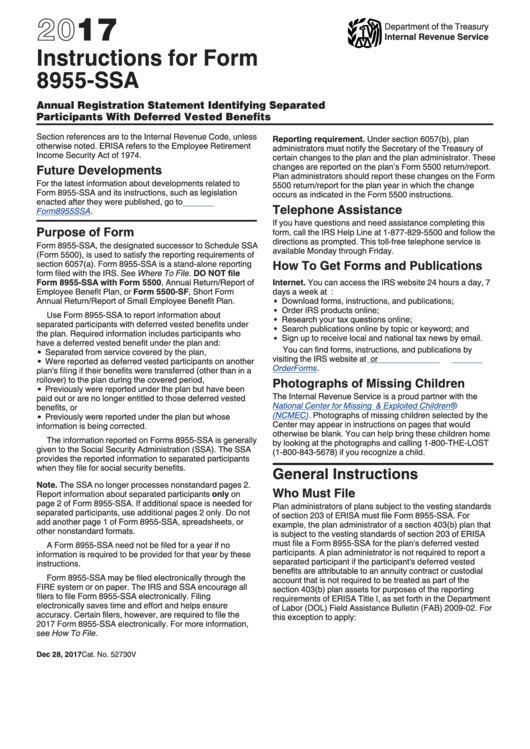

What Is Form 8955-Ssa

What Is Form 8955-Ssa - Software to create files in the proper format for filing electronically to the irs. Seven months after the close of the plan year. If the plan administrator or plan sponsor complete the form electronically, the irs transfers the electronic data. To help put this particular form in context, the “ssa” stands for social security administration, and the purpose of the form is to reunite retiring participants with old retirement account balances they may have forgotten about. Also, like the form 5500, the deadline can be extended by 2 ½ months by submitting form 5558. Annual registration statement identifying separated participants with deferred vested benefits created date:

Software to create files in the proper format for filing electronically to the irs. Also, like the form 5500, the deadline can be extended by 2 ½ months by submitting form 5558. If the plan administrator or plan sponsor complete the form electronically, the irs transfers the electronic data. Annual registration statement identifying separated participants with deferred vested benefits created date: To help put this particular form in context, the “ssa” stands for social security administration, and the purpose of the form is to reunite retiring participants with old retirement account balances they may have forgotten about. Seven months after the close of the plan year.

Annual registration statement identifying separated participants with deferred vested benefits created date: Seven months after the close of the plan year. Software to create files in the proper format for filing electronically to the irs. If the plan administrator or plan sponsor complete the form electronically, the irs transfers the electronic data. To help put this particular form in context, the “ssa” stands for social security administration, and the purpose of the form is to reunite retiring participants with old retirement account balances they may have forgotten about. Also, like the form 5500, the deadline can be extended by 2 ½ months by submitting form 5558.

FAQ on Forms 5500, 8955SSA, and 5330

Annual registration statement identifying separated participants with deferred vested benefits created date: Seven months after the close of the plan year. Also, like the form 5500, the deadline can be extended by 2 ½ months by submitting form 5558. If the plan administrator or plan sponsor complete the form electronically, the irs transfers the electronic data. To help put this.

Top 5 Form 8955ssa Templates free to download in PDF format

To help put this particular form in context, the “ssa” stands for social security administration, and the purpose of the form is to reunite retiring participants with old retirement account balances they may have forgotten about. Software to create files in the proper format for filing electronically to the irs. If the plan administrator or plan sponsor complete the form.

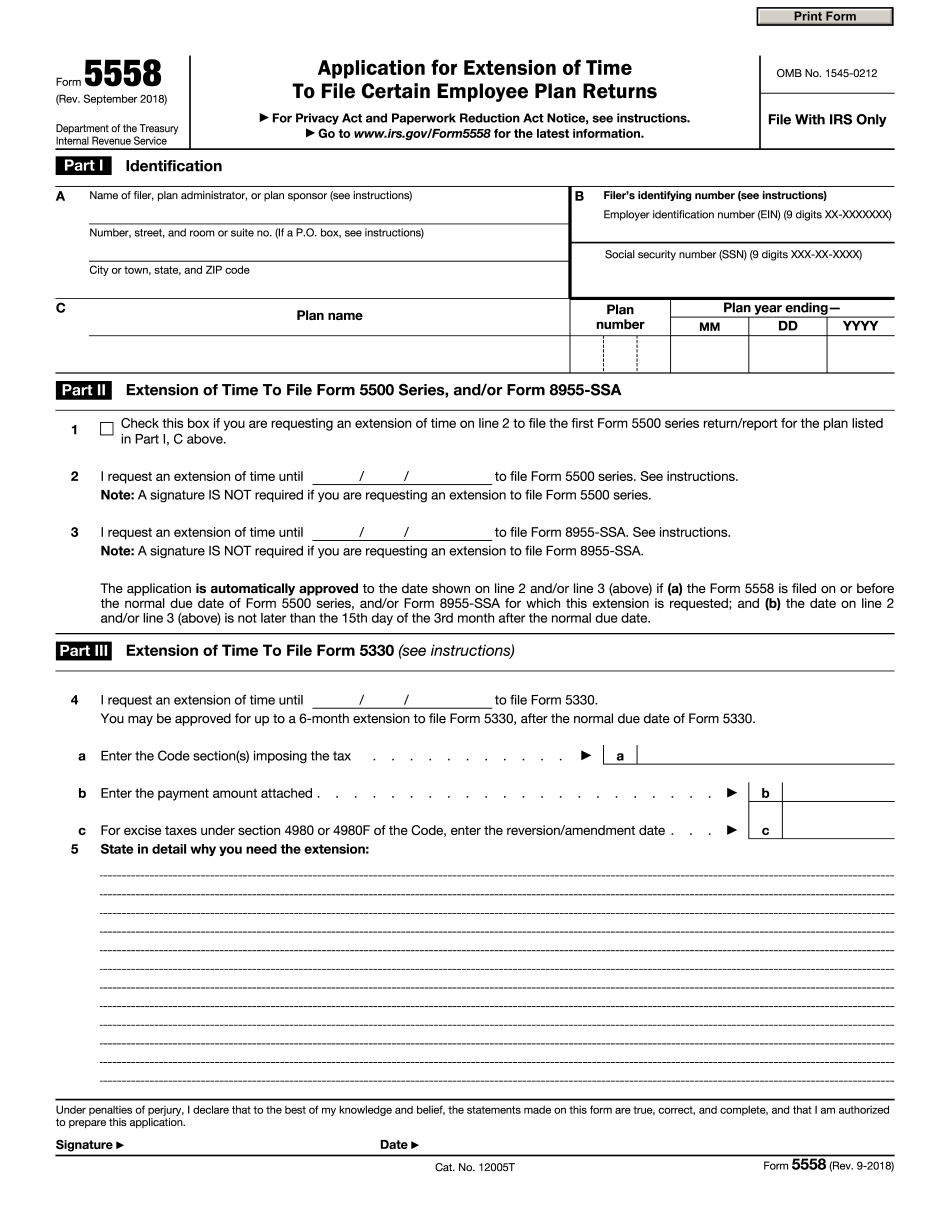

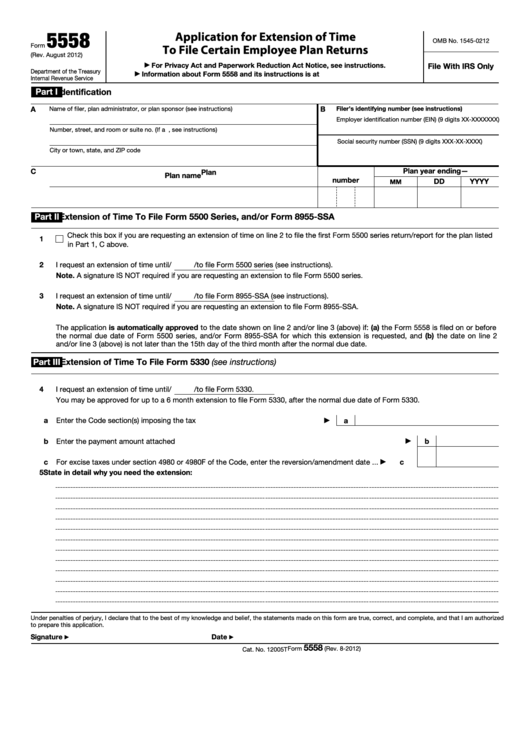

Form 5558 Application for Extension of Time to File Certain Employee

Software to create files in the proper format for filing electronically to the irs. Also, like the form 5500, the deadline can be extended by 2 ½ months by submitting form 5558. To help put this particular form in context, the “ssa” stands for social security administration, and the purpose of the form is to reunite retiring participants with old.

when did form 8955ssa start Fill Online, Printable, Fillable Blank

If the plan administrator or plan sponsor complete the form electronically, the irs transfers the electronic data. Also, like the form 5500, the deadline can be extended by 2 ½ months by submitting form 5558. Annual registration statement identifying separated participants with deferred vested benefits created date: To help put this particular form in context, the “ssa” stands for social.

Form 5558 Application For Extension Of Time To File Certain Employee

To help put this particular form in context, the “ssa” stands for social security administration, and the purpose of the form is to reunite retiring participants with old retirement account balances they may have forgotten about. Software to create files in the proper format for filing electronically to the irs. Also, like the form 5500, the deadline can be extended.

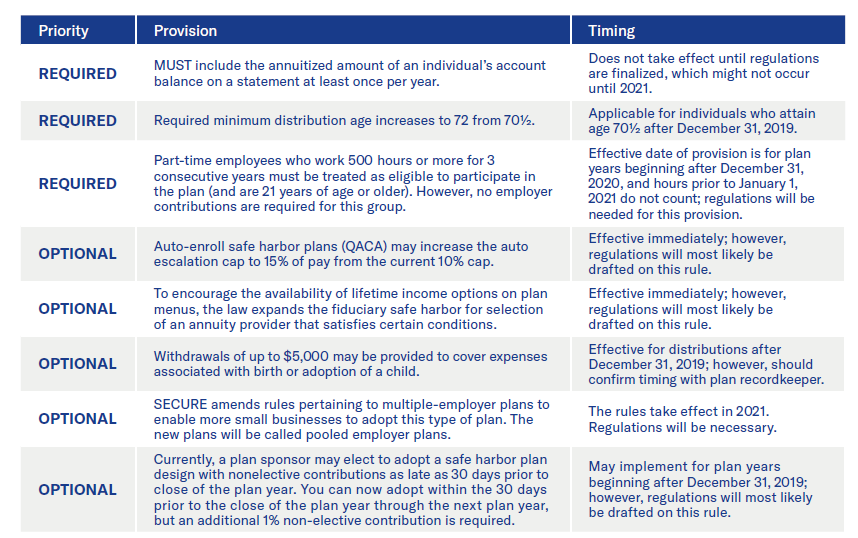

Secure Act Equitable

If the plan administrator or plan sponsor complete the form electronically, the irs transfers the electronic data. Software to create files in the proper format for filing electronically to the irs. Also, like the form 5500, the deadline can be extended by 2 ½ months by submitting form 5558. Annual registration statement identifying separated participants with deferred vested benefits created.

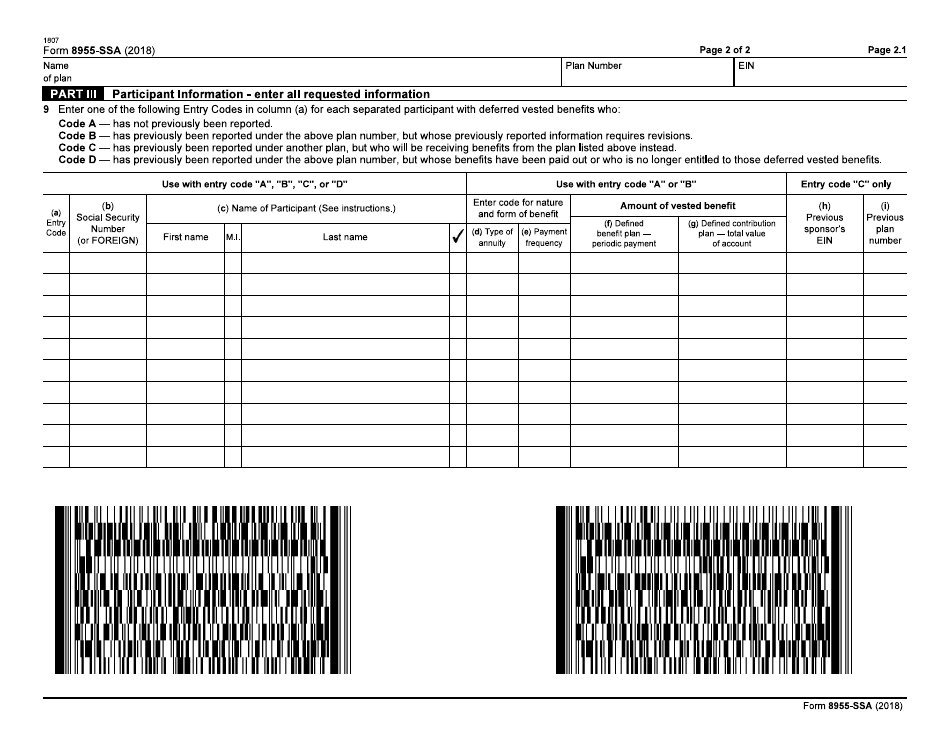

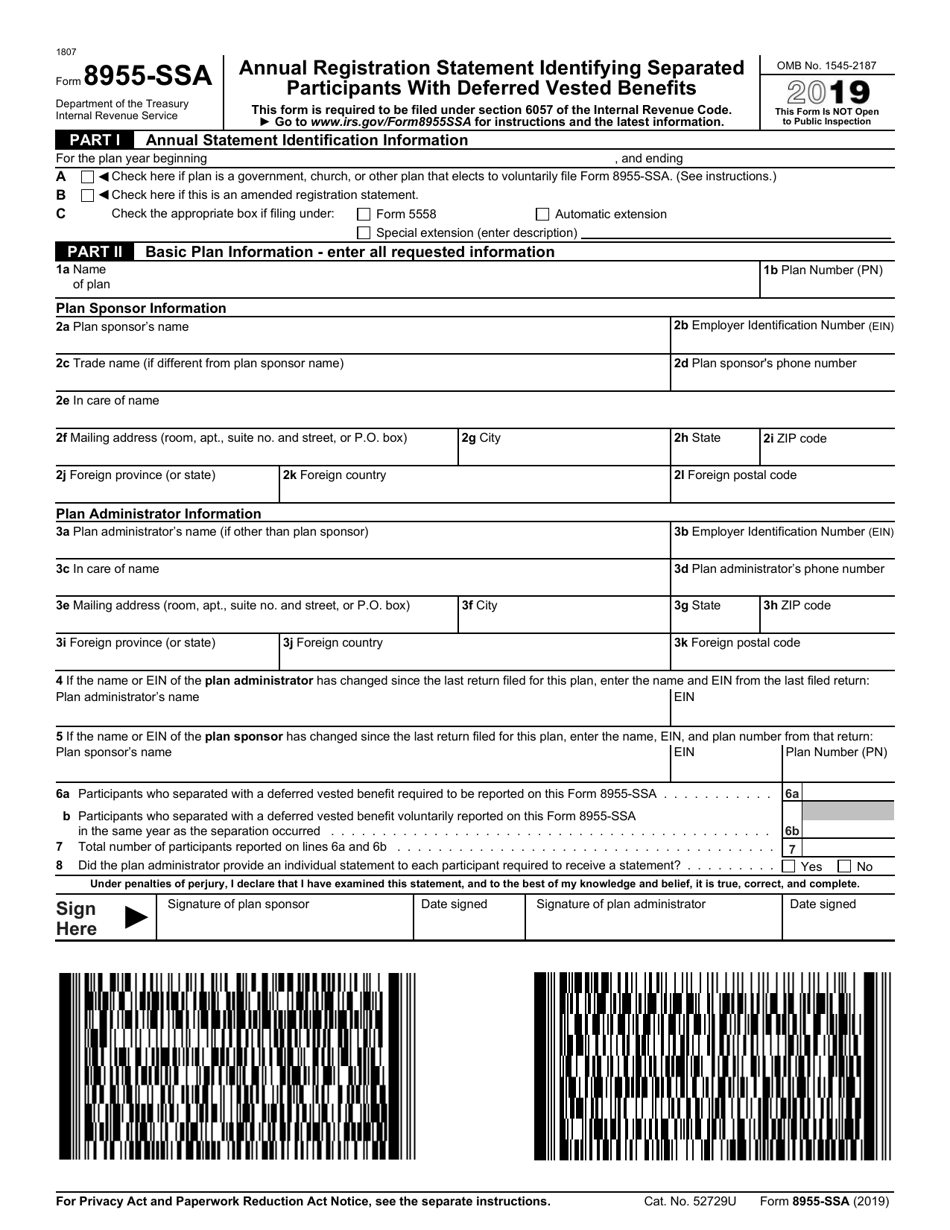

IRS Form 8955SSA Download Fillable PDF or Fill Online Annual

Also, like the form 5500, the deadline can be extended by 2 ½ months by submitting form 5558. Seven months after the close of the plan year. Annual registration statement identifying separated participants with deferred vested benefits created date: To help put this particular form in context, the “ssa” stands for social security administration, and the purpose of the form.

IRS Form 8955SSA Download Fillable PDF or Fill Online Annual

If the plan administrator or plan sponsor complete the form electronically, the irs transfers the electronic data. Also, like the form 5500, the deadline can be extended by 2 ½ months by submitting form 5558. Seven months after the close of the plan year. Software to create files in the proper format for filing electronically to the irs. To help.

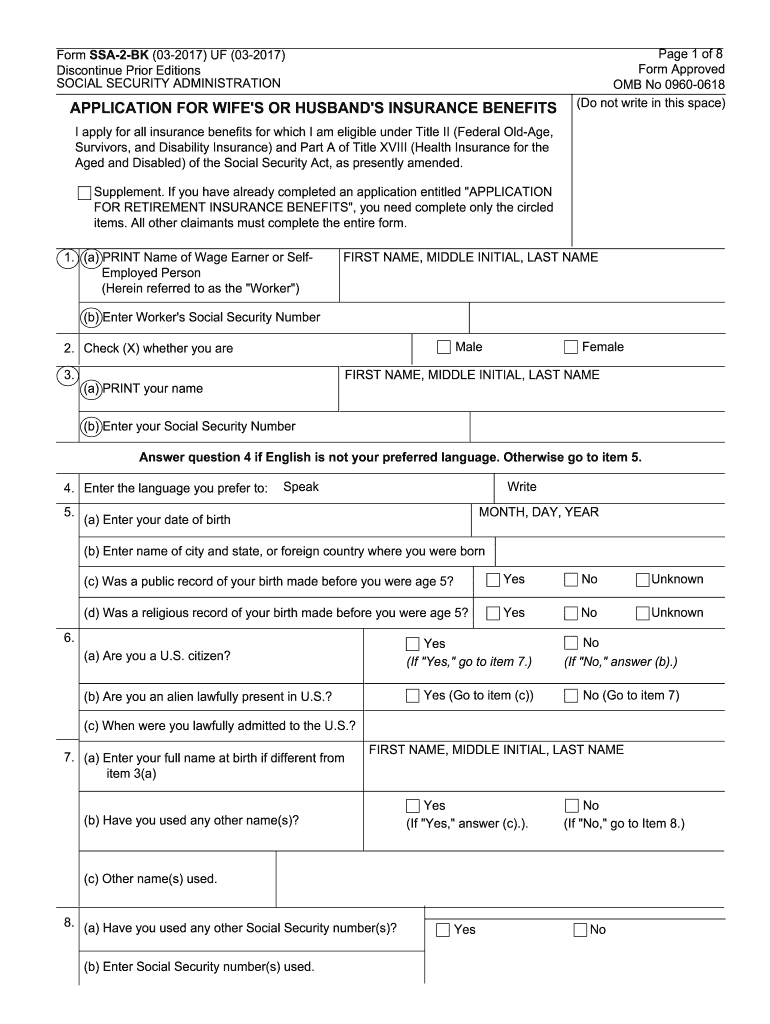

Form SSA 2 Fill Out and Sign Printable PDF Template signNow

To help put this particular form in context, the “ssa” stands for social security administration, and the purpose of the form is to reunite retiring participants with old retirement account balances they may have forgotten about. If the plan administrator or plan sponsor complete the form electronically, the irs transfers the electronic data. Seven months after the close of the.

FAQ on Forms 5500, 8955SSA, and 5330

Software to create files in the proper format for filing electronically to the irs. If the plan administrator or plan sponsor complete the form electronically, the irs transfers the electronic data. Annual registration statement identifying separated participants with deferred vested benefits created date: Seven months after the close of the plan year. To help put this particular form in context,.

Also, Like The Form 5500, The Deadline Can Be Extended By 2 ½ Months By Submitting Form 5558.

To help put this particular form in context, the “ssa” stands for social security administration, and the purpose of the form is to reunite retiring participants with old retirement account balances they may have forgotten about. Software to create files in the proper format for filing electronically to the irs. If the plan administrator or plan sponsor complete the form electronically, the irs transfers the electronic data. Annual registration statement identifying separated participants with deferred vested benefits created date: