Where Do I Get Form 740 Kentucky

Where Do I Get Form 740 Kentucky - .00 20 percent on line 18 times total deductions entered on line. Web 19 percent on line 17 times total deductions entered on line 16 (enter here and on form 740, line 10, column a). Your social security number k. These 2021 forms and more are available: Web when submitting payments for electronically filed returns, do not send a copy of your return. Sign it in a few clicks draw your signature, type it,. Form 740 is the kentucky income tax. / fein spouse's social security no. Web this form may be used by both individuals and corporations requesting an income tax refund. Web which form should i file?

.00 20 percent on line 18 times total deductions entered on line. Edit your form 740 online type text, add images, blackout confidential details, add comments, highlights and more. Form 740 is the kentucky income tax. Web select a different state: Amount paid 0 0 42a740es0002 kentucky department of revenue frankfort, ky 40620. Your social security number k. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Include your social security number and tax. Web we last updated kentucky form 740 in february 2023 from the kentucky department of revenue. This form is for income earned in tax year 2022, with tax returns due in april.

Your social security number k. Sign it in a few clicks draw your signature, type it,. .00 20 percent on line 18 times total deductions entered on line. Web get 2022 ky 740 form esigned straight from your smartphone using these six steps: Refund inquiries—you may check the status of your refund atwww.revenue.ky.gov. • had income from kentucky sources. Web we last updated kentucky form 740 in february 2023 from the kentucky department of revenue. Edit your form 740 online type text, add images, blackout confidential details, add comments, highlights and more. Form 740 is the kentucky income tax return for use by all taxpayers. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save form 740 v rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★.

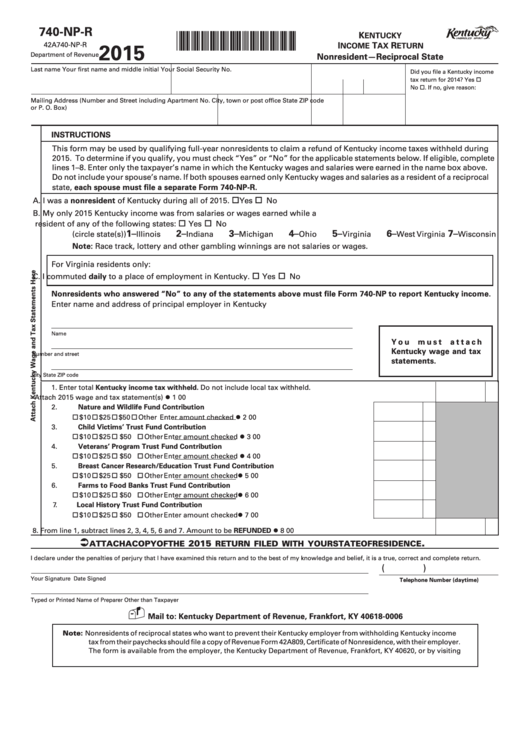

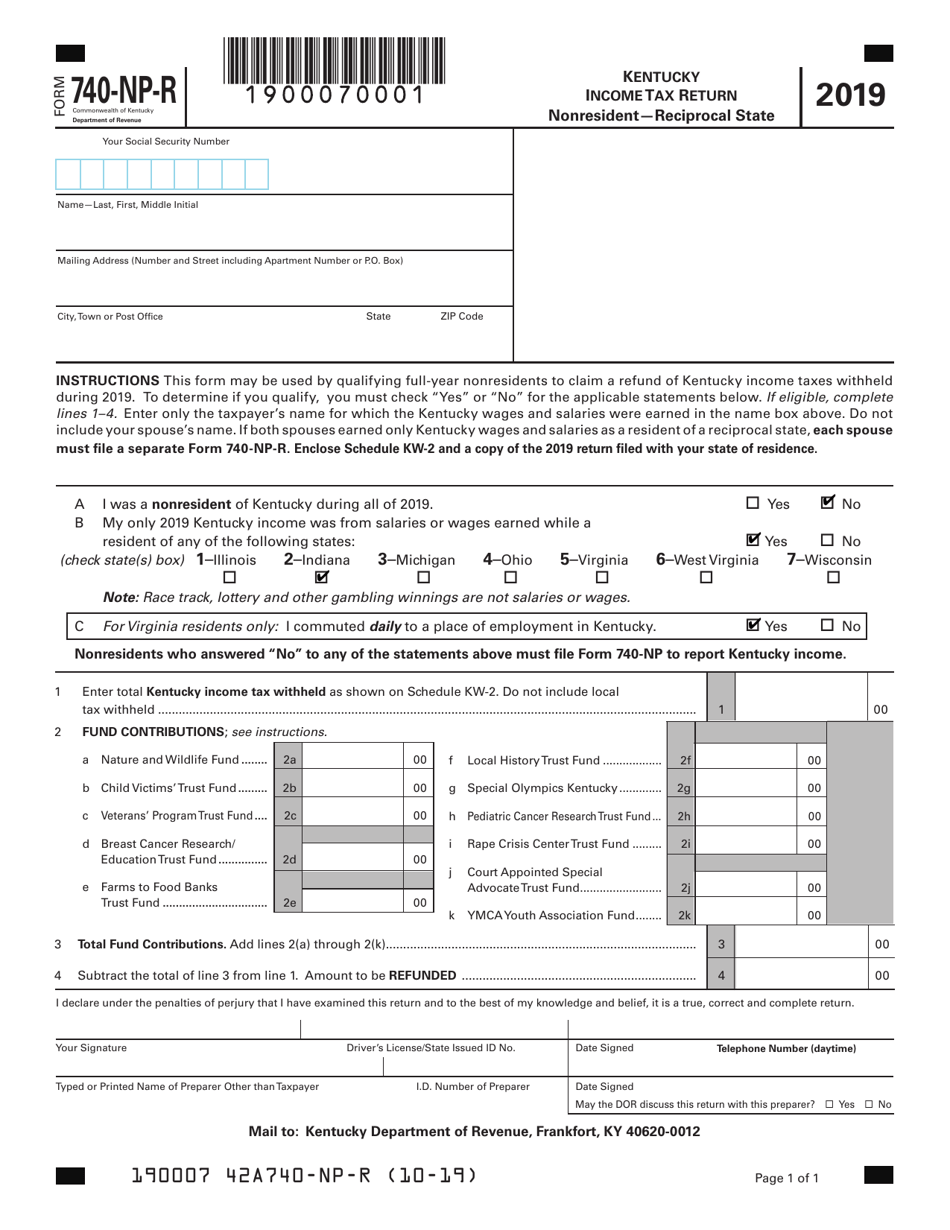

Fillable Form 740NpR (State Form 42a740NpR) Kentucky Tax

Web get 2022 ky 740 form esigned straight from your smartphone using these six steps: Web enter name(s) as shown on form 740, page 1. .00 20 percent on line 18 times total deductions entered on line. Include your social security number and tax. This system is available 24 hours a day, 7.

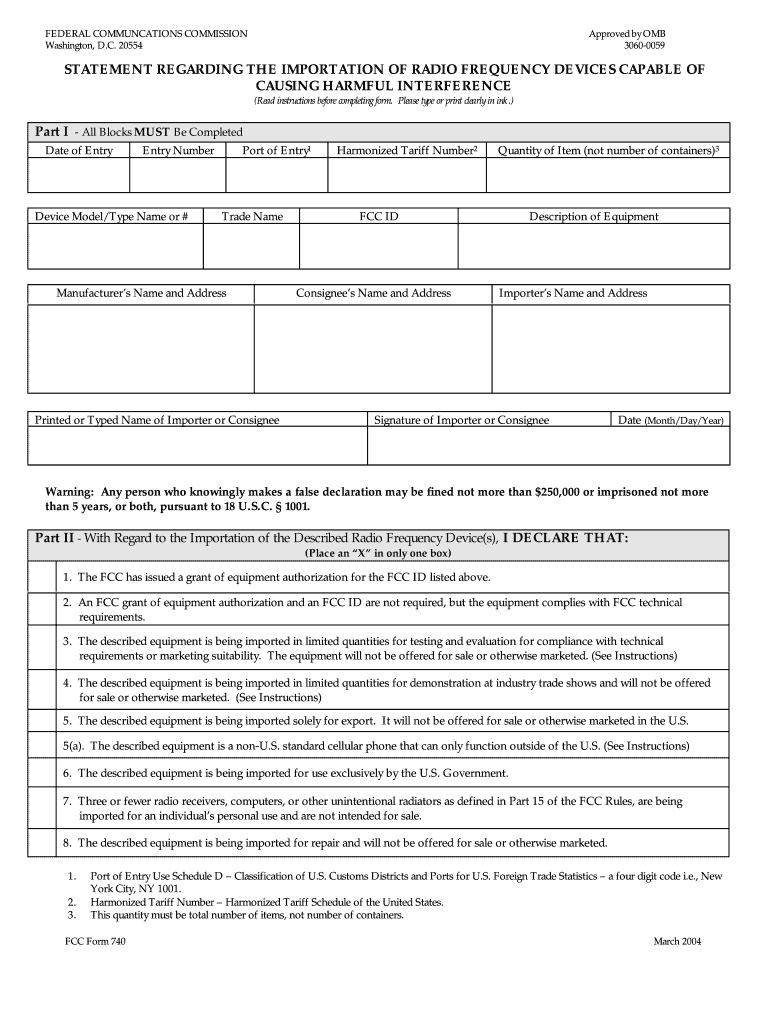

FCC Form 740 2004 Fill and Sign Printable Template Online US Legal

Web this form may be used by both individuals and corporations requesting an income tax refund. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save form 740 v rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★. Form 740.

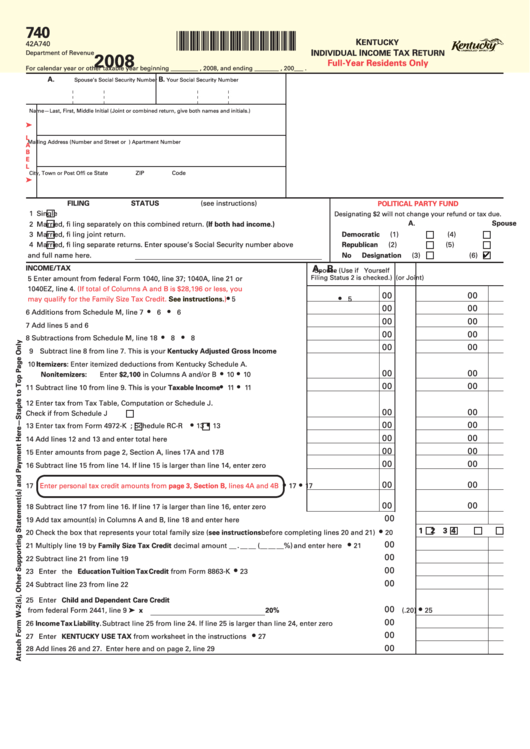

Fillable Form 740 Kentucky Individual Tax Return FullYear

This system is available 24 hours a day, 7. Web get 2022 ky 740 form esigned straight from your smartphone using these six steps: / fein spouse's social security no. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save form 740 v rating ★ ★ ★.

Schedule M (740) Kentucky Federal Adjusted Gross Modification…

Web select a different state: .00 20 percent on line 18 times total deductions entered on line. Web 19 percent on line 17 times total deductions entered on line 16 (enter here and on form 740, line 10, column a). Web we last updated the form 740 individual full year resident income tax instructions packet in february 2023, so this.

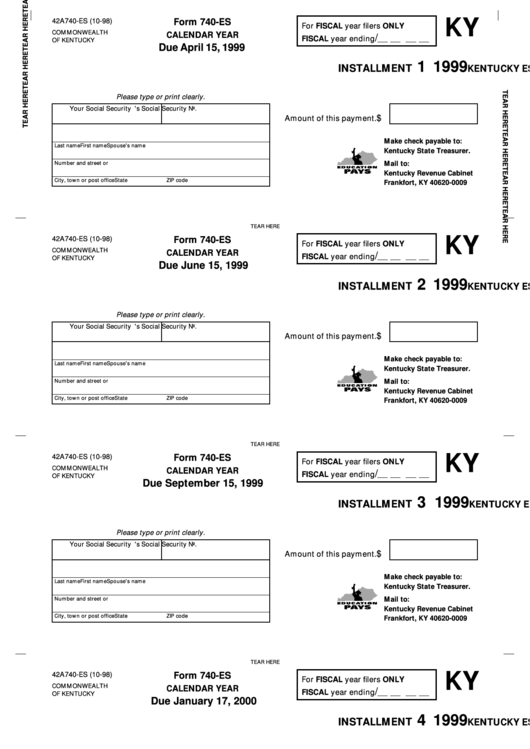

KY DoR 740ES 2019 Fill out Tax Template Online US Legal Forms

Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save form 740 v rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★. Amount paid 0 0 42a740es0002 kentucky department of revenue frankfort, ky 40620. Web 19 percent on line 17.

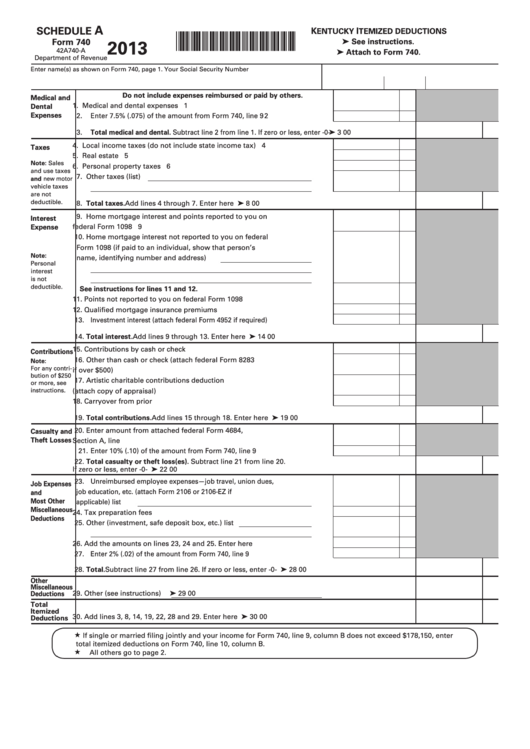

Fillable Schedule A (Form 740) Kentucky Itemized Deductions 2013

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Edit your form 740 online type text, add images, blackout confidential details, add comments, highlights and more. Web when submitting payments for electronically filed returns, do not send a copy of your return. Your social security number k. Web this form may.

Schedule A (740) Kentucky Itemized Deductions Form 42A740A

Web where to get forms forms and instructions are available online from the department of revenue’s web site at www.revenue.ky.gov and at all kentucky taxpayer service. Web when submitting payments for electronically filed returns, do not send a copy of your return. Web we last updated kentucky form 740 in february 2023 from the kentucky department of revenue. Web this.

dipitdesign Kentucky Tax Form 740

Your social security number k. Web this form may be used by both individuals and corporations requesting an income tax refund. Web get 2022 ky 740 form esigned straight from your smartphone using these six steps: Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save form.

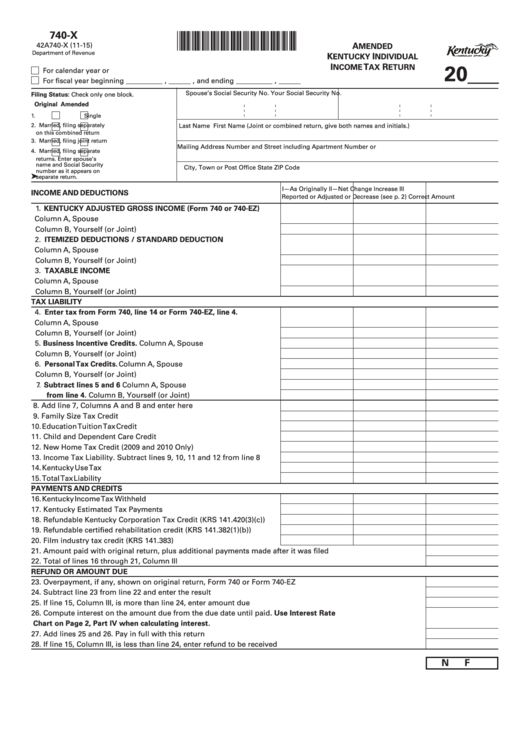

Fillable Form 740X Amended Kentucky Individual Tax Return

• had income from kentucky sources. Web we last updated the form 740 individual full year resident income tax instructions packet in february 2023, so this is the latest version of income tax instructions, fully updated. • moved into or out of kentucky during the taxable. Web where to get forms forms and instructions are available online from the department.

Web 19 Percent On Line 17 Times Total Deductions Entered On Line 16 (Enter Here And On Form 740, Line 10, Column A).

Web which form should i file? • had income from kentucky sources. Web when submitting payments for electronically filed returns, do not send a copy of your return. Web this form may be used by both individuals and corporations requesting an income tax refund.

Sign It In A Few Clicks Draw Your Signature, Type It,.

Complete, edit or print tax forms instantly. Web get 2022 ky 740 form esigned straight from your smartphone using these six steps: Web enter name(s) as shown on form 740, page 1. Edit your form 740 online type text, add images, blackout confidential details, add comments, highlights and more.

Web Select A Different State:

This form is for income earned in tax year 2022, with tax returns due in april. These 2021 forms and more are available: Web we last updated kentucky form 740 in february 2023 from the kentucky department of revenue. .00 20 percent on line 18 times total deductions entered on line.

Web How It Works Open Form Follow The Instructions Easily Sign The Form With Your Finger Send Filled & Signed Form Or Save Form 740 V Rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★.

Refund inquiries—you may check the status of your refund atwww.revenue.ky.gov. • moved into or out of kentucky during the taxable. This system is available 24 hours a day, 7. Get ready for tax season deadlines by completing any required tax forms today.