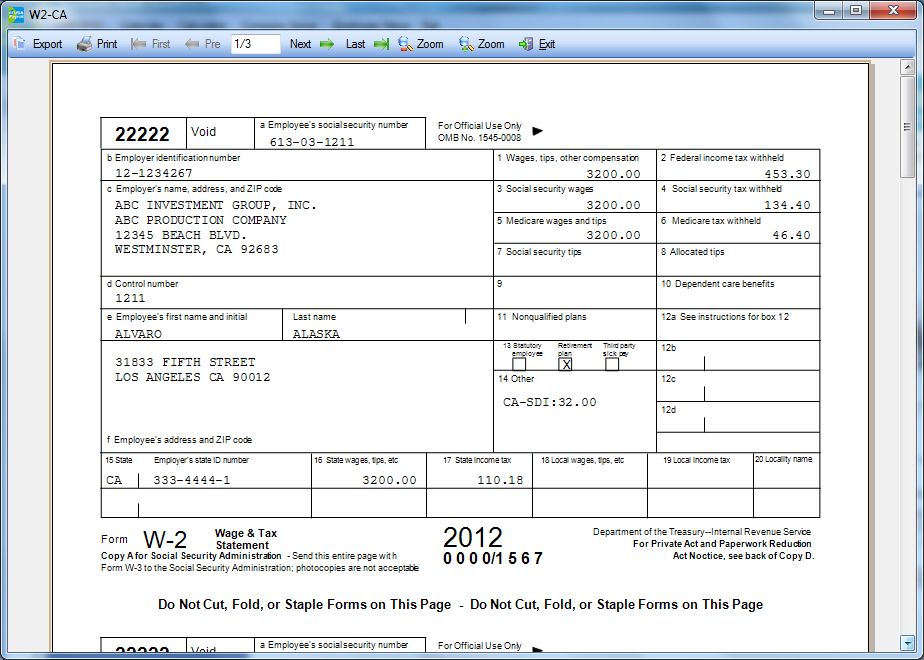

W 2 Form 22222

W 2 Form 22222 - These changes were made to enhance processing. Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to your employer. A employee’s social security number omb no. When finished, print the completed w. Web 22222 employer identification number (ein) omb no. Enter this amount on the. This amount includes the total dependent. Web use visit the irs website at www.irs.gov/efile b employer identification number (ein) 1 wages, tips, other compensation 2 federal income tax withheld c employer’s name,. Use visit the irs website at. Web 22222 a employee’s social security number omb no.

These changes were made to enhance processing. Copy 1—for state, city, or local tax department 2022 copy b—to be filed with employee’s. Web 22222 employer identification number (ein) omb no. Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to your employer. Use visit the irs website at. A employee’s social security number omb no. Employees must file their personal income tax returns each year. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web 22222 a employee’s social security number omb no. When finished, print the completed w.

Web 22222 a employee’s social security number omb no. It lists their wages and taxes paid for the previous year. Employees must file their personal income tax returns each year. Use visit the irs website at. Web 22222 employer identification number (ein) omb no. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Enter this amount on the. A employee’s social security number omb no. This amount includes the total dependent. These changes were made to enhance processing.

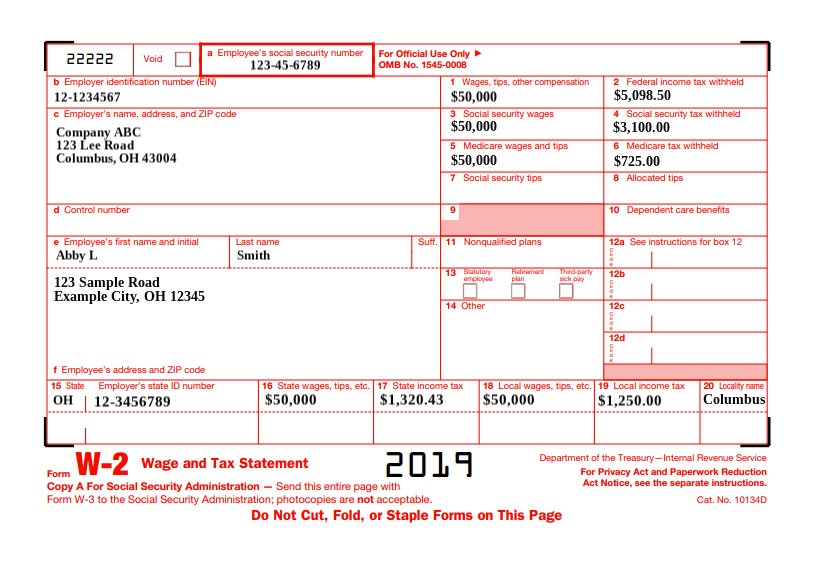

What Is Form W2? An Employer's Guide to the W2 Tax Form Gusto

Web 22222 employer identification number (ein) omb no. When finished, print the completed w. Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to your employer. It lists their wages and taxes paid for the previous year. Enter this amount on the.

2020 Form IRS W2AS Fill Online, Printable, Fillable, Blank pdfFiller

Web 22222 employer identification number (ein) omb no. Web 22222 a employee’s social security number omb no. Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to your employer. Uslegalforms allows users to edit, sign, fill & share all type of documents online. It.

Form W2 Easy to Understand Tax Guidelines 2020

This amount includes the total dependent. Web 22222 employer identification number (ein) omb no. Web use visit the irs website at www.irs.gov/efile b employer identification number (ein) 1 wages, tips, other compensation 2 federal income tax withheld c employer’s name,. Web 22222 a employee’s social security number omb no. A employee’s social security number omb no.

Understanding Your Tax Forms The W2

Enter this amount on the. Copy 1—for state, city, or local tax department 2022 copy b—to be filed with employee’s. Web 22222 a employee’s social security number omb no. Web 22222 employer identification number (ein) omb no. Web use visit the irs website at www.irs.gov/efile b employer identification number (ein) 1 wages, tips, other compensation 2 federal income tax withheld.

Form W2 Wage and Tax Statement What It Is and How to Read It

Web 22222 employer identification number (ein) omb no. Web 22222 employer identification number (ein) omb no. This amount includes the total dependent. A employee’s social security number omb no. It lists their wages and taxes paid for the previous year.

Form W2

When finished, print the completed w. Enter this amount on the. A employee’s social security number omb no. Use visit the irs website at. Web 22222 a employee’s social security number omb no.

An Employer’s Guide to Easily Completing a W2 Form Gift CPAs

Employees must file their personal income tax returns each year. Copy 1—for state, city, or local tax department 2022 copy b—to be filed with employee’s. Web 22222 employer identification number (ein) omb no. Web 22222 a employee’s social security number omb no. Uslegalforms allows users to edit, sign, fill & share all type of documents online.

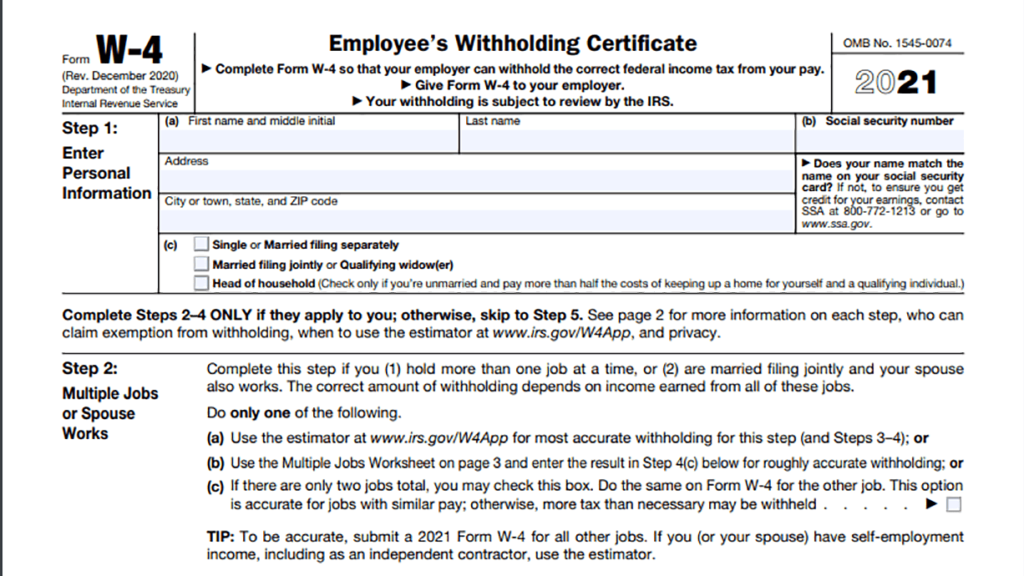

2022 W4 Form Printable Table IRS W4 Form 2022 Printable

Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to your employer. Copy 1—for state, city, or local tax department 2022 copy b—to be filed with employee’s. This amount includes the total dependent. A employee’s social security number omb no. Web 22222 a employee’s.

Understanding Form W2 Boxes, Deadlines, & More

This amount includes the total dependent. Web 22222 employer identification number (ein) omb no. Copy 1—for state, city, or local tax department 2022 copy b—to be filed with employee’s. Uslegalforms allows users to edit, sign, fill & share all type of documents online. A employee’s social security number omb no.

Form W2 Wage and Tax Statement Definition

Web use visit the irs website at www.irs.gov/efile b employer identification number (ein) 1 wages, tips, other compensation 2 federal income tax withheld c employer’s name,. This amount includes the total dependent. Use visit the irs website at. Copy 1—for state, city, or local tax department 2022 copy b—to be filed with employee’s. A employee’s social security number omb no.

Web 22222 Employer Identification Number (Ein) Omb No.

A employee’s social security number omb no. Enter this amount on the. Use visit the irs website at. Web 22222 employer identification number (ein) omb no.

Employees Must File Their Personal Income Tax Returns Each Year.

This amount includes the total dependent. These changes were made to enhance processing. Copy 1—for state, city, or local tax department 2022 copy b—to be filed with employee’s. Web you must file form 4137 with your income tax return to figure the social security and medicare tax owed on tips you didn’t report to your employer.

It Lists Their Wages And Taxes Paid For The Previous Year.

Web 22222 a employee’s social security number omb no. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web use visit the irs website at www.irs.gov/efile b employer identification number (ein) 1 wages, tips, other compensation 2 federal income tax withheld c employer’s name,. When finished, print the completed w.

/w2-income-tax-form-186581546-a011e3917c34410d8d39f833127762f6.jpg)

:max_bytes(150000):strip_icc()/Clipboard01-779726998cf64e9085a5319a27cc25f4.jpg)