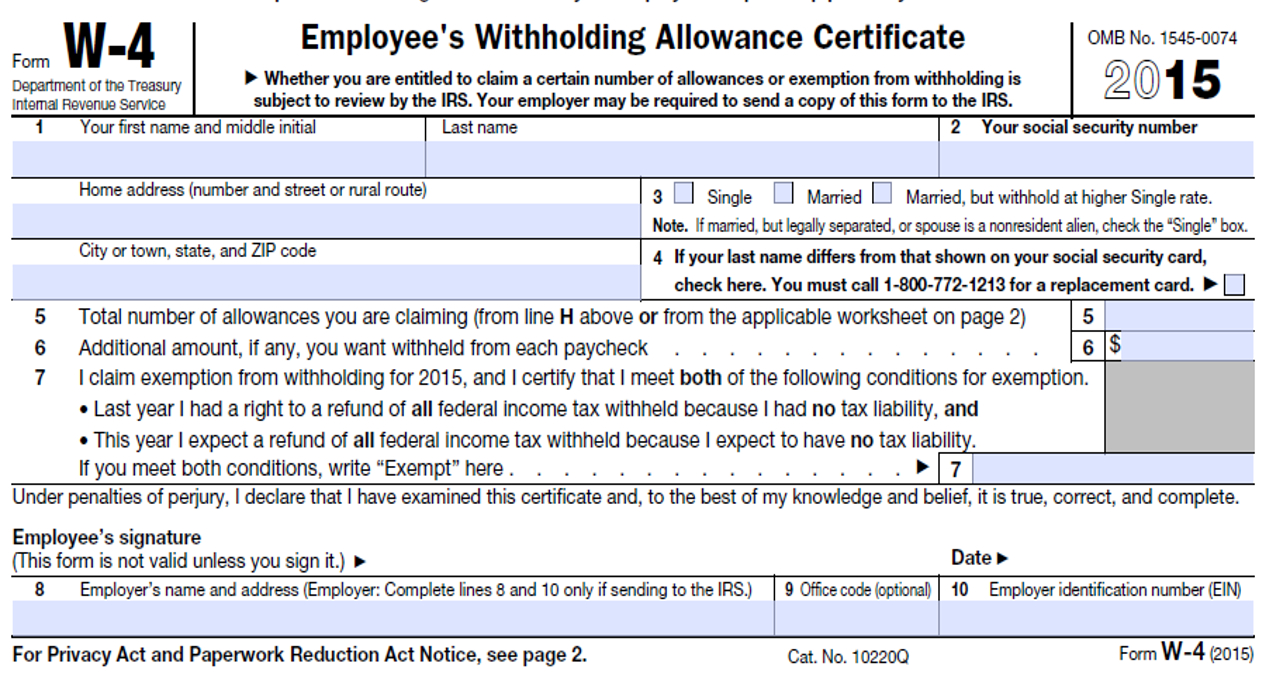

The W-4 Tax Form Is Used To Everfi

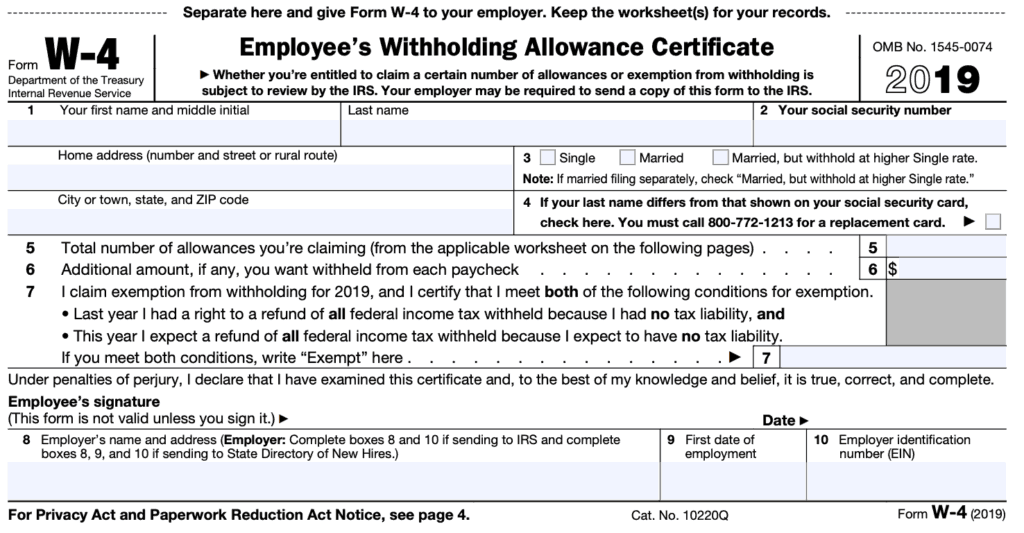

The W-4 Tax Form Is Used To Everfi - Employees will use the worksheets and tables to determine their allowances and any additional withholding amount. A federal tax form filled out by an employee to indicate the amount that should be. This form determines how much tax your employer will withhold. Web june 10, 2020. Web sui tax rate notice (sample) move your mouse over the image to see an example missouri sui rate notice, or click here to open in a separate window. Keep more of your paycheck by optimizing your form w4. This form determines how much money withheld from your wages for tax purposes. Click the card to flip 👆. At the end of the year, your employer. Determine how much your gross.

Payroll taxes and federal income tax withholding. Employers will continue to use the information. Tell your employer how much federal income tax to withhold from your paychecks to send to the irs. Click the card to flip 👆. Your withholding usually will be most accurate when all allowances. The irs always posts the next years tax forms before the end of the year. Let efile.com help you with it. In may you will take. Web june 10, 2020. This form determines how much money withheld from your wages for tax purposes.

Employers will continue to use the information. Keep more of your paycheck by optimizing your form w4. To determine how much federal income tax your employer. In may you will take. The irs always posts the next years tax forms before the end of the year. At the end of the year, your employer. Let efile.com help you with it. This form determines how much money withheld from your wages for tax purposes. Two earners or multiple jobs. Web sui tax rate notice (sample) move your mouse over the image to see an example missouri sui rate notice, or click here to open in a separate window.

How To Fill Out Your W4 Tax Form Youtube Free Printable W 4 Form

Two earners or multiple jobs. Your withholding usually will be most accurate when all allowances. To determine how much federal income tax your employer. This form determines how much money withheld from your wages for tax purposes. Tell your employer how much federal income tax to withhold from your paychecks to send to the irs.

The New W4 Tax Withholding Form Is Coming Soon. But Why Is The IRS

However, once you start the enrollment process you. The irs always posts the next years tax forms before the end of the year. Web june 10, 2020. Employees will use the worksheets and tables to determine their allowances and any additional withholding amount. At the end of the year, your employer.

Form W4 Tax forms, W4 tax form, How to get money

A federal tax form filled out by an employee to indicate the amount that should be. However, once you start the enrollment process you. Your withholding usually will be most accurate when all allowances. Let efile.com help you with it. At the end of the year, your employer.

Owe too much in taxes? Here's how to tackle the new W4 tax form

Web sui tax rate notice (sample) move your mouse over the image to see an example missouri sui rate notice, or click here to open in a separate window. This form determines how much tax your employer will withhold. Employers will continue to use the information. Tell your employer how much federal income tax to withhold from your paychecks to.

Why you should care about new W4 tax form The Columbian

Tell your employer how much federal income tax to withhold from your paychecks to send to the irs. This form determines how much money withheld from your wages for tax purposes. Two earners or multiple jobs. Employers will continue to use the information. Tell your employer how much federal income tax to withhold from your paychecks to send to the.

Here's how to fill out the new W4 form if you change jobs, get married

A federal tax form filled out by an employee to indicate the amount that should be. At the end of the year, your employer. Employers will continue to use the information. Click the card to flip 👆. Determine how much your gross.

Navigating the New W4 Form Primary Funding

This form determines how much tax your employer will withhold. Employees will use the worksheets and tables to determine their allowances and any additional withholding amount. Keep more of your paycheck by optimizing your form w4. In may you will take. Tell your employer how much federal income tax to withhold from your paychecks to send to the irs.

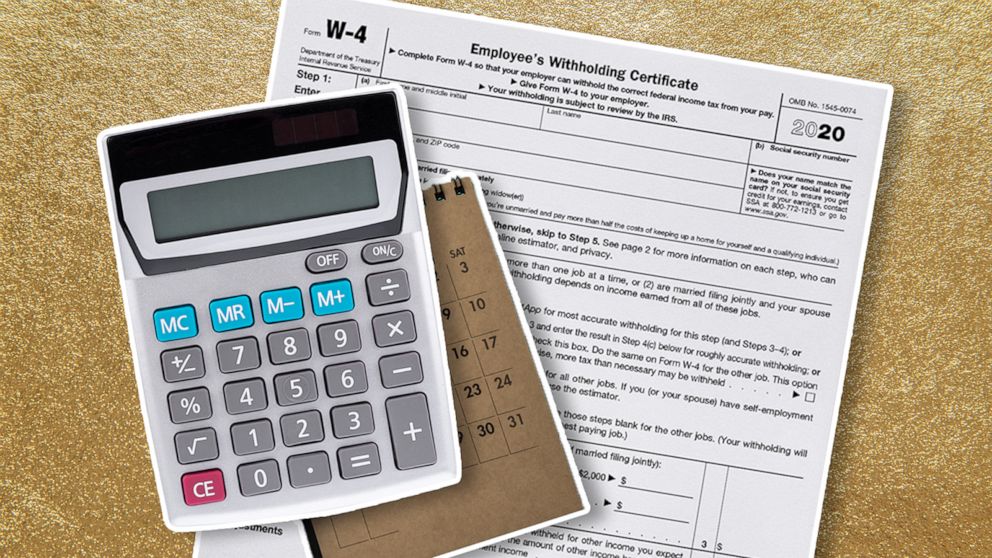

Everything you need to know about the new W4 tax form ABC News

Web june 10, 2020. Click the card to flip 👆. Determine how much your gross. Tell your employer how much federal income tax to withhold from your paychecks to send to the irs. To determine how much federal income tax your employer.

New W4 tax form explained 47abc

Employees will use the worksheets and tables to determine their allowances and any additional withholding amount. The irs always posts the next years tax forms before the end of the year. To determine how much federal income tax your employer. At the end of the year, your employer. Web sui tax rate notice (sample) move your mouse over the image.

Should I Claim 1 or 0 Allowances On My W4 To Lower My Taxes?

This form determines how much money withheld from your wages for tax purposes. In may you will take. Web june 10, 2020. Employees will use the worksheets and tables to determine their allowances and any additional withholding amount. To determine how much federal income tax your employer.

Tell Your Employer How Much Federal Income Tax To Withhold From Your Paychecks To Send To The Irs.

This form determines how much tax your employer will withhold. Web june 10, 2020. Determine how much your gross. Tell your employer how much federal income tax to withhold from your paychecks to send to the irs.

At The End Of The Year, Your Employer.

Two earners or multiple jobs. Keep more of your paycheck by optimizing your form w4. However, once you start the enrollment process you. The irs always posts the next years tax forms before the end of the year.

A Federal Tax Form Filled Out By An Employee To Indicate The Amount That Should Be.

Payroll taxes and federal income tax withholding. Your withholding usually will be most accurate when all allowances. In may you will take. This form determines how much money withheld from your wages for tax purposes.

Let Efile.com Help You With It.

To determine how much federal income tax your employer. Click the card to flip 👆. Employers will continue to use the information. Employees will use the worksheets and tables to determine their allowances and any additional withholding amount.