Texas Homestead Form

Texas Homestead Form - File your homestead exemption forms online for free. Applicant may also be required to complete an affidavit to qualify for an exemption under certain situations. Web the texas homestead exemption form or tex4141 is a form that determines whether an individual is eligible for the homestead exemption and how it benefits you. This is the place to be at if you need to edit and download this form. Web download and complete texas property tax forms. The forms listed below are pdf files. Do not file this form with the texas comptroller of public accounts. You must furnish all information and documentation required by the application. All homestead applications must be accompanied by a copy of applicant's drivers license or other information as required by the texas property tax code. Keep a scanned copy of your texas driver's license handy when you begin your homestead exemption application.

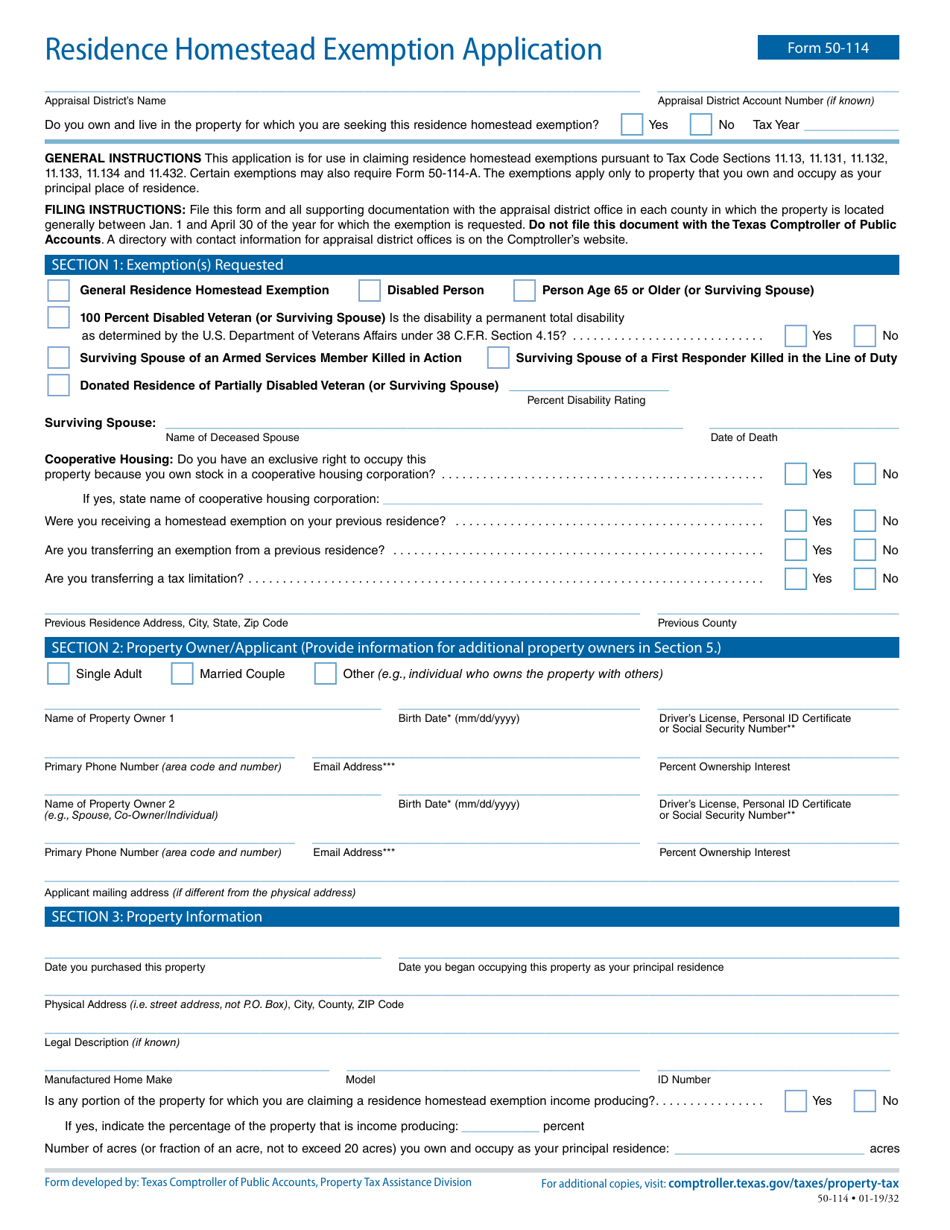

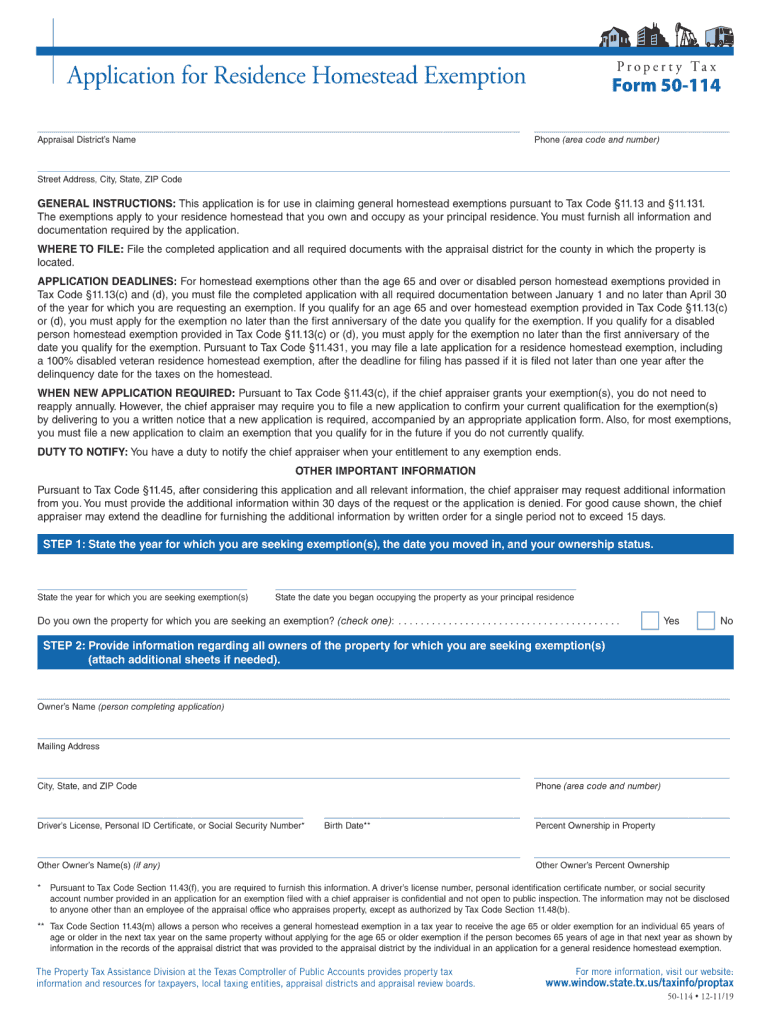

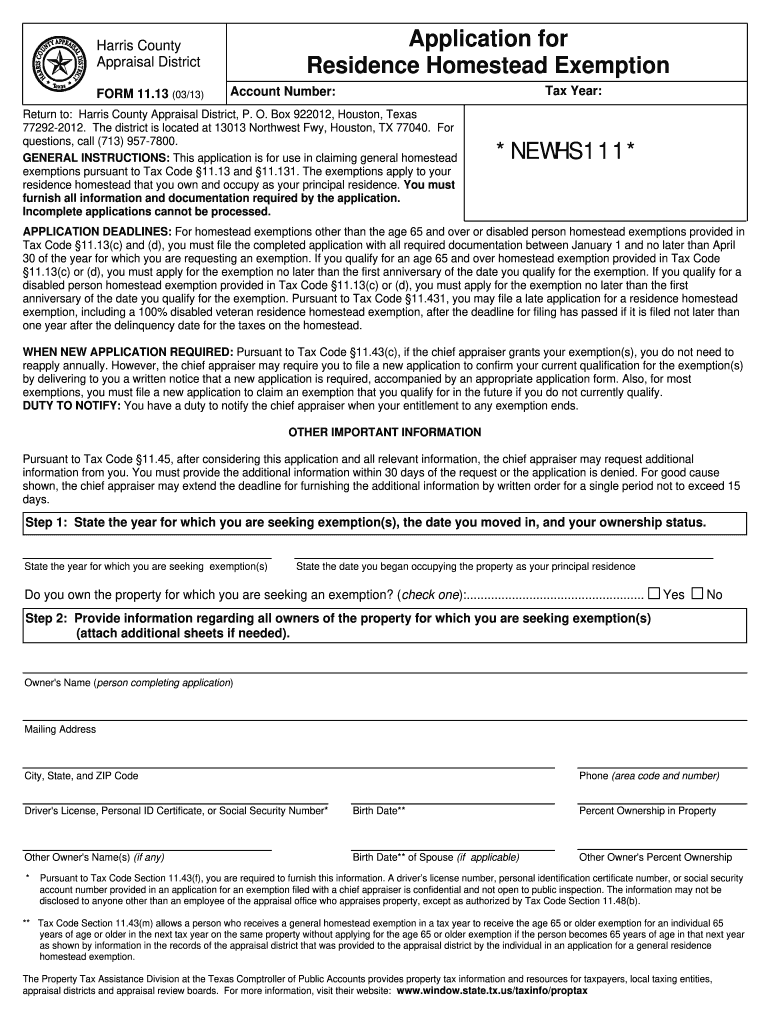

Web for the $40,000 general residence homestead exemption, you may submit an application for residential homestead exemption (pdf) and supporting documentation, with the appraisal district where the property is located. Web this application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. Web property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each county in which the property is located (tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432). They include graphics, fillable form fields, scripts and functionality that work best with the free adobe reader. Make sure your dl reflects your new home address. Do not file this form with the texas comptroller of public accounts. All homestead applications must be accompanied by a copy of applicant's drivers license or other information as required by the texas property tax code. Web the texas homestead exemption form or tex4141 is a form that determines whether an individual is eligible for the homestead exemption and how it benefits you. For filing with the appraisal district office in each county in which the property is located generally between jan. Web how to fill out the homestead exemption form in texas.

Web this application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. Once you receive the exemption, you do not need to reapply unless the chief appraiser sends you a new application. This is the place to be at if you need to edit and download this form. Web download and complete texas property tax forms. Texas comptroller of public accounts. File your homestead exemption forms online for free. Applicant may also be required to complete an affidavit to qualify for an exemption under certain situations. You must furnish all information and documentation required by the application. For filing with the appraisal district office in each county in which the property is located generally between jan. Make sure your dl reflects your new home address.

Form 50114 Download Fillable PDF or Fill Online Residence Homestead

For filing with the appraisal district office in each county in which the property is located generally between jan. They include graphics, fillable form fields, scripts and functionality that work best with the free adobe reader. Do not file this document with the texas comptroller of public accounts Web residence homestead exemption application. 1 and april 30 of the year.

Designation Of Homestead Request Form Texas

Do not file this form with the texas comptroller of public accounts. Texas comptroller of public accounts. Applicant may also be required to complete an affidavit to qualify for an exemption under certain situations. Web how to fill out the homestead exemption form in texas. Web this application is for use in claiming general homestead exemptions pursuant to tax code.

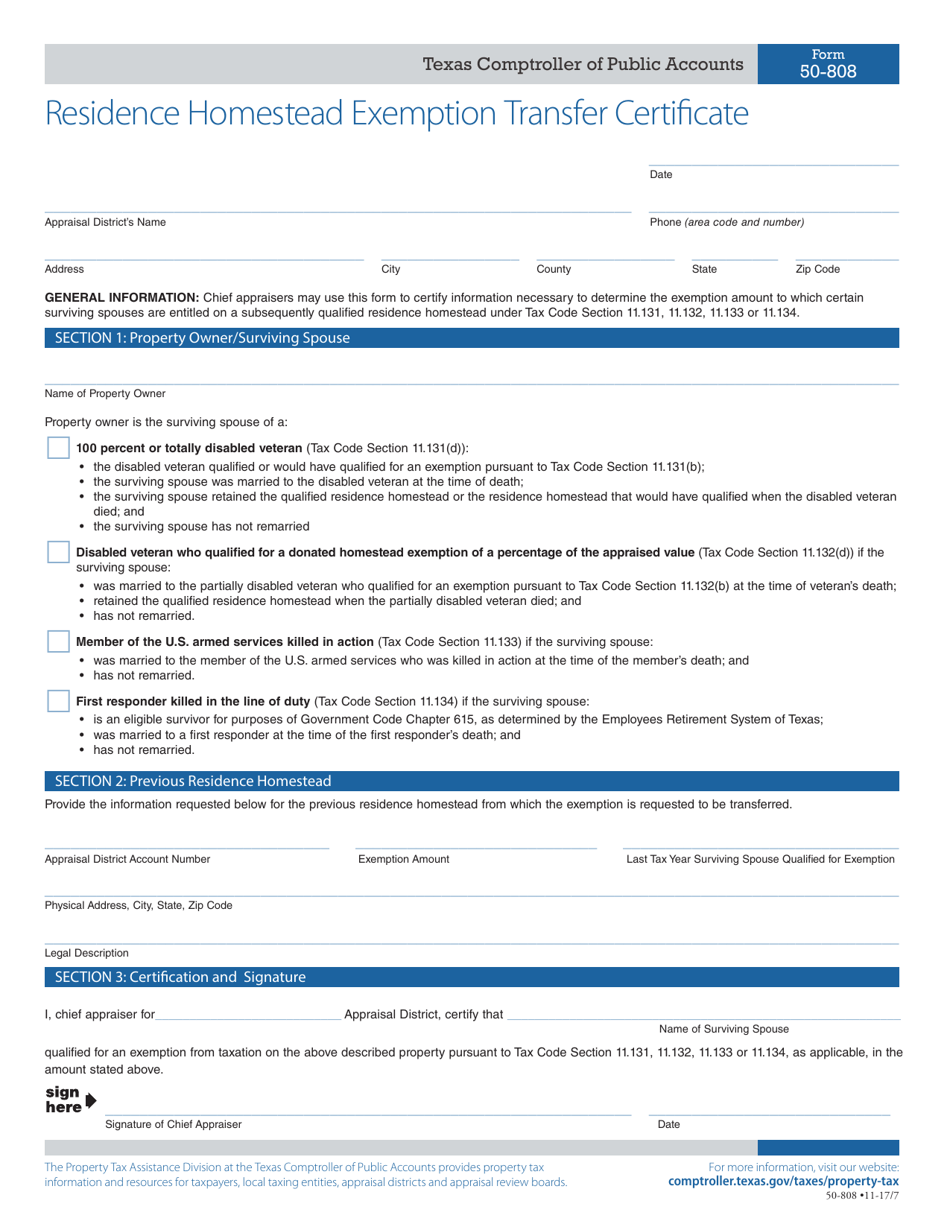

Form 50808 Download Fillable PDF or Fill Online Residence Homestead

Once you receive the exemption, you do not need to reapply unless the chief appraiser sends you a new application. Do not file this form with the texas comptroller of public accounts. Web download and complete texas property tax forms. Most counties have the homestead exemption form. The forms listed below are pdf files.

Homestead exemption form

Web the texas homestead exemption form or tex4141 is a form that determines whether an individual is eligible for the homestead exemption and how it benefits you. Most counties have the homestead exemption form. Web this application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. For filing with the appraisal district office in.

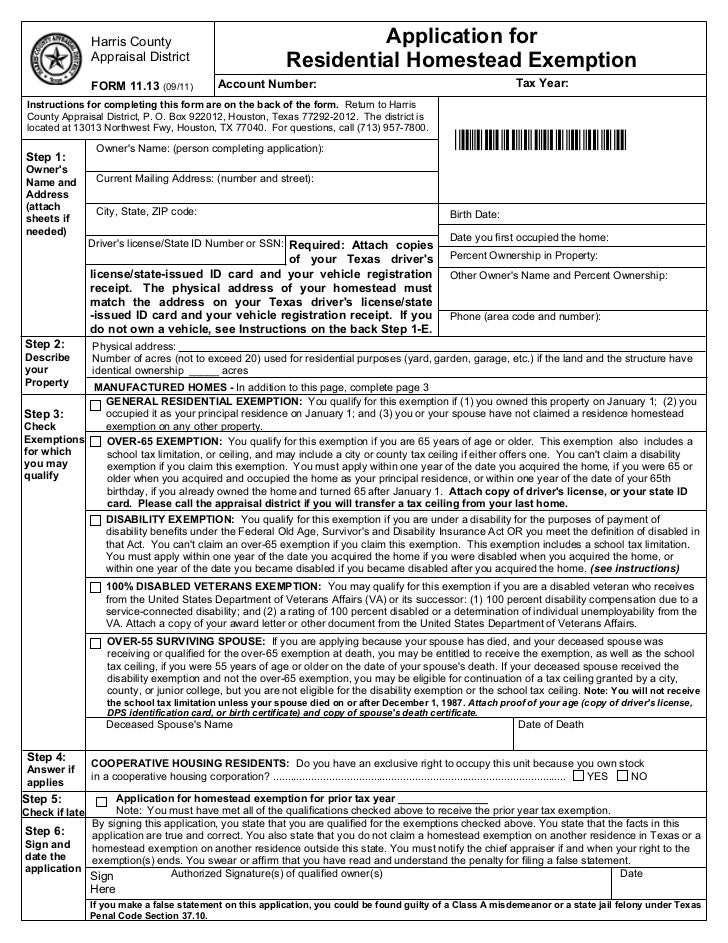

Form 11.13 Download Printable PDF or Fill Online Application for

Web the texas homestead exemption form or tex4141 is a form that determines whether an individual is eligible for the homestead exemption and how it benefits you. Web this application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. They include graphics, fillable form fields, scripts and functionality that work best with the free.

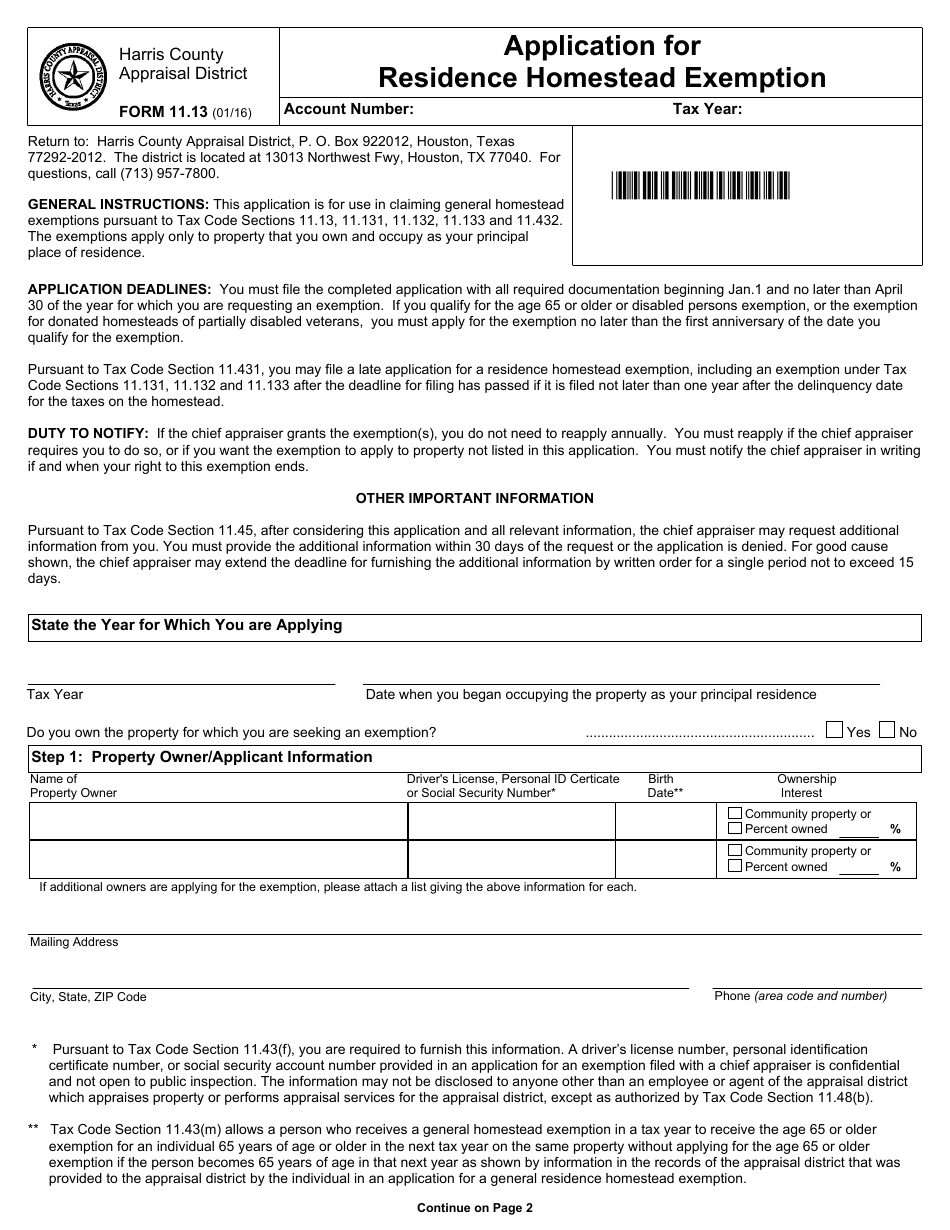

Texas Application for Residence Homestead Exemption Residence

The exemptions apply to your residence homestead that you own and occupy as your principal residence. Once completed, the application and. Web download and complete texas property tax forms. Web how to fill out the homestead exemption form in texas. Do not file this form with the texas comptroller of public accounts.

Texas Application for Residence Homestead Exemption Legal Forms and

This is the place to be at if you need to edit and download this form. File your homestead exemption forms online for free. The exemptions apply to your residence homestead that you own and occupy as your principal residence. Texas comptroller of public accounts. Web download and complete texas property tax forms.

How to fill out your Texas homestead exemption form YouTube

Do not file this form with the texas comptroller of public accounts. Web how to fill out the homestead exemption form in texas. The forms listed below are pdf files. 1 and april 30 of the year for which the exemption is requested. For filing with the appraisal district office in each county in which the property is located generally.

Form 1693 Fill Out and Sign Printable PDF Template signNow

Web this application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. They include graphics, fillable form fields, scripts and functionality that work best with the free adobe reader. Keep a scanned copy of your texas driver's license handy when you begin your homestead exemption application. You must furnish all information and documentation required.

Grayson Cad Fill Out and Sign Printable PDF Template signNow

Keep a scanned copy of your texas driver's license handy when you begin your homestead exemption application. The exemptions apply to your residence homestead that you own and occupy as your principal residence. For filing with the appraisal district office in each county in which the property is located generally between jan. 1 and april 30 of the year for.

You Must Furnish All Information And Documentation Required By The Application.

Texas comptroller of public accounts. Web download and complete texas property tax forms. Web property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each county in which the property is located (tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432). Applicant may also be required to complete an affidavit to qualify for an exemption under certain situations.

Once You Receive The Exemption, You Do Not Need To Reapply Unless The Chief Appraiser Sends You A New Application.

Do not file this form with the texas comptroller of public accounts. Keep a scanned copy of your texas driver's license handy when you begin your homestead exemption application. They include graphics, fillable form fields, scripts and functionality that work best with the free adobe reader. Most counties have the homestead exemption form.

The Forms Listed Below Are Pdf Files.

Web this application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. All homestead applications must be accompanied by a copy of applicant's drivers license or other information as required by the texas property tax code. Once completed, the application and. Web how to fill out the homestead exemption form in texas.

Make Sure Your Dl Reflects Your New Home Address.

Web the texas homestead exemption form or tex4141 is a form that determines whether an individual is eligible for the homestead exemption and how it benefits you. Do not file this document with the texas comptroller of public accounts This is the place to be at if you need to edit and download this form. The exemptions apply to your residence homestead that you own and occupy as your principal residence.