Wages Expense On Balance Sheet

Wages Expense On Balance Sheet - Web there are three main types of wage expenses: Are reported directly on the current income statement as expenses in the period in which they were. Web most students learn that labor and wages are a cost item on the profit and loss statement (p&l). Web key takeaways wage expenses are variable costs and are recorded on the income statement. These amounts affect the bottom line of your income statement, which affects the assets and liabilities on your balance. Under the accrual method of accounting, wage expenses are recorded when the work is performed rather than. Web the salaries and wages of people in the nonmanufacturing functions such as selling, general administrative, etc. However, labor expenses appear on the balance sheet as well, and in three notable ways: Web your balance sheet shows salaries, wages and expenses indirectly.

Web your balance sheet shows salaries, wages and expenses indirectly. These amounts affect the bottom line of your income statement, which affects the assets and liabilities on your balance. However, labor expenses appear on the balance sheet as well, and in three notable ways: Web there are three main types of wage expenses: Under the accrual method of accounting, wage expenses are recorded when the work is performed rather than. Web most students learn that labor and wages are a cost item on the profit and loss statement (p&l). Web key takeaways wage expenses are variable costs and are recorded on the income statement. Web the salaries and wages of people in the nonmanufacturing functions such as selling, general administrative, etc. Are reported directly on the current income statement as expenses in the period in which they were.

Web most students learn that labor and wages are a cost item on the profit and loss statement (p&l). However, labor expenses appear on the balance sheet as well, and in three notable ways: Web your balance sheet shows salaries, wages and expenses indirectly. Web the salaries and wages of people in the nonmanufacturing functions such as selling, general administrative, etc. Are reported directly on the current income statement as expenses in the period in which they were. Web key takeaways wage expenses are variable costs and are recorded on the income statement. Under the accrual method of accounting, wage expenses are recorded when the work is performed rather than. Web there are three main types of wage expenses: These amounts affect the bottom line of your income statement, which affects the assets and liabilities on your balance.

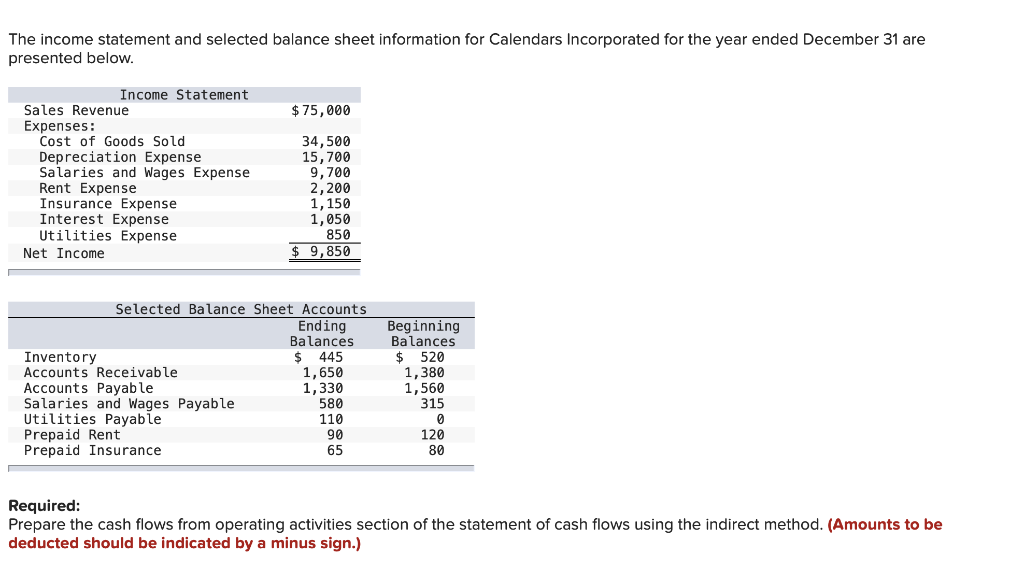

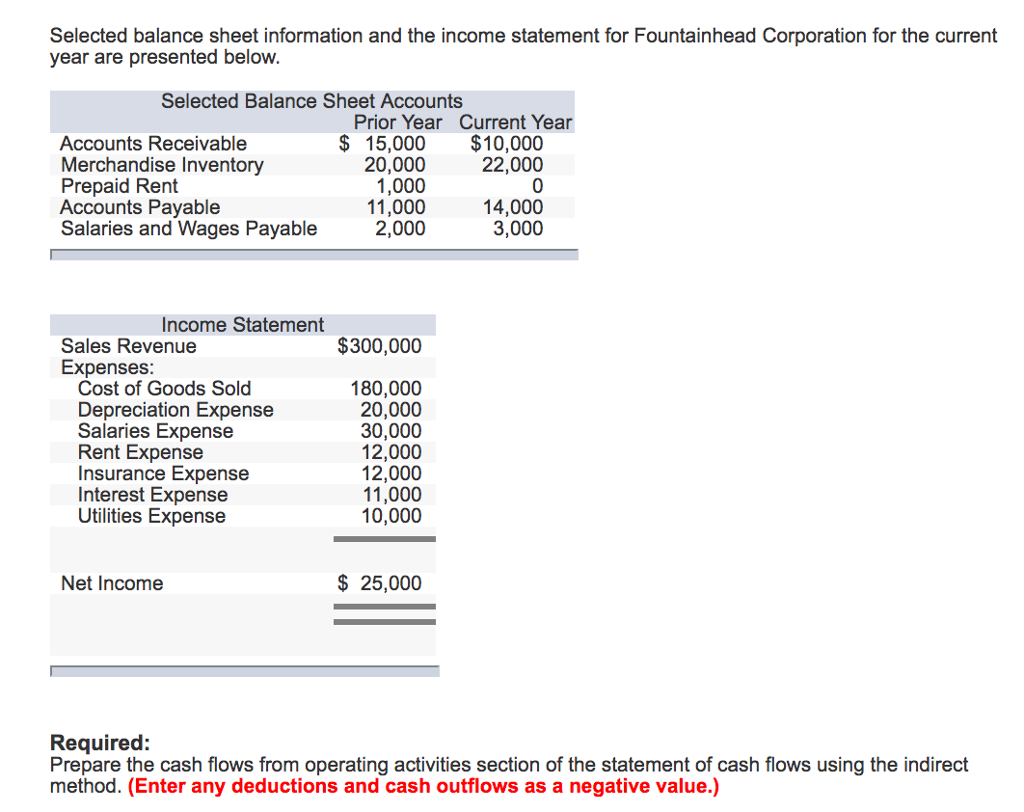

Solved Selected balance sheet information and the

Web there are three main types of wage expenses: Are reported directly on the current income statement as expenses in the period in which they were. Web the salaries and wages of people in the nonmanufacturing functions such as selling, general administrative, etc. These amounts affect the bottom line of your income statement, which affects the assets and liabilities on.

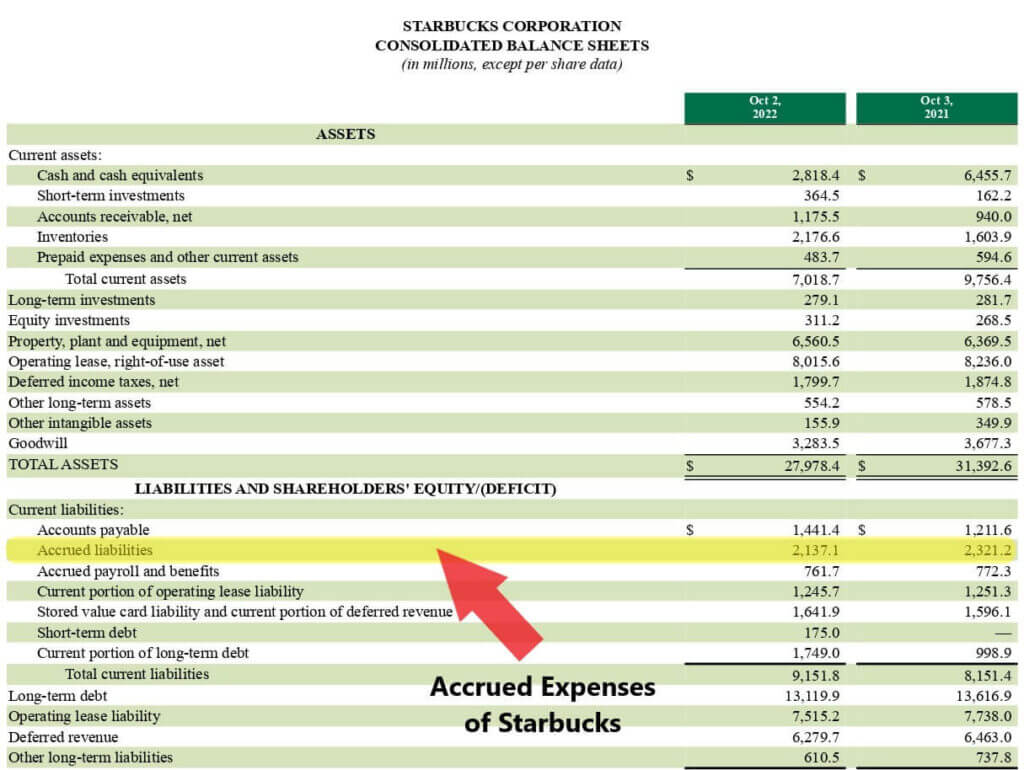

Accrued Expense Examples of Accrued Expenses

Web your balance sheet shows salaries, wages and expenses indirectly. Web the salaries and wages of people in the nonmanufacturing functions such as selling, general administrative, etc. However, labor expenses appear on the balance sheet as well, and in three notable ways: Web most students learn that labor and wages are a cost item on the profit and loss statement.

The Differences in Wages Payable & Wages Expense Business Accounting

However, labor expenses appear on the balance sheet as well, and in three notable ways: Web the salaries and wages of people in the nonmanufacturing functions such as selling, general administrative, etc. These amounts affect the bottom line of your income statement, which affects the assets and liabilities on your balance. Are reported directly on the current income statement as.

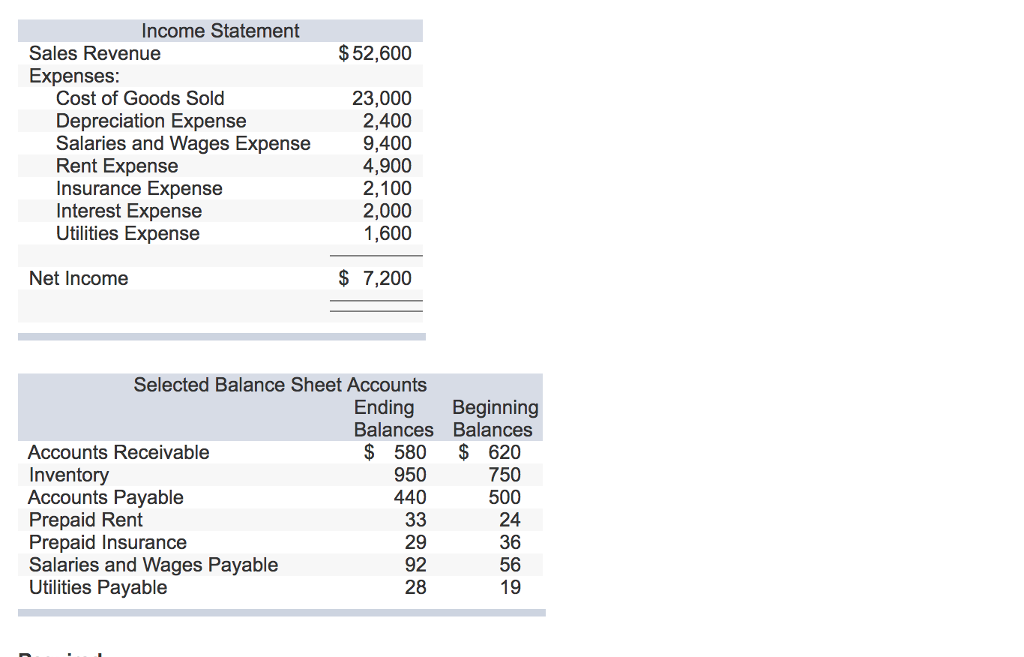

[Solved] statement and balance sheet excerp SolutionInn

Web the salaries and wages of people in the nonmanufacturing functions such as selling, general administrative, etc. These amounts affect the bottom line of your income statement, which affects the assets and liabilities on your balance. Web most students learn that labor and wages are a cost item on the profit and loss statement (p&l). Web key takeaways wage expenses.

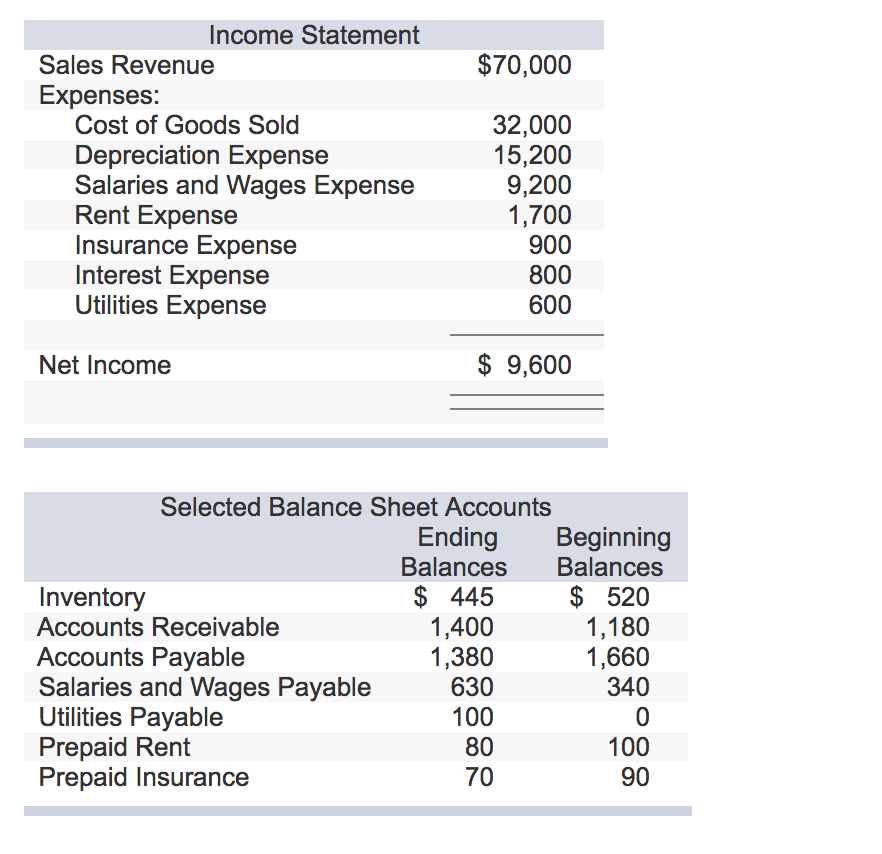

Solved The statement and selected balance sheet

Web most students learn that labor and wages are a cost item on the profit and loss statement (p&l). Are reported directly on the current income statement as expenses in the period in which they were. Web there are three main types of wage expenses: Web key takeaways wage expenses are variable costs and are recorded on the income statement..

Wages Payable Current Liability Accounting

Web key takeaways wage expenses are variable costs and are recorded on the income statement. Under the accrual method of accounting, wage expenses are recorded when the work is performed rather than. Are reported directly on the current income statement as expenses in the period in which they were. Web there are three main types of wage expenses: Web your.

Solved The statement and selected balance sheet

These amounts affect the bottom line of your income statement, which affects the assets and liabilities on your balance. Web key takeaways wage expenses are variable costs and are recorded on the income statement. However, labor expenses appear on the balance sheet as well, and in three notable ways: Under the accrual method of accounting, wage expenses are recorded when.

Salaries And Wages Expense Balance Sheet Financial Statement

These amounts affect the bottom line of your income statement, which affects the assets and liabilities on your balance. Web your balance sheet shows salaries, wages and expenses indirectly. Web key takeaways wage expenses are variable costs and are recorded on the income statement. Web there are three main types of wage expenses: However, labor expenses appear on the balance.

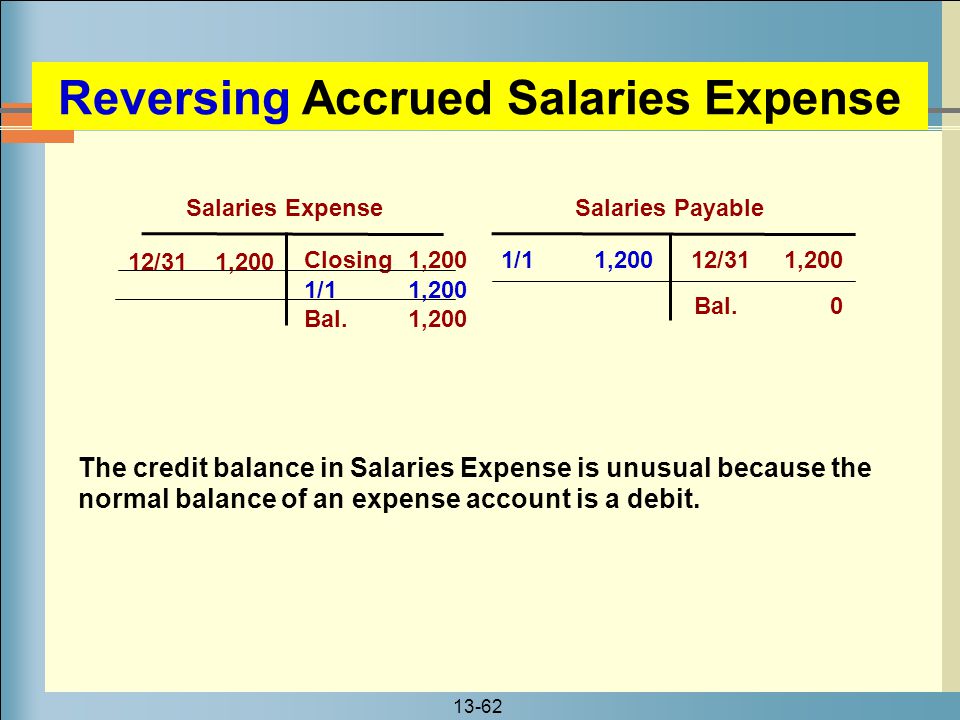

Accrued Salaries Double Entry Bookkeeping

Under the accrual method of accounting, wage expenses are recorded when the work is performed rather than. Web your balance sheet shows salaries, wages and expenses indirectly. These amounts affect the bottom line of your income statement, which affects the assets and liabilities on your balance. Web most students learn that labor and wages are a cost item on the.

Solved The statement and selected balance sheet

Web key takeaways wage expenses are variable costs and are recorded on the income statement. These amounts affect the bottom line of your income statement, which affects the assets and liabilities on your balance. Under the accrual method of accounting, wage expenses are recorded when the work is performed rather than. Web there are three main types of wage expenses:.

Web Your Balance Sheet Shows Salaries, Wages And Expenses Indirectly.

Web there are three main types of wage expenses: Web the salaries and wages of people in the nonmanufacturing functions such as selling, general administrative, etc. Under the accrual method of accounting, wage expenses are recorded when the work is performed rather than. Are reported directly on the current income statement as expenses in the period in which they were.

Web Most Students Learn That Labor And Wages Are A Cost Item On The Profit And Loss Statement (P&L).

Web key takeaways wage expenses are variable costs and are recorded on the income statement. These amounts affect the bottom line of your income statement, which affects the assets and liabilities on your balance. However, labor expenses appear on the balance sheet as well, and in three notable ways:

![[Solved] statement and balance sheet excerp SolutionInn](https://s3.amazonaws.com/si.question.images/images/question_images/1543/4/8/9/0145bffc5f6069c91543471535041.jpg)