Turbotax Form 8862

Turbotax Form 8862 - Form 8862 is missing from the tax retur. For 2021, special rules applied regarding the age requirementsforcertain filers claiming the earned income credit (eic) without a qualifying child. For details, see line 10. Enter the appropriate number in qualifying children: Web form 8862 is available in turbo tax. Open your return if you don't already have it open. Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical errors, after 1996. Easily fill out pdf blank, edit, and sign them. 1=one, 2=two, 3=three, 4=none (mandatory for eic claim). Follow these steps to add it to your taxes.

Married filing jointly vs separately. Web here's a turbotax faq on how to fix a rejection involving this form: Web several standards must be met for you to claim the eic: Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical errors, after 1996. Open your return if you don't already have it open. Follow these steps to add it to your taxes. 1=one, 2=two, 3=three, 4=none (mandatory for eic claim). We can help you file form 8862. For details, see line 10. Web tax tips & video homepage.

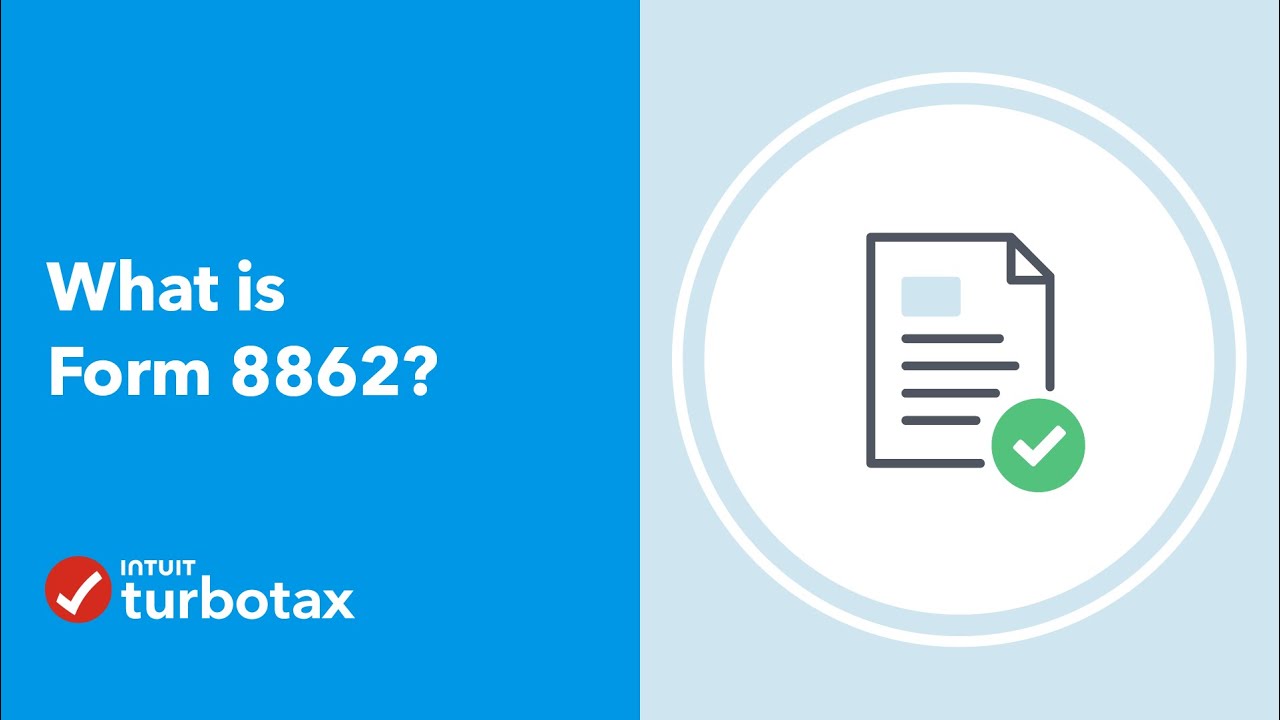

We can help you file form 8862. Here's how to file form 8862 in turbotax. You can download form 8862 from the irs website and file it. Web what’s new age requirements for taxpayers without a qualifying child. Solved • by turbotax • 7249 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for something other than a math or clerical error, you may need to file form 8862 before the irs allows you to use the credit again. You can't be a qualifying child on another return. To resolve this rejection, you'll need to add form 8862: You can create the form in turbotax. Make sure you perform these following steps so that the form generates in your return. Earned income credit (eic), child tax credit (ctc), refundable child tax credit (rctc), additional child tax credit (actc), credit for other dependents (odc), and american opportunity tax credit (aotc)

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

What’s new age requirements for taxpayers without a qualifying child. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced or disallowed for any reason other than a math or clerical error. After you have finished entering the information for form 8862, you can refile.

Form 8862 TurboTax How To Claim The Earned Tax Credit 2022

Answer the questions accordingly, and we’ll include form 8862 with your return. Filing this form allows you to reclaim credits for which you are now eligible. For 2022, filers without a qualifying child must be at least age 25 but under age 65. Solved • by turbotax • 7249 • updated february 25, 2023 if your earned income credit (eic).

What is Form 8862? TurboTax Support Video YouTube

We can help you file form 8862. You can create the form in turbotax. You must be a citizen of the united states, and must live in the u.s. Filing this form allows you to reclaim credits for which you are now eligible. Save or instantly send your ready documents.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

For more than half of the year. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc), credit for other dependents (odc) or american opportunity credit (aotc) was reduced or disallowed for any reason other than a math or clerical error. We can help you file form 8862. Web for the latest information about developments related to.

how do i add form 8862 TurboTax® Support

We can help you file form 8862. Answer the questions accordingly, and we’ll include form 8862 with your return. Guide to head of household. Click on eic/ctc/aoc after disallowances (8862). Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any.

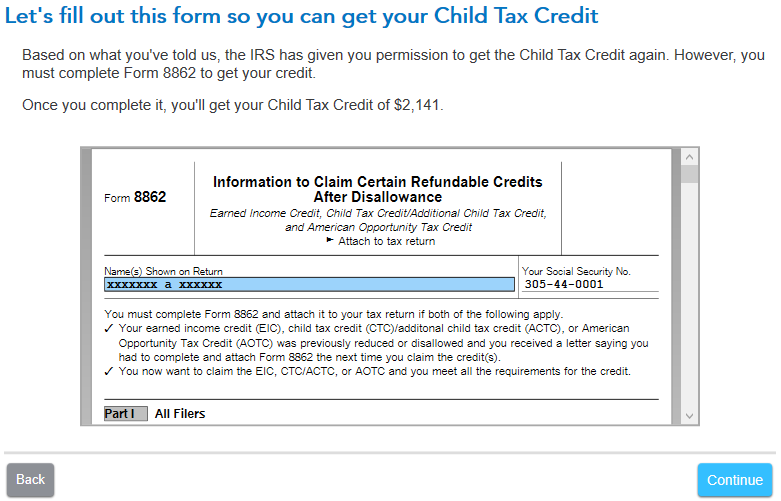

What Does Form 8862 Look Like Fill Online, Printable, Fillable, Blank

Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. After you have finished entering the information for form 8862, you can refile your return by clicking filing and repeating the filing steps. Web irs form 8862 is used to claim the earned income tax.

Filing Tax Form 8862 Information to Claim Earned Credit after

Once you complete the form, you’ll be able to claim the eic. Information to claim certain credits after disallowance. For 2021, special rules applied regarding the age requirementsforcertain filers claiming the earned income credit (eic) without a qualifying child. Web taxpayers complete form 8862 and attach it to their tax return if: Web here's a turbotax faq on how to.

What is Form 8862? TurboTax Support Video YouTube

Form 8862 is missing from the tax return and it is required to be able t. Save or instantly send your ready documents. For more than half of the year. After you have finished entering the information for form 8862, you can refile your return by clicking filing and repeating the filing steps. For details, see line 10.

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Complete any other applicable information on this screen. For more answers to your. Follow these steps to add it to your taxes. Follow these steps to add it to your taxes. Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical errors,.

Form 8862 (Rev. December 2012) Edit, Fill, Sign Online Handypdf

Click here to view the turbotax article. File taxes with no income. Click on eic/ctc/aoc after disallowances (8862). For details, see line 10. Earned income credit (eic), child tax credit (ctc), refundable child tax credit (rctc), additional child tax credit (actc), credit for other dependents (odc), and american opportunity tax credit (aotc)

Web Taxpayers Complete Form 8862 And Attach It To Their Tax Return If:

For 2021, special rules applied regarding the age requirementsforcertain filers claiming the earned income credit (eic) without a qualifying child. 596 for more information on when to use. Web what’s new age requirements for taxpayers without a qualifying child. 1=one, 2=two, 3=three, 4=none (mandatory for eic claim).

Open Your Return If You Don't Already Have It Open.

Click here to view the turbotax article. Please see the faq link provided below for assistance: Web you’ll need to complete form 8862 if your earned income credit (eic) was disallowed for any year after 1996, and permission was later restored (you'll get another notice from the irs). Follow these steps to add it to your taxes.

Form 8862 Is Missing From The Tax Return And It Is Required To Be Able T.

We can help you file form 8862. For details, see line 10. What’s new age requirements for taxpayers without a qualifying child. Information to claim earned income credit after disallowance to your return.

Make Sure You Perform These Following Steps So That The Form Generates In Your Return.

Here's how to file form 8862 in turbotax. Married filing jointly vs separately. Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math or clerical error, you must include form 8862, information to claim certain credits after disallowance with your next tax return. Web here's a turbotax faq on how to fix a rejection involving this form:

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-170516.jpg)

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/aaa.jpg)