What Is A Form 8995

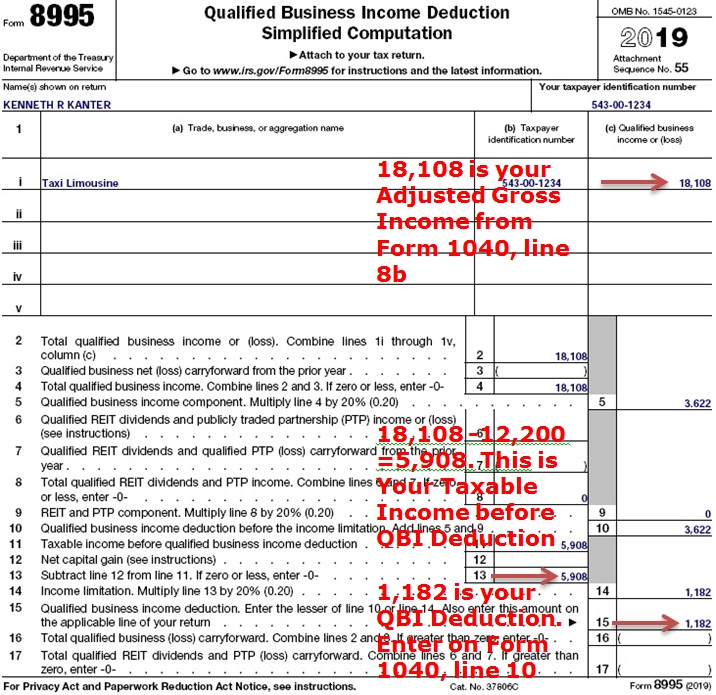

What Is A Form 8995 - Web the 2022 irs form 8995 calculates the allowable qbi deduction for eligible taxpayers with qualified trade or business income, which can significantly reduce their taxable income. Web use form 8995 to figure your qualified business income (qbi) deduction. Irs form 8995 is used to report the qualified business income deduction. Web what is form 8995? The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp. Web the internal revenue service (irs) created a new tax form, irs form 8995, to help provide a simplified computation of their new deduction. Form 8995 is a simplified. Are you able to delete the form? Form 8995 and form 8995a. In this article, we’ll review.

Are you able to delete the form? Web 41 18,683 bookmark icon 1 best answer dmarkm1 expert alumni the form 8995 is used to figure your qualified business income (qbi) deduction. Web form 8995 will report qualified business income from many sources including those you mentioned. In this article, we’ll review. Web use form 8995 to figure your qualified business income (qbi) deduction. It is also known as. Web the 2022 irs form 8995 calculates the allowable qbi deduction for eligible taxpayers with qualified trade or business income, which can significantly reduce their taxable income. Business owners can reduce their tax bill by taking advantage of form 8995 and the qbi program (qualified business income deduction). Web form 8995 is the simplified form and is used if all of the following are true: Web the internal revenue service (irs) created a new tax form, irs form 8995, to help provide a simplified computation of their new deduction.

In this article, we’ll review. Are you able to delete the form? Web what is form 8995? Web form 8995 is the simplified form and is used if all of the following are true: Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). Web form 8995 will report qualified business income from many sources including those you mentioned. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp. Web 41 18,683 bookmark icon 1 best answer dmarkm1 expert alumni the form 8995 is used to figure your qualified business income (qbi) deduction. Web use form 8995 to figure your qualified business income (qbi) deduction. Web the internal revenue service (irs) created a new tax form, irs form 8995, to help provide a simplified computation of their new deduction.

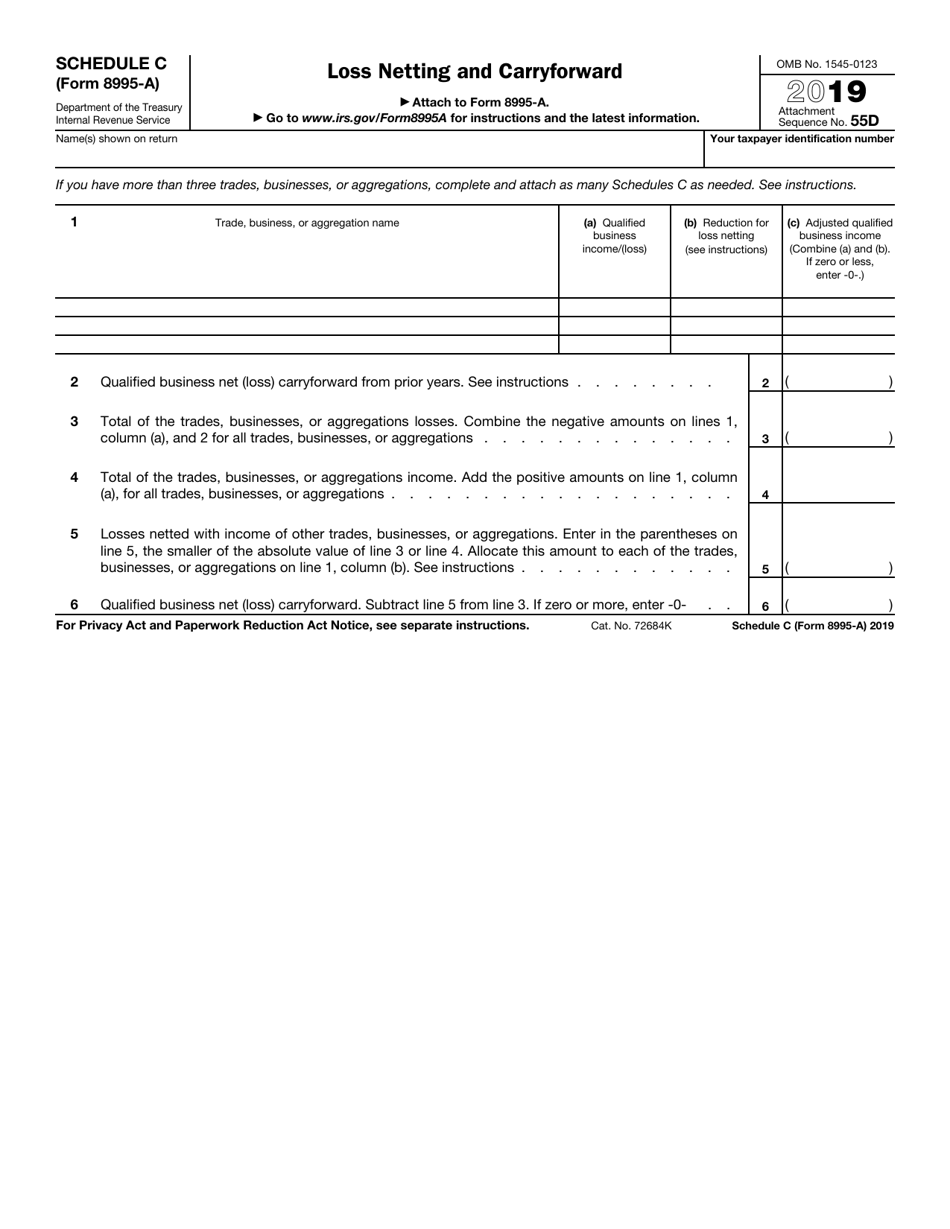

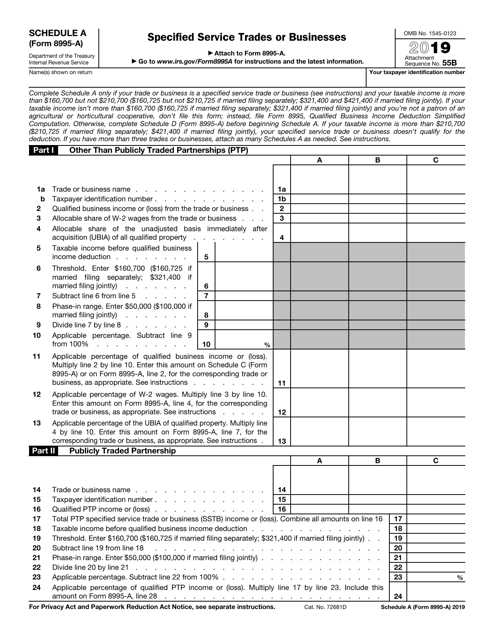

IRS Form 8995A Schedule C Download Fillable PDF or Fill Online Loss

In this article, we’ll review. Web form 8995 is the simplified form and is used if all of the following are true: Web what is form 8995? Web the internal revenue service (irs) created a new tax form, irs form 8995, to help provide a simplified computation of their new deduction. Are you able to delete the form?

IRS Form 8995 Instructions Your Simplified QBI Deduction

Web the internal revenue service (irs) created a new tax form, irs form 8995, to help provide a simplified computation of their new deduction. Web form 8995 will report qualified business income from many sources including those you mentioned. Web form 8995 is the simplified form and is used if all of the following are true: Form 8995 is a.

Staying on Top of Changes to the 20 QBI Deduction (199A) One Year

Web the internal revenue service (irs) created a new tax form, irs form 8995, to help provide a simplified computation of their new deduction. Include the following schedules (their specific instructions are. Are you able to delete the form? Web form 8995, qualified business income deduction simplified computation, projected availability is 1/19/2023. It is also known as.

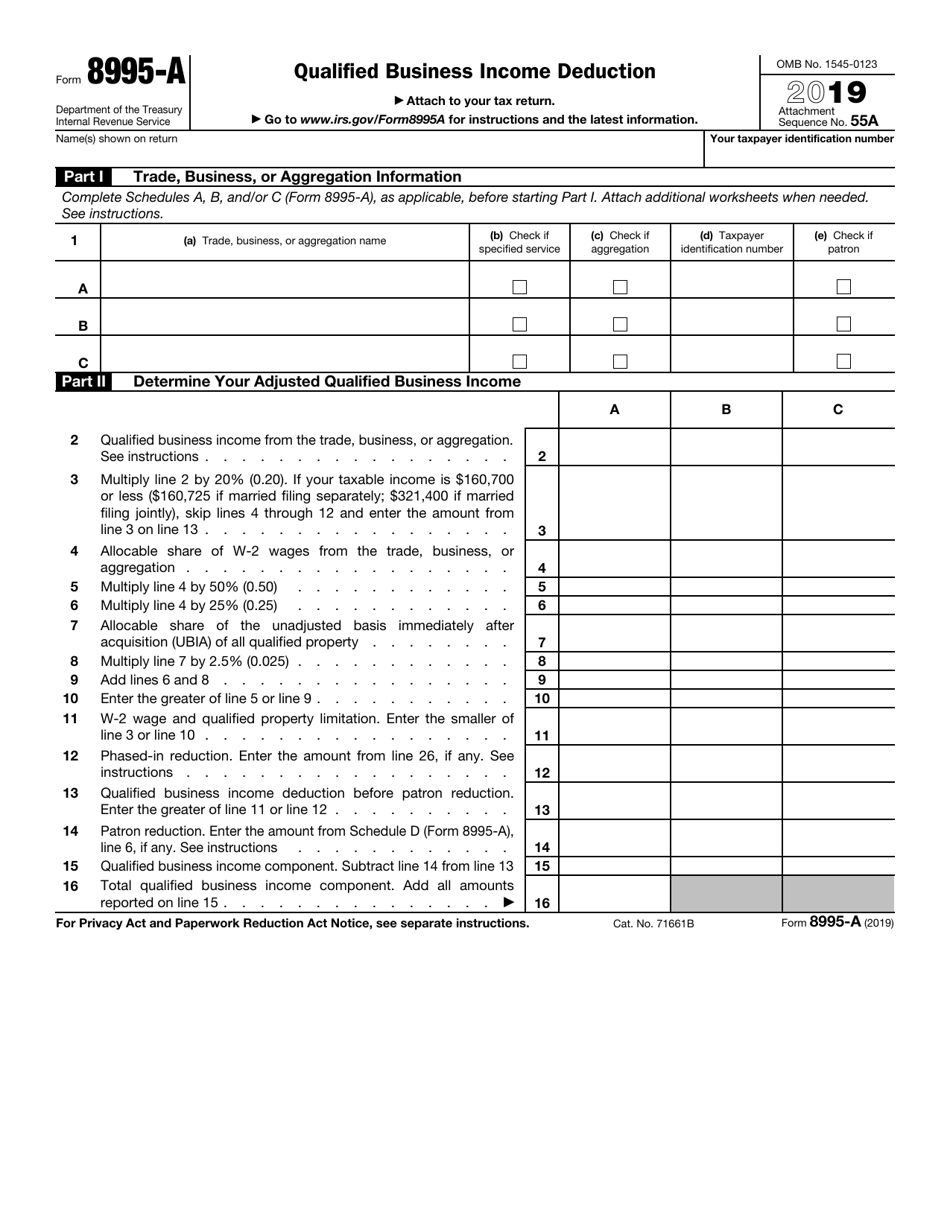

IRS Form 8995A Download Fillable PDF or Fill Online Qualified Business

Form 8995 is a simplified. It is also known as. Web what is form 8995? Web what is form 8995? Irs form 8995 is used to report the qualified business income deduction.

Other Version Form 8995A 8995 Form Product Blog

Include the following schedules (their specific instructions are. Web form 8995 is the simplified form and is used if all of the following are true: Web 41 18,683 bookmark icon 1 best answer dmarkm1 expert alumni the form 8995 is used to figure your qualified business income (qbi) deduction. Web what is form 8995? Web form 8995 is a newly.

Form 8995 Basics & Beyond

Web form 8995 is the simplified form and is used if all of the following are true: In this article, we’ll review. It is also known as. Irs form 8995 is used to report the qualified business income deduction. Web what is form 8995?

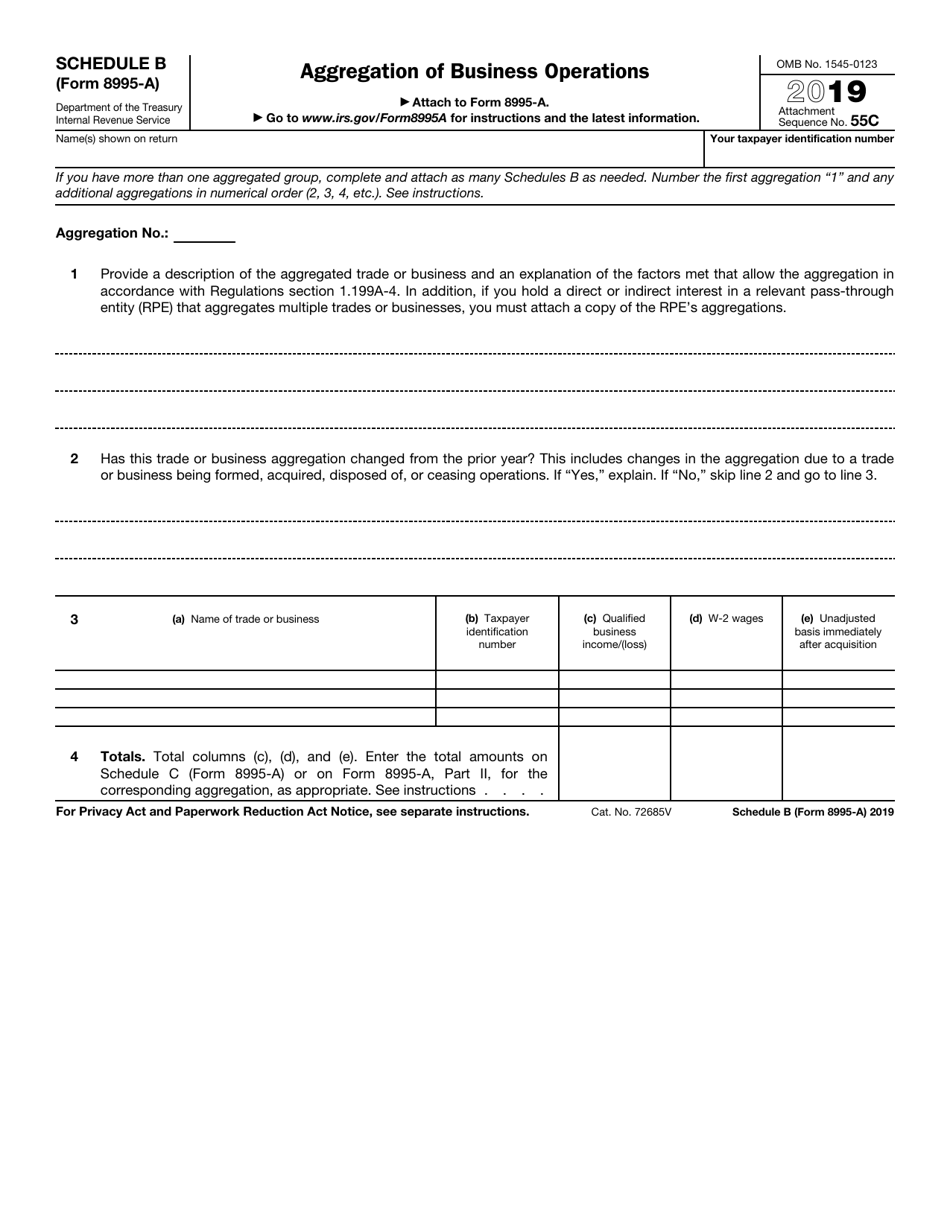

IRS Form 8995A Schedule B Download Fillable PDF or Fill Online

Web the internal revenue service (irs) created a new tax form, irs form 8995, to help provide a simplified computation of their new deduction. Web use form 8995 to figure your qualified business income (qbi) deduction. It is also known as. Web 41 18,683 bookmark icon 1 best answer dmarkm1 expert alumni the form 8995 is used to figure your.

Do Your 2021 Tax Return Right with IRS VITA Certified EXPERTS for

Web form 8995 is a newly created tax form used to calculate the qualified business income deduction (qbid). The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp. Form 8995 and form 8995a. Web the 2022 irs form 8995 calculates the allowable qbi deduction for eligible taxpayers with qualified trade or business income, which can significantly reduce.

IRS Form 8995A Schedule A Download Fillable PDF or Fill Online

In this article, we’ll review. Web the 2022 irs form 8995 calculates the allowable qbi deduction for eligible taxpayers with qualified trade or business income, which can significantly reduce their taxable income. Form 8995 and form 8995a. Web what is form 8995? Web what is form 8995?

Web The Internal Revenue Service (Irs) Created A New Tax Form, Irs Form 8995, To Help Provide A Simplified Computation Of Their New Deduction.

Web what is form 8995? Business owners can reduce their tax bill by taking advantage of form 8995 and the qbi program (qualified business income deduction). The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp. Web use form 8995 to figure your qualified business income (qbi) deduction.

Web Form 8995 Is A Newly Created Tax Form Used To Calculate The Qualified Business Income Deduction (Qbid).

In this article, we’ll review. It is also known as. Web 41 18,683 bookmark icon 1 best answer dmarkm1 expert alumni the form 8995 is used to figure your qualified business income (qbi) deduction. Include the following schedules (their specific instructions are.

Web The 2022 Irs Form 8995 Calculates The Allowable Qbi Deduction For Eligible Taxpayers With Qualified Trade Or Business Income, Which Can Significantly Reduce Their Taxable Income.

Irs form 8995 is used to report the qualified business income deduction. Web form 8995 is the simplified form and is used if all of the following are true: Web form 8995, qualified business income deduction simplified computation, projected availability is 1/19/2023. Form 8995 and form 8995a.

Are You Able To Delete The Form?

Form 8995 is a simplified. Web form 8995 will report qualified business income from many sources including those you mentioned. Web what is form 8995?