Turbotax Form 8960

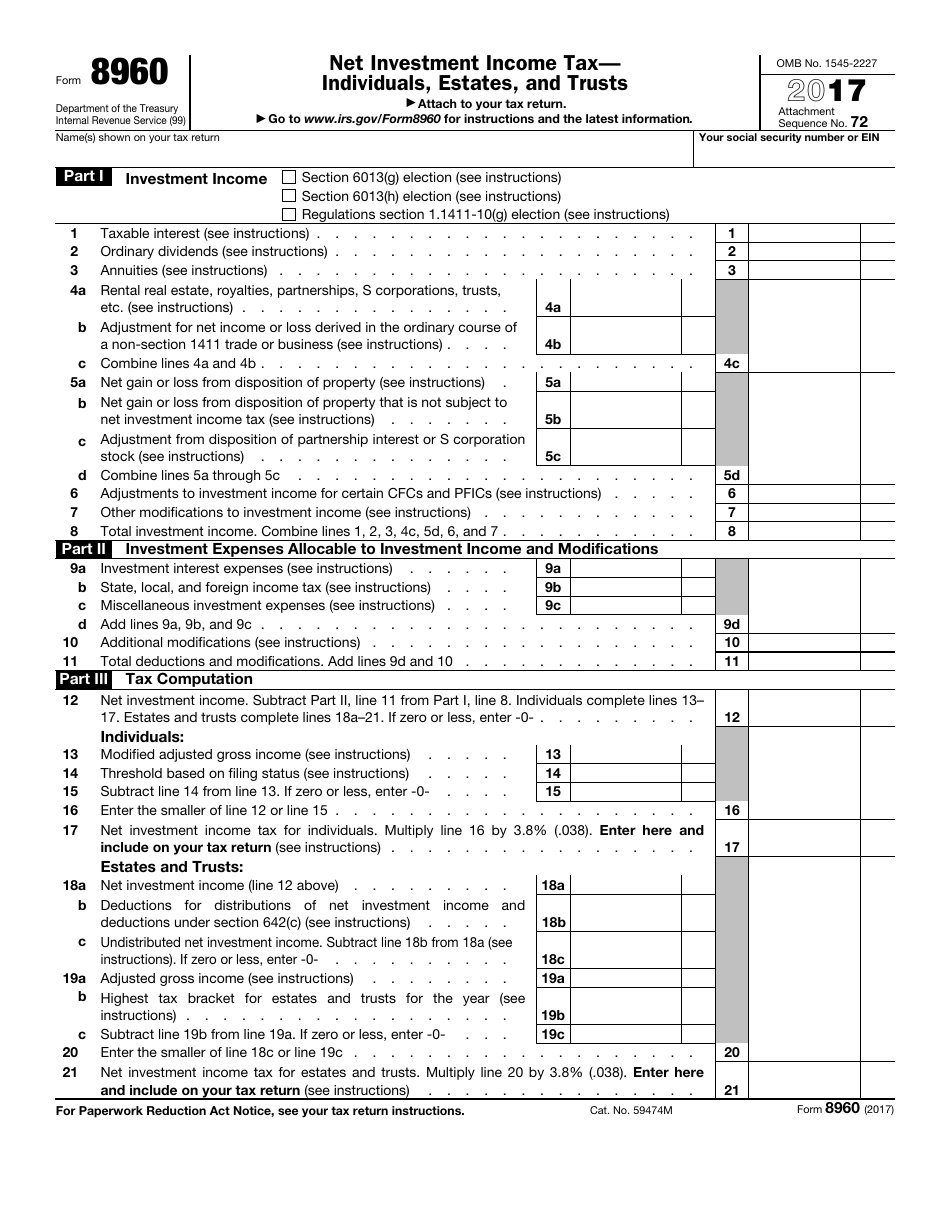

Turbotax Form 8960 - Web information about form 8960, net investment income tax individuals, estates, and trusts, including recent updates, related forms and instructions on how to file. Web form 8960 department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts attach to your tax return. Web individuals, estates, and trusts will use form 8960 pdf and instructions pdf to compute their net investment income tax. April 9, 2020 12:48 pm. Web why is form 8960 included in turbotax when i do not have these types of investments? Easily sort by irs forms to find the product that best fits your tax. Per irs instructions for form 8960,. Web step by step instructions comments if your income is above a certain threshold, the internal revenue service may require you to pay an additional tax, known. By clicking continue, you will leave the community and be. Line 9b provides that i can deduct a large part of my state income tax (the part attributable to.

Per irs instructions for form 8960,. By clicking continue, you will leave the community and be. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Definitions controlled foreign corporation (cfc). Per irs, the form is not required only sch d and form 8949 if you have gain/loss to report. Web form 8960 department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts attach to your tax return. Easily sort by irs forms to find the product that best fits your tax. Web form 8960 department of the treasury internal revenue service net investment income tax— individuals, estates, and trusts attach to your tax return. This issue will be resolved. Web information about form 8960, net investment income tax individuals, estates, and trusts, including recent updates, related forms and instructions on how to file.

For individuals, the tax will be reported on,. Definitions controlled foreign corporation (cfc). Web use form 8960 net investment income tax—individuals, estates, and trusts to figure the amount of your net investment income tax (niit). What needs to be done: You have clicked a link to a site outside of the turbotax community. April 9, 2020 12:48 pm. By clicking continue, you will leave the community and be. Web 1 this is the net investment income tax to finance obamacare. This return cannot be electronically filed due to a processing error on form 8960, net investment income tax. Per irs, the form is not required only sch d and form 8949 if you have gain/loss to report.

Form 8960 Instructions Tax In The United States S Corporation

Web use form 8960 net investment income tax—individuals, estates, and trusts to figure the amount of your net investment income tax (niit). Definitions controlled foreign corporation (cfc). Web form 8960 department of the treasury internal revenue service net investment income tax— individuals, estates, and trusts attach to your tax return. Web 1 this is the net investment income tax to.

TurboTax makes filing (almost) fun Inside Design Blog Turbotax

Web form 8960 department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts attach to your tax return. Web use form 8960 net investment income tax—individuals, estates, and trusts to figure the amount of your net investment income tax (niit). You have clicked a link to a site outside of the turbotax community. If.

IRS Form 8960 Download Fillable PDF or Fill Online Net Investment

If you are using a desktop (installed on your computer) version of turbotax, you can enter enter the figure directly on line 7. Web step by step instructions comments if your income is above a certain threshold, the internal revenue service may require you to pay an additional tax, known. Web 1 this is the net investment income tax to.

TurboTax Deluxe 2014 Fed + State + Fed Efile Tax Software

Line 9b provides that i can deduct a large part of my state income tax (the part attributable to. You have clicked a link to a site outside of the turbotax community. Web form 8960 department of the treasury internal revenue service (99) net investment income tax— individuals, estates, and trusts attach to your tax return. Web level 1 net.

CONVERTING TURBOTAX FILES TO PDF

April 9, 2020 12:48 pm. Web step by step instructions comments if your income is above a certain threshold, the internal revenue service may require you to pay an additional tax, known. Web 1 this is the net investment income tax to finance obamacare. This issue will be resolved. What needs to be done:

form 2106 turbotax Fill Online, Printable, Fillable Blank

This issue will be resolved. Definitions controlled foreign corporation (cfc). Per irs, the form is not required only sch d and form 8949 if you have gain/loss to report. Web individuals, estates, and trusts will use form 8960 pdf and instructions pdf to compute their net investment income tax. Web you are leaving turbotax.

What Is Form 8960? H&R Block

Web individuals, estates, and trusts will use form 8960 pdf and instructions pdf to compute their net investment income tax. Per irs instructions for form 8960,. If you are using a desktop (installed on your computer) version of turbotax, you can enter enter the figure directly on line 7. Generally, a cfc is any foreign corporation if more. This issue.

irs form 8960 for 2019 Fill Online, Printable, Fillable Blank form

Web information about form 8960, net investment income tax individuals, estates, and trusts, including recent updates, related forms and instructions on how to file. For individuals, the tax will be reported on,. Per irs, the form is not required only sch d and form 8949 if you have gain/loss to report. By clicking continue, you will leave the community and.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

Line 9b provides that i can deduct a large part of my state income tax (the part attributable to. Web why is form 8960 included in turbotax when i do not have these types of investments? Web step by step instructions comments if your income is above a certain threshold, the internal revenue service may require you to pay an.

What is Form 8960 Net Investment Tax TurboTax Tax Tips & Videos

Web why is form 8960 included in turbotax when i do not have these types of investments? In order to arrive at net investment income, gross investment income (items. What needs to be done: Per irs instructions for form 8960,. Per irs, the form is not required only sch d and form 8949 if you have gain/loss to report.

You Have Clicked A Link To A Site Outside Of The Turbotax Community.

Per irs, the form is not required only sch d and form 8949 if you have gain/loss to report. Web level 1 net investment income tax form 8960 this paragraph is in the irs literature:. Web why is form 8960 included in turbotax when i do not have these types of investments? This issue will be resolved.

Per Irs Instructions For Form 8960,.

April 9, 2020 12:48 pm. Line 9b provides that i can deduct a large part of my state income tax (the part attributable to. Generally, a cfc is any foreign corporation if more. Web form 8960 department of the treasury internal revenue service net investment income tax— individuals, estates, and trusts attach to your tax return.

Web Use Form 8960 To Figure The Amount Of Your Net Investment Income Tax (Niit).

Web individuals, estates, and trusts will use form 8960 pdf and instructions pdf to compute their net investment income tax. Definitions controlled foreign corporation (cfc). By clicking continue, you will leave the community and be. In order to arrive at net investment income, gross investment income (items.

Web 1 This Is The Net Investment Income Tax To Finance Obamacare.

If you are using a desktop (installed on your computer) version of turbotax, you can enter enter the figure directly on line 7. Web you are leaving turbotax. Web information about form 8960, net investment income tax individuals, estates, and trusts, including recent updates, related forms and instructions on how to file. Easily sort by irs forms to find the product that best fits your tax.