Va Estimated Tax Form

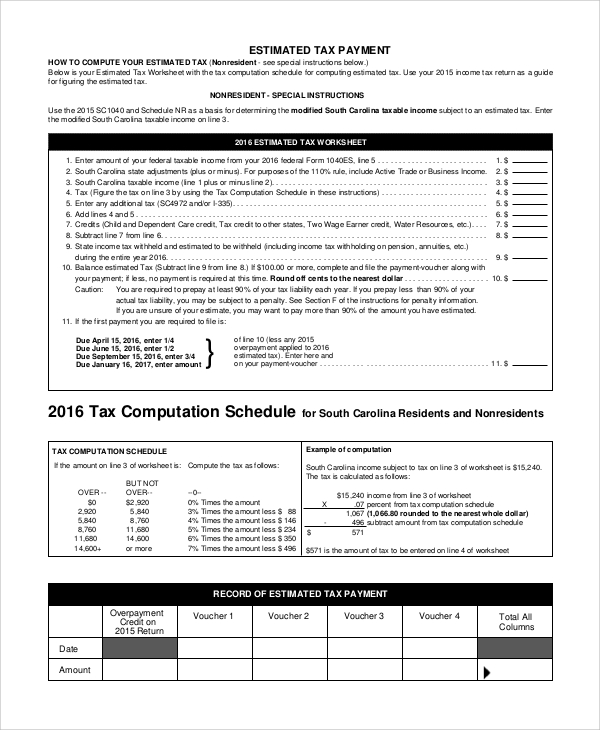

Va Estimated Tax Form - Tax blank filling out can turn into a significant challenge and serious headache if no correct guidance supplied. Beginning in 2021, the frederick county office of the commissioner of the revenue and the treasurer’s office will no longer be accepting and. Select an eform below to start filing. • file form 1041 for 2023 by march 1, 2024, and pay the total tax due. Details on how to only prepare and print a. If you haven't filed or paid taxes using eforms and need more information,. Quickly access top tasks for frequently downloaded va forms. Web • pay the total estimated tax (line 16 of the 2023 estimated tax worksheet) by january 16, 2024. Web form 760es is used by individuals to make estimated income tax payments. To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes,.

Web eforms are a fast and free way to file and pay state taxes online. Web form 760es is used by individuals to make estimated income tax payments. Details on how to only prepare and print a. Web • pay the total estimated tax (line 16 of the 2023 estimated tax worksheet) by january 16, 2024. Filing is required only for individuals whose income and net tax due exceed the amounts. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Filing is required only for individuals whose income and net tax due exceed the amounts. Web estimated income tax worksheet on page 3) is less than $11,950; Web this report will show the difference between the amount of tax the corporation would pay if it filed as part of a unitary combined group and the amount of tax based on how they. Web search for va forms by keyword, form name, or form number.

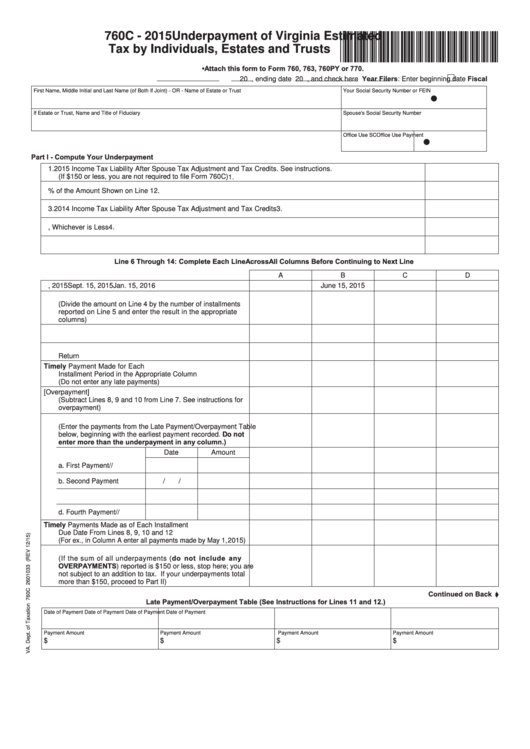

Filing is required only for individuals whose income and net tax due exceed the amounts. I did not receive any form from the state showing that i paid. Web estimated income tax worksheet on page 3) is less than $11,950; Or (d) your expected estimated tax liability exceeds your withholding and tax credits by $150 or less. How do i know if i need to complete form 760c? Details on how to only prepare and print a. Web search for va forms by keyword, form name, or form number. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Web follow the simple instructions below: To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes,.

FREE 7+ Sample Federal Tax Forms in PDF

Web if you owe more than $150 to the state of virginia at the end of the tax year, you may be subject to pay underestimated tax. Tax blank filling out can turn into a significant challenge and serious headache if no correct guidance supplied. Or (d) your expected estimated tax liability exceeds your withholding and tax credits by $150.

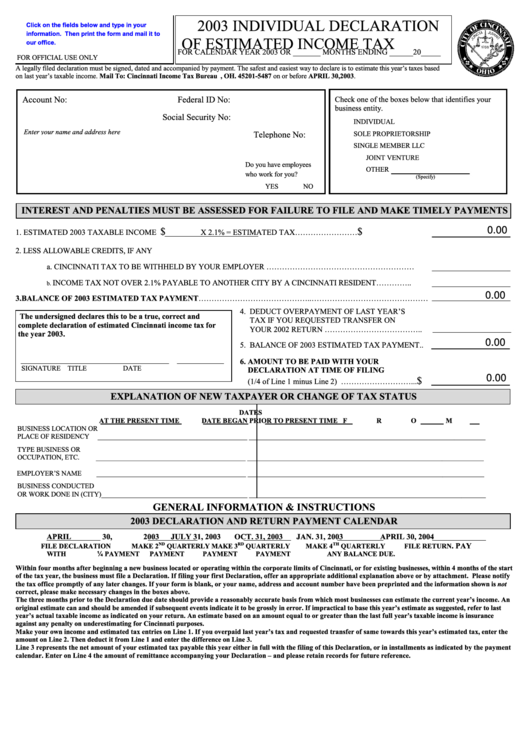

Fillable Individual Declaration Of Estimated Tax Form/form D1

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Details on how to only prepare and print a. Or (d) your expected estimated tax liability exceeds your withholding and tax credits by $150 or less. Beginning in 2021, the frederick county office of the commissioner of the revenue and the treasurer’s office.

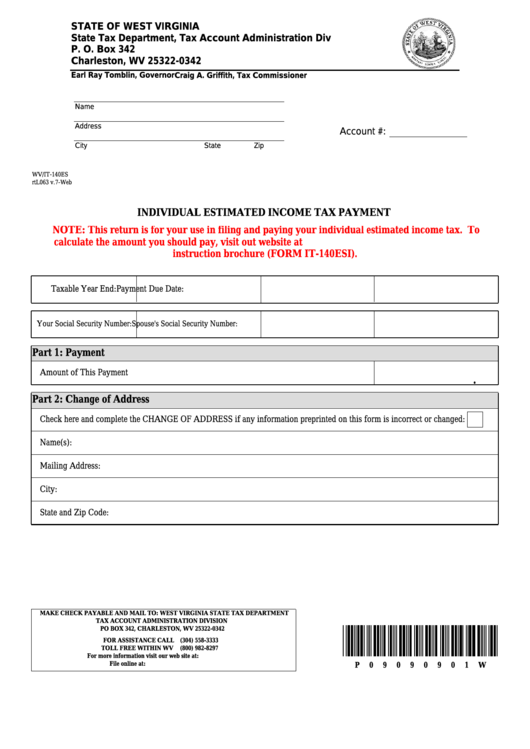

Form Wv/it140es Individual Estimated Tax Payment printable

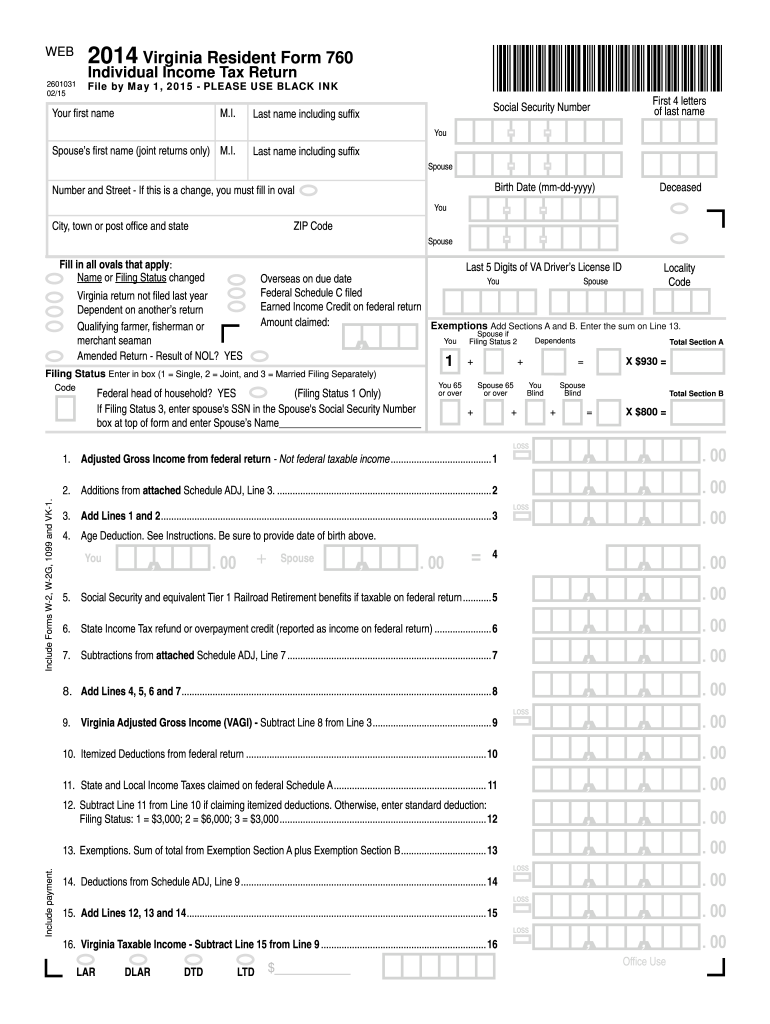

Web form 760es is a virginia individual income tax form. Details on how to only prepare and print a. Web this report will show the difference between the amount of tax the corporation would pay if it filed as part of a unitary combined group and the amount of tax based on how they. Web form 760es is used by.

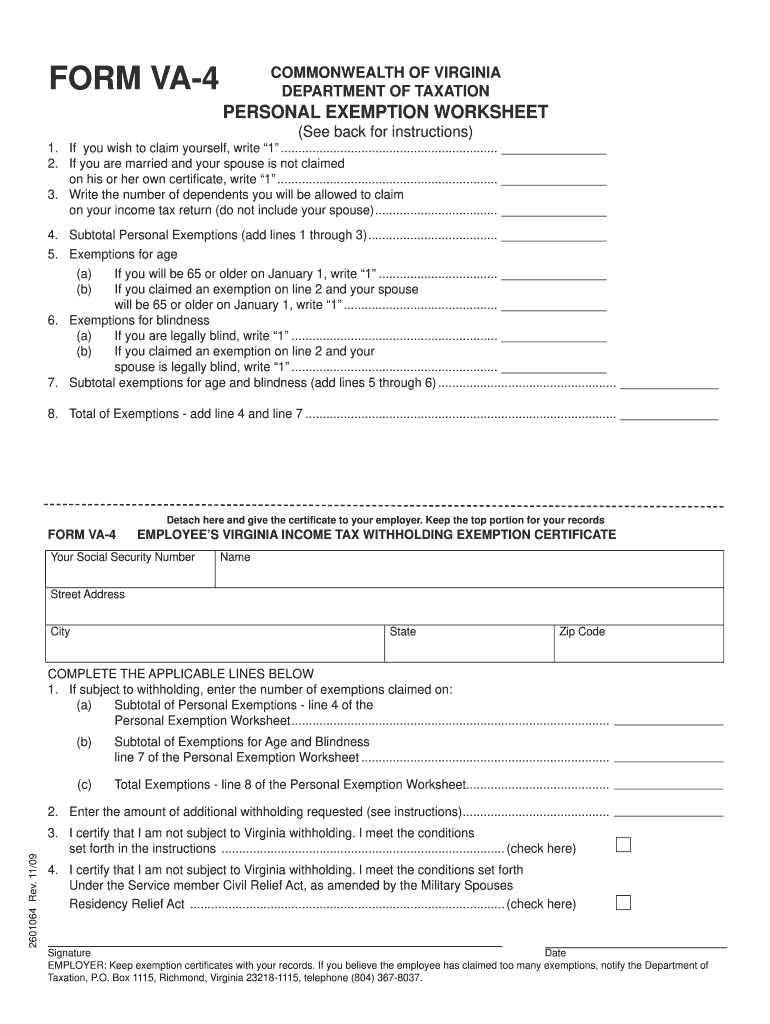

Va 4 State Tax Form Fillable Fill Out and Sign Printable PDF Template

To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes,. Beginning in 2021, the frederick county office of the commissioner of the revenue and the treasurer’s office will no longer be accepting and. Web eforms are a fast and free way to file and pay state taxes online. Web follow the simple instructions below:.

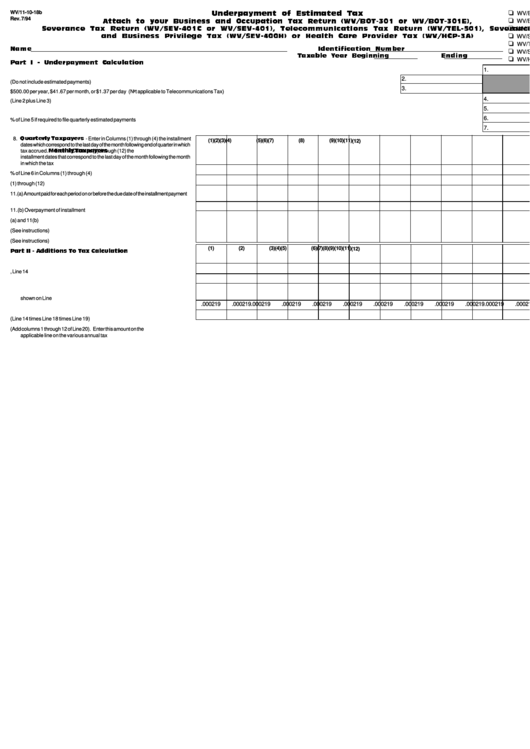

Underpayment Of Estimated Tax Form West Virginia printable pdf download

Filing is required only for individuals whose income and net tax due exceed the amounts. Web last year i sent virginia estimated tax payments as recommended by turbotax using form 760es/cg. Quickly access top tasks for frequently downloaded va forms. Select an eform below to start filing. Tax blank filling out can turn into a significant challenge and serious headache.

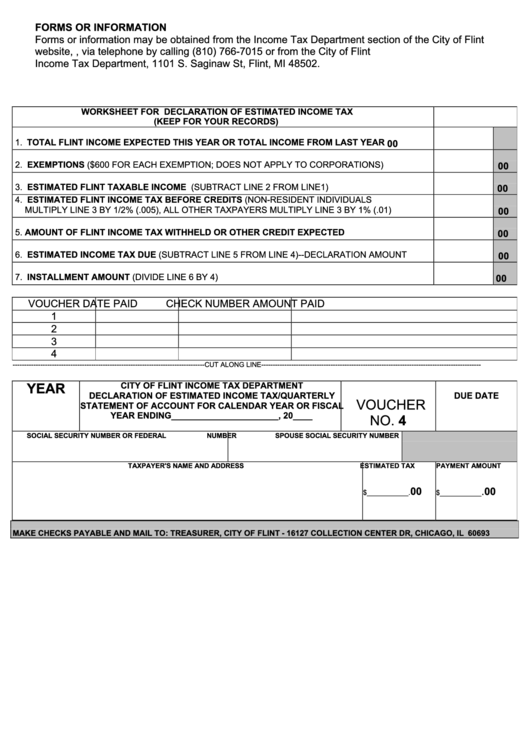

Declaration Of Estimated Tax Form printable pdf download

Web eforms are a fast and free way to file and pay state taxes online. Beginning in 2021, the frederick county office of the commissioner of the revenue and the treasurer’s office will no longer be accepting and. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Select an eform below.

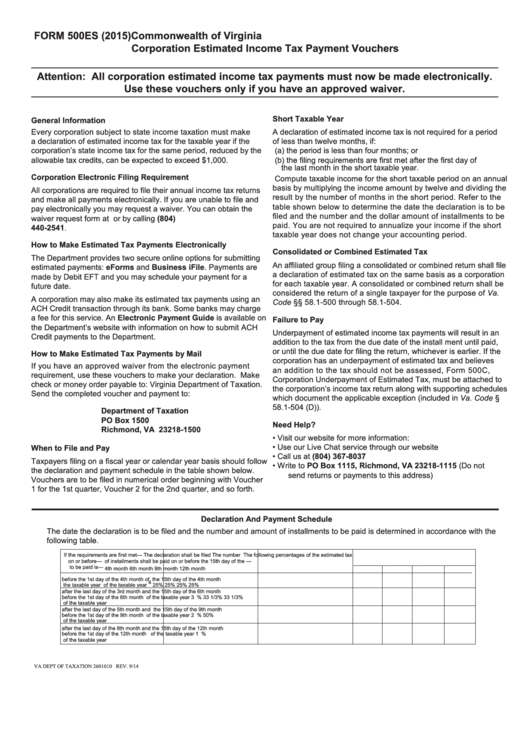

Fillable Form 500es Virginia Estimated Tax Declaration For

Web virginia state income tax forms for tax year 2022 (jan. Web if you owe more than $150 to the state of virginia at the end of the tax year, you may be subject to pay underestimated tax. To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes,. Web this report will show the.

What to Know About Making Estimated Tax Payments

Tax blank filling out can turn into a significant challenge and serious headache if no correct guidance supplied. Beginning in 2021, the frederick county office of the commissioner of the revenue and the treasurer’s office will no longer be accepting and. Details on how to only prepare and print a. Web search for va forms by keyword, form name, or.

Fillable Form 760c Underpayment Of Virginia Estimated Tax By

Beginning in 2021, the frederick county office of the commissioner of the revenue and the treasurer’s office will no longer be accepting and. If you haven't filed or paid taxes using eforms and need more information,. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Web search for va forms by keyword,.

2014 Form VA DoT 760 Fill Online, Printable, Fillable, Blank PDFfiller

If you haven't filed or paid taxes using eforms and need more information,. Select an eform below to start filing. Filing is required only for individuals whose income and net tax due exceed the amounts. • file form 1041 for 2023 by march 1, 2024, and pay the total tax due. Us legal forms is developed as.

Or (D) Your Expected Estimated Tax Liability Exceeds Your Withholding And Tax Credits By $150 Or Less.

Web estimated income tax worksheet on page 3) is less than $11,950; Select an eform below to start filing. How do i know if i need to complete form 760c? • file form 1041 for 2023 by march 1, 2024, and pay the total tax due.

Beginning In 2021, The Frederick County Office Of The Commissioner Of The Revenue And The Treasurer’s Office Will No Longer Be Accepting And.

Quickly access top tasks for frequently downloaded va forms. Filing is required only for individuals whose income and net tax due exceed the amounts. I did not receive any form from the state showing that i paid. Web follow the simple instructions below:

Web Last Year I Sent Virginia Estimated Tax Payments As Recommended By Turbotax Using Form 760Es/Cg.

To figure your estimated tax, you must figure your expected adjusted gross income, taxable income, taxes,. Web form 760es is a virginia individual income tax form. Web virginia state income tax forms for tax year 2022 (jan. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn.

Filing Is Required Only For Individuals Whose Income And Net Tax Due Exceed The Amounts.

Web search for va forms by keyword, form name, or form number. Web • pay the total estimated tax (line 16 of the 2023 estimated tax worksheet) by january 16, 2024. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web if you owe more than $150 to the state of virginia at the end of the tax year, you may be subject to pay underestimated tax.

/GettyImages-154920329-577423dd3df78cb62c196616.jpg)