What Is Form 3804 Cr

What Is Form 3804 Cr - Web form 4868, also known as an “application for automatic extension of time to file u.s. Ssn or itin fein part i elective tax credit amount. The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. Web other items you may find useful. About publication 17, your federal income tax. Form 3885a, depreciation and amortization adjustments. Web california individual form availability. Name(s) as shown on your california tax return (smllcs see instructions) ssn or itin. About publication 547, casualties, disasters,. Form ftb 3804 also includes a schedule of qualified taxpayers that requires.

Attach the completed form ftb 3804. A tax form distributed by the internal revenue service (irs) used to report casualties and thefts of personal property. Ssn or itin fein part i elective tax credit amount. Web go to california > passthrough entity tax worksheet. If reporting a qualified disaster loss, see the instructions for special rules that apply. Name(s) as shown on your california tax return (smllcs see instructions) ssn or itin. Web other items you may find useful. About publication 17, your federal income tax. The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. Individual income tax return,” is a form that taxpayers can file with the irs if.

The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. Automatically include all shareholders go to california > other information worksheet. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Web go to california > passthrough entity tax worksheet. Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file. A tax form distributed by the internal revenue service (irs) used to report casualties and thefts of personal property. Name(s) as shown on your california tax return (smllcs see instructions) ssn or itin. Ssn or itin fein part i elective tax credit amount. Individual income tax return,” is a form that taxpayers can file with the irs if. Web form 4868, also known as an “application for automatic extension of time to file u.s.

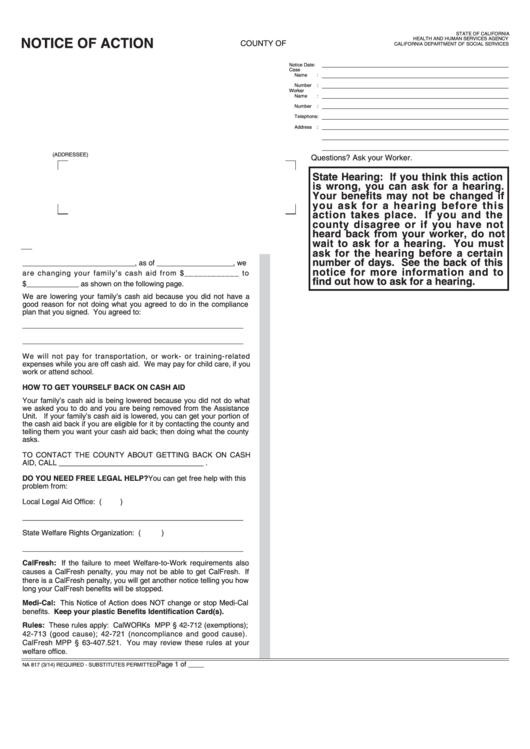

Fillable Form Na 817 Notice Of Action Sanction Of Participant After

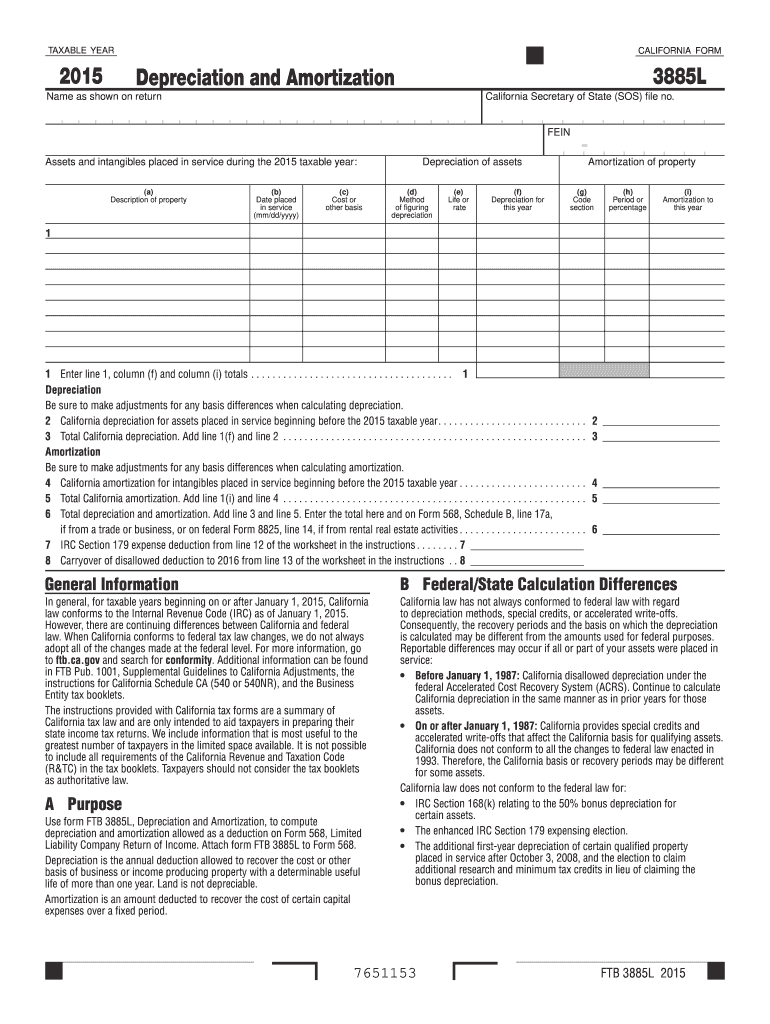

About publication 547, casualties, disasters,. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Web other items you may find useful. The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. Form 3885a, depreciation and amortization adjustments.

Form 3885L Fill Out and Sign Printable PDF Template signNow

Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Form 3885a, depreciation and amortization adjustments. Web other items you may find useful. Attach the completed form ftb 3804. If reporting a qualified disaster loss, see the instructions for special rules that apply.

CA Form FTB 3801CR 20202022 Fill and Sign Printable Template Online

A tax form distributed by the internal revenue service (irs) used to report casualties and thefts of personal property. Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file. If reporting a qualified disaster loss, see the instructions for special rules that apply. Form ftb 3804.

LINGERIE FEMININA FANTASIA DE ESTUDANTE CR3804 Prazer 24

Form 3885a, depreciation and amortization adjustments. The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. Name(s) as shown on your california tax return (smllcs see instructions) ssn or itin. Web go to california > passthrough entity tax worksheet. Web use form ftb 3804 to report the elective tax on the electing.

Jfs intearn report fill out on line 2010 form Fill out & sign online

Name(s) as shown on your california tax return (smllcs see instructions) ssn or itin. Attach the completed form ftb 3804. Ssn or itin fein part i elective tax credit amount. If reporting a qualified disaster loss, see the instructions for special rules that apply. Individual income tax return,” is a form that taxpayers can file with the irs if.

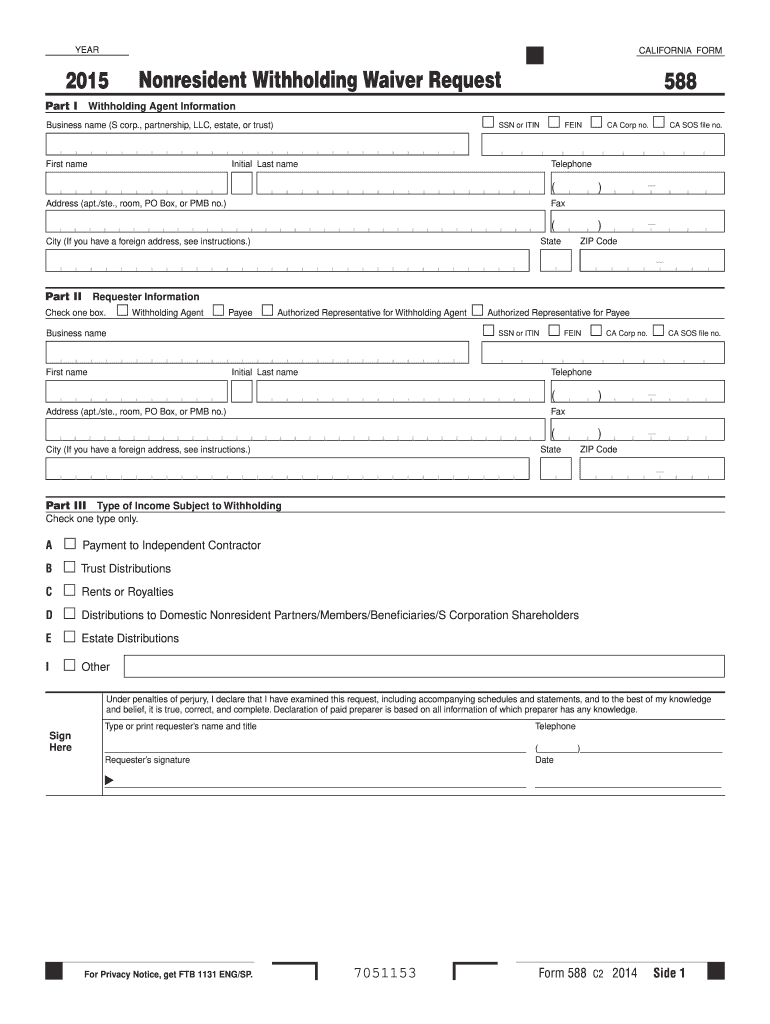

Form 588 California Franchise Tax Board Fill out & sign online DocHub

About publication 17, your federal income tax. Web form 4868, also known as an “application for automatic extension of time to file u.s. Attach the completed form ftb 3804. The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. Form ftb 3804 also includes a schedule of qualified taxpayers that requires.

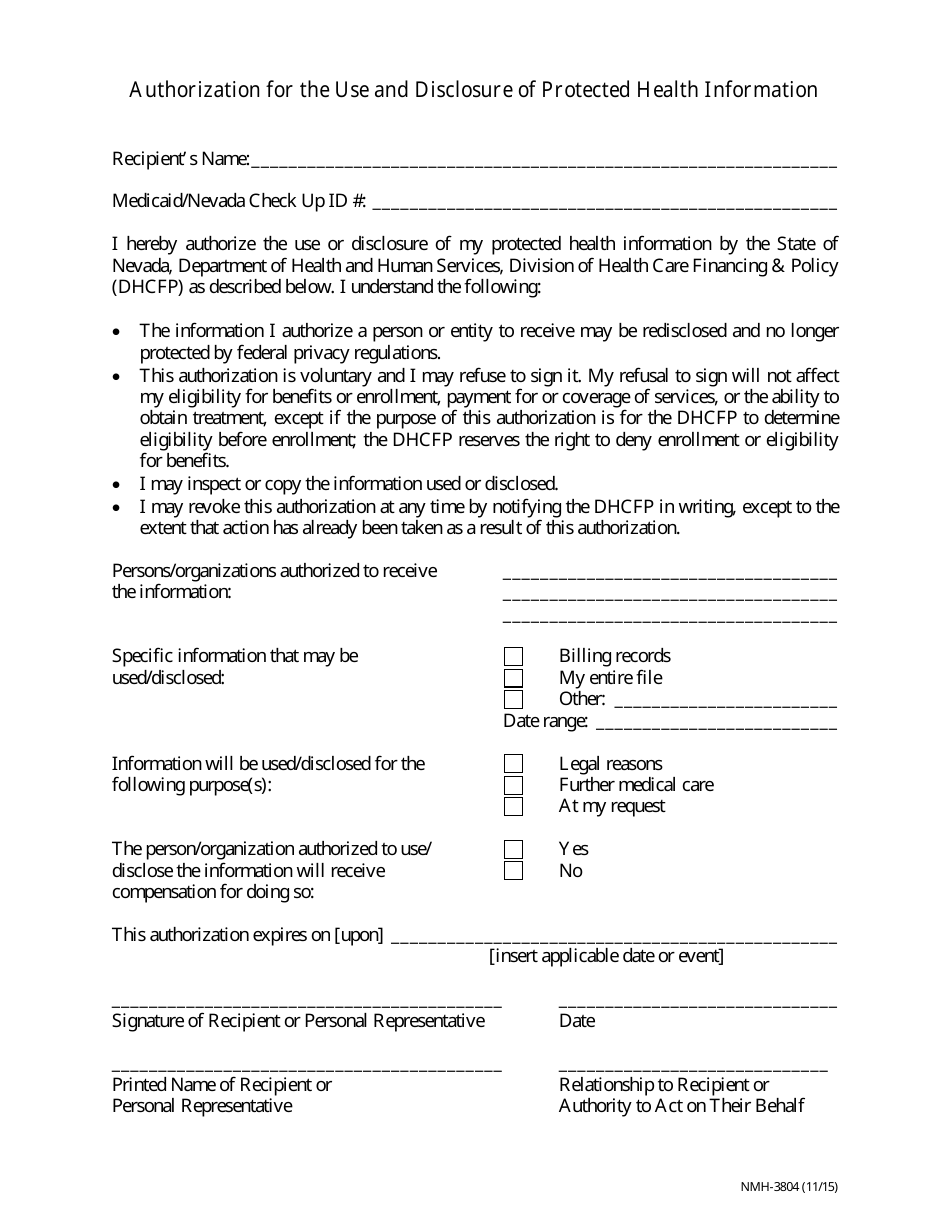

Form NMH3804 Download Fillable PDF or Fill Online Authorization for

Web information, get form ftb 3804. Web other items you may find useful. The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Web information about form 8804, annual return for partnership withholding tax.

Comprar Fantasia de Estudante Cr3804 Tamanho 36 S

Automatically include all shareholders go to california > other information worksheet. The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. Attach the completed form ftb 3804. Ssn or itin fein part i elective tax credit amount. Web form 4868, also known as an “application for automatic extension of time to file.

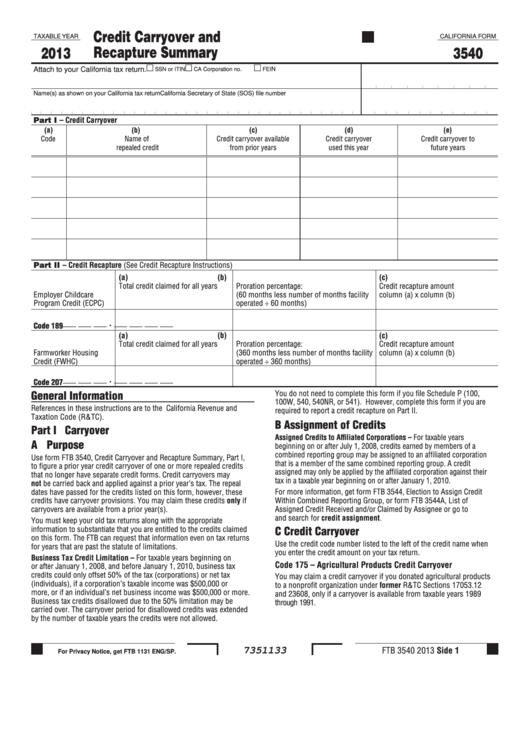

Fillable California Form 3540 Credit Carryover And Recapture Summary

Web other items you may find useful. If reporting a qualified disaster loss, see the instructions for special rules that apply. Web form 4868, also known as an “application for automatic extension of time to file u.s. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Ssn or itin fein part.

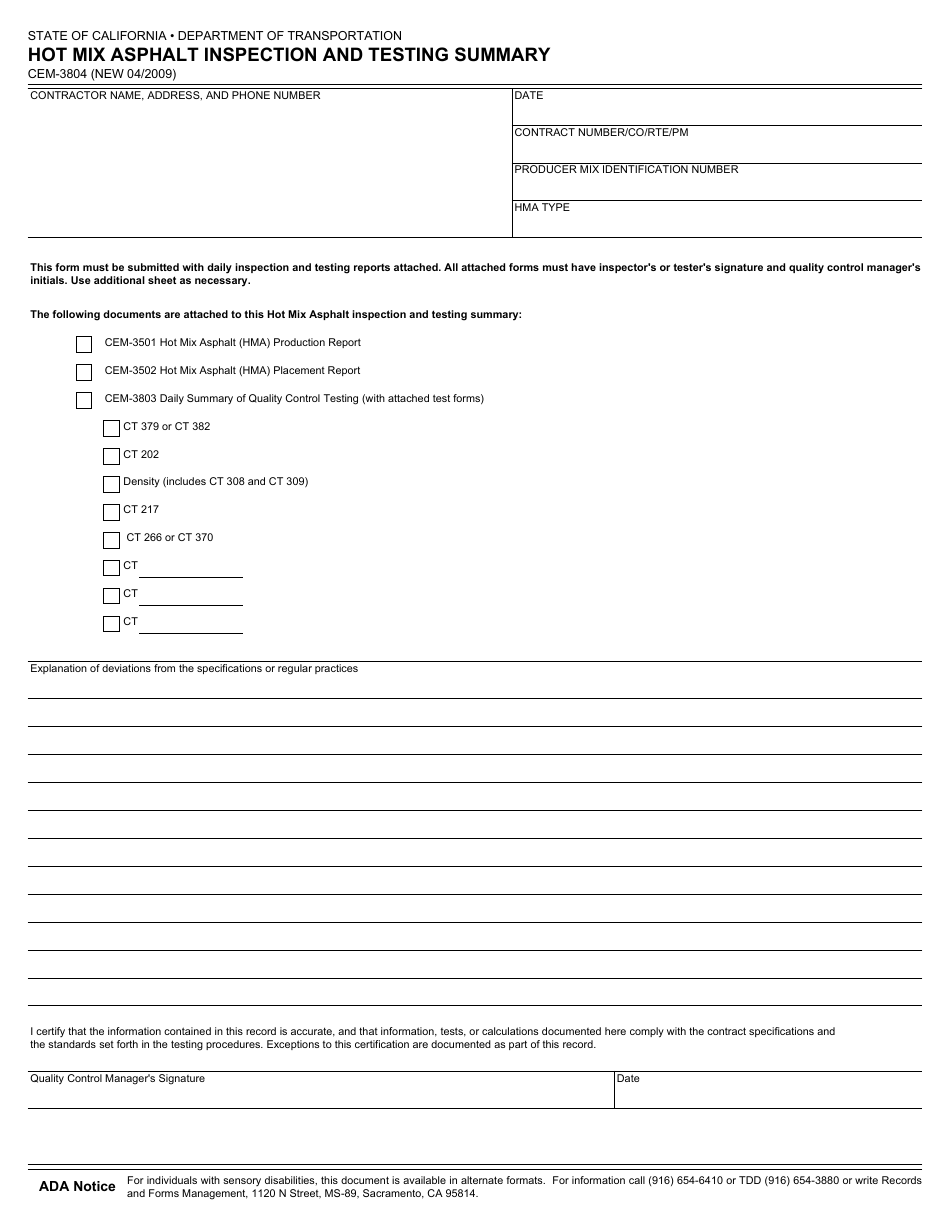

Form CEM3804 Download Fillable PDF or Fill Online Hot Mix Asphalt

Web other items you may find useful. Form 3885a, depreciation and amortization adjustments. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Name(s) as shown on your california tax return (smllcs see instructions) ssn or itin. Automatically include all shareholders go to california > other information worksheet.

Web Information, Get Form Ftb 3804.

Attach the completed form ftb 3804. Name(s) as shown on your california tax return (smllcs see instructions) ssn or itin. About publication 17, your federal income tax. The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted.

Web Use Form Ftb 3804 To Report The Elective Tax On The Electing Qualified Pte’s Qualified Net Income.

Web other items you may find useful. If reporting a qualified disaster loss, see the instructions for special rules that apply. Ssn or itin fein part i elective tax credit amount. Automatically include all shareholders go to california > other information worksheet.

About Publication 547, Casualties, Disasters,.

Web go to california > passthrough entity tax worksheet. Form 3885a, depreciation and amortization adjustments. Web california individual form availability. Form ftb 3804 also includes a schedule of qualified taxpayers that requires.

Individual Income Tax Return,” Is A Form That Taxpayers Can File With The Irs If.

Web form 4868, also known as an “application for automatic extension of time to file u.s. A tax form distributed by the internal revenue service (irs) used to report casualties and thefts of personal property. Web information about form 8804, annual return for partnership withholding tax (section 1446), including recent updates, related forms, and instructions on how to file.