What Is Form 8233

What Is Form 8233 - Federal 8233 form attachments for students. Please email the payroll office at. Download form | view sample. You must complete a form 8233 for each tax year. Web use form 8233 exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien. Its primary function is to claim an exemption from any tax on income from. Web according to the internal revenue service, form 8233 is used by nonresident aliens so that they can request an exemption based on an income tax treaty or personal exemption. Web complete form 8233 for compensation you receive for dependent personal services only if you are claiming a tax treaty withholding exemption for part or all of that income. The irs form 8233 is an employment authorization and certificate that the nra employee files with their employer to claim exemptions from federal income tax. Web 314 rows audience:

Enter your name (surname, first, middle). For example, a foreign politician who makes a paid speaking. Web 314 rows audience: Web the purpose of form 8233 is for nonresidents to avoid double taxation on their income. Web use form 8233 exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien. By filing form 8233, they are looking to claim an exemption from federal income tax withholding. Web instructions for completing form 8233 part i identification of beneficial owner 1 name of individual who is the beneficial owner: Web form 8233 is a form from the internal revenue service (irs) used by nonresident alien individuals. Web tax accounting nonresidents student wages and tax treaties form 8233 form 8233 information form 8233 is valid for one year only and must be completed each calendar. Its primary function is to claim an exemption from any tax on income from.

Web complete form 8233 for compensation you receive for dependent personal services only if you are claiming a tax treaty withholding exemption for part or all of that income. It is also known as “exemption from withholding on compensation for. The irs form 8233 is an employment authorization and certificate that the nra employee files with their employer to claim exemptions from federal income tax. Web instructions for completing form 8233 part i identification of beneficial owner 1 name of individual who is the beneficial owner: Web complete a separate form 8233 for each type of income and give it to each withholding agent for review. The corporate payroll services is required to file a completed irs form 8233 and attachment with the internal revenue service. Download form | view sample. Web use form 8233 exemption from withholding on compensation for independent (and certain dependent) personal services of a nonresident alien. For compensation you receive for independent personal services, complete form 8233 to claim a tax treaty. Enter your name (surname, first, middle).

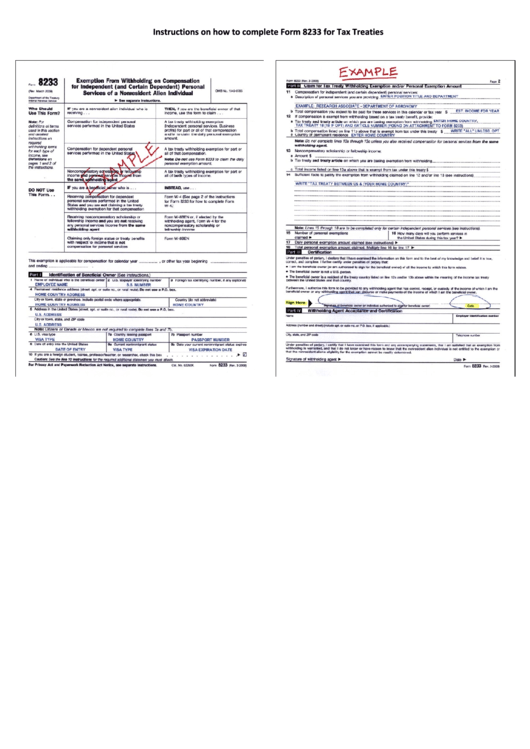

Instructions On How To Complete Form 8233 For Tax Treaties printable

Its primary function is to claim an exemption from any tax on income from. Web complete form 8233 for compensation you receive for dependent personal services only if you are claiming a tax treaty withholding exemption for part or all of that income. You must complete a form 8233 for each tax year. Web form 8233 must be completed by.

Form 8833, TreatyBased Return Position Disclosure Under Section 6114

For example, a foreign politician who makes a paid speaking. Download form | view sample. The artist must also provide either an ssn or itin. Web the purpose of form 8233 is for nonresidents to avoid double taxation on their income. Web the 8233 is an internal revenue service (irs) mandated form to collect correct nonresident alien (nra) taxpayer information.

W8BEN Form and Instructions Irs Tax Forms Withholding Tax

You must complete a form 8233 for each tax year. The irs form 8233 is an employment authorization and certificate that the nra employee files with their employer to claim exemptions from federal income tax. Web the purpose of form 8233 is for nonresidents to avoid double taxation on their income. Web the 8233 is an internal revenue service (irs).

irs form 8233 printable pdf file enter the appropriate calendar year

Federal 8233 form attachments for students. By filing form 8233, they are looking to claim an exemption from federal income tax withholding. Web according to the internal revenue service, form 8233 is used by nonresident aliens so that they can request an exemption based on an income tax treaty or personal exemption. Web form 8233 is a form from the.

Top 17 Form 8233 Templates free to download in PDF format

Web complete a separate form 8233 for each type of income and give it to each withholding agent for review. Web rate of withholding using form 13930. The irs form 8233 is an employment authorization and certificate that the nra employee files with their employer to claim exemptions from federal income tax. Web form 8233 is a form from the.

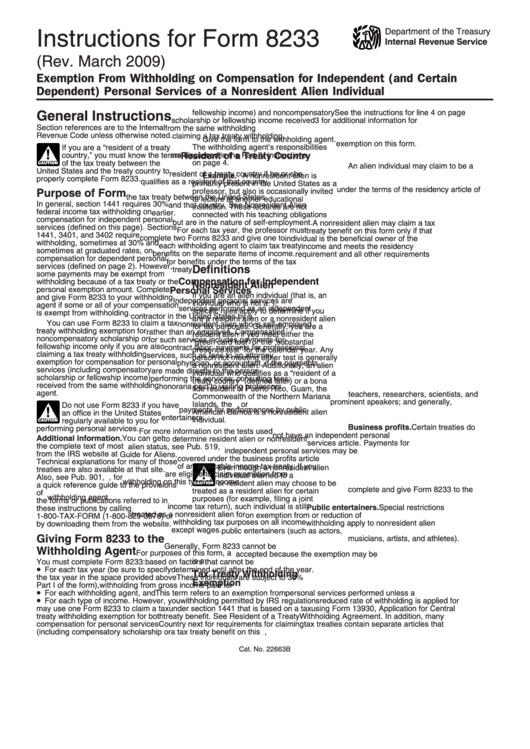

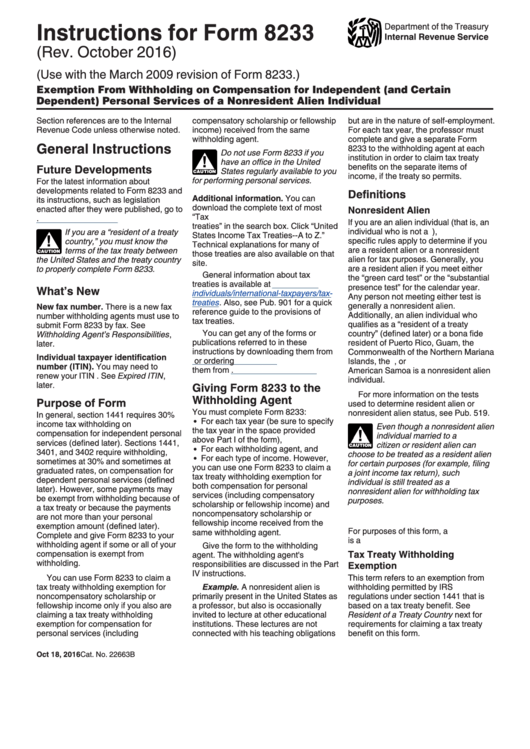

Instructions For Form 8233 2016 printable pdf download

Web 314 rows audience: If an 8233 is not completed, wages will be subject to income tax being deducted from your paycheck. For example, a foreign politician who makes a paid speaking. Web form 8233 is a form from the internal revenue service (irs) used by nonresident alien individuals. Web instructions for completing form 8233 part i identification of beneficial.

8233 Printable PDF Sample

Web complete form 8233 for compensation you receive for dependent personal services only if you are claiming a tax treaty withholding exemption for part or all of that income. Download form | view sample. Web the purpose of form 8233 is for nonresidents to avoid double taxation on their income. For compensation you receive for independent personal services, complete form.

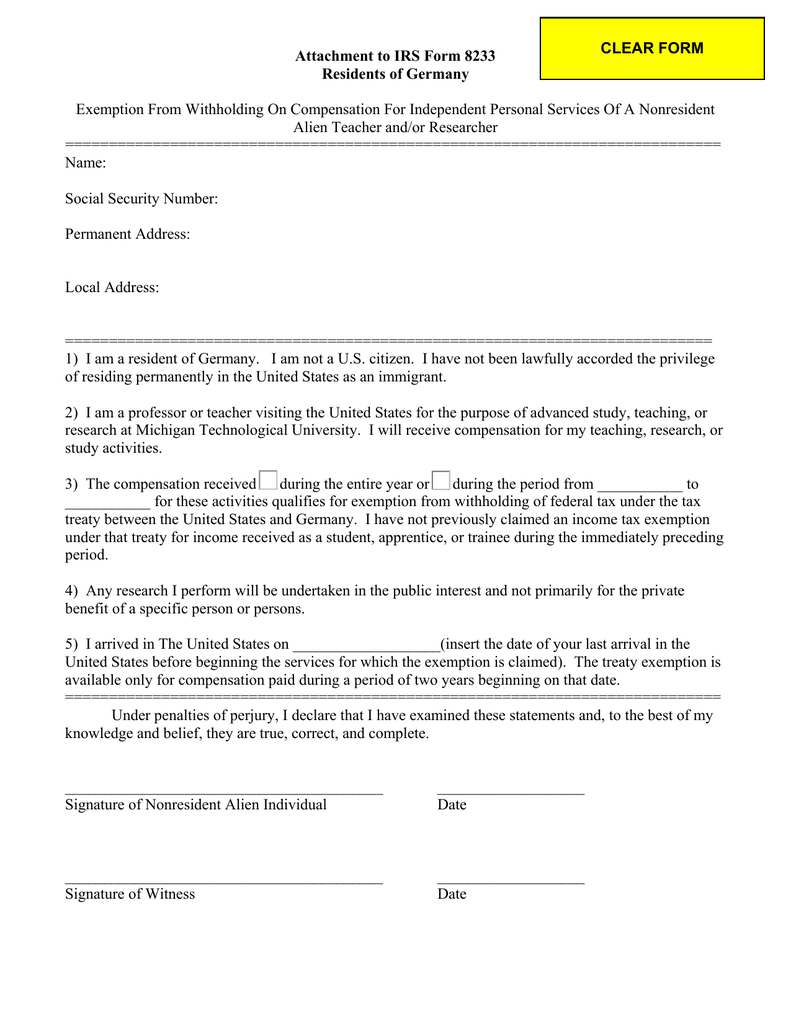

Attachment to IRS Form 8233 Residents of Germany

Download form | view sample. By filing form 8233, they are looking to claim an exemption from federal income tax withholding. Please email the payroll office at. Web 314 rows audience: It is also known as “exemption from withholding on compensation for.

W8BEN Form edocr

Web the purpose of form 8233 is for nonresidents to avoid double taxation on their income. Web tax accounting nonresidents student wages and tax treaties form 8233 form 8233 information form 8233 is valid for one year only and must be completed each calendar. Web 314 rows audience: Download form | view sample. Web federal 8233 forms, attachments and instructions.

Form 8233 Exemption from Withholding on Compensation for Independent

Federal 8233 form attachments for. You must complete a form 8233 for each tax year. If an 8233 is not completed, wages will be subject to income tax being deducted from your paycheck. Web federal 8233 forms, attachments and instructions. Web 314 rows audience:

Enter Your Name (Surname, First, Middle).

The artist must also provide either an ssn or itin. By filing form 8233, they are looking to claim an exemption from federal income tax withholding. Web complete a separate form 8233 for each type of income and give it to each withholding agent for review. Web the purpose of form 8233 is for nonresidents to avoid double taxation on their income.

For Example, A Foreign Politician Who Makes A Paid Speaking.

Web form 8233 is a federal individual income tax form. If an 8233 is not completed, wages will be subject to income tax being deducted from your paycheck. Web rate of withholding using form 13930. For compensation you receive for independent personal services, complete form 8233 to claim a tax treaty.

Its Primary Function Is To Claim An Exemption From Any Tax On Income From.

Please email the payroll office at. Download form | view sample. This irm is intended for customer accounts services issues involving form 8233, exemption from withholding on compensation for. Web form 8233 is a form from the internal revenue service (irs) used by nonresident alien individuals.

The Irs Form 8233 Is An Employment Authorization And Certificate That The Nra Employee Files With Their Employer To Claim Exemptions From Federal Income Tax.

Web according to the internal revenue service, form 8233 is used by nonresident aliens so that they can request an exemption based on an income tax treaty or personal exemption. Web complete form 8233 for compensation you receive for dependent personal services only if you are claiming a tax treaty withholding exemption for part or all of that income. Web the 8233 is an internal revenue service (irs) mandated form to collect correct nonresident alien (nra) taxpayer information for both individuals and entities for. Web 314 rows audience: