What Is Form 851

What Is Form 851 - Web a consolidated tax return needs to show the income statement and balance sheets of each and every subsidiary, with the later for both beginning and ending of the. Income tax return for cooperative associations for calendar year 2022 or tax year beginning,. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. The parent corporation of an affiliated group files form 851 with its consolidated income tax return to: Request for taxpayer advocate service assistance (and application for taxpayer assistance order). December 2010) department of the treasury internal revenue service. Unit of issue (s) pdf (this form may require. Web form 851 is a federal corporate income tax form. Web this form must be completed by the parent corporation for itself and for corporations in the affiliated group. December 2005) affiliations schedule file with each consolidated income tax return.

Note that federally disregarded lps or llcs are not listed on form 851, as this form only lists corporations. This form must be used by taxpayers filing a florida consolidated income tax return and is used to report the members of the consolidated. Web this form must be completed by the parent corporation for itself and for corporations in the affiliated group. Unit of issue (s) pdf (this form may require. December 2005) affiliations schedule file with each consolidated income tax return. The parent corporation of an affiliated group files form 851 with its consolidated income tax return to: Web generaldependencysmall is attached at the form or schedule level and allows for an explanation of up to 5,000 characters (efile type is texttype with maximum length 5,000. Report the amount of overpayment. Web form 851 is a federal corporate income tax form. File with each consolidated income tax return.

The parent corporation of an affiliated group files form 851 with its consolidated income tax return to: Web form 851 is a federal corporate income tax form. Request for taxpayer advocate service assistance (and application for taxpayer assistance order). Income tax return for cooperative associations for calendar year 2022 or tax year beginning,. Web generaldependencysmall is attached at the form or schedule level and allows for an explanation of up to 5,000 characters (efile type is texttype with maximum length 5,000. Web corporations filing a consolidated income tax return do so on form 1120 using the parent company's tax year. Web this form must be completed by the parent corporation for itself and for corporations in the affiliated group. They must attach form 851, which is an affiliation schedule, and. File with each consolidated income tax return. Web form 851 contains details about each affiliated corporation— its common parent, tax year end, number of shares of voting stock owned by the parent, and the total value.

Magic Form 851 Beli Dantelli Yüksek Bel Siyah Hamile Külotu

File with each consolidated income tax return. Web a consolidated tax return needs to show the income statement and balance sheets of each and every subsidiary, with the later for both beginning and ending of the. Income tax return for cooperative associations for calendar year 2022 or tax year beginning,. Web da form 581. Web form 851 contains details about.

USCIS sends automatic 18month residency extension notices to Removal

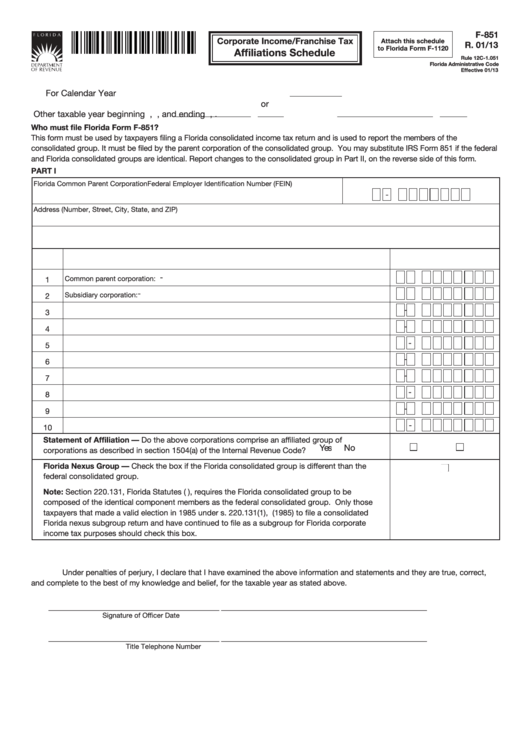

This form must be used by taxpayers filing a florida consolidated income tax return and is used to report the members of the consolidated. Web this form must be completed by the parent corporation for itself and for corporations in the affiliated group. December 2010) department of the treasury internal revenue service. The parent corporation of an affiliated group files.

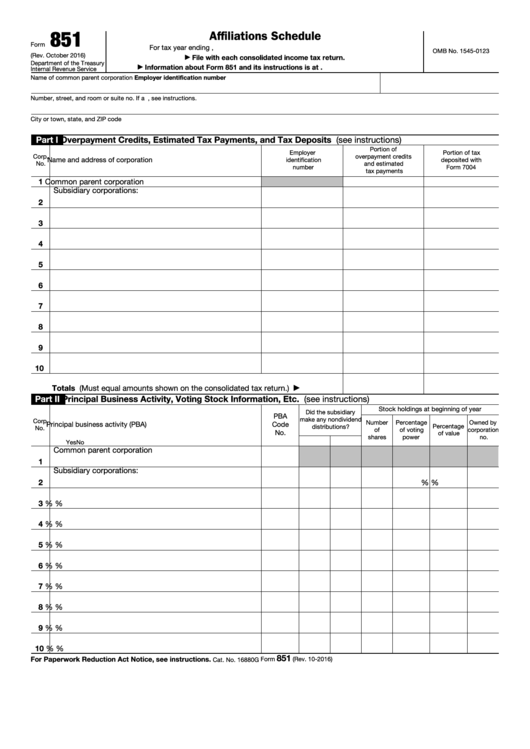

Fillable Form 851 Affiliations Schedule For Tax Year Ending 2016

File with each consolidated income tax return. Web a consolidated tax return needs to show the income statement and balance sheets of each and every subsidiary, with the later for both beginning and ending of the. They must attach form 851, which is an affiliation schedule, and. Request for taxpayer advocate service assistance (and application for taxpayer assistance order). December.

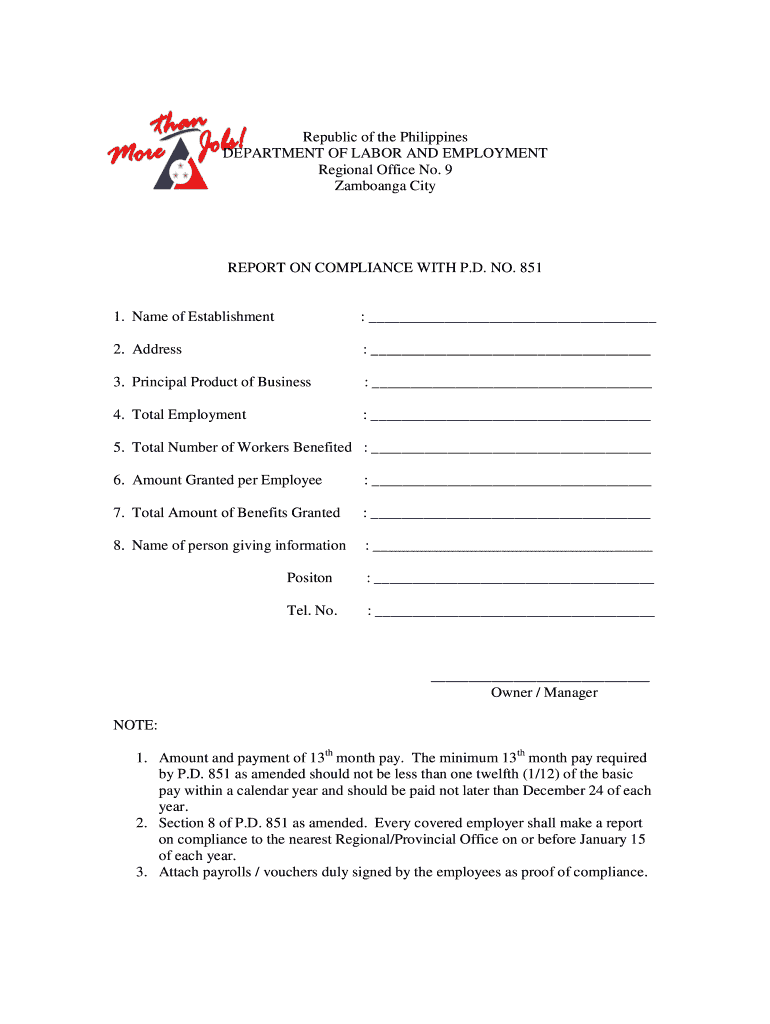

Pd 851 Form Fill Out and Sign Printable PDF Template signNow

Note that federally disregarded lps or llcs are not listed on form 851, as this form only lists corporations. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Request for taxpayer advocate service assistance (and application for taxpayer assistance order). Web corporations filing a consolidated income tax return do so on form.

Aoc 851 2002 form Fill out & sign online DocHub

This form must be used by taxpayers filing a florida consolidated income tax return and is used to report the members of the consolidated. They must attach form 851, which is an affiliation schedule, and. Web this form must be completed by the parent corporation for itself and for corporations in the affiliated group. Web form 851 contains details about.

FL F851 2016 Fill out Tax Template Online US Legal Forms

They must attach form 851, which is an affiliation schedule, and. Web da form 581. Income tax return for cooperative associations for calendar year 2022 or tax year beginning,. File with each consolidated income tax return. Web the consolidated return, with form 851 (affiliations schedule) attached, shall be filed with the district director with whom the common parent would have.

Form 851 Affiliations Schedule (2010) Free Download

Note that federally disregarded lps or llcs are not listed on form 851, as this form only lists corporations. Web what is the 851 tax form? The parent corporation of an affiliated group files form 851 with its consolidated income tax return to: They must attach form 851, which is an affiliation schedule, and. File with each consolidated income tax.

Form 851 Affiliations Schedule (2010) Free Download

This form must be used by taxpayers filing a florida consolidated income tax return and is used to report the members of the consolidated. The parent corporation of an affiliated group files form 851 with its consolidated income tax return to: Web generaldependencysmall is attached at the form or schedule level and allows for an explanation of up to 5,000.

Form F851 Corporate Tax Affiliations Schedule

Note that federally disregarded lps or llcs are not listed on form 851, as this form only lists corporations. Report the amount of overpayment. Web form 851 is a federal corporate income tax form. Web da form 581. Income tax return for cooperative associations for calendar year 2022 or tax year beginning,.

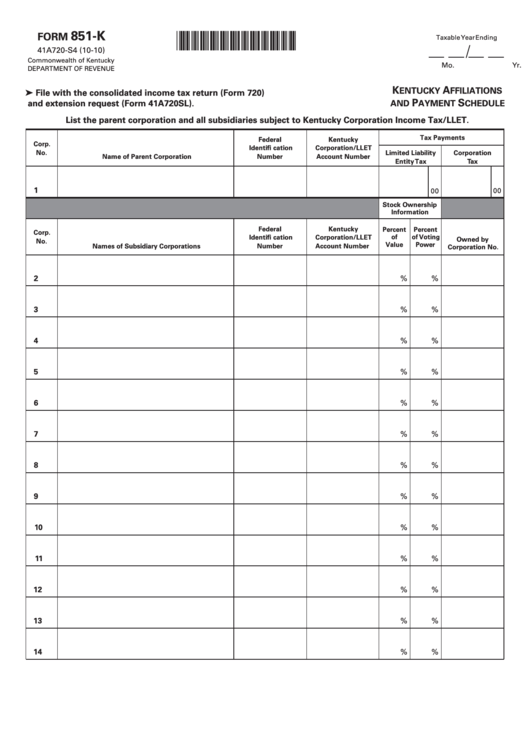

Form 851K Kentucky Affiliations And Payment Schedule Kentucky

Web da form 581. Web the consolidated return, with form 851 (affiliations schedule) attached, shall be filed with the district director with whom the common parent would have filed a separate return. December 2005) affiliations schedule file with each consolidated income tax return. Web this form must be completed by the parent corporation for itself and for corporations in the.

Request For Taxpayer Advocate Service Assistance (And Application For Taxpayer Assistance Order).

Web form 851 is a federal corporate income tax form. The parent corporation of an affiliated group files form 851 with its consolidated income tax return to: They must attach form 851, which is an affiliation schedule, and. Note that federally disregarded lps or llcs are not listed on form 851, as this form only lists corporations.

Web Form 851 Contains Details About Each Affiliated Corporation— Its Common Parent, Tax Year End, Number Of Shares Of Voting Stock Owned By The Parent, And The Total Value.

December 2010) department of the treasury internal revenue service. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. December 2005) affiliations schedule file with each consolidated income tax return. Web what is the 851 tax form?

Web This Form Must Be Completed By The Parent Corporation For Itself And For Corporations In The Affiliated Group.

Web a consolidated tax return needs to show the income statement and balance sheets of each and every subsidiary, with the later for both beginning and ending of the. Web generaldependencysmall is attached at the form or schedule level and allows for an explanation of up to 5,000 characters (efile type is texttype with maximum length 5,000. Web the consolidated return, with form 851 (affiliations schedule) attached, shall be filed with the district director with whom the common parent would have filed a separate return. Income tax return for cooperative associations for calendar year 2022 or tax year beginning,.

File With Each Consolidated Income Tax Return.

This form must be used by taxpayers filing a florida consolidated income tax return and is used to report the members of the consolidated. Web da form 581. Information found on the federal form 851 includes: Report the amount of overpayment.