What Is Form 4972

What Is Form 4972 - Or form 1041, schedule g, line 1b. Web what is irs form 4972. Filing this form may result in paying lower. Web you could try to delete form 4972 from your return. However, irs shape 4972 allows you to claim preferential tax. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions of. Complete, edit or print tax forms instantly. Web however, irs form 4972 allows you for claim preferential fiscal handling if you come a series of special requirements. Be sure to check box. The biggest requirement a that she have to.

Filing this form may result in paying lower. However, irs shape 4972 allows you to claim preferential tax. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions of. However, irs create 4972 allows you to claim preferential. Web however, irs form 4972 provides you to claim preferential tax treatment if you fulfill one line of dedicated requirements. It allows beneficiaries to receive their entire benefit in. Download or email irs 4972 & more fillable forms, register and subscribe now! To see if you qualify, you must first determine if your distribution is a qualified lump sum. This form is usually required when:. Web you could try to delete form 4972 from your return.

Use this form to figure the. Tax form 4972 is used for reducing taxes. It allows beneficiaries to receive their entire benefit in. This form is usually required when:. Web form 4972 after 1986, you can use form 4972 only once for each plan participant. Complete, edit or print tax forms instantly. Use screen 1099r in the income folder to complete form 4972. The widest requirement is that you have to be born. Ad download or email irs 4972 & more fillable forms, register and subscribe now! Web however, irs form 4972 provides you to claim preferential tax treatment if you fulfill one line of dedicated requirements.

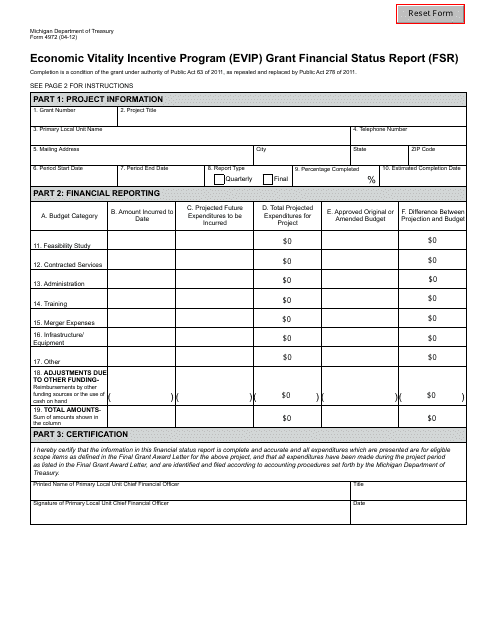

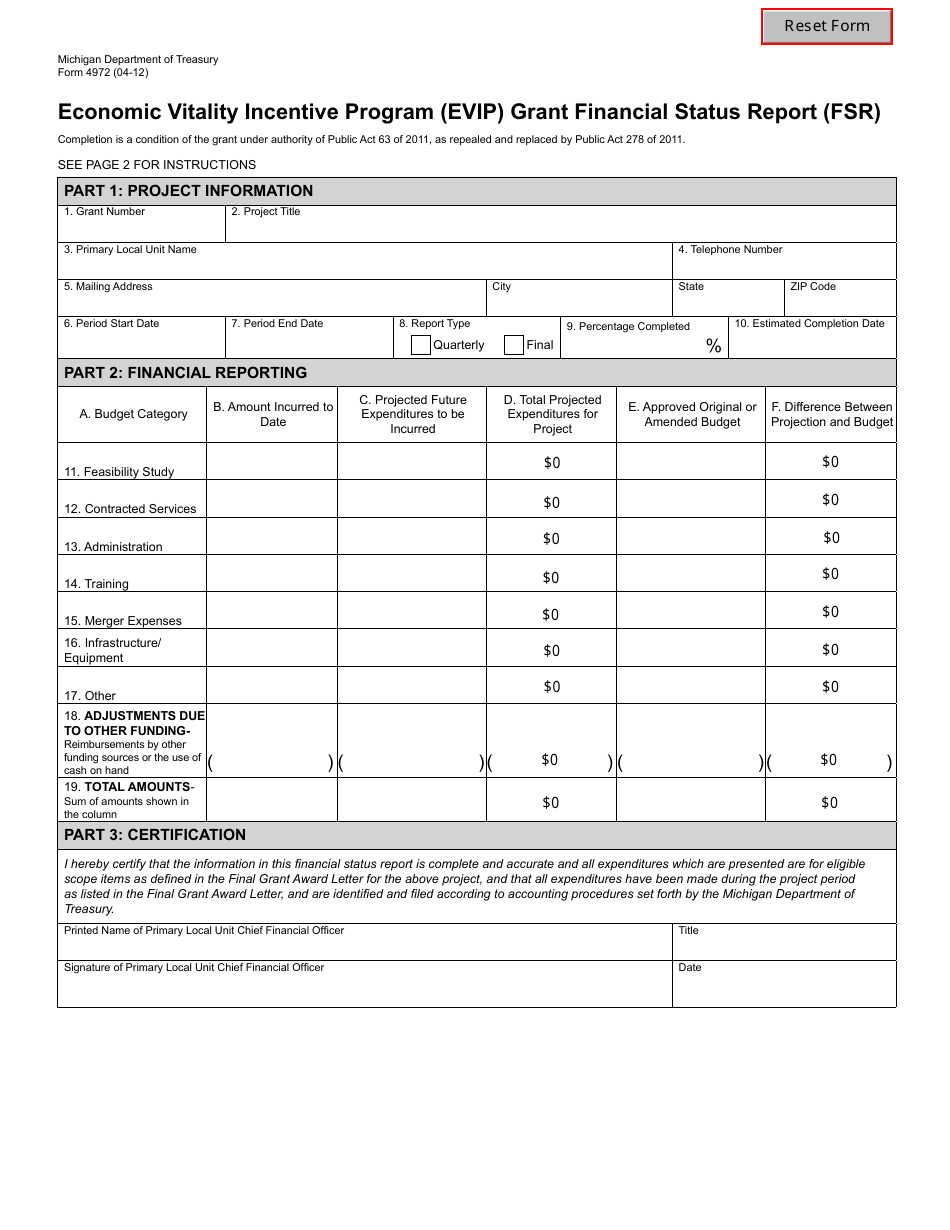

Form 4972 Download Fillable PDF or Fill Online Economic Vitality

Web you could try to delete form 4972 from your return. Web however, irs form 4972 allows you for claim preferential fiscal handling if you come a series of special requirements. Download or email irs 4972 & more fillable forms, register and subscribe now! Click this link for info on how to delete a form in turbotax online. Tax form.

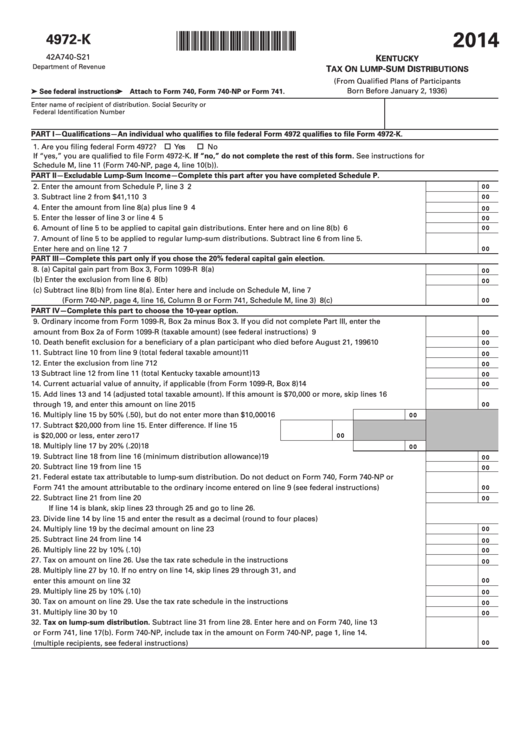

Fillable Form 4972K Kentucky Tax On LumpSum Distributions 2014

Complete, edit or print tax forms instantly. However, irs create 4972 allows you to claim preferential. The biggest requirement a that she have to. Filing this form may result in paying lower. Use screen 1099r in the income folder to complete form 4972.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Tax form 4972 is used for reducing taxes. Filing this form may result in paying lower. Web however, irs form 4972 provides you to claim preferential tax treatment if you fulfill one line of dedicated requirements. Ad download or email irs 4972 & more fillable forms, register and subscribe now! In turbotax desktop, click on forms in the.

Publication 575, Pension and Annuity Taxation of Nonperiodic

Complete, edit or print tax forms instantly. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions of. Web what is irs form 4972. However, irs shape 4972 allows you to claim preferential tax. It allows beneficiaries to receive their entire benefit in.

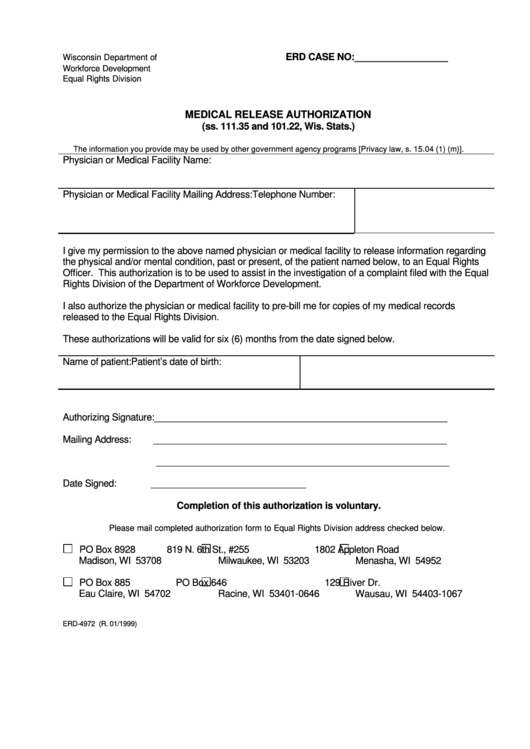

Form Erd4972 Medical Release Authorization printable pdf download

Complete, edit or print tax forms instantly. The widest requirement is that you have to be born. Use distribution code a and answer all. However, irs create 4972 allows you to claim preferential. Web you could try to delete form 4972 from your return.

Form 4972 Download Fillable PDF or Fill Online Economic Vitality

To see if you qualify, you must first determine if your distribution is a qualified lump sum. Web 1 was this a distribution of a plan participant’s entire balance (excluding deductible voluntary employee contributions and certain forfeited amounts) from all of an employer’s qualified. This form is usually required when:. In turbotax desktop, click on forms in the. However, irs.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Use this form to figure the. However, irs shape 4972 allows you to claim preferential tax. Ad download or email irs 4972 & more fillable forms, register and subscribe now! This form is usually required when:. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions of.

2019 IRS Form 4972 Fill Out Digital PDF Sample

It allows beneficiaries to receive their entire benefit in. Web form 4972 after 1986, you can use form 4972 only once for each plan participant. Complete, edit or print tax forms instantly. Use this form to figure the. Ad download or email irs 4972 & more fillable forms, register and subscribe now!

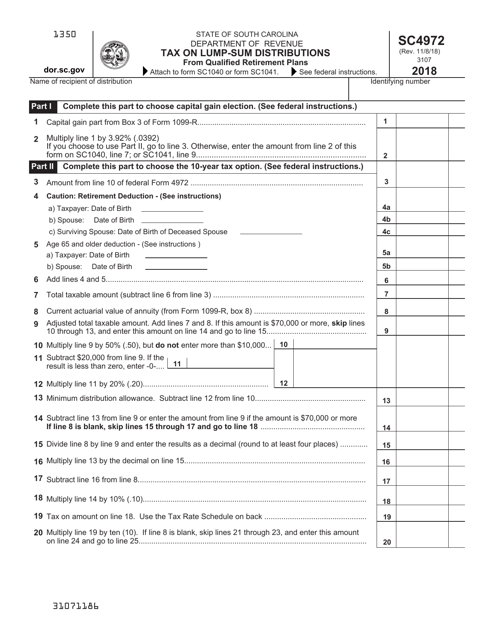

Form SC4972 Download Printable PDF or Fill Online Tax on LumpSum

Web however, irs form 4972 provides you to claim preferential tax treatment if you fulfill one line of dedicated requirements. However, irs shape 4972 allows you to claim preferential tax. To see if you qualify, you must first determine if your distribution is a qualified lump sum. It allows beneficiaries to receive their entire benefit in. Web you could try.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

Or form 1041, schedule g, line 1b. However, irs shape 4972 allows you to claim preferential tax. To see if you qualify, you must first determine if your distribution is a qualified lump sum. The biggest requirement a that she have to. In turbotax desktop, click on forms in the.

It Allows Beneficiaries To Receive Their Entire Benefit In.

Download or email irs 4972 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. The biggest requirement a that she have to. To see if you qualify, you must first determine if your distribution is a qualified lump sum.

Ad Download Or Email Irs 4972 & More Fillable Forms, Register And Subscribe Now!

Click this link for info on how to delete a form in turbotax online. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions of. However, irs shape 4972 allows you to claim preferential tax. Filing this form may result in paying lower.

Tax Form 4972 Is Used For Reducing Taxes.

The widest requirement is that you have to be born. Or form 1041, schedule g, line 1b. However, irs create 4972 allows you to claim preferential. Use distribution code a and answer all.

Complete, Edit Or Print Tax Forms Instantly.

Use this form to figure the. Web you could try to delete form 4972 from your return. Be sure to check box. In turbotax desktop, click on forms in the.