What Is Form 2555 Used For

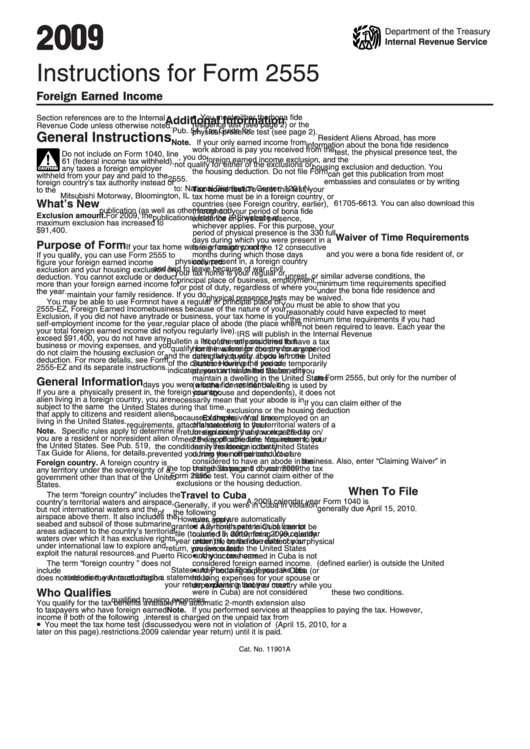

What Is Form 2555 Used For - Web the feie (form 2555) can be used to exclude “foreign earned income” from being subject to us tax. Download or email irs 2555 & more fillable forms, register and subscribe now! One may file form 2555. It is used to claim the foreign earned income exclusion and/or the. Web form 2555, alternatively referred to as the foreign earned income form, is an important tax document that u.s. Web foreign earned income exclusion (form 2555) u.s. Go to www.irs.gov/form2555 for instructions and the. Web form 2555 can make an expat’s life a lot easier! Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you.

Who should use the foreign earned income exclusion? Web the feie (form 2555) can be used to exclude “foreign earned income” from being subject to us tax. The feie is ideal for people. Web foreign earned income exclusion (form 2555) u.s. Expats use to claim the foreign earned income. June 24th, 2022 get to know the author uncle sam and american expats. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their. A guide for us expats katelynn minott, cpa & ceo published: Web form 2555 can make an expat’s life a lot easier! Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction.

Web form 2555, alternatively referred to as the foreign earned income form, is an important tax document that u.s. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their. Expats use to claim the foreign earned income. Web form 2555 can make an expat’s life a lot easier! Who should use the foreign earned income exclusion? The feie is ideal for people. Web the feie (form 2555) can be used to exclude “foreign earned income” from being subject to us tax. Web foreign earned income exclusion (form 2555) u.s. A form that one files with the irs to claim a foreign earned income exclusion from u.s. June 24th, 2022 get to know the author uncle sam and american expats.

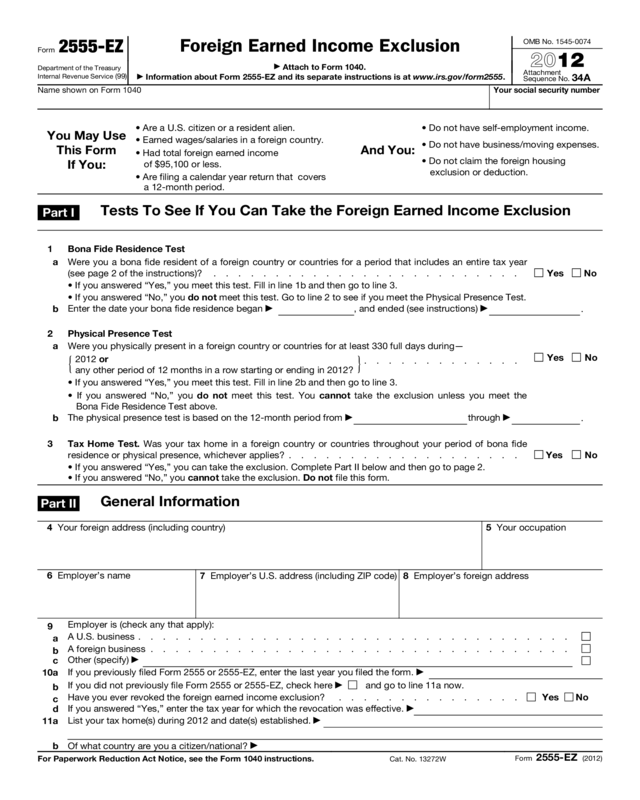

Form 2555Ez Edit, Fill, Sign Online Handypdf

Citizens and resident aliens who live and work abroad may be able to exclude all or part of their foreign salary or wages from. Who should use the foreign earned income exclusion? Web timely filing the form 2555 is essential for claiming the foreign earned income exclusion one of the more common misconceptions. Go to www.irs.gov/form2555 for instructions and the..

Form 2555 Instructions and Tips for US Expat Tax Payers YouTube

Download or email irs 2555 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. The feie is ideal for people. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their. Web tax form 2555 is.

Form 2555 EZ SDG Accountant

Web filing form 2555: You cannot exclude or deduct more than the. The feie is ideal for people. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their. Expats use to claim the foreign earned income.

Form 2555 Foreign Earned (2014) Free Download

Web the feie (form 2555) can be used to exclude “foreign earned income” from being subject to us tax. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you. Taxation of.

2017 Form 2555 Edit, Fill, Sign Online Handypdf

Go to www.irs.gov/form2555 for instructions and the. Web timely filing the form 2555 is essential for claiming the foreign earned income exclusion one of the more common misconceptions. What this means for most expats is that they can use the feie. Taxation of income earned in a foreign country. Go to www.irs.gov/form2555 for instructions and the latest.

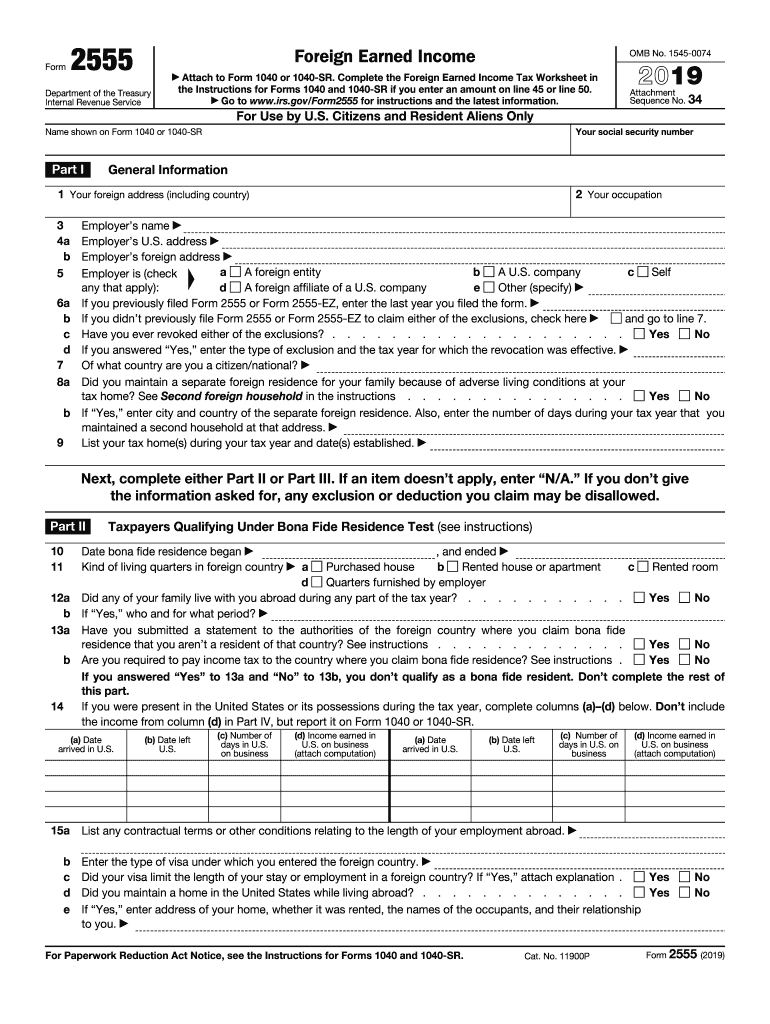

2019 Form IRS 2555 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 2555 can make an expat’s life a lot easier! Taxation of income earned in a foreign country. One may file form 2555. It is used to claim the foreign earned income exclusion and/or the. June 24th, 2022 get to know the author uncle sam and american expats.

Ssurvivor Example Of Form 2555 Filled Out

Taxation of income earned in a foreign country. Expats use to claim the foreign earned income. A form that one files with the irs to claim a foreign earned income exclusion from u.s. The feie is ideal for people. Web form 2555 can make an expat’s life a lot easier!

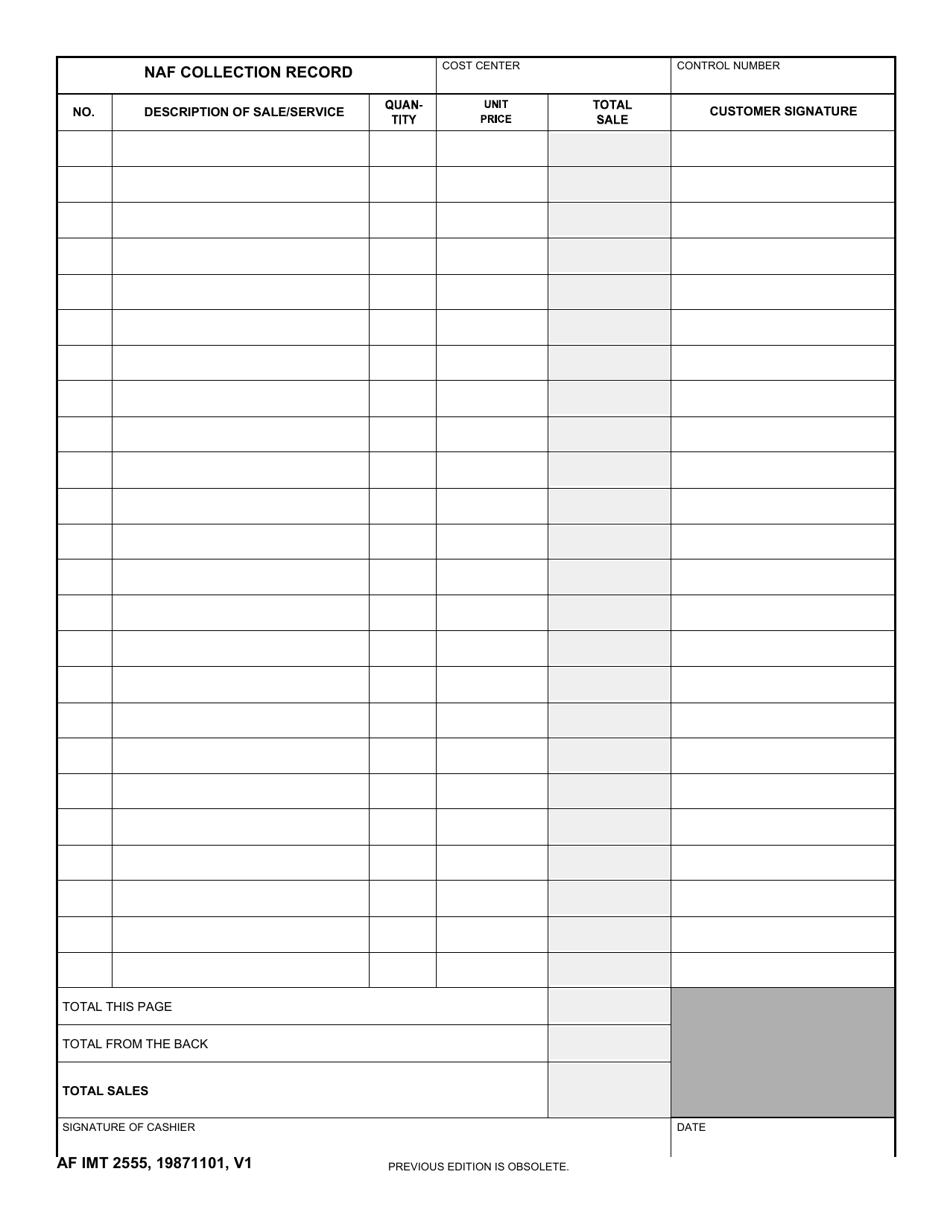

AF IMT Form 2555 Download Fillable PDF or Fill Online NAF Collection

Web filing form 2555: You cannot exclude or deduct more than the. Web form 2555 can make an expat’s life a lot easier! June 24th, 2022 get to know the author uncle sam and american expats. A form that one files with the irs to claim a foreign earned income exclusion from u.s.

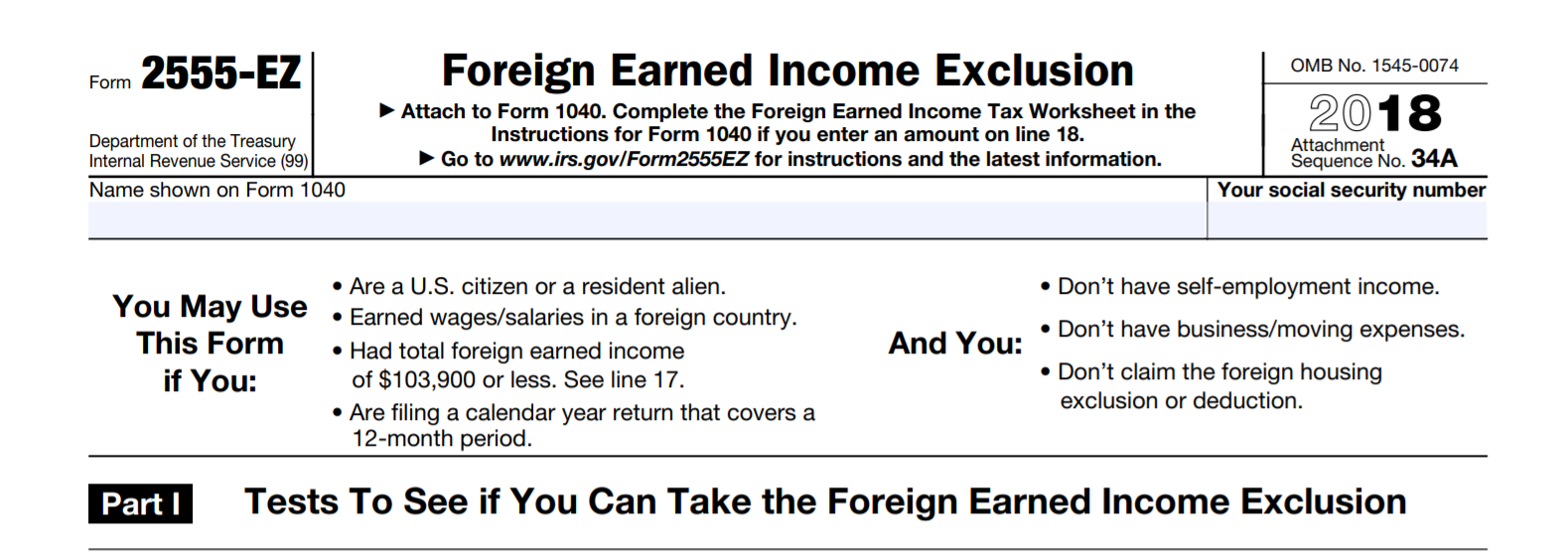

Breanna Tax Form 2555 Ez 2019

Web the feie (form 2555) can be used to exclude “foreign earned income” from being subject to us tax. Web filing form 2555: Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Download or email irs 2555 & more fillable forms, register and subscribe now! A form.

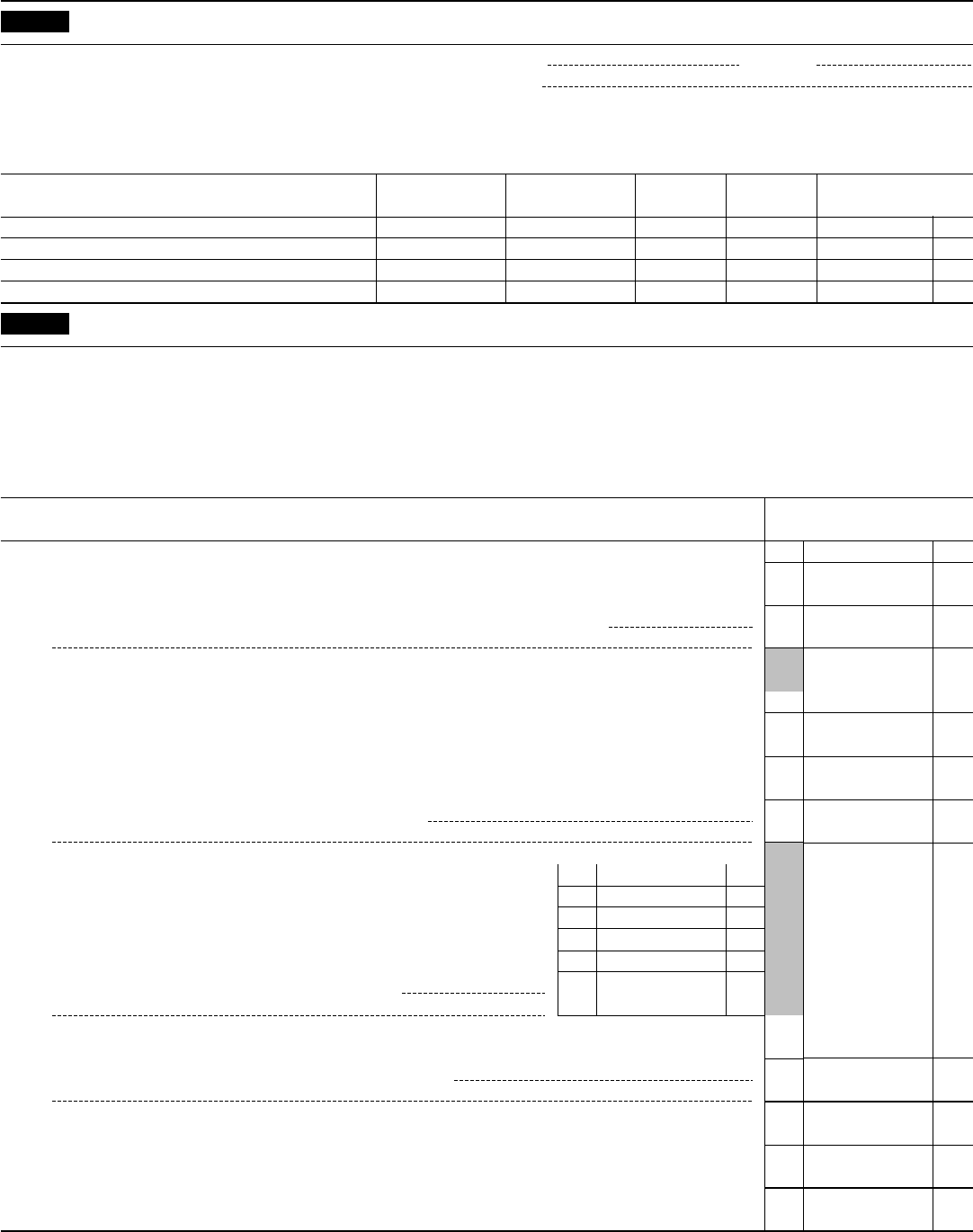

Instructions For Form 2555 Foreign Earned Internal Revenue

Expats use to claim the foreign earned income. Who should use the foreign earned income exclusion? Web timely filing the form 2555 is essential for claiming the foreign earned income exclusion one of the more common misconceptions. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship.

Expats Use To Claim The Foreign Earned Income.

Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you. Complete, edit or print tax forms instantly. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. A form that one files with the irs to claim a foreign earned income exclusion from u.s.

A Guide For Us Expats Katelynn Minott, Cpa & Ceo Published:

Go to www.irs.gov/form2555 for instructions and the. Web form 2555, alternatively referred to as the foreign earned income form, is an important tax document that u.s. It is used to claim the foreign earned income exclusion and/or the. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their.

The Feie Is Ideal For People.

Who should use the foreign earned income exclusion? Web the feie (form 2555) can be used to exclude “foreign earned income” from being subject to us tax. Go to www.irs.gov/form2555 for instructions and the latest. Taxation of income earned in a foreign country.

Web Filing Form 2555:

Go to www.irs.gov/form2555 for instructions and the. Web tax form 2555 is used to claim this exclusion and the housing exclusion or deduction. You cannot exclude or deduct more than the. Download or email irs 2555 & more fillable forms, register and subscribe now!