What Is Form 8453 Ol

What Is Form 8453 Ol - By signing this form, you. Web i will keep form ftb 8453 on file for four years from the due date of the return or four years from the date the return is filed, whichever is later, and i will make a copy available to the. Web mail form 8453 to the irs within after you’ve received your acknowledgment that the irs has accepted your return to this address: By signing form ftb 8453. Web this form is used to authenticate an electronic employment tax return or request for refund, authorize an electronic return originator (ero) or an intermediate. And 1099r, distributions from pensions, annuities,. Web information about form 8453, u.s. Web forms and publications about filing your indiana taxes electronically for individuals and corporations can be found in the table below. Web do not mail this form to the ftb. Web do not mail this form to the ftb.

If a joint return, or request for refund, your spouse must also sign. Web forms and publications about filing your indiana taxes electronically for individuals and corporations can be found in the table below. By signing form ftb 8453. If you do not receive an acknowledgement, you must contact your intermediate service provider. Individual income tax transmittal for an irs. Web do not mail this form to the ftb. Web do not mail this form to the ftb. By signing this form, you. Individual income tax transmittal for an irs. Web mail form 8453 to the irs within after you’ve received your acknowledgment that the irs has accepted your return to this address:

If a joint return, or request for refund, your spouse must also sign. Web this form is used to authenticate an electronic employment tax return or request for refund, authorize an electronic return originator (ero) or an intermediate. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Individual income tax transmittal for an irs. Web do not mail this form to the ftb. By signing this form, you. Web mail form 8453 to the irs within after you’ve received your acknowledgment that the irs has accepted your return to this address: By signing form ftb 8453. Individual income tax transmittal for an irs. Web forms and publications about filing your indiana taxes electronically for individuals and corporations can be found in the table below.

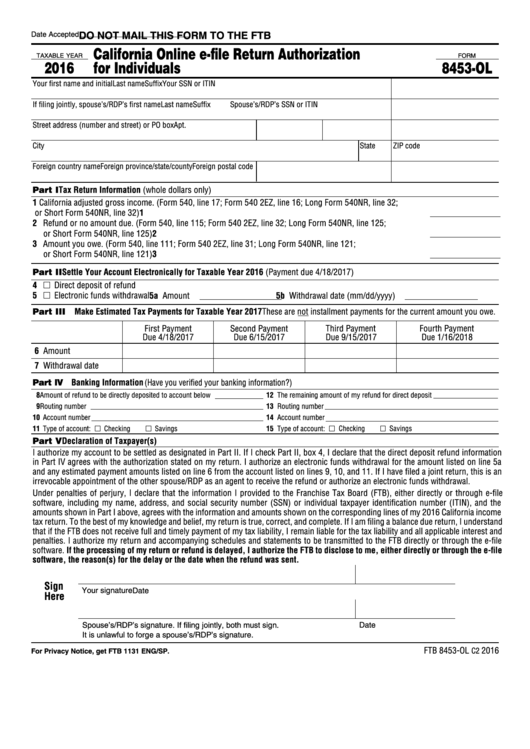

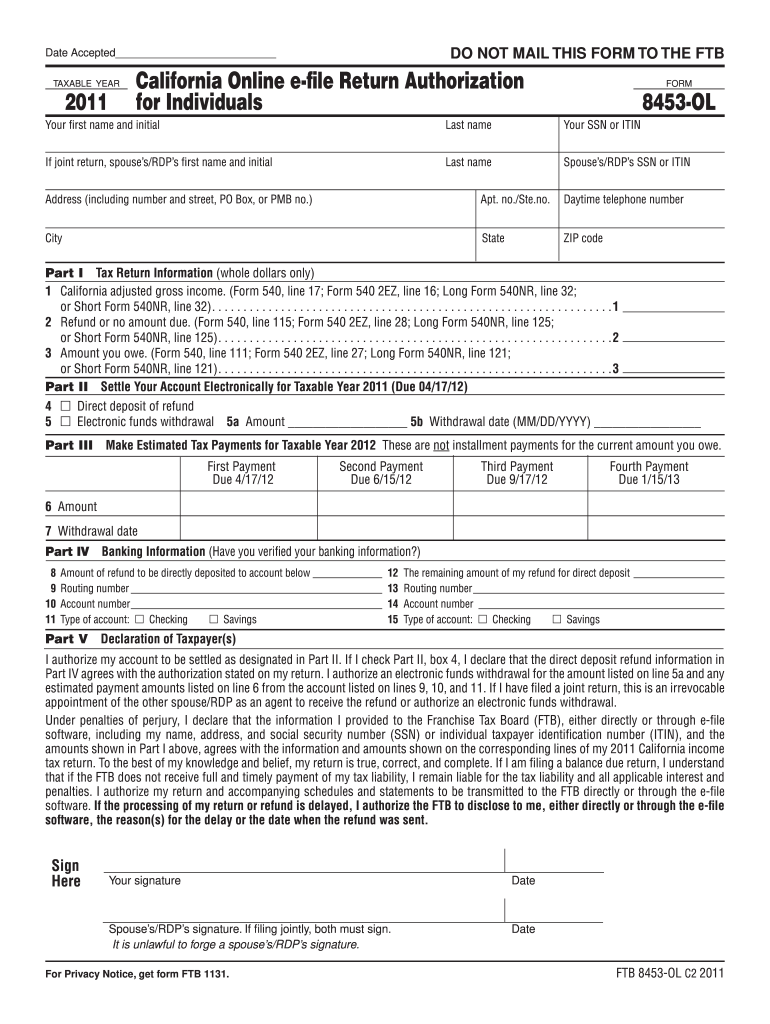

Fillable Form 8453Ol California Online EFile Return Authorization

If a joint return, or request for refund, your spouse must also sign. Web this form is used to authenticate an electronic employment tax return or request for refund, authorize an electronic return originator (ero) or an intermediate. Web do not mail this form to the ftb. By signing this form, you. Web do not mail this form to the.

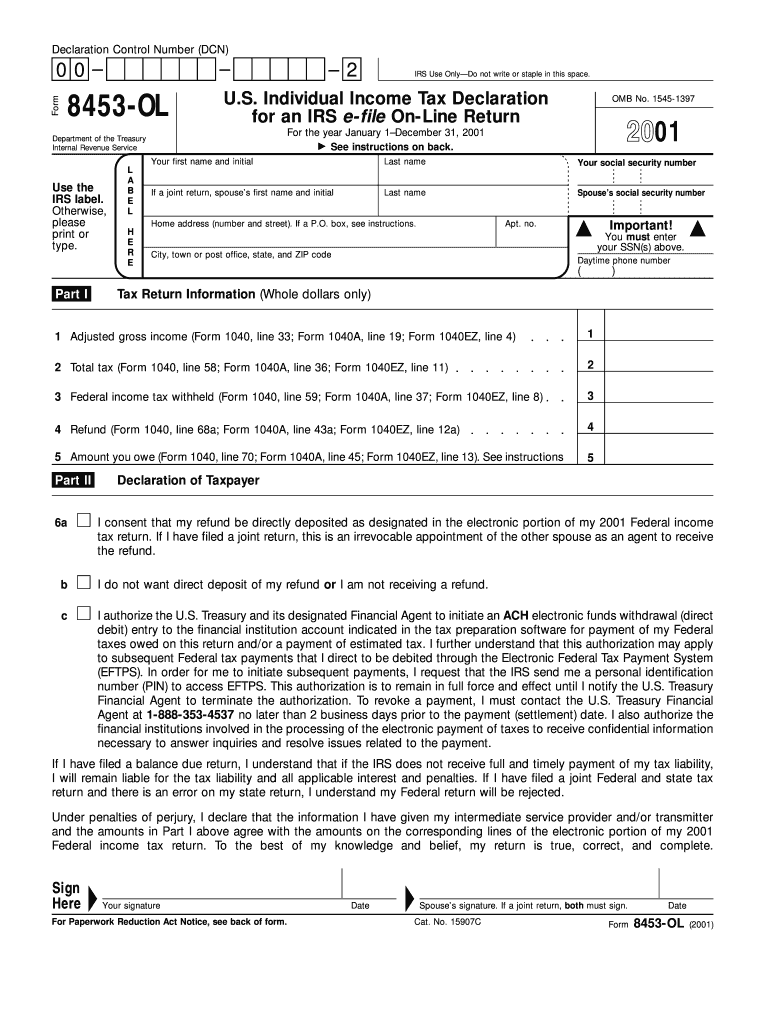

8453 ol Fill out & sign online DocHub

Web do not mail this form to the ftb. Web do not mail this form to the ftb. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. If you do not receive an acknowledgement, you must contact.

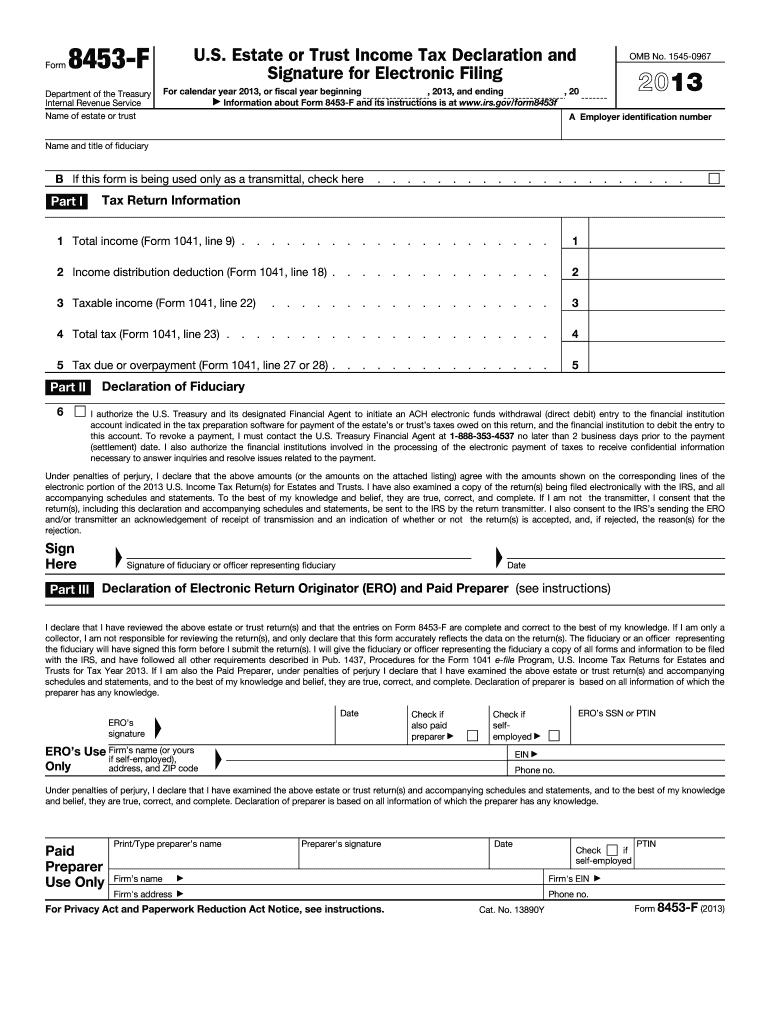

20132021 Form IRS 8453F Fill Online, Printable, Fillable, Blank

Web this form is used to authenticate an electronic employment tax return or request for refund, authorize an electronic return originator (ero) or an intermediate. Web do not mail this form to the ftb. Web forms and publications about filing your indiana taxes electronically for individuals and corporations can be found in the table below. Web most taxpayers are required.

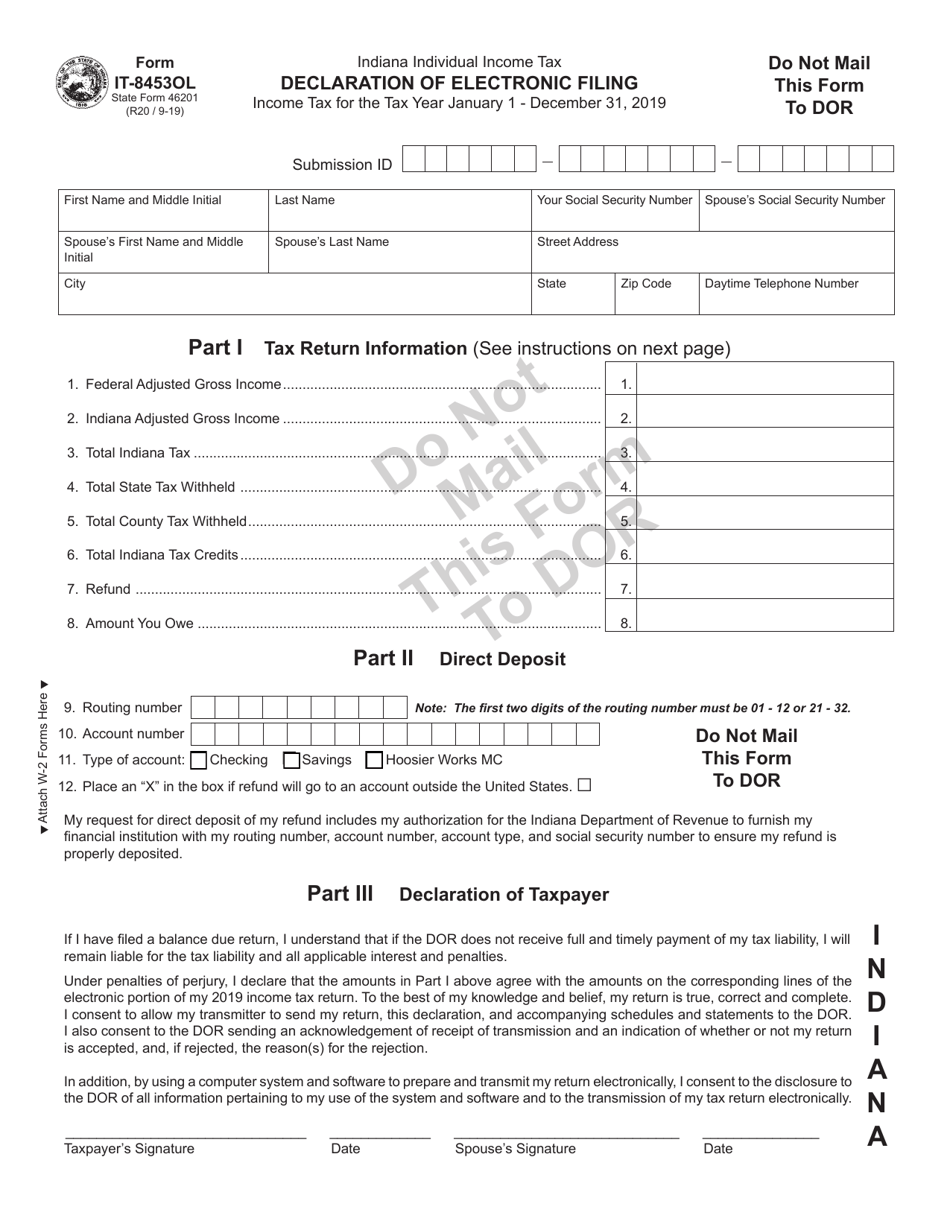

Form IT8453OL (State Form 46201) Download Fillable PDF or Fill Online

If you do not receive an acknowledgement, you must contact your intermediate service provider. Web information about form 8453, u.s. Individual income tax transmittal for an irs. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. By.

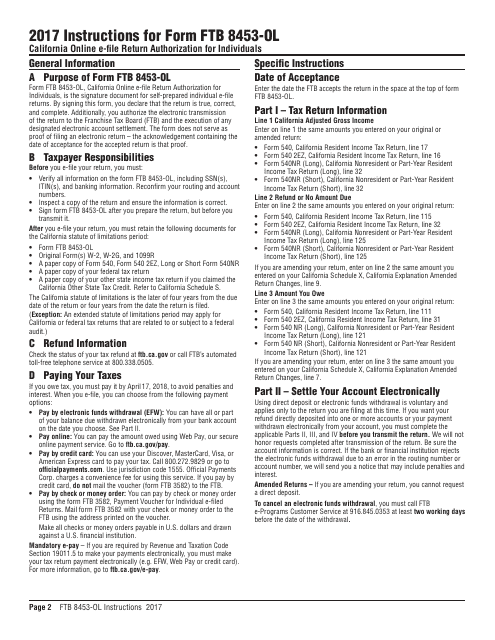

Instructions for Form Ftb 8453ol California Online EFile Return

If a joint return, or request for refund, your spouse must also sign. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web mail form 8453 to the irs within after you’ve received your acknowledgment that the.

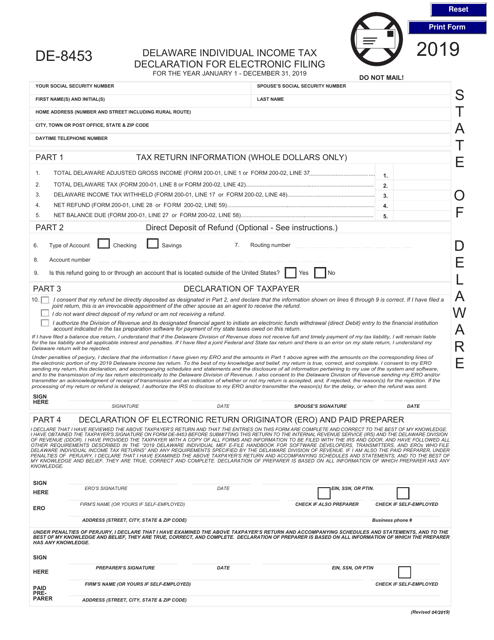

Form DE8453 Download Fillable PDF or Fill Online Delaware Individual

Web i will keep form ftb 8453 on file for four years from the due date of the return or four years from the date the return is filed, whichever is later, and i will make a copy available to the. Web do not mail this form to the ftb. Web do not mail this form to the ftb. By.

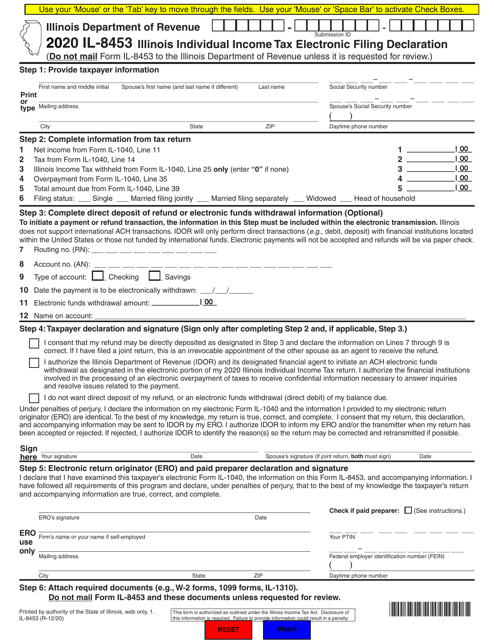

Form IL8453 Download Fillable PDF or Fill Online Illinois Individual

Web do not mail this form to the ftb. Web i will keep form ftb 8453 on file for four years from the due date of the return or four years from the date the return is filed, whichever is later, and i will make a copy available to the. If a joint return, or request for refund, your spouse.

Form 8453OL Fill out & sign online DocHub

Web forms and publications about filing your indiana taxes electronically for individuals and corporations can be found in the table below. If a joint return, or request for refund, your spouse must also sign. Web mail form 8453 to the irs within after you’ve received your acknowledgment that the irs has accepted your return to this address: Web i will.

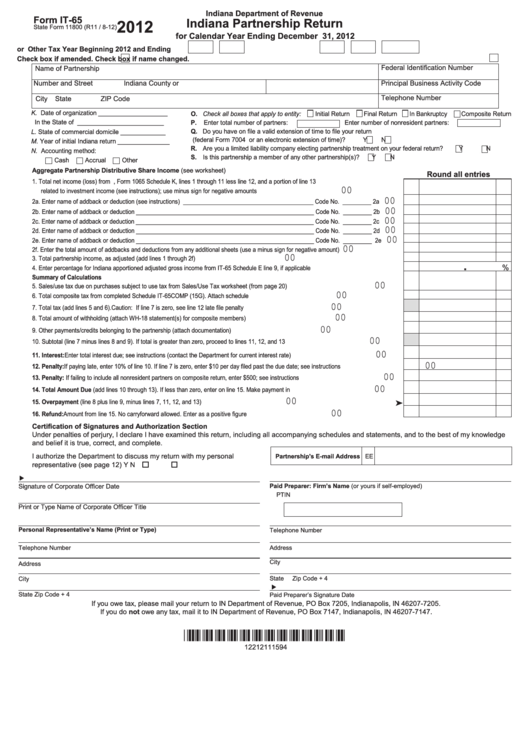

Fillable Form It65 Indiana Partnership Return 2012 printable pdf

And 1099r, distributions from pensions, annuities,. Web information about form 8453, u.s. By signing this form, you. By signing form ftb 8453. Web do not mail this form to the ftb.

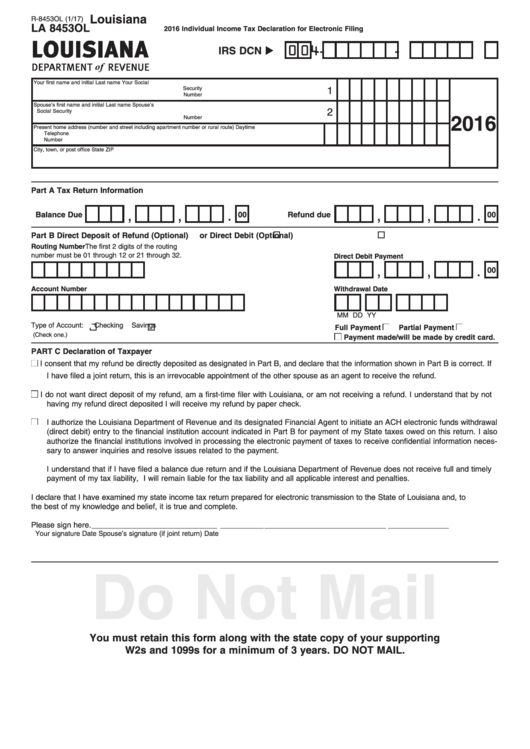

8453 Ol Form Louisiana Department Of Revenue Individual Tax

Web information about form 8453, u.s. By signing form ftb 8453. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web do not mail this form to the ftb. Web do not mail this form to the.

Web Do Not Mail This Form To The Ftb.

Individual income tax transmittal for an irs. Web i will keep form ftb 8453 on file for four years from the due date of the return or four years from the date the return is filed, whichever is later, and i will make a copy available to the. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web information about form 8453, u.s.

If You Do Not Receive An Acknowledgement, You Must Contact Your Intermediate Service Provider.

Individual income tax transmittal for an irs. Web this form is used to authenticate an electronic employment tax return or request for refund, authorize an electronic return originator (ero) or an intermediate. By signing this form, you. Web forms and publications about filing your indiana taxes electronically for individuals and corporations can be found in the table below.

Web Do Not Mail This Form To The Ftb.

Web mail form 8453 to the irs within after you’ve received your acknowledgment that the irs has accepted your return to this address: By signing form ftb 8453. And 1099r, distributions from pensions, annuities,. If a joint return, or request for refund, your spouse must also sign.