What Is A 945 Form

What Is A 945 Form - The irs form 945 is a companion to form 941, employer’s federal tax return. Web the most common reason you’ll file form 945 is to report backup withholding for an independent contractor. This form is commonly used to report backup withholding, which is required. Annual return of withheld federal income tax (irs form 945). Web the irs form 945 is known as the annual return of withheld federal income tax. Web the irs form 945 is the annual return of withheld federal income tax. Fill out form 945 when you withhold federal. The forms filer plus software is a filing. Web what is form 945? Payments by check or money order use the following guidelines when you.

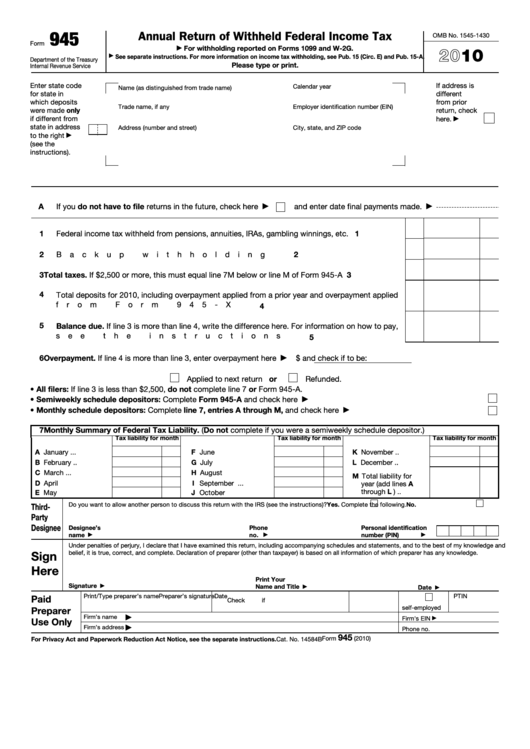

Web up to $40 cash back 2018 945 form form945annual return of withheld federal income tax department of the treasury internal revenue service omb no. Web irs form 945 is used to report annual federal income tax. Web the most common reason you’ll file form 945 is to report backup withholding for an independent contractor. Web june 25, 2021 q: Web annual record of federal tax liability go to www.irs.gov/form945a for instructions and the latest information. Fill out form 945 when you withhold federal. Web irs form 945 instructions. Web the irs form 945 is the annual return of withheld federal income tax. Web the irs form 945 is known as the annual return of withheld federal income tax. If you’re reading this article, odds are that you’re trying to report federal tax withheld for non payroll payments.

Web irs form 945 is used to report federal income tax withheld from nonpayroll payments. This form is commonly used to report backup withholding, which is required. Use this form to report your federal tax liability (based on the dates payments were made or wages were. Web annual record of federal tax liability go to www.irs.gov/form945a for instructions and the latest information. Web irs form 945 is used to report annual federal income tax. Web the irs form 945 is the annual return of withheld federal income tax. The forms filer plus software is a filing. Web what is form 945? Web essentially, any business that has withheld or was required to withhold federal income tax from a payment that was made outside of their payroll should file. Both can be essential for businesses of all sizes.

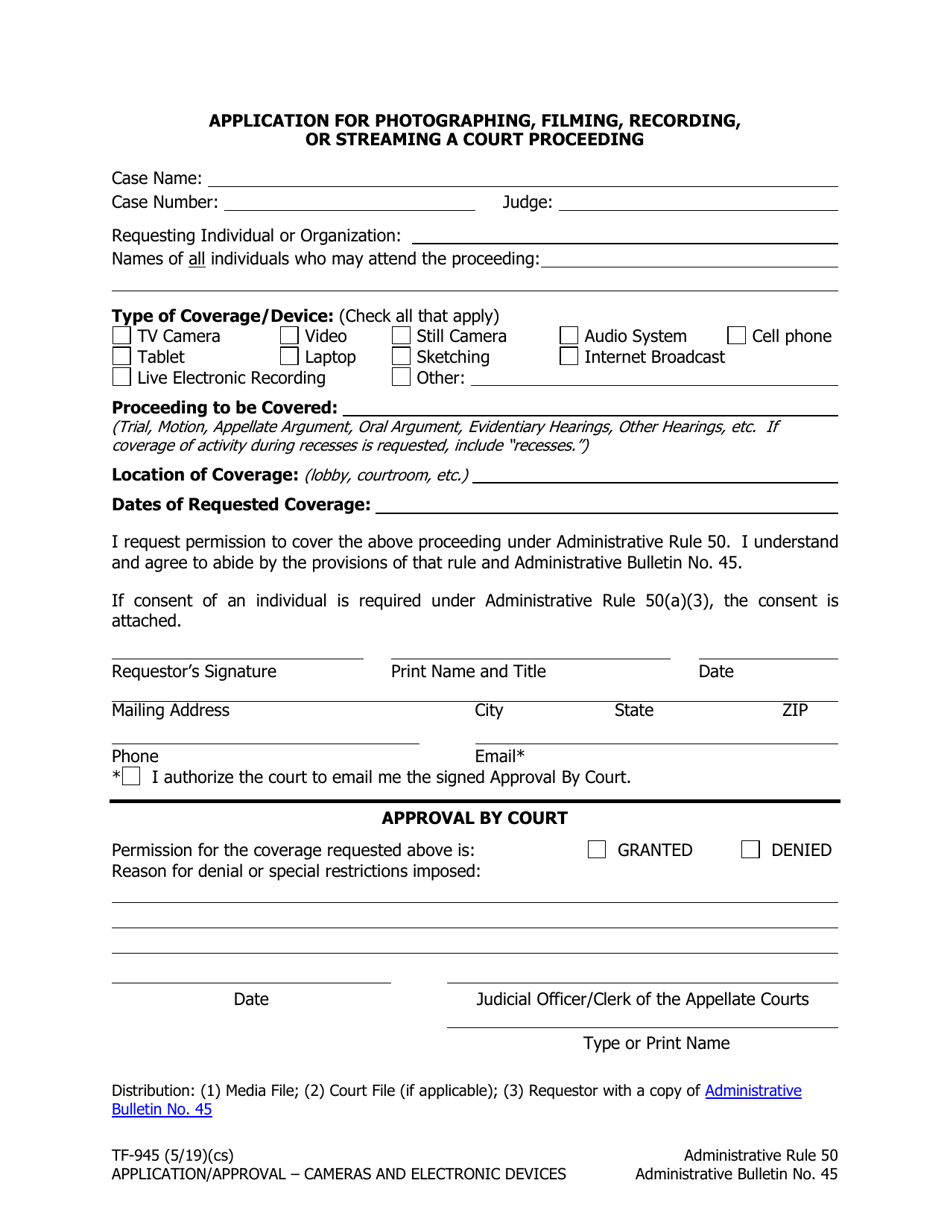

Form TF945 Download Fillable PDF or Fill Online Application for

Web irs form 945 is used to report federal income tax withheld from nonpayroll payments. If you’re reading this article, odds are that you’re trying to report federal tax withheld for non payroll payments. Web the irs form 945 is the annual return of withheld federal income tax. Web the most common reason you’ll file form 945 is to report.

2022 irs form 945 instructions Fill Online, Printable, Fillable Blank

Web annual record of federal tax liability go to www.irs.gov/form945a for instructions and the latest information. Web up to $40 cash back 2018 945 form form945annual return of withheld federal income tax department of the treasury internal revenue service omb no. If you’re reading this article, odds are that you’re trying to report federal tax withheld for non payroll payments..

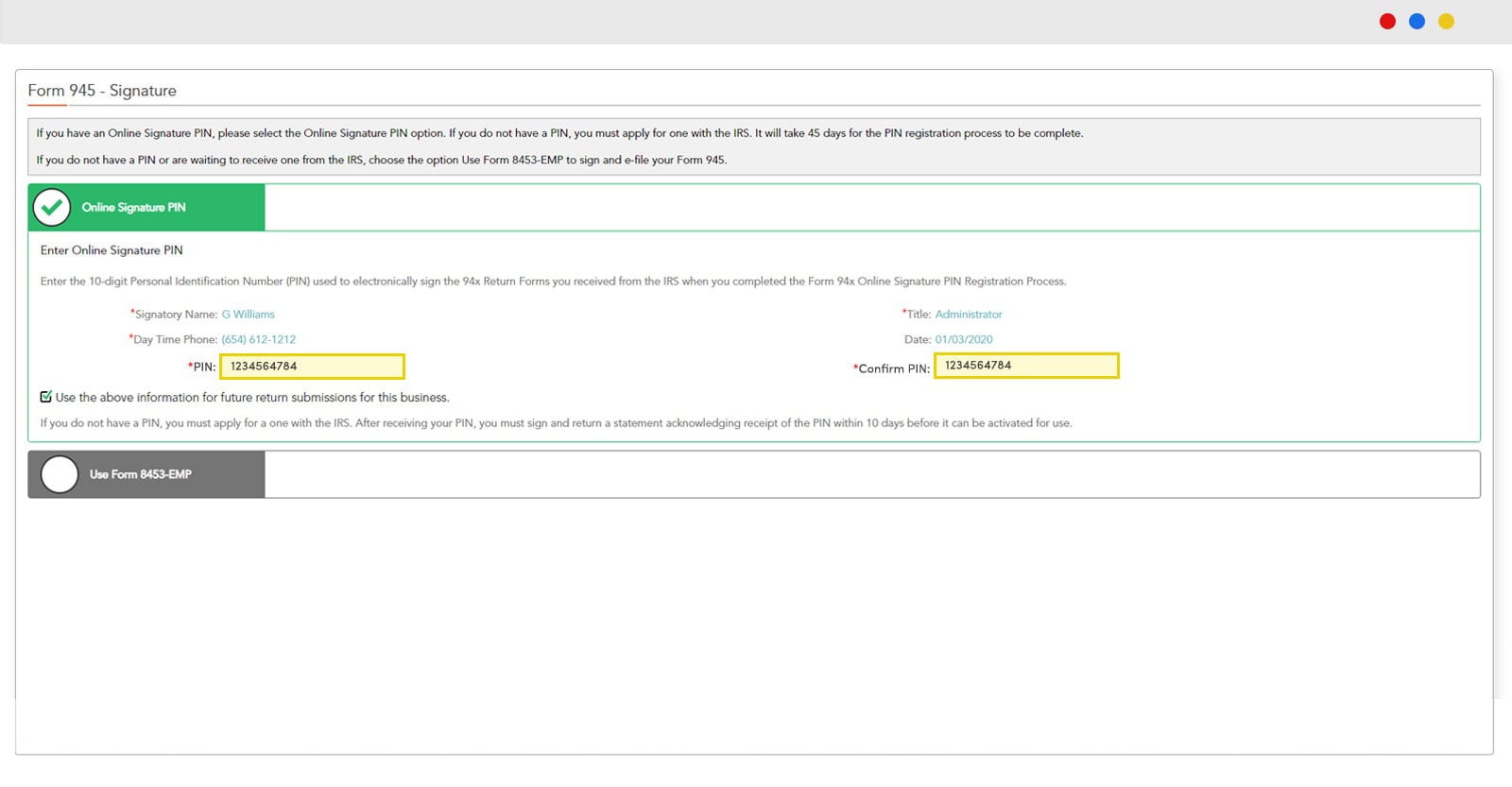

File Form 945 Online Efile 945 Form 945 2020 945 Schedule A

Web the irs form 945 is the annual return of withheld federal income tax. The forms filer plus software is a filing. The irs form 945 is a companion to form 941, employer’s federal tax return. Web irs form 945 is used to report annual federal income tax. Web what is form 945?

Irs form 945 Fill online, Printable, Fillable Blank

The irs form 945 is a companion to form 941, employer’s federal tax return. Web up to $40 cash back 2018 945 form form945annual return of withheld federal income tax department of the treasury internal revenue service omb no. It’s used to report federal income tax withheld from nonpayroll payments,. Web june 25, 2021 q: Web what is form 945?

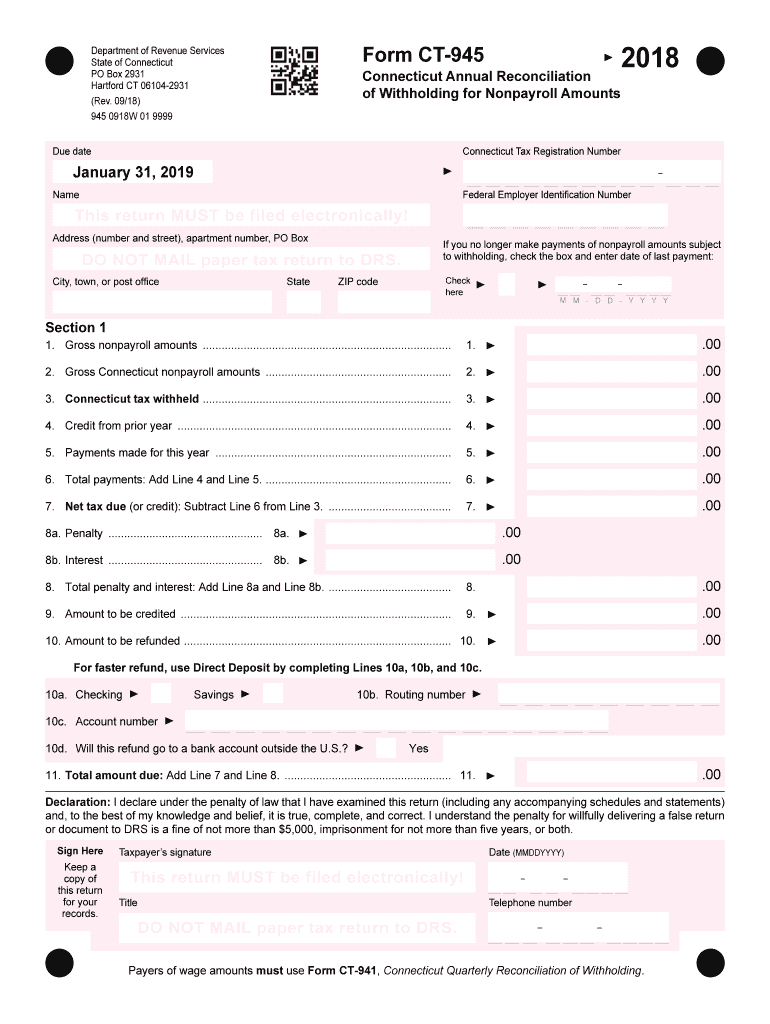

Ct 945 Fill Out and Sign Printable PDF Template signNow

Payments by check or money order use the following guidelines when you. Web irs form 945 instructions. Web what is form 945? It summarizes the federal income taxes a business owner or bank has. Web june 25, 2021 q:

Fill Free fillable Form 945A 2017 Annual Record Federal Tax

The irs form 945 is a companion to form 941, employer’s federal tax return. Both can be essential for businesses of all sizes. Annual return of withheld federal income tax (irs form 945). Web irs form 945 is used to report federal income tax withheld from nonpayroll payments. This form is commonly used to report backup withholding, which is required.

irs form 945a 2022 Fill Online, Printable, Fillable Blank form945

Web annual record of federal tax liability go to www.irs.gov/form945a for instructions and the latest information. Web up to $40 cash back 2018 945 form form945annual return of withheld federal income tax department of the treasury internal revenue service omb no. This means the payment was. If you’re reading this article, odds are that you’re trying to report federal tax.

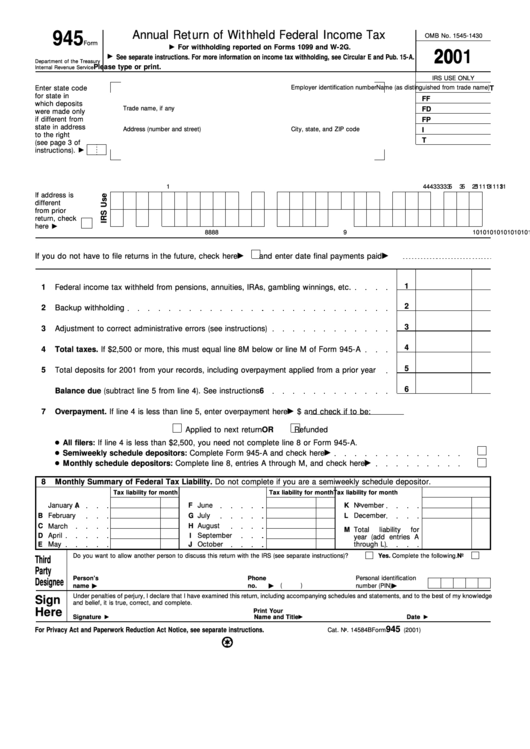

Fillable Form 945 Annual Return Of Withheld Federal Tax 2001

This form is commonly used to report backup withholding, which is required. Web the irs form 945 is known as the annual return of withheld federal income tax. Web what is form 945? What is irs form 945? Use this form to report your federal tax liability (based on the dates payments were made or wages were.

FORM 945 Instructions On How To File Form 945

Use this form to report your federal tax liability (based on the dates payments were made or wages were. Fill out form 945 when you withhold federal. Web irs form 945 is used to report federal income tax withheld from nonpayroll payments. Web the irs form 945 is known as the annual return of withheld federal income tax. Web what.

Fillable Form 945 Annual Return Of Withheld Federal Tax 2010

The forms filer plus software is a filing. Web irs form 945 is used to report annual federal income tax. Use this form to report your federal tax liability (based on the dates payments were made or wages were. It summarizes the federal income taxes a business owner or bank has. Web irs form 945 is used to report federal.

Web June 25, 2021 Q:

Web what is form 945? It summarizes the federal income taxes a business owner or bank has. Web irs form 945 is used to report annual federal income tax. Web irs form 945 instructions.

Web The Irs Form 945 Is The Annual Return Of Withheld Federal Income Tax.

This form is commonly used to report backup withholding, which is required. Payments by check or money order use the following guidelines when you. Annual return of withheld federal income tax (irs form 945). Use this form to report your federal tax liability (based on the dates payments were made or wages were.

Web The Irs Form 945 Is Known As The Annual Return Of Withheld Federal Income Tax.

If you’re reading this article, odds are that you’re trying to report federal tax withheld for non payroll payments. Fill out form 945 when you withhold federal. The forms filer plus software is a filing. Web up to $40 cash back 2018 945 form form945annual return of withheld federal income tax department of the treasury internal revenue service omb no.

What Is Irs Form 945?

Web irs form 945 is used to report federal income tax withheld from nonpayroll payments. Web the most common reason you’ll file form 945 is to report backup withholding for an independent contractor. Web essentially, any business that has withheld or was required to withhold federal income tax from a payment that was made outside of their payroll should file. Web annual record of federal tax liability go to www.irs.gov/form945a for instructions and the latest information.