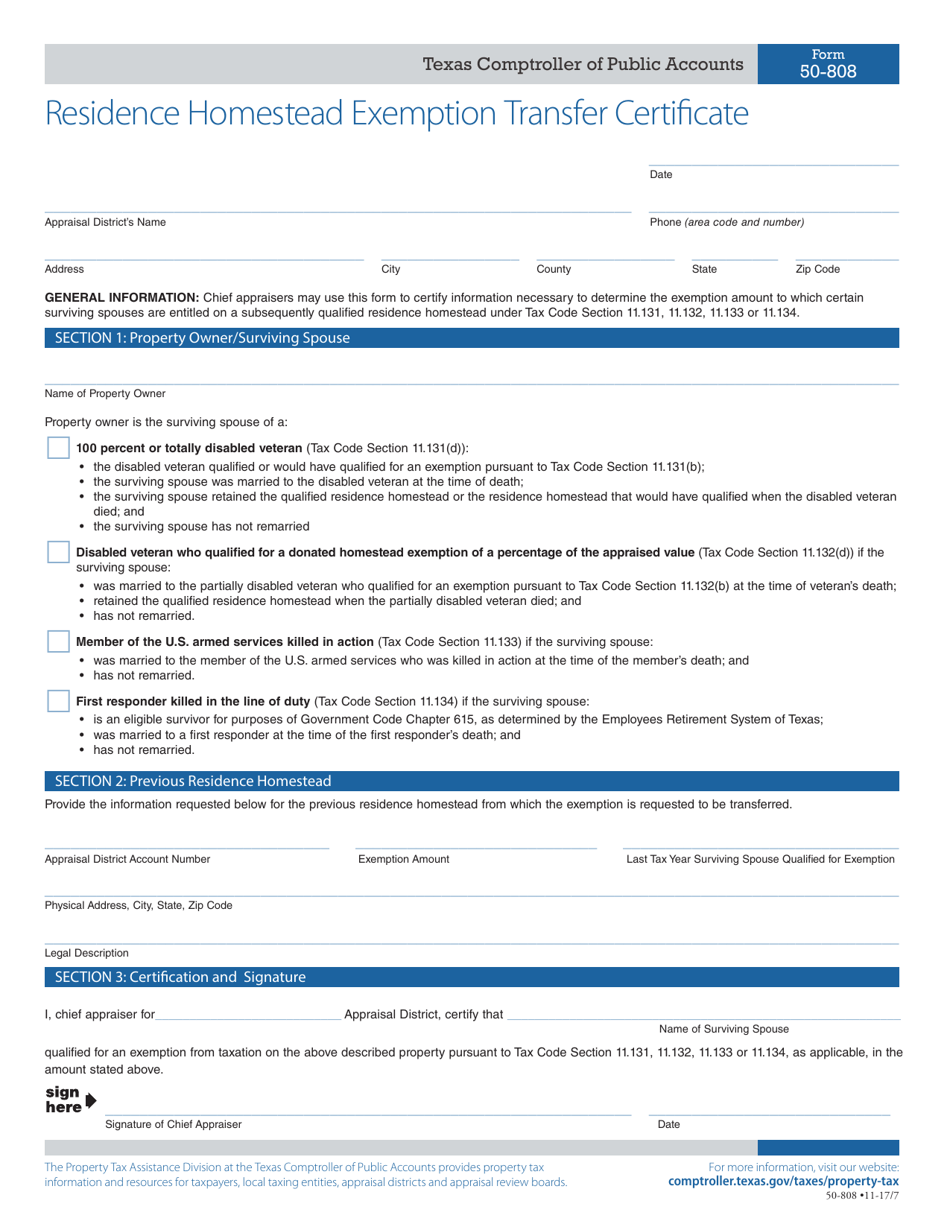

Form 50808 Download Fillable PDF or Fill Online Residence Homestead

Complete, edit or print tax forms instantly. Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each county in. This document must be filed. 2020 report year forms and instructions; With us legal forms the process of completing official documents.

Form 50114 Application For Residential Homestead Exemption printable

In a few minutes following the instructions below: Instructions for filling out the form are provided in the form itself. With us legal forms the process of completing official documents. Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each. This document must be filed with the.

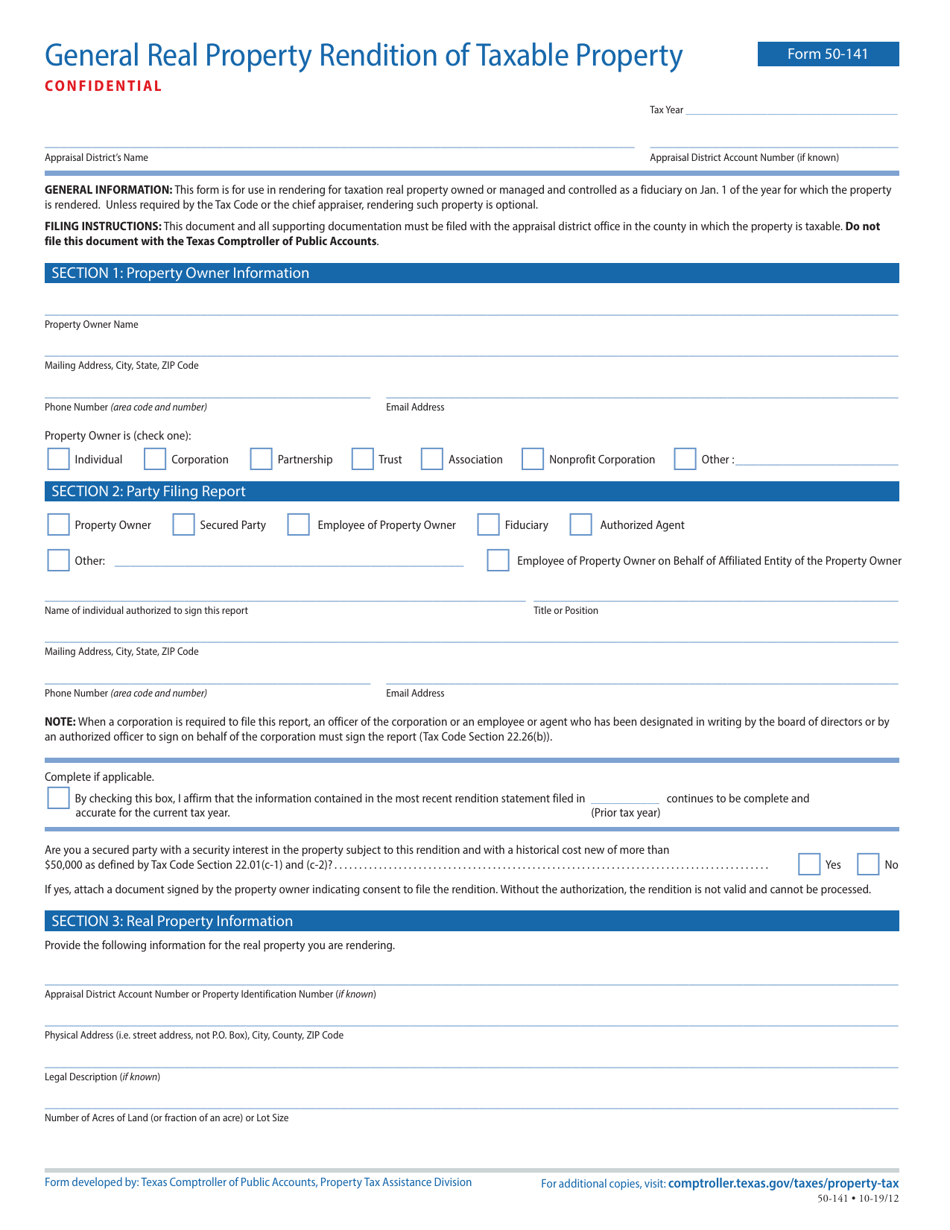

Form 50141 Download Fillable PDF or Fill Online General Real Property

2019 report year forms and instructions; 2020 report year forms and instructions; Web general instructions this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and. Web texas tax forms to expedite the processing of your tax returns, please file electronically or use our preprinted forms whenever possible. With us legal forms.

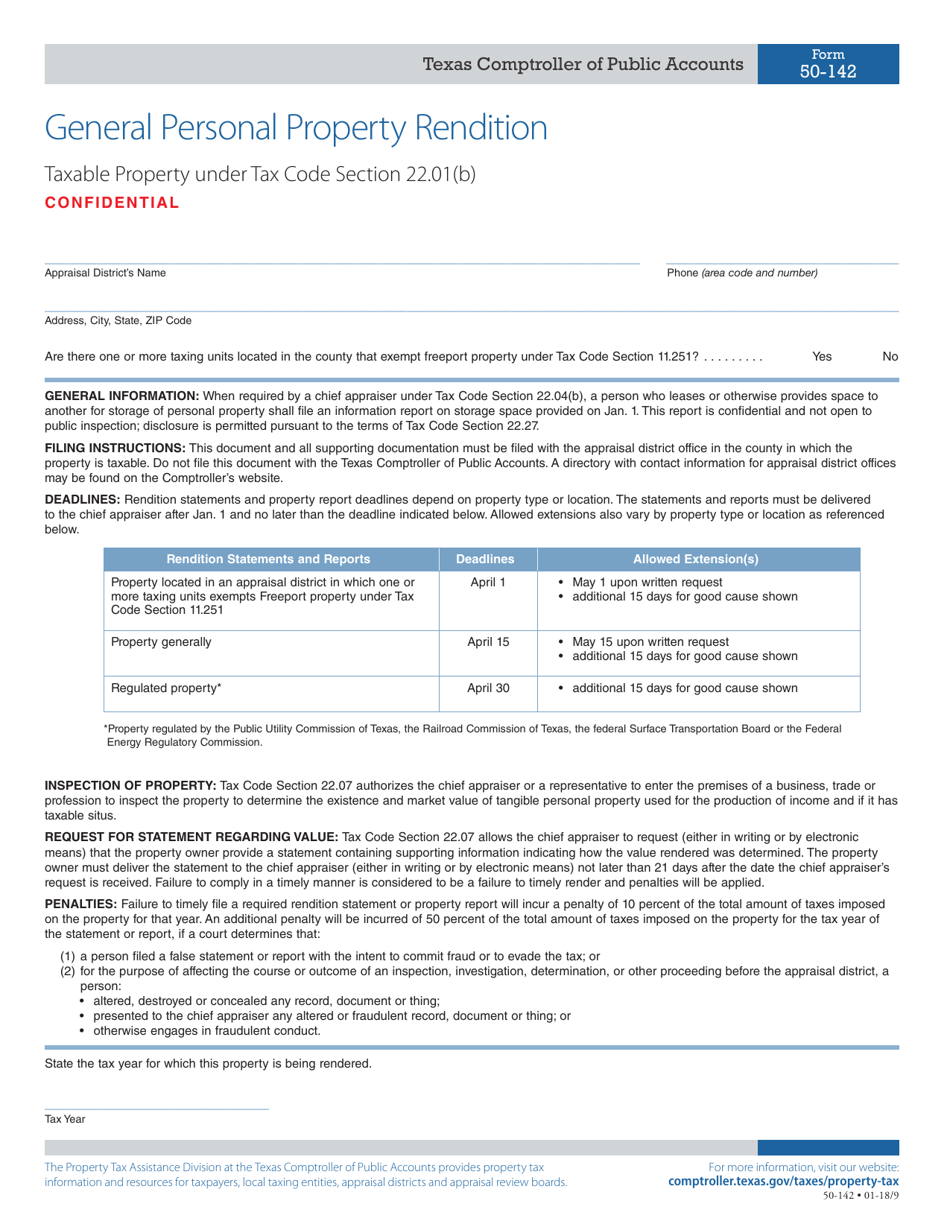

Form 50142 Download Fillable PDF or Fill Online General Personal

2020 report year forms and instructions; Instructions for filling out the form are provided in the form itself. With us legal forms the process of completing official documents. 2019 report year forms and instructions; Complete, edit or print tax forms instantly.

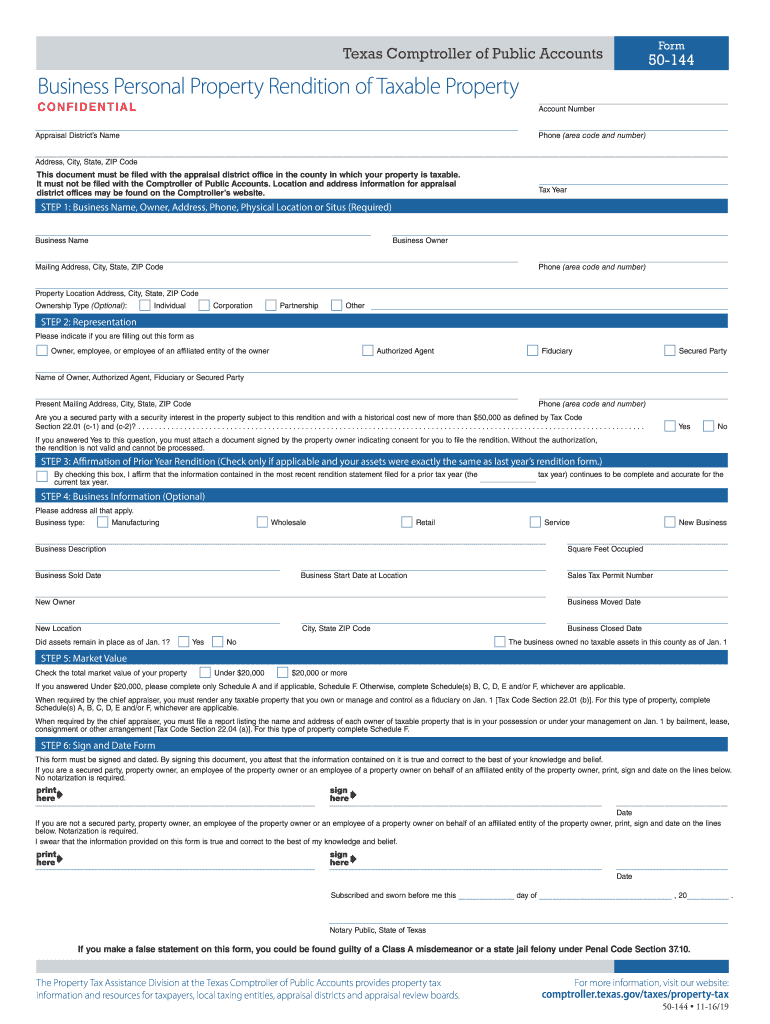

Texas Form 50 144 Fillable Fill Out and Sign Printable PDF Template

Find the template you want in the library of legal form samples. Web 2022 report year forms and instructions; Attach the completed and notarized affidavit to your. In a few minutes following the instructions below: Web execute form 50 114 instructions within several clicks following the guidelines listed below:

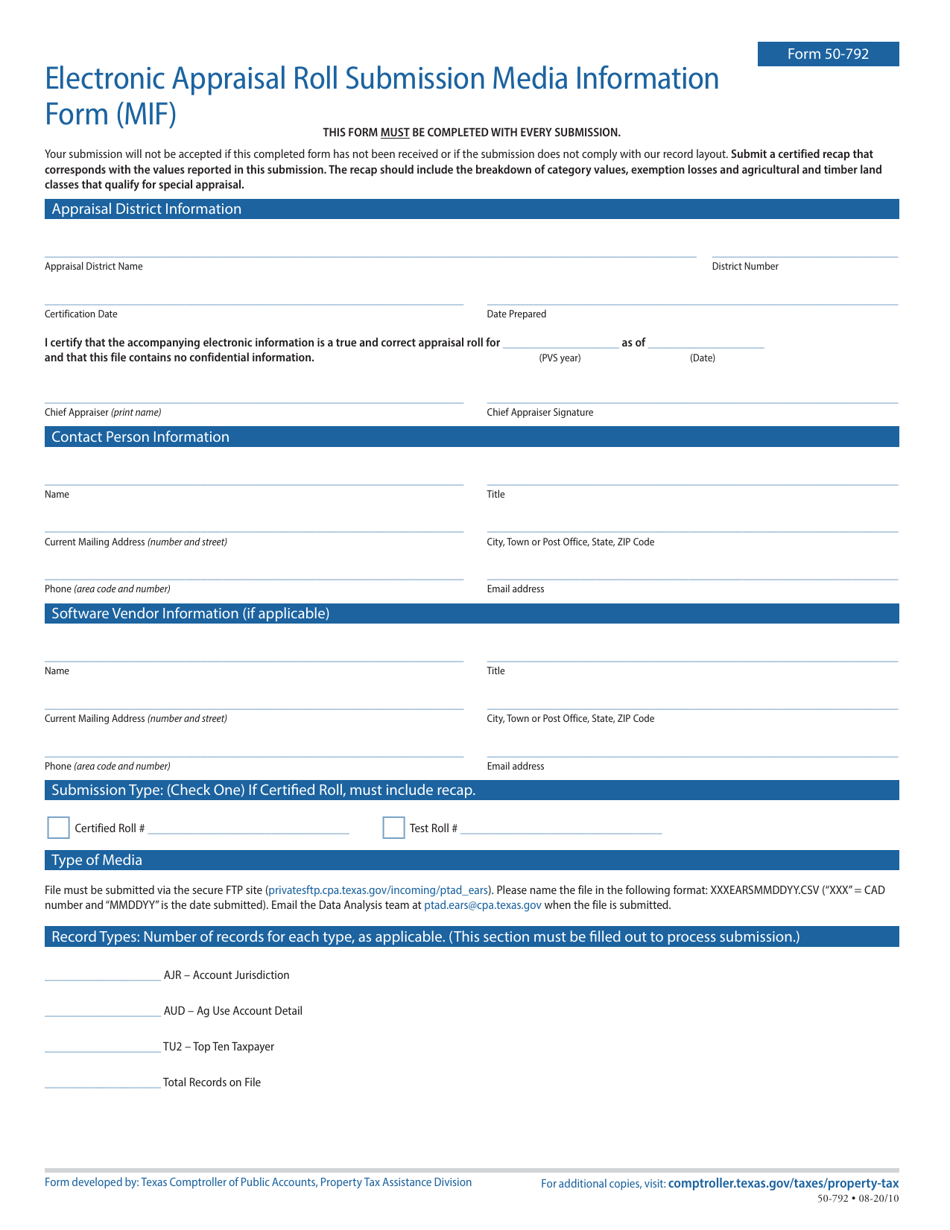

Form 50792 Download Fillable PDF or Fill Online Electronic Appraisal

Find the template you want in the library of legal form samples. This document must be filed. Attach the completed and notarized affidavit to your. Web general instructions this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and. Complete, edit or print tax forms instantly.

How To Apply For Homestead Exemption In Montgomery County Texas PROFRTY

This document must be filed. Web follow the simple instructions below: Web execute form 50 114 instructions within several clicks following the guidelines listed below: File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between jan. In a few minutes following the instructions below:

Web 2022 Report Year Forms And Instructions;

If your address has changed, please update. This document must be filed. This document must be filed with the. Find the template you want in the library of legal form samples.

Property Owners Applying For A Residence Homestead Exemption File This Form And Supporting Documentation With The Appraisal District In Each.

Instructions for filling out the form are provided in the form itself. File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between jan. Click on the get form. Attach the completed and notarized affidavit to your.

Property Owners Applying For A Residence Homestead Exemption File This Form And Supporting Documentation With The Appraisal District In Each County In.

Web texas tax forms to expedite the processing of your tax returns, please file electronically or use our preprinted forms whenever possible. Complete, edit or print tax forms instantly. Age 65 or older exemption (tax code section 11.13(c) and (d)) this. Choose the template you require from the.

2019 Report Year Forms And Instructions;

Web follow the simple instructions below: The times of distressing complex tax and legal documents are over. Web execute form 50 114 instructions within several clicks following the guidelines listed below: Web general instructions this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and.