Va 760Cg Form

Va 760Cg Form - Web if you need to change or amend an accepted virginia state income tax return for the current or previous tax year you need to complete form 760. We last updated the virginia income tax instructional booklet in january 2023, so this is. Interest on obligations of other states,. File by may 1, 2023 — use black ink. Printing and scanning is no longer the best way to manage documents. Web handy tips for filling out va760cg online. Web 2019 virginia resident form 760 individual income tax return author: Web virginia form 760 *va0760122888* resident income tax return. Enjoy smart fillable fields and interactivity. Web am i required to complete form 760c, underpayment of virginia estimated tax?

Web handy tips for filling out va760cg online. Web complete form 760, lines 1 through 9, to determine your virginia adjusted gross income (vagi). If you owe more than $150 to the state of virginia at the end of the tax year, you may be subject to. Web this booklet includes instructions for filling out and filing your form 760 income tax return. Edit your form 760cg online type text, add images, blackout confidential details, add comments, highlights and more. Web 2019 virginia resident form 760 individual income tax return author: Web home va 760 cg: Form 760 is a form used. Web what is a va760cg form?? If the amount on line 9 is less than the amount shown below for your filing.

Web form 760c is a virginia individual income tax form. Enjoy smart fillable fields and interactivity. Web home va 760 cg: Web handy tips for filling out va760cg online. Web am i required to complete form 760c, underpayment of virginia estimated tax? We last updated the virginia income tax instructional booklet in january 2023, so this is. Edit your form 760cg online type text, add images, blackout confidential details, add comments, highlights and more. Web if you need to change or amend an accepted virginia state income tax return for the current or previous tax year you need to complete form 760. Web virginia form 760 *va0760122888* resident income tax return. If the amount on line 9 is less than the amount shown below for your filing.

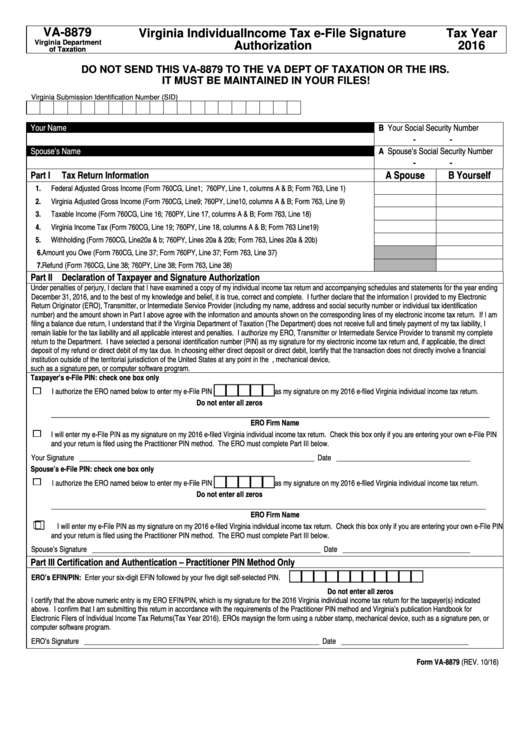

Form Va8879 Virginia Individual Tax EFile Signature

Web virginia form 760 *va0760122888* resident income tax return. Web form 760c is a virginia individual income tax form. Web am i required to complete form 760c, underpayment of virginia estimated tax? • enclose this form with form 760, 763, 760py or 770. Web home va 760 cg:

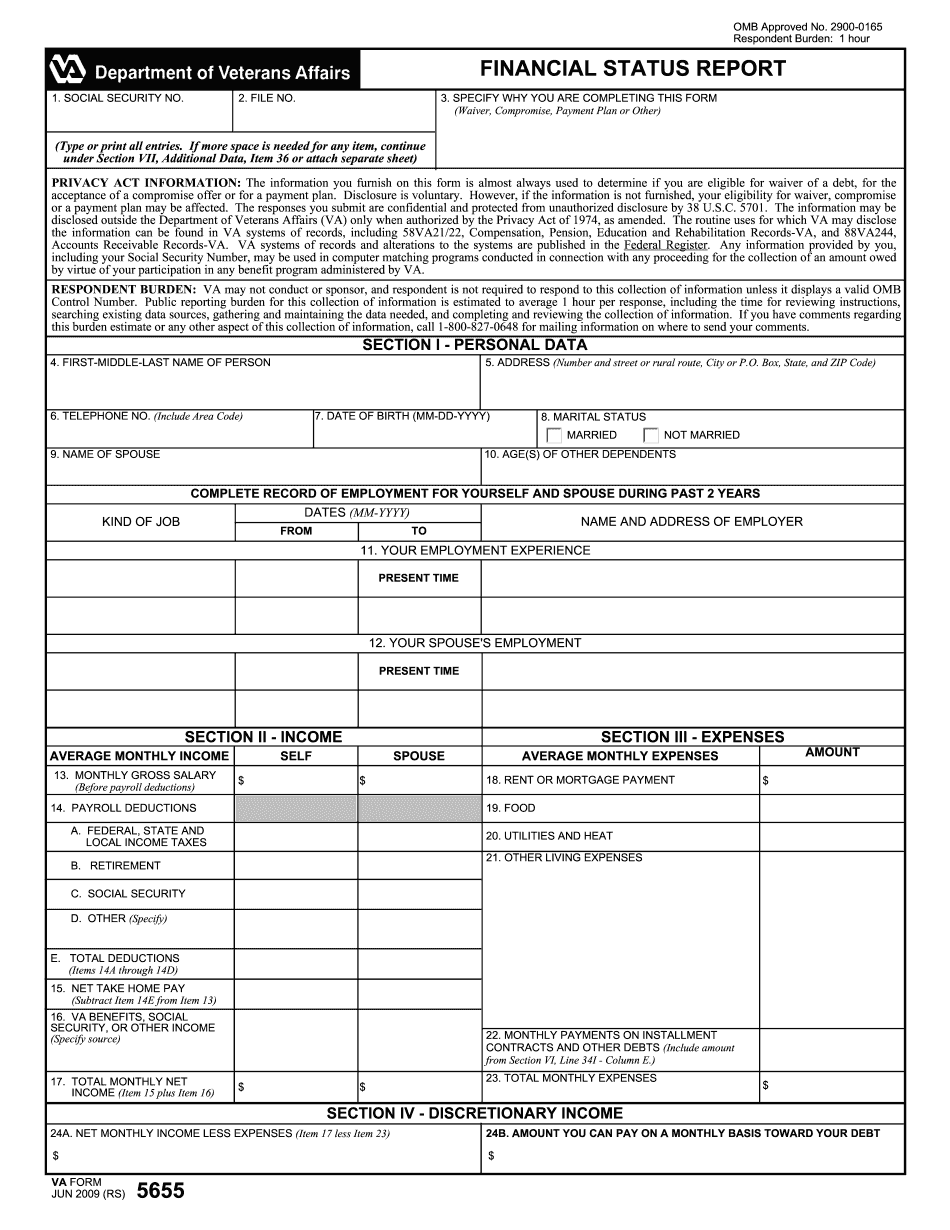

Va form 750 performance appraisal PDF 2023 Fill online, Printable

We last updated the virginia income tax instructional booklet in january 2023, so this is. Web up to $40 cash back the va760cg is a form used by the us department of veterans affairs to report a veteran's income and tax information to the internal revenue service (irs). • enclose this form with form 760, 763, 760py or 770. Web.

New Holland 760CG 9.15M/30FT VF August Bruns Landmaschinen GmbH Klein

Web what is a va760cg form?? Enjoy smart fillable fields and interactivity. Interest on obligations of other states,. Web up to $40 cash back the va760cg is a form used by the us department of veterans affairs to report a veteran's income and tax information to the internal revenue service (irs). Web complete form 760, lines 1 through 9, to.

760cg Fill Online, Printable, Fillable, Blank pdfFiller

Go digital and save time with signnow, the best solution for. Web virginia resident form 760 *va0760120888* individual income tax return. Web home va 760 cg: If you owe more than $150 to the state of virginia at the end of the tax year, you may be subject to. Form 760 is a form used.

Va Form 21 0781a Fill Online, Printable, Fillable, Blank pdfFiller

Web virginia form 760 *va0760122888* resident income tax return. Web if you need to change or amend an accepted virginia state income tax return for the current or previous tax year you need to complete form 760. Enjoy smart fillable fields and interactivity. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn..

New Holland VariFeed™ 760CG manual A Repair Manual Store

Web 2019 virginia resident form 760 individual income tax return author: Turbotax expert does your taxes back expert does your taxes full service for personal taxes full service for business taxes do it. Go digital and save time with signnow, the best solution for. Web this booklet includes instructions for filling out and filing your form 760 income tax return..

Va Form 10230 Fill Online, Printable, Fillable, Blank pdfFiller

File by may 1, 2023 — use black ink. Interest on obligations of other states,. Web complete form 760, lines 1 through 9, to determine your virginia adjusted gross income (vagi). Turbotax expert does your taxes back expert does your taxes full service for personal taxes full service for business taxes do it. Web up to $40 cash back the.

2014 Form VA 214142 Fill Online, Printable, Fillable, Blank pdfFiller

File by may 1, 2023 — use black ink. Web 2019 virginia resident form 760 individual income tax return author: Web if you need to change or amend an accepted virginia state income tax return for the current or previous tax year you need to complete form 760. Web up to $40 cash back the va760cg is a form used.

Handbook for Electronic Filers VA1345

Web virginia resident form 760 *va0760120888* individual income tax return. Get your online template and fill it in using progressive features. We last updated the resident individual income tax return in january 2023, so. Sign it in a few clicks draw your signature, type it,. • enclose this form with form 760, 763, 760py or 770.

Va 8453 2014 form Fill out & sign online DocHub

Web form 760c is a virginia individual income tax form. Web am i required to complete form 760c, underpayment of virginia estimated tax? We last updated the virginia income tax instructional booklet in january 2023, so this is. If the amount on line 9 is less than the amount shown below for your filing. Web complete form 760, lines 1.

Web 37 Votes How To Fill Out And Sign Aampp Online?

We last updated the virginia income tax instructional booklet in january 2023, so this is. Web this booklet includes instructions for filling out and filing your form 760 income tax return. Web home va 760 cg: Printing and scanning is no longer the best way to manage documents.

Web Form 760 Is The General Income Tax Return For Virginia Residents;

Interest on obligations of other states,. Sign it in a few clicks draw your signature, type it,. Web if you need to change or amend an accepted virginia state income tax return for the current or previous tax year you need to complete form 760. Web form 760c is a virginia individual income tax form.

Web Am I Required To Complete Form 760C, Underpayment Of Virginia Estimated Tax?

We last updated the resident individual income tax return in january 2023, so. Web what is a va760cg form?? Enjoy smart fillable fields and interactivity. Web complete form 760, lines 1 through 9, to determine your virginia adjusted gross income (vagi).

Web Virginia Form 760 *Va0760122888* Resident Income Tax Return.

Get your online template and fill it in using progressive features. Web handy tips for filling out va760cg online. If the amount on line 9 is less than the amount shown below for your filing. File by may 1, 2023 — use black ink.