What Is Form 8804

What Is Form 8804 - Web form 8804 is filed separately from the form 1065, u.s. It is covered by section 1446 internal revenue code, created by the department of the treasury. Web forms 8804, 8805, and 8813: Web use this section to force the effectively connected taxable income allocable to foreign partners and to enter reductions to effectively connected taxable income for form 8804,. Web form 8804, annual return for partnership withholding tax (section 1446) (online) title form 8804, annual return for partnership withholding tax (section 1446) [electronic resource]. Any additional withholding tax owed for the partnership's tax year is paid (in u. Web form 8804 is utilized to report the partnership’s total liability for the tax year as stipulated in section 1446. This form is also a transmittal one for form 8805. Web form 8804 is an annual summary statement of the various forms 8805 that are sent to the foreign partners of a u.s. Web form 8804 summarizes any form 8805 you sent to your foreign partners, even if you didn’t withhold taxes.

It is due by the 15th day of the third month following the end of the partnership's. Web 8804 annual return for partnership withholding tax form 8804 department of the treasury internal revenue service annual return for partnership withholding tax (section 1446). Form 8804, annual return for partnership withholding tax (section 1446), form 8805, foreign partner’s information statement of. Web the 8804 form is also known as annual return for partnership withholding tax. Web form 8804, annual return for partnership withholding tax (section 1446) specifically is used to report the total liability under section 1446 for the. Web form 8804 is also a transmittal form for forms 8805. Web form 8804 is utilized to report the partnership’s total liability for the tax year as stipulated in section 1446. Web form 8804 is a tax form used by partnerships with foreign partners to report and pay their share of effectively connected taxable income (ecti). Web form 8804 is an annual summary statement of the various forms 8805 that are sent to the foreign partners of a u.s. Web use this section to force the effectively connected taxable income allocable to foreign partners and to enter reductions to effectively connected taxable income for form 8804,.

Web use this section to force the effectively connected taxable income allocable to foreign partners and to enter reductions to effectively connected taxable income for form 8804,. It is due by the 15th day of the third month following the end of the partnership's. Web forms 8804, 8805, and 8813: Web form 8804 is a tax form used by partnerships with foreign partners to report and pay their share of effectively connected taxable income (ecti). Any additional withholding tax owed for the partnership's tax year is paid (in u. Web form 8804 is an annual summary statement of the various forms 8805 that are sent to the foreign partners of a u.s. Form 8804, annual return for partnership withholding tax (section 1446), form 8805, foreign partner’s information statement of. Web 8804 annual return for partnership withholding tax form 8804 department of the treasury internal revenue service annual return for partnership withholding tax (section 1446). Web form 8804, annual return for partnership withholding tax (section 1446) specifically is used to report the total liability under section 1446 for the. Web form 8804 summarizes any form 8805 you sent to your foreign partners, even if you didn’t withhold taxes.

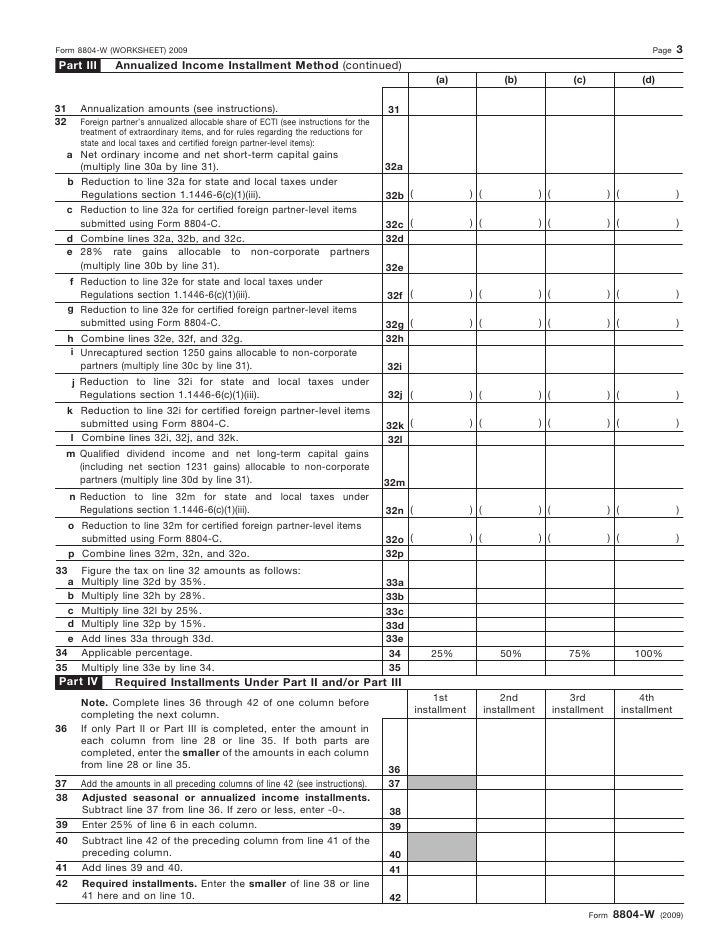

Form 8804W Installment Payments of Section 1446 Tax for Partnership…

It is due by the 15th day of the third month following the end of the partnership's. Web form 8804 summarizes any form 8805 you sent to your foreign partners, even if you didn’t withhold taxes. Form 8804 is also a transmittal form for form(s) 8805. Web form 8804 is an annual summary statement of the various forms 8805 that.

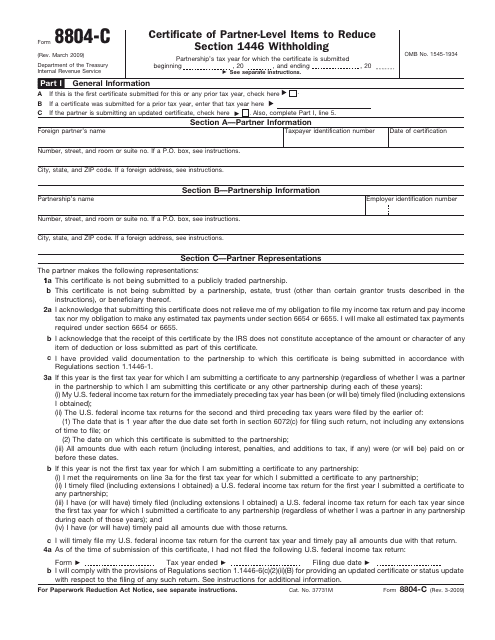

Form 8804C Certificate of PartnerLevel Items to Reduce Section 1446

Web form 8804 is filed separately from the form 1065, u.s. Web form 8804 is also a transmittal form for forms 8805. Individual income tax return,” is a form that taxpayers can file with the irs if. Form 8804, annual return for partnership withholding tax (section 1446), form 8805, foreign partner’s information statement of. Any additional withholding tax owed for.

2019 8804 2019 Blank Sample to Fill out Online in PDF

This form is also a transmittal one for form 8805. It is covered by section 1446 internal revenue code, created by the department of the treasury. Any additional withholding tax owed for the partnership's tax year is paid (in u. Web form 8804 is an annual summary statement of the various forms 8805 that are sent to the foreign partners.

Form 8804 (Schedule A) Penalty for Underpayment of Estimated Section…

Web form 8804, annual return for partnership withholding tax (section 1446) specifically is used to report the total liability under section 1446 for the. Web form 8804 is utilized to report the partnership’s total liability for the tax year as stipulated in section 1446. Web 8804 annual return for partnership withholding tax form 8804 department of the treasury internal revenue.

IRS Form 8804C Download Fillable PDF or Fill Online Certificate of

Form 8804, annual return for partnership withholding tax (section 1446), form 8805, foreign partner’s information statement of. Web form 8804 is utilized to report the partnership’s total liability for the tax year as stipulated in section 1446. This form is also a transmittal one for form 8805. Web form 8804 is filed separately from the form 1065, u.s. Web use.

Form 8804C Certificate of PartnerLevel Items to Reduce Section 1446

Web use form 8804 to report the total liability under section 1446 for the partnership's tax year. This form is also a transmittal one for form 8805. Web form 8804, annual return for partnership withholding tax (section 1446) (online) title form 8804, annual return for partnership withholding tax (section 1446) [electronic resource]. It is due by the 15th day of.

Form 8804 Annual Return for Partnership Withholding Tax

Any additional withholding tax owed for the partnership's tax year is paid (in u. It is due by the 15th day of the third month following the end of the partnership's. Web form 8804 summarizes any form 8805 you sent to your foreign partners, even if you didn’t withhold taxes. Individual income tax return,” is a form that taxpayers can.

3.21.15 Withholding on Foreign Partners Internal Revenue Service

It is due by the 15th day of the third month following the end of the partnership's. This form is also a transmittal one for form 8805. Web form 8804 is utilized to report the partnership’s total liability for the tax year as stipulated in section 1446. Web the 8804 form is also known as annual return for partnership withholding.

Form 8804 (Schedule A) Penalty for Underpayment of Estimated Section…

Any additional withholding tax owed for the partnership's tax year is paid (in u. Individual income tax return,” is a form that taxpayers can file with the irs if. Web use this section to force the effectively connected taxable income allocable to foreign partners and to enter reductions to effectively connected taxable income for form 8804,. Web the 8804 form.

Form 8804 (Schedule A) Penalty for Underpayment of Estimated Section…

This form is also a transmittal one for form 8805. It is covered by section 1446 internal revenue code, created by the department of the treasury. Web the 8804 form is also known as annual return for partnership withholding tax. Use form 8805 to show the. Partnership or the foreign partners of a foreign partnership with.

Web Form 8804 Is Utilized To Report The Partnership’s Total Liability For The Tax Year As Stipulated In Section 1446.

Web 8804 annual return for partnership withholding tax form 8804 department of the treasury internal revenue service annual return for partnership withholding tax (section 1446). Web form 8804 is also a transmittal form for forms 8805. Web form 7204, consent to extend the time to assess tax related to contested foreign income taxes—provisional foreign tax credit agreement. Web form 8804 summarizes any form 8805 you sent to your foreign partners, even if you didn’t withhold taxes.

Web Form 8804 Is An Annual Summary Statement Of The Various Forms 8805 That Are Sent To The Foreign Partners Of A U.s.

Form 8804, annual return for partnership withholding tax (section 1446), form 8805, foreign partner’s information statement of. This form is also a transmittal one for form 8805. Web the 8804 form is also known as annual return for partnership withholding tax. Web form 8804, annual return for partnership withholding tax (section 1446) specifically is used to report the total liability under section 1446 for the.

It Is Covered By Section 1446 Internal Revenue Code, Created By The Department Of The Treasury.

Web forms 8804, 8805, and 8813: It is due by the 15th day of the third month following the end of the partnership's. Web form 8804 is filed separately from the form 1065, u.s. Use form 8805 to show the.

Partnership Or The Foreign Partners Of A Foreign Partnership With.

Web use this section to force the effectively connected taxable income allocable to foreign partners and to enter reductions to effectively connected taxable income for form 8804,. Form 8804 is also a transmittal form for form(s) 8805. Any additional withholding tax owed for the partnership's tax year is paid (in u. Web form 4868, also known as an “application for automatic extension of time to file u.s.