Travel Expenses Form

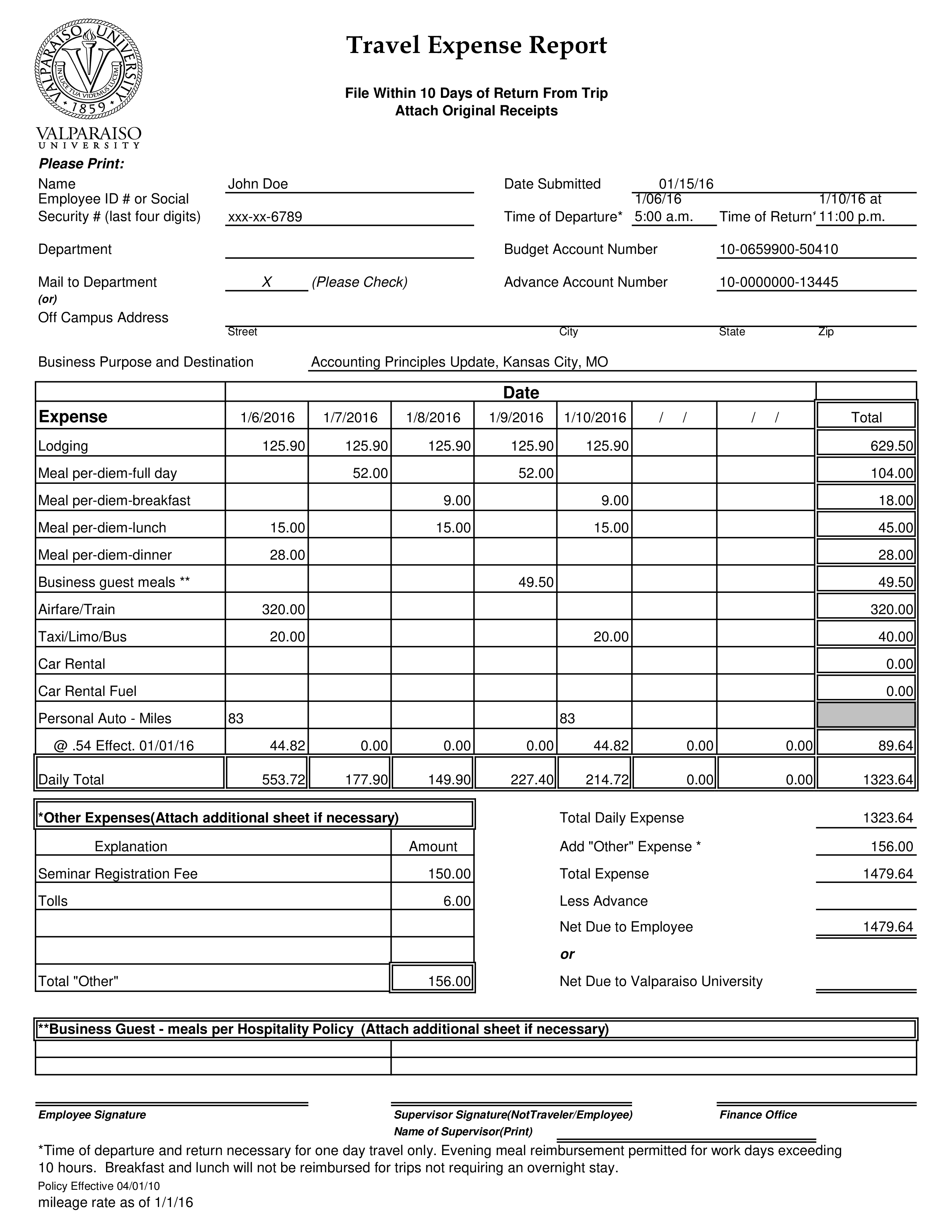

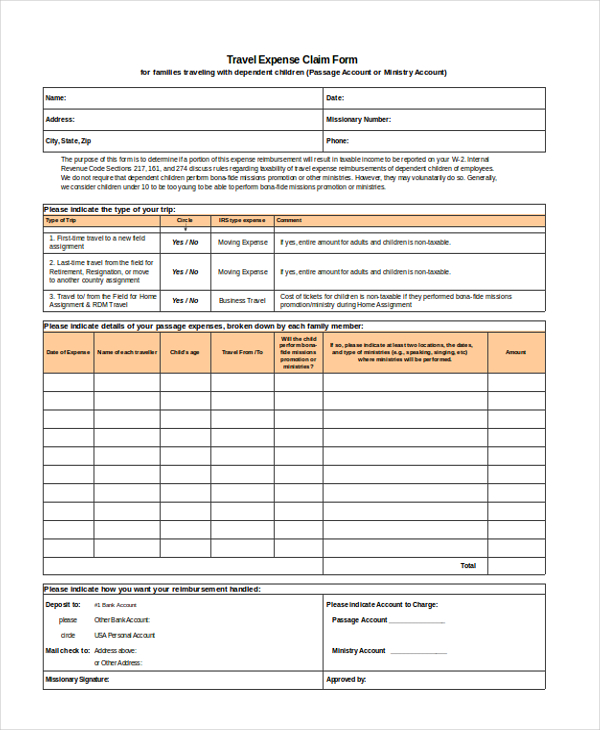

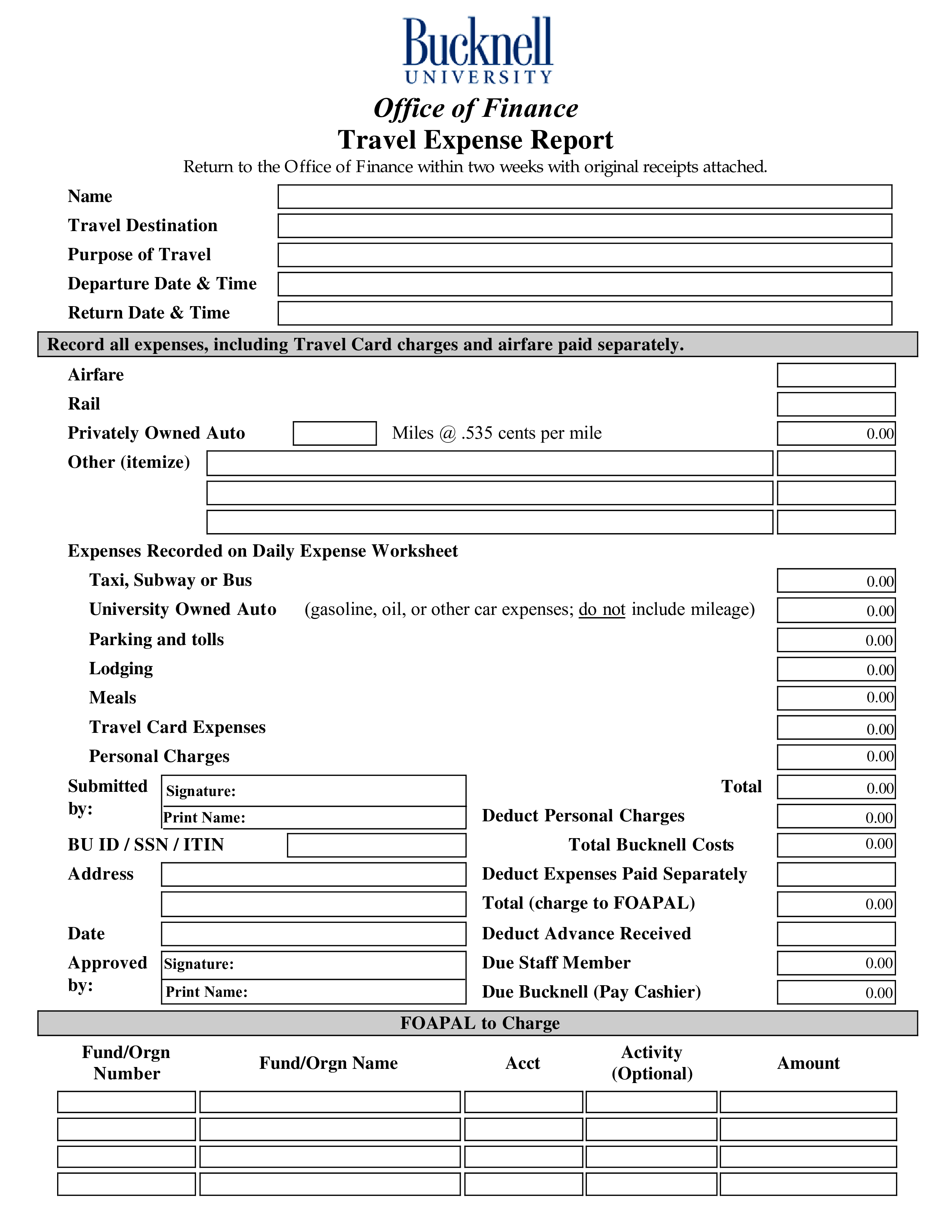

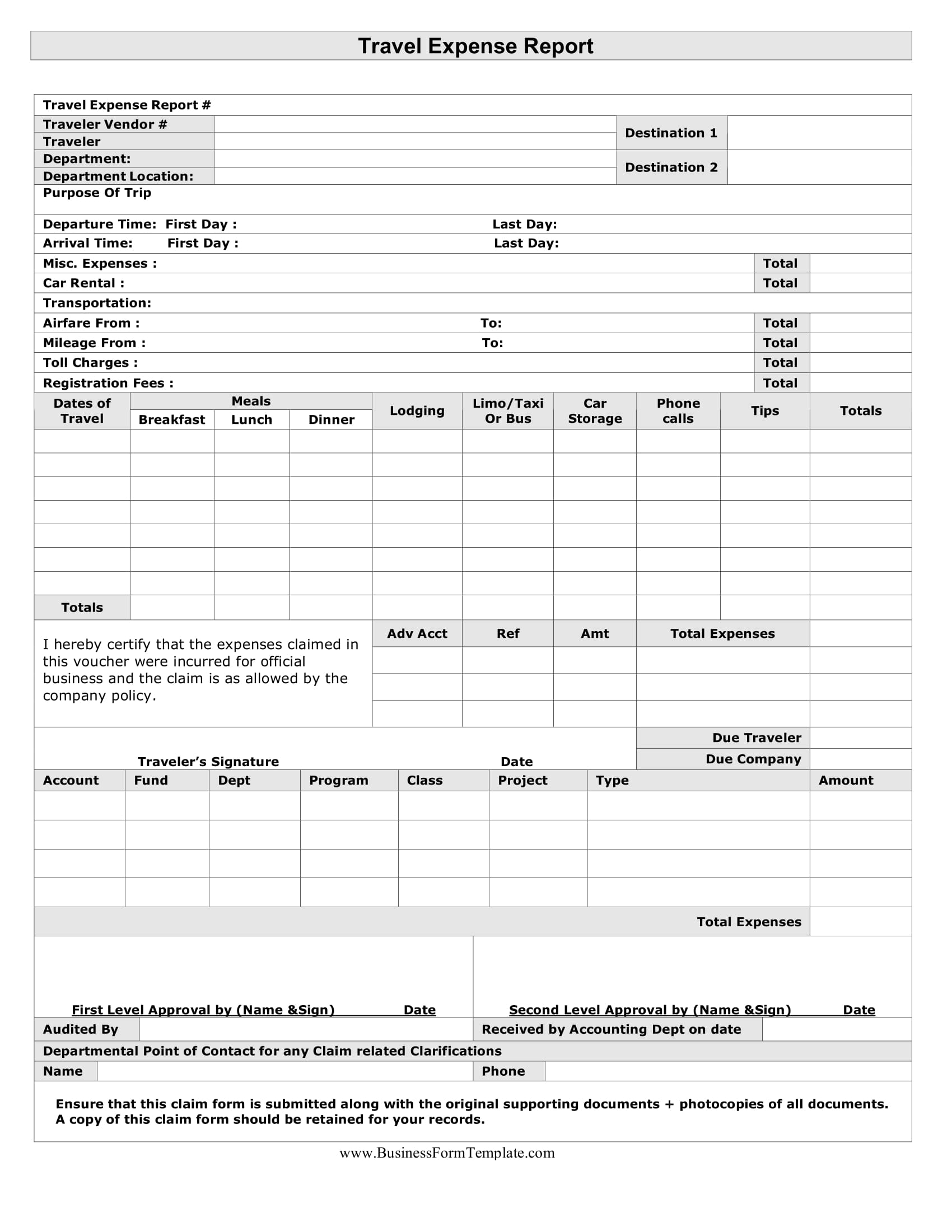

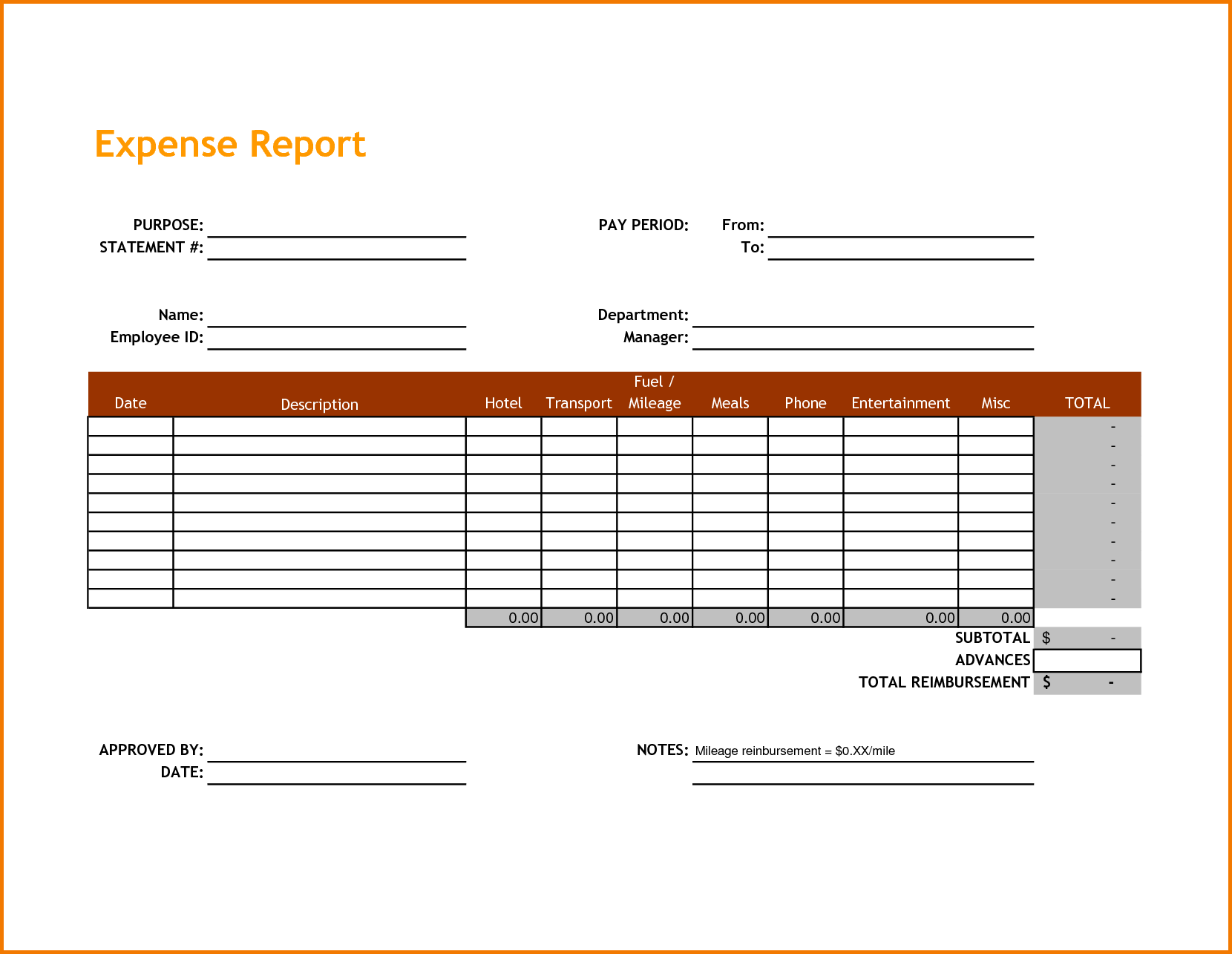

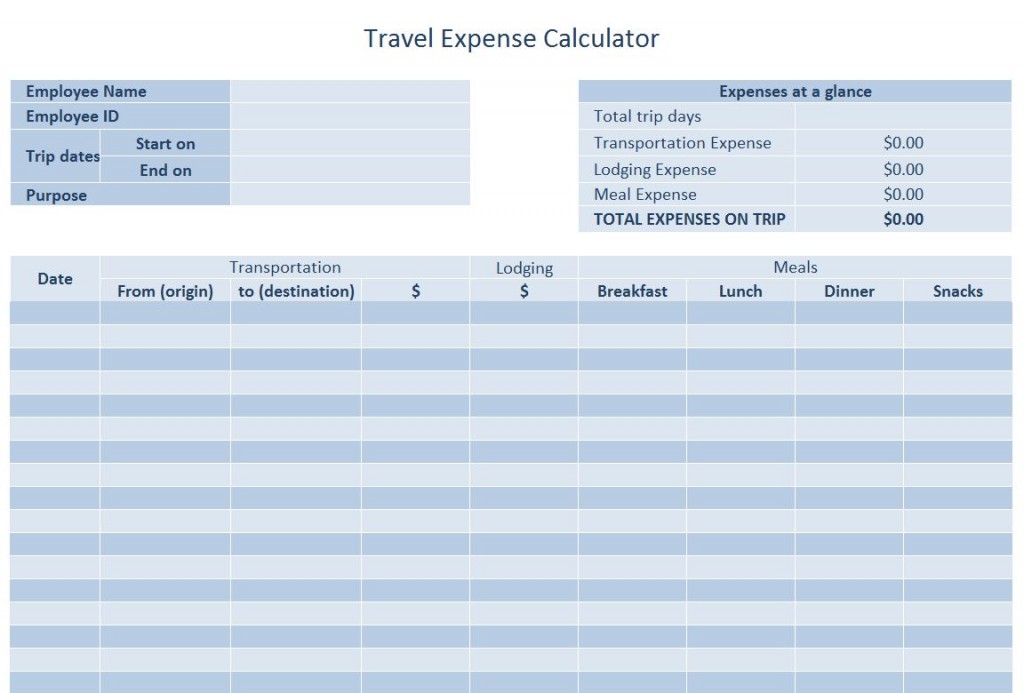

Travel Expenses Form - This travel expenses form contains form fields that ask for employee's name, position or title, unit or department, contact. Web our travel expense report template is available as a free download in word format. A travel expenses form is a document used for reimbursing the expenses that the employee spent during his/her trip. Web for tax purposes, travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. Web download the simple printable expense report form for adobe pdf this basic printable expense report template simplifies the expense reporting process for employees and ensures that managers can issue reimbursement quickly. If the trip is being sponsored, remember to include the contact information and details of the sponsors. Web this printable travel expense report can be used to organize travel expenses on a business trip. This report includes entries for typical business travel costs in addition to detailed employee information. Employees can either print out the template and fill it out manually or complete the sections of the form directly on their pc. Simply customize the form to suit your business, embed it on.

Web our travel expense report template is available as a free download in word format. Web an expense report is commonly used for recording business travel expenses such as transportation, food, lodging, and conference fees. An ordinary expense is one that is common and accepted in your trade or business. For each expense, enter the date, description, and type (e.g., lodging, travel, fuel or mileage). Web for tax purposes, travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. If the trip is being sponsored, remember to include the contact information and details of the sponsors. Web this printable travel expense report can be used to organize travel expenses on a business trip. Trips that are approved by the management are covered financially by the company. Publication 463 explains what expenses are deductible, how to report them, what records you'll need, and how to treat expense reimbursements. Employees can either print out the template and fill it out manually or complete the sections of the form directly on their pc.

You can't deduct expenses that are lavish or extravagant, or that are for personal purposes. A travel expenses form is a document used for reimbursing the expenses that the employee spent during his/her trip. Web information about publication 463, travel, entertainment, gift, and car expenses, including recent updates. Web a travel request form should indicate the trip’s estimated expenses, including costs of meals and accommodation, transportation expenses, travel expenses, and car rentals, among others. For each expense, enter the date, description, and type (e.g., lodging, travel, fuel or mileage). Web this printable travel expense report can be used to organize travel expenses on a business trip. Employees can either print out the template and fill it out manually or complete the sections of the form directly on their pc. This report includes entries for typical business travel costs in addition to detailed employee information. This travel expenses form contains form fields that ask for employee's name, position or title, unit or department, contact. Publication 463 explains what expenses are deductible, how to report them, what records you'll need, and how to treat expense reimbursements.

4+ Travel Expense Report Template SampleTemplatess SampleTemplatess

You can't deduct expenses that are lavish or extravagant, or that are for personal purposes. If the trip is being sponsored, remember to include the contact information and details of the sponsors. For each expense, enter the date, description, and type (e.g., lodging, travel, fuel or mileage). This travel expenses form contains form fields that ask for employee's name, position.

Sample Travel Expense Report Templates at

If the trip is being sponsored, remember to include the contact information and details of the sponsors. The expense columns represent lodging, fuel, meals, entertainment and other expenses. For each expense, enter the date, description, and type (e.g., lodging, travel, fuel or mileage). Web for tax purposes, travel expenses are the ordinary and necessary expenses of traveling away from home.

FREE 11+ Sample Travel Expense Claim Forms in MS Word PDF MS Excel

Simply customize the form to suit your business, embed it on. Web this printable travel expense report can be used to organize travel expenses on a business trip. Publication 463 explains what expenses are deductible, how to report them, what records you'll need, and how to treat expense reimbursements. But an expense report can also be used to document any.

Travel Expense Report Templates at

If the trip is being sponsored, remember to include the contact information and details of the sponsors. Simply customize the form to suit your business, embed it on. You can't deduct expenses that are lavish or extravagant, or that are for personal purposes. But an expense report can also be used to document any business expense for which an employee.

Travel Expense Claim Form California Free Download

A travel expenses form is a document used for reimbursing the expenses that the employee spent during his/her trip. Web an expense report is commonly used for recording business travel expenses such as transportation, food, lodging, and conference fees. Trips that are approved by the management are covered financially by the company. Web information about publication 463, travel, entertainment, gift,.

FREE 13+ Expense Report Forms in MS Word PDF Excel

Publication 463 explains what expenses are deductible, how to report them, what records you'll need, and how to treat expense reimbursements. A travel expenses form is a document used for reimbursing the expenses that the employee spent during his/her trip. If the trip is being sponsored, remember to include the contact information and details of the sponsors. The expense columns.

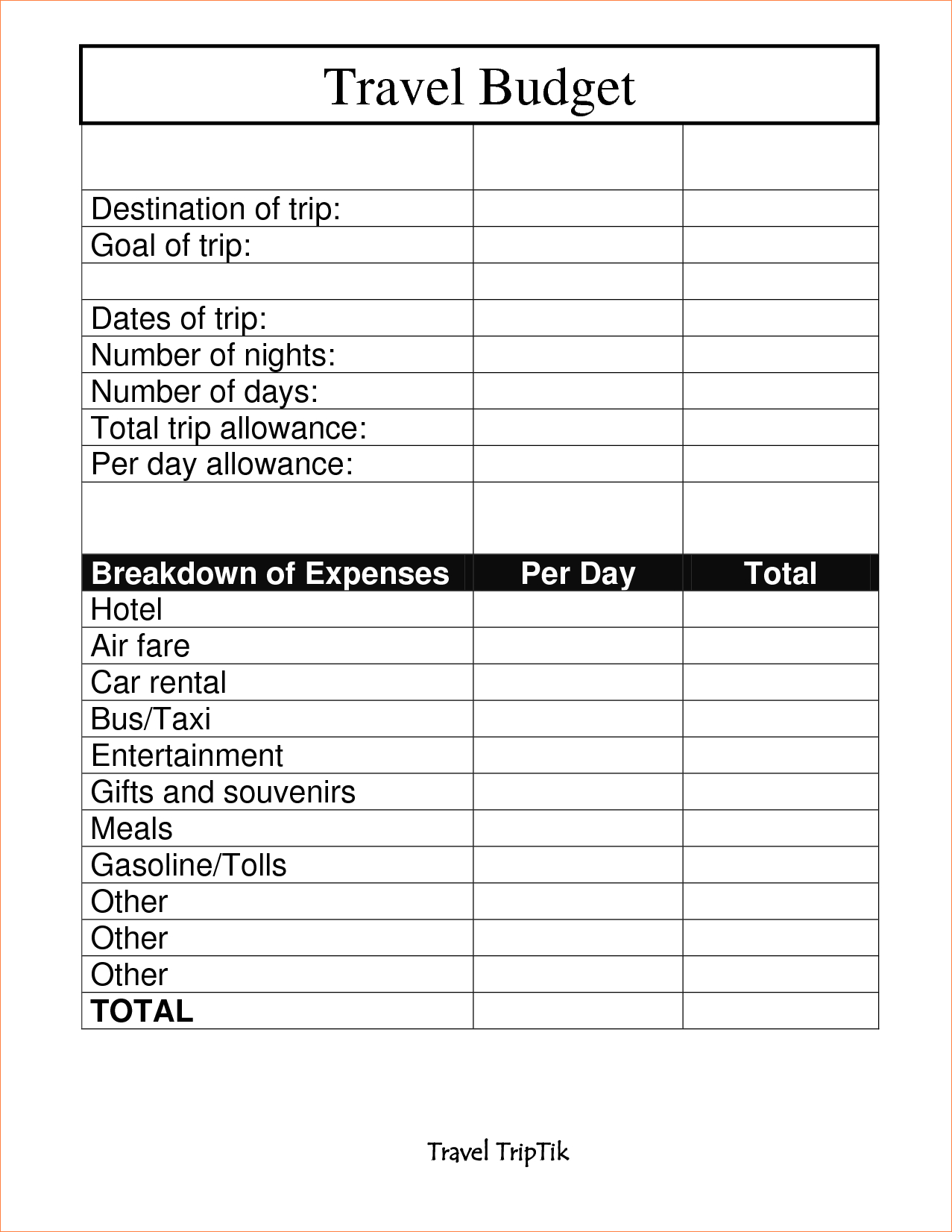

Travel Expenses Spreadsheet Template Regarding Example Of Travel Budget

This report includes entries for typical business travel costs in addition to detailed employee information. You can't deduct expenses that are lavish or extravagant, or that are for personal purposes. Web for tax purposes, travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. But an expense report can also be.

travel expense report template 1 —

For each expense, enter the date, description, and type (e.g., lodging, travel, fuel or mileage). The expense columns represent lodging, fuel, meals, entertainment and other expenses. Web an expense report is commonly used for recording business travel expenses such as transportation, food, lodging, and conference fees. Web for tax purposes, travel expenses are the ordinary and necessary expenses of traveling.

Travel Expense Report Template Travel Expenses Template

The expense columns represent lodging, fuel, meals, entertainment and other expenses. For each expense, enter the date, description, and type (e.g., lodging, travel, fuel or mileage). Web a travel request form should indicate the trip’s estimated expenses, including costs of meals and accommodation, transportation expenses, travel expenses, and car rentals, among others. Web this printable travel expense report can be.

Travel Expense Forms

An ordinary expense is one that is common and accepted in your trade or business. This report includes entries for typical business travel costs in addition to detailed employee information. You can't deduct expenses that are lavish or extravagant, or that are for personal purposes. Web download the simple printable expense report form for adobe pdf this basic printable expense.

Web Information About Publication 463, Travel, Entertainment, Gift, And Car Expenses, Including Recent Updates.

An ordinary expense is one that is common and accepted in your trade or business. Web this printable travel expense report can be used to organize travel expenses on a business trip. Web an expense report is commonly used for recording business travel expenses such as transportation, food, lodging, and conference fees. Travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job.

Web Our Travel Expense Report Template Is Available As A Free Download In Word Format.

You can't deduct expenses that are lavish or extravagant, or that are for personal purposes. Web for tax purposes, travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. A travel expenses form is a document used for reimbursing the expenses that the employee spent during his/her trip. This travel expenses form contains form fields that ask for employee's name, position or title, unit or department, contact.

Web A Travel Request Form Should Indicate The Trip’s Estimated Expenses, Including Costs Of Meals And Accommodation, Transportation Expenses, Travel Expenses, And Car Rentals, Among Others.

Simply customize the form to suit your business, embed it on. For each expense, enter the date, description, and type (e.g., lodging, travel, fuel or mileage). This report includes entries for typical business travel costs in addition to detailed employee information. The expense columns represent lodging, fuel, meals, entertainment and other expenses.

Publication 463 Explains What Expenses Are Deductible, How To Report Them, What Records You'll Need, And How To Treat Expense Reimbursements.

Employees can either print out the template and fill it out manually or complete the sections of the form directly on their pc. If the trip is being sponsored, remember to include the contact information and details of the sponsors. But an expense report can also be used to document any business expense for which an employee needs to be reimbursed. Trips that are approved by the management are covered financially by the company.