Vt Homestead Declaration Form

Vt Homestead Declaration Form - The homestead declaration must be filed each year by vermont residents for purposes of the state education tax rate. You may file up to oct. To be considered for a property tax credit, you must file a 1) homestead declaration. To be considered for a property tax credit, you must file a 1) homestead declaration (section a of this form), 2) property tax credit. Web vt homestead declaration and property tax credit claim: Web homestead declarations must be filed annually. Homestead declaration return for vermont residents only; An unpublished notice by the small business administration on 08/02/2023. After the april due date, if you have not filed, the municipality may assess a penalty of up. Web filing due dates you must file a homestead declaration annually by the april due date.

Use our filing checklist that follows at help. Property owners whose dwellings meet the definition of a vermont homestead must file a homestead declaration annually by the. Web the form to the vermont department of taxes how to file a property tax credit claim: Web homestead declaration and property tax adjustment filing | vermont.gov. April 18, 2023 use the following. To be considered for a property tax credit, you must file a 1) homestead declaration. Web filing due dates you must file a homestead declaration annually by the april due date. Web how to file a property tax credit claim: 15, 2019, but the town may assess a. Web all forms and instructions;

15, 2019, but the town may assess a. You may file up to oct. Web all forms and instructions; Web home vt homestead declaration and property tax credit claim: Web the form to the vermont department of taxes how to file a property tax credit claim: An unpublished notice by the small business administration on 08/02/2023. Homestead declaration return for vermont residents only; To be considered for a property tax credit, you must file a 1) homestead declaration. Web homestead declarations must be filed annually. Web vt homestead declaration and property tax credit claim:

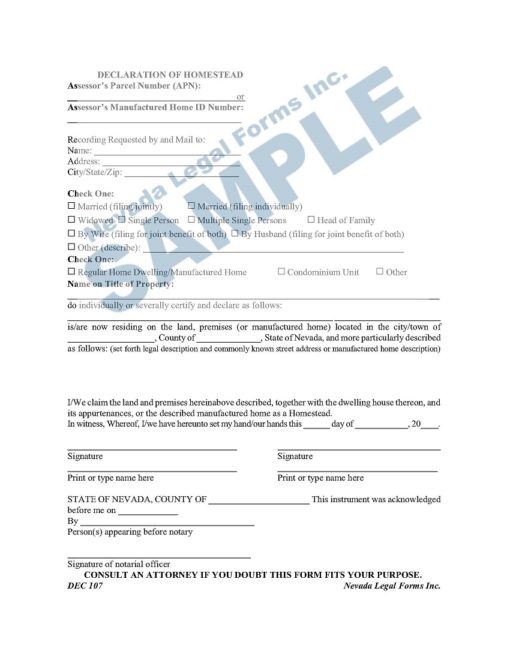

DECLARATION OF HOMESTEAD Nevada Legal Forms & Services

Web homestead declaration and property tax adjustment filing | vermont.gov. Property owners whose dwellings meet the definition of a vermont homestead must file a homestead declaration annually by the. The homestead declaration must be filed each year by vermont residents for purposes of the state education tax rate. To be considered for a property tax credit, you must file a.

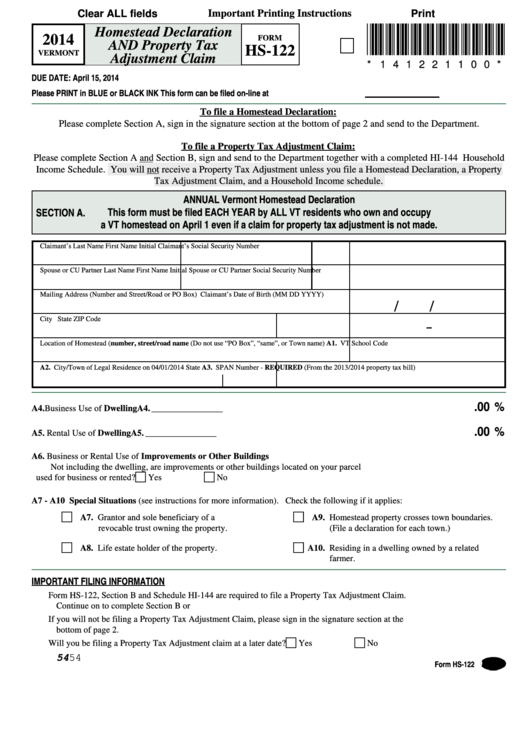

Fillable Form Hs122 Vermont Homestead Declaration And Property Tax

Use our filing checklist that follows at help. Web how to file a property tax credit claim: Web vt homestead declaration and property tax credit claim: Web homestead declarations must be filed annually. Homestead declaration return for vermont residents only;

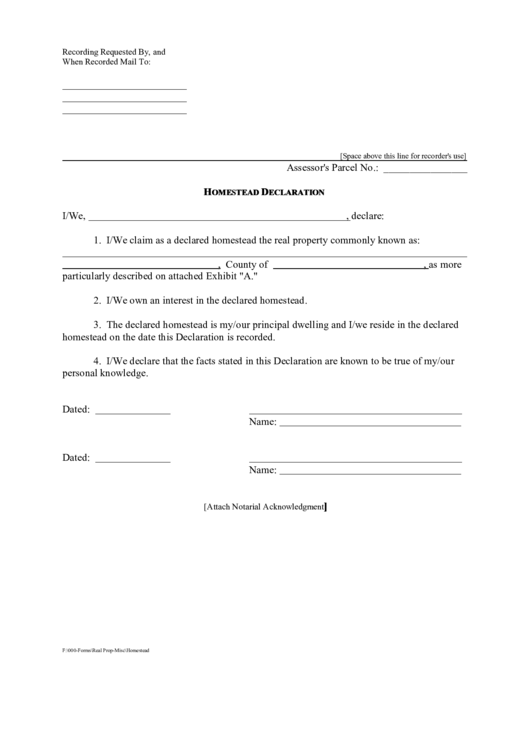

Declaration of Homestead YouTube

Web this form must be filed each year by every vermont resident whose property meets the definition of a homestead. 15, 2019, but the town may assess a. Web home vt homestead declaration and property tax credit claim: After the april due date, if you have not filed, the municipality may assess a penalty of up. You may file up.

HS122 Homestead Declaration and Property Tax Adjustment

An unpublished notice by the small business administration on 08/02/2023. To be considered for a property tax credit, you must file a 1) homestead declaration. Web filing due dates you must file a homestead declaration annually by the april due date. Web how to file a property tax credit claim: April 18, 2023 use the following.

Top 17 Homestead Declaration Form Templates free to download in PDF format

Get ready for tax season deadlines by completing any required tax forms today. To be considered for a property tax credit, you must file a 1) homestead declaration. To be considered for a property tax credit, you must file a 1) homestead declaration (section a of this form), 2) property tax credit. Use our filing checklist that follows at help..

Homestead Declaration Form Los Angeles County 2020 Fill and Sign

Web instructions for vermont homestead declaration and property tax credit claim and household income schedule due date: Web homestead declaration and property tax adjustment filing | vermont.gov. You may file up to oct. Web all forms and instructions; 15, 2019, but the town may assess a.

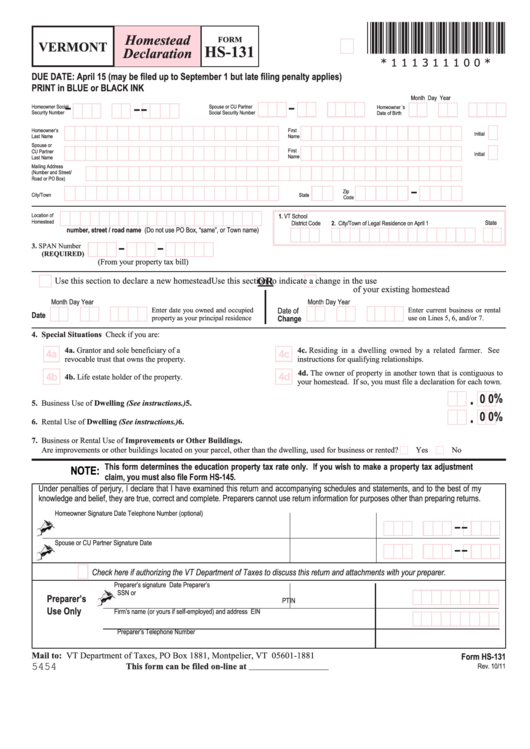

Form Hs131 Vermont Homestead Declaration printable pdf download

To be considered for a property tax credit, you must file a 1) homestead declaration (section a of this form), 2) property tax credit. Web homestead declarations must be filed annually. Homestead declaration return for vermont residents only; April 18, 2023 use the following. Web the form to the vermont department of taxes how to file a property tax credit.

Vermont Homestead Declaration And Property Tax Adjustment Claim

To be considered for a property tax credit, you must file a 1) homestead declaration. You may file up to oct. Property owners whose dwellings meet the definition of a vermont homestead must file a homestead declaration annually by the. The homestead declaration must be filed each year by vermont residents for purposes of the state education tax rate. Use.

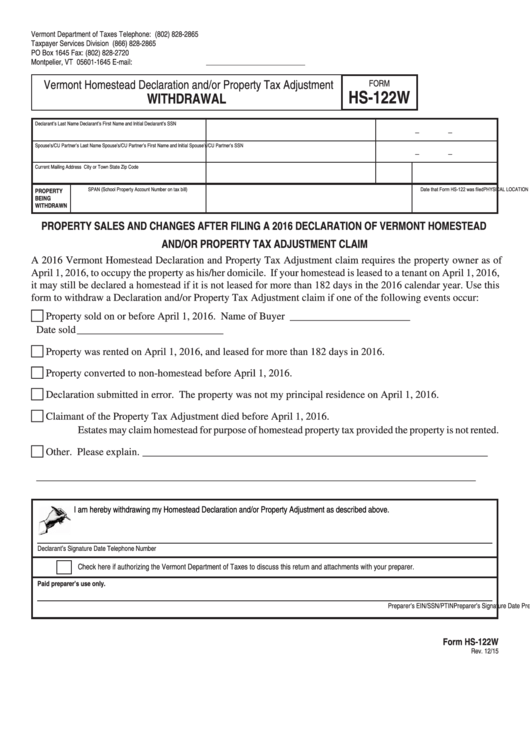

Form Hs122w Vermont Homestead Declaration And/or Property Tax

Homestead declaration return for vermont residents only; To be considered for a property tax credit, you must file a 1) homestead declaration. April 18, 2023 use the following. An unpublished notice by the small business administration on 08/02/2023. You may file up to oct.

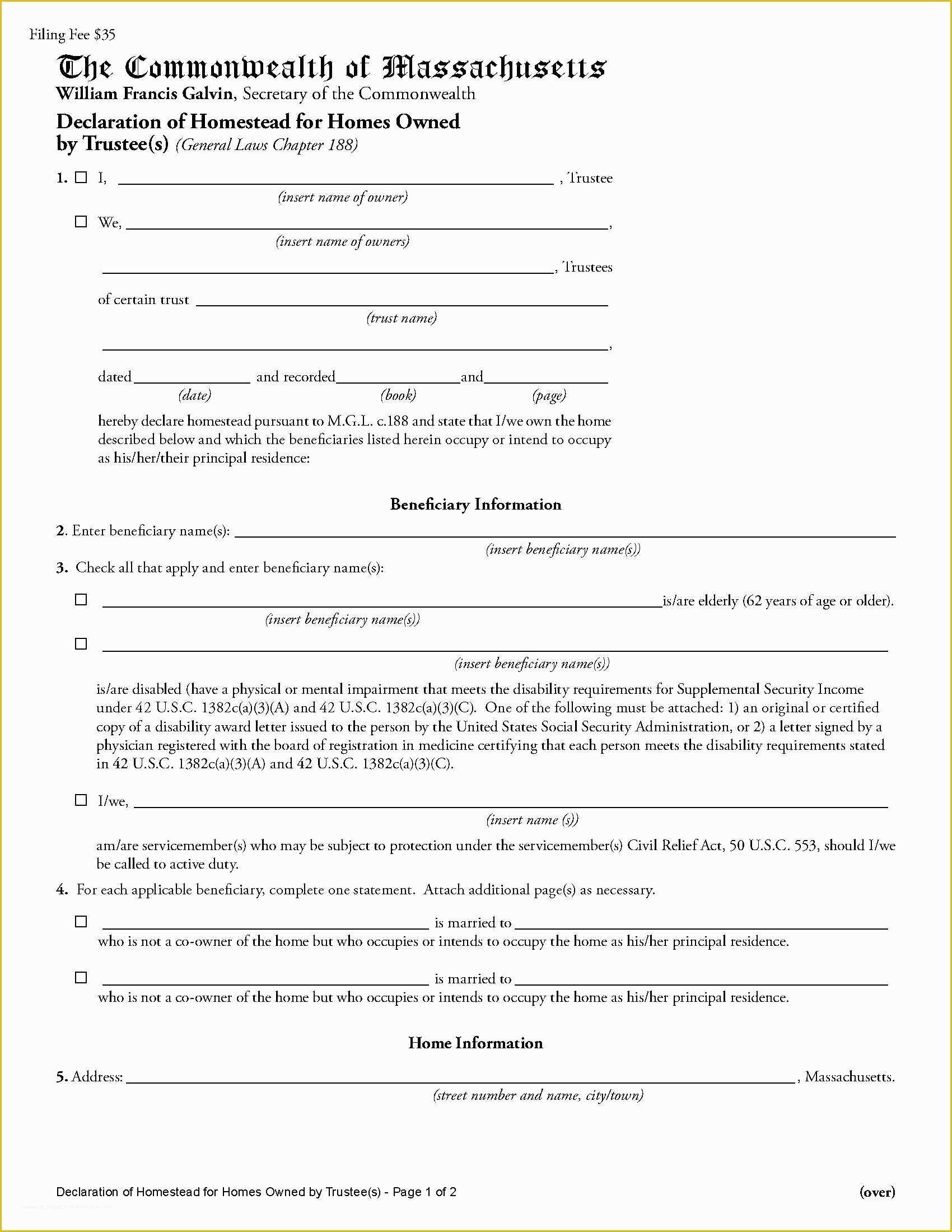

Free Declaration Of Trust Template Of Deed Trust Template Zimbabwe

April 18, 2023 use the following. To be considered for a property tax credit, you must file a 1) homestead declaration. A vermont homestead is the principal dwelling and parcel of. After the april due date, if you have not filed, the municipality may assess a penalty of up. Web vt homestead declaration and property tax credit claim:

Use Our Filing Checklist That Follows At Help.

Web this form must be filed each year by every vermont resident whose property meets the definition of a homestead. Get ready for tax season deadlines by completing any required tax forms today. Web homestead declarations must be filed annually. Web vt homestead declaration and property tax credit claim:

To Be Considered For A Property Tax Credit, You Must File A 1) Homestead Declaration.

Web how to file a property tax credit claim: Property owners whose dwellings meet the definition of a vermont homestead must file a homestead declaration annually by the. Web the form to the vermont department of taxes how to file a property tax credit claim: Web instructions for vermont homestead declaration and property tax credit claim and household income schedule due date:

A Vermont Homestead Is The Principal Dwelling And Parcel Of.

April 18, 2023 use the following. Web all forms and instructions; You may file up to oct. 15, 2019, but the town may assess a.

After The April Due Date, If You Have Not Filed, The Municipality May Assess A Penalty Of Up.

Web homestead declaration and property tax adjustment filing | vermont.gov. The homestead declaration must be filed each year by vermont residents for purposes of the state education tax rate. Web filing due dates you must file a homestead declaration annually by the april due date. To be considered for a property tax credit, you must file a 1) homestead declaration (section a of this form), 2) property tax credit.