What Is Credit Reduction On Form 940

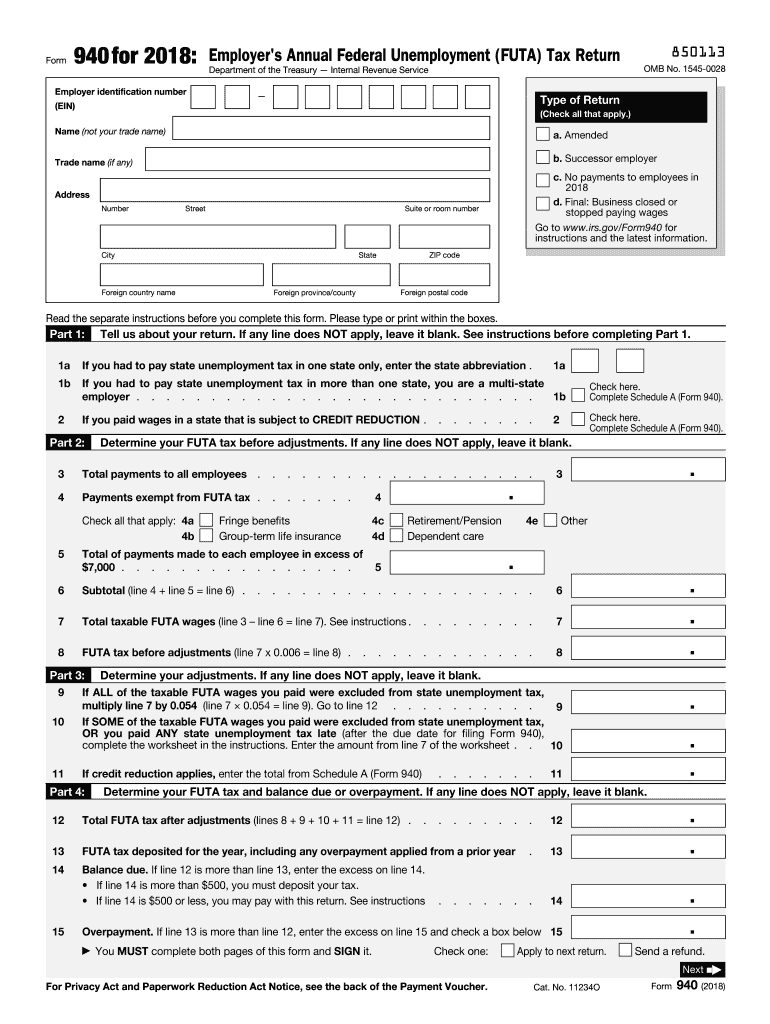

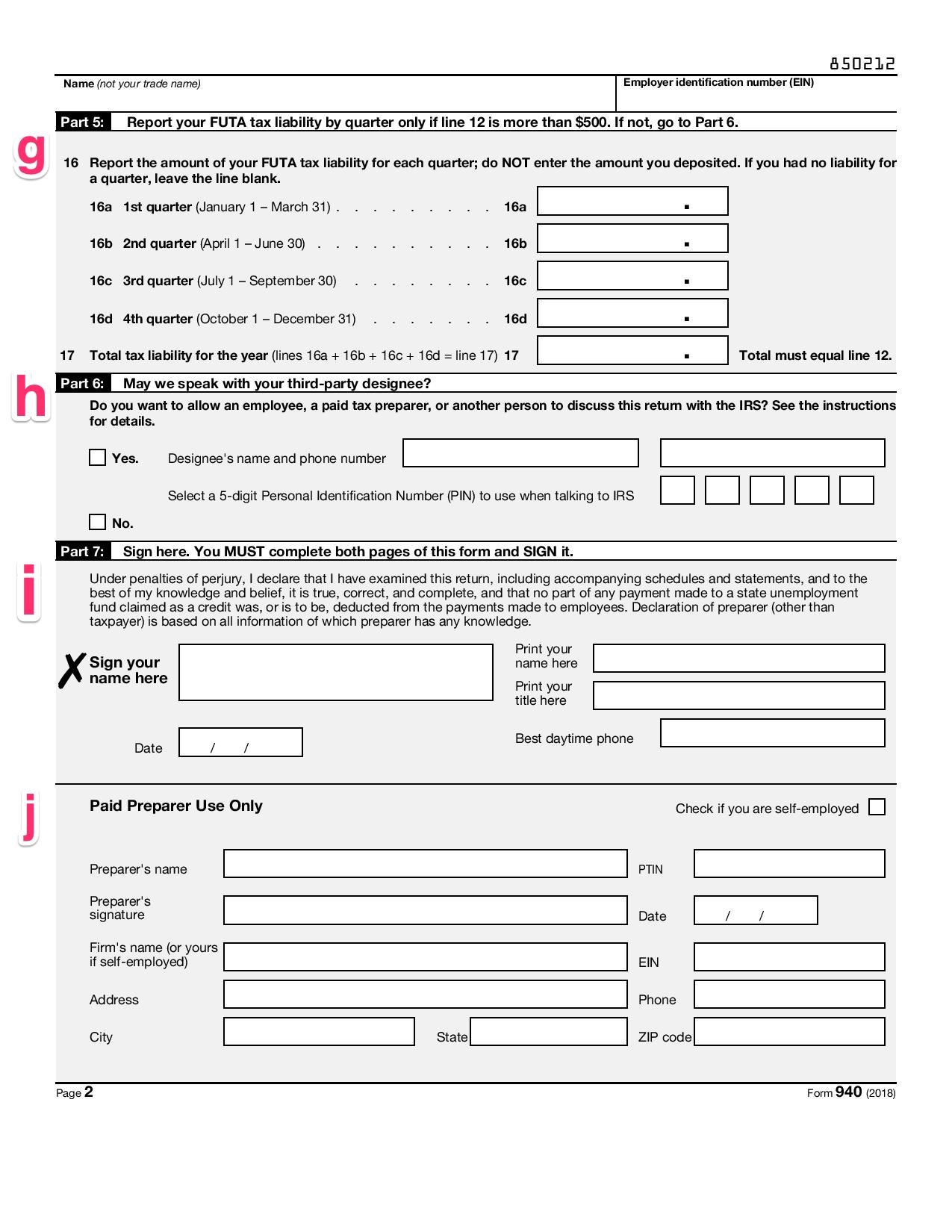

What Is Credit Reduction On Form 940 - Web draft schedule a notes that california, connecticut, illinois, and new york might receive a credit reduction rate of 0.6% for 2023. For example, an employer in a state with a credit reduction of 0.3% would compute its futa tax by. Web what is credit reduction on form 940? Web for 2022, there are credit reduction states. Web state a is subject to credit reduction at a rate of 0.003 (0.3%). This is a state that hasn't repaid money it borrowed from the federal government to pay unemployment benefits. Web address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code type of return (check all that apply.). Web the additional futa tax owed due to the futa credit reduction will be shown on the 2022 form 940, and the increase in futa tax is due on january 31, 2023. Web use schedule a (form 940) to figure your annual federal unemployment tax act (futa) tax for states that have a credit reduction on wages that are. Virgin islands, with a 2.4% credit reduction.

Web in 2018, the only credit reduction state was the u.s. Web state a is subject to credit reduction at a rate of 0.003 (0.3%). A consideration employers must have for the filing of the 2022 form 940 is the possibility of a futa credit reduction. What are the irs form 940 credit reduction states for 2022? Web a credit reduction state is one that took loans from the federal government to meet its state unemployment tax liabilities but has not repaid the loans in time. Web use schedule a (form 940) to figure your annual federal unemployment tax act (futa) tax for states that have a credit reduction on wages that are. How to add schedule a (form 940) information to irs. Web the credit reduction is for the year 2018. Web what are the form 940 credit reduction states for 2022? Web a state that hasn't repaid money it borrowed from the federal government to pay unemployment benefits is a “credit reduction state.” if an employer pays wages.

What are the irs form 940 credit reduction states for 2022? If a state has an outstanding unemployment benefits loan from the federal government, it is considered a credit. Web a credit reduction state is one that took loans from the federal government to meet its state unemployment tax liabilities but has not repaid the loans in time. Virgin islands, with a 2.4% credit reduction. Web a state that hasn't repaid money it borrowed from the federal government to pay unemployment benefits is a “credit reduction state.” if an employer pays wages. If you paid any wages that are subject to the unemployment compensation laws of a credit reduction state, your credit against. Department of labor (usdol) released an updated futa credit reduction estimate for calendar year 2021 (reported on the 2021 form 940) which continues to. Web futa credit reduction. Because you paid wages in a state that is subject to credit reduction, you must complete schedule a and file it with. Web what are the form 940 credit reduction states for 2022?

2012 Form 940 Instructions Updated Releases New

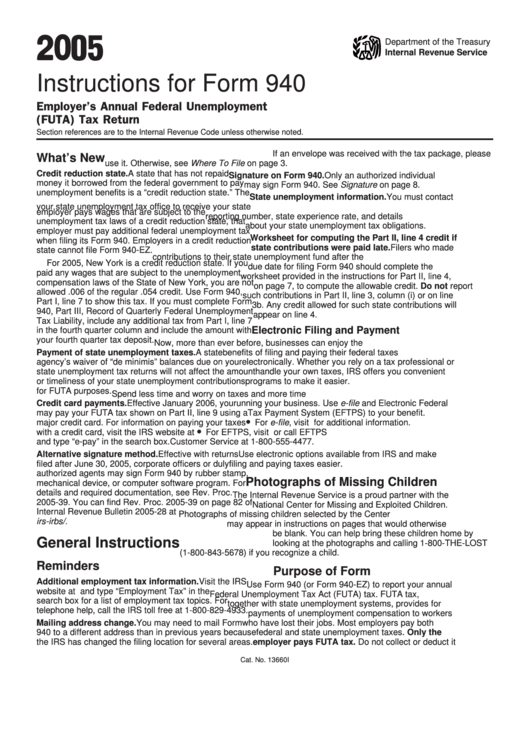

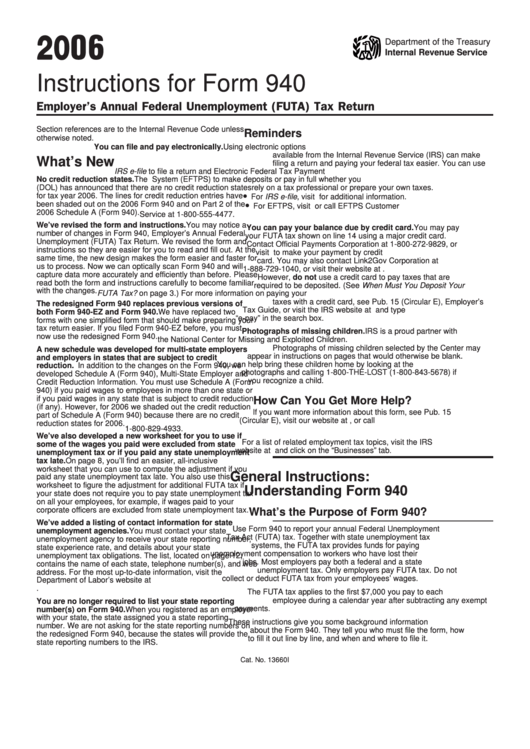

Web the credit reduction results in a higher tax due on the form 940. Web instructions for schedule a (form 940) for 2010: Department of labor (usdol) released an updated futa credit reduction estimate for calendar year 2021 (reported on the 2021 form 940) which continues to. Web what are the form 940 credit reduction states for 2022? If you.

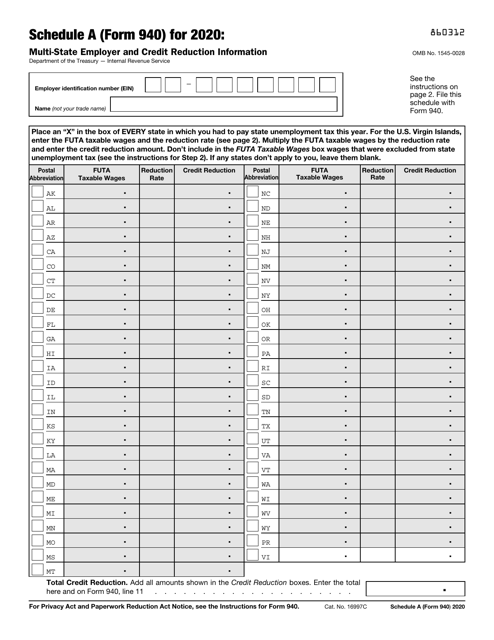

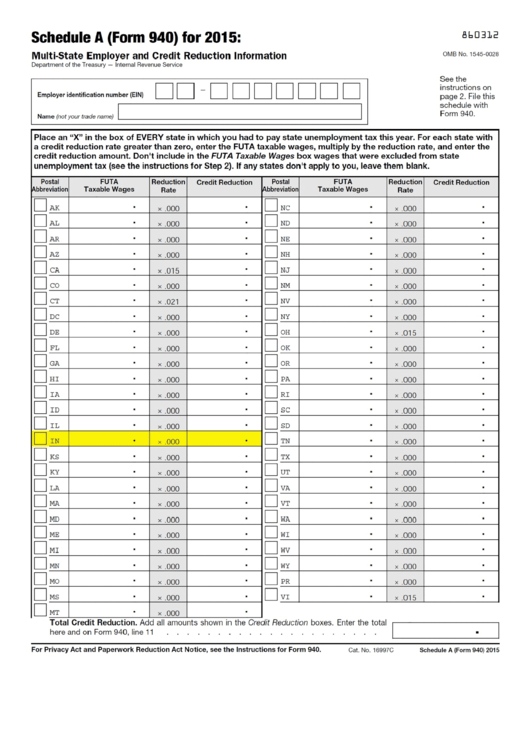

IRS Form 940 Schedule A Download Fillable PDF or Fill Online Multi

Web what is a credit reduction state? Web in 2018, the only credit reduction state was the u.s. Web credit reduction state: If you paid any wages that are subject to the unemployment compensation laws of a credit reduction state, your credit against. Web draft schedule a notes that california, connecticut, illinois, and new york might receive a credit reduction.

Schedule A (Form 940) MultiState Employer And Credit Reduction

Virgin islands, with a 2.4% credit reduction. Web in 2018, the only credit reduction state was the u.s. Web state a is subject to credit reduction at a rate of 0.003 (0.3%). Web address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code type of return (check all that apply.). Web.

futa credit reduction states 2022 Fill Online, Printable, Fillable

For example, an employer in a state with a credit reduction of 0.3% would compute its futa tax by. Web what is credit reduction on form 940? Web instructions for schedule a (form 940) for 2010: Department of labor (usdol) released an updated futa credit reduction estimate for calendar year 2021 (reported on the 2021 form 940) which continues to..

Instructions For Form 940 Employer'S Annual Federal Unemployment

A consideration employers must have for the filing of the 2022 form 940 is the possibility of a futa credit reduction. Credit reduction states are states that have borrowed money from the federal government but have. If you paid any wages that are subject to the unemployment compensation laws of a credit reduction state, your credit against. Virgin islands, with.

Instructions For Form 940 Employer'S Annual Federal Unemployment

This is a state that hasn't repaid money it borrowed from the federal government to pay unemployment benefits. Completing schedule a (form 940) part 1:. Web address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code type of return (check all that apply.). Web if you paid any wages that are.

IRS 940 2018 Fill and Sign Printable Template Online US Legal Forms

For example, an employer in a state with a credit reduction of 0.3% would compute its futa tax by. Because you paid wages in a state that is subject to credit reduction, you must complete schedule a and file it with. Web credit reduction state: Web instructions for schedule a (form 940) for 2010: If you paid any wages that.

Form 940 (Schedule A) MultiState Employer and Credit Reduction

Web address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code type of return (check all that apply.). For example, an employer in a state with a credit reduction of 0.3% would compute its futa tax by. Web a state that hasn't repaid money it borrowed from the federal government to.

2022 Form 940 Schedule A

Web a credit reduction state is one that took loans from the federal government to meet its state unemployment tax liabilities but has not repaid the loans in time. Web state a is subject to credit reduction at a rate of 0.003 (0.3%). Web the credit reduction results in a higher tax due on the form 940. Because you paid.

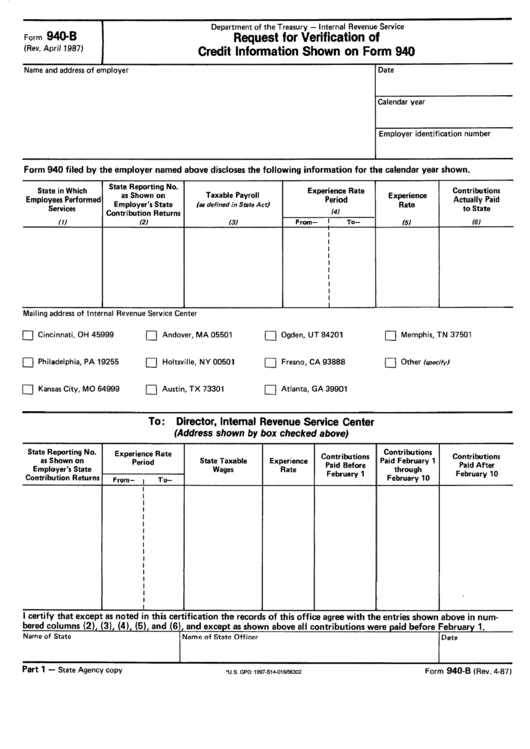

Form 940B Request For Verification Of Credit Information Shown On

Web the credit reduction is for the year 2018. Web what are the form 940 credit reduction states for 2022? Web address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code type of return (check all that apply.). If a state has an outstanding unemployment benefits loan from the federal government,.

How To Add Schedule A (Form 940) Information To Irs.

For example, an employer in a state with a credit reduction of 0.3% would compute its futa tax by. Web the credit reduction is for the year 2018. Web address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code type of return (check all that apply.). Web what is a credit reduction state?

Web A Credit Reduction State Is One That Took Loans From The Federal Government To Meet Its State Unemployment Tax Liabilities But Has Not Repaid The Loans In Time.

If a state has an outstanding unemployment benefits loan from the federal government, it is considered a credit. Web futa credit reduction. A consideration employers must have for the filing of the 2022 form 940 is the possibility of a futa credit reduction. What are the irs form 940 credit reduction states for 2022?

Web Instructions For Schedule A (Form 940) For 2010:

Web use schedule a (form 940) to figure your annual federal unemployment tax act (futa) tax for states that have a credit reduction on wages that are. Web for 2022, there are credit reduction states. Web if you paid any wages that are subject to the unemployment compensation laws of a credit reduction state, your credit against federal unemployment tax will be reduced based on. Web draft schedule a notes that california, connecticut, illinois, and new york might receive a credit reduction rate of 0.6% for 2023.

Web Credit Reduction State:

Credit reduction states are states that have borrowed money from the federal government but have. I would recommend contacting the state agency for them to help your question about the tax refund. Web what is credit reduction on form 940? Web a state that hasn't repaid money it borrowed from the federal government to pay unemployment benefits is a “credit reduction state.” if an employer pays wages.