Where Do I Send My Form 940

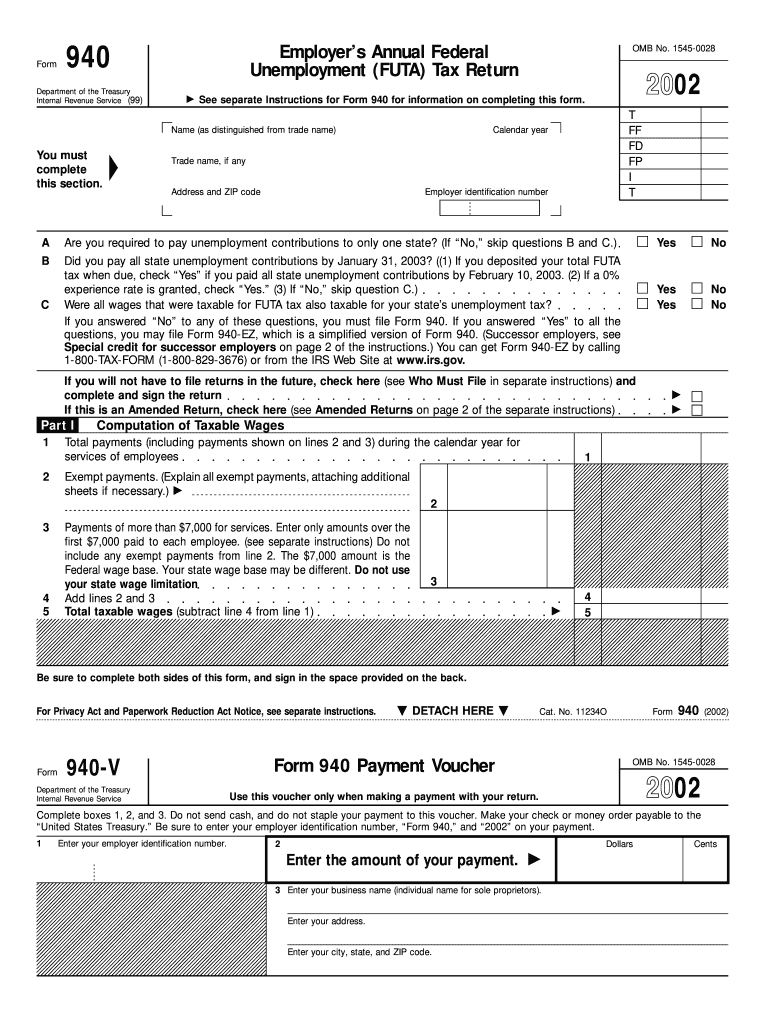

Where Do I Send My Form 940 - Line by line form 940 instructions for 2022 tax year. Approved section 3504 agents and cpeos must complete schedule r (form 940) when filing an aggregate form 940. Web keep track of your payments because you’ll need them to complete your form 940 correctly. ( for a copy of a form, instruction, or. Box 409101 ogden, ut 84409 if you are in the above states and. 940, 941, 943, 944 and 945. Web about form 940, employer's annual federal unemployment (futa) tax return. Identify the irs processing center location based on your current resident. It is secure and accurate. Employers must submit the form to the irs.

Virgin islands and are not submitting a payment mail the form to internal revenue service, p.o. ( for a copy of a form, instruction, or. Web if you’ll be mailing the complete form, the irs address you’ll use depends on where you’re located and whether you’re including a payment with your form along. Use form 940 to report your annual federal unemployment tax act (futa). Web keep track of your payments because you’ll need them to complete your form 940 correctly. Where to mail form 940 for 2022 & 2021 tax year? Web aggregate form 940 filers. Approved section 3504 agents and cpeos must complete schedule r (form 940) when filing an aggregate form 940. Web form 940 instructions. Web about form 940, employer's annual federal unemployment (futa) tax return.

Web about form 940, employer's annual federal unemployment (futa) tax return. Web if you’ll be mailing the complete form, the irs address you’ll use depends on where you’re located and whether you’re including a payment with your form along. Web form 940 instructions. Employers must submit the form to the irs. Web irs form 940 instructions. 10, 2022 to file form 940. Box 409101 ogden, ut 84409 if you are in the above states and. Web 22 rows addresses for forms beginning with the number 9. Use form 940 to report your annual federal unemployment tax act (futa). When filing paper copies, employers must mail.

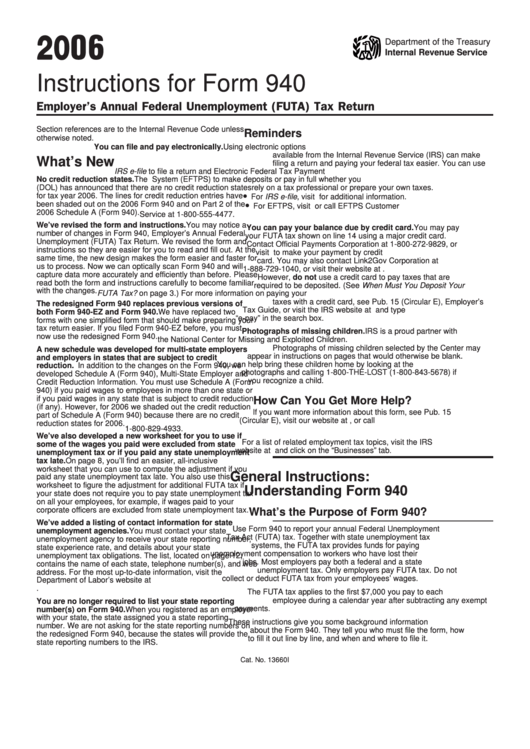

Instructions For Form 940 Employer'S Annual Federal Unemployment

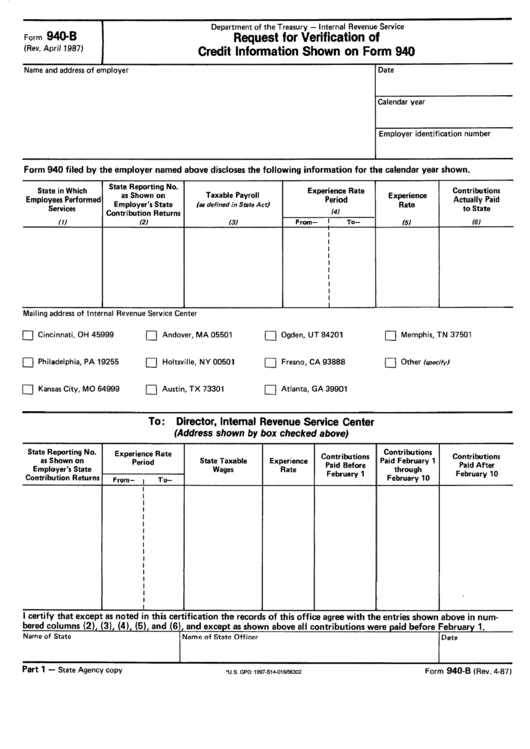

Web keep track of your payments because you’ll need them to complete your form 940 correctly. Line by line form 940 instructions for 2022 tax year. Web the document is intended to assist small businesses and the irs in reaching an agreement on the amount of federal unemployment tax (futa) payable. 940, 941, 943, 944 and 945. Employers must submit.

Form 940B Request for Verification of Credit Information (2010) Free

Web if you are sending via united states postal service select the addresses listed below by state. Use form 940 to report your annual federal unemployment tax act (futa). 10, 2022 to file form 940. 940, 941, 943, 944 and 945. Web form 940 instructions.

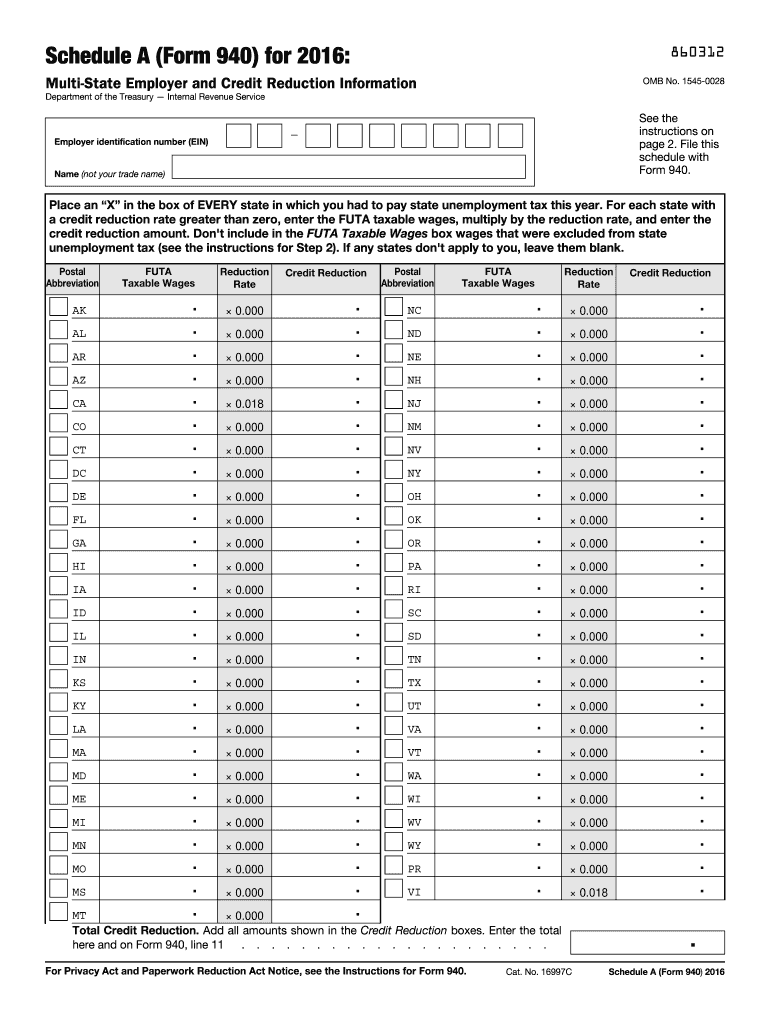

940 Form 2016 Fill Out and Sign Printable PDF Template signNow

Approved section 3504 agents and cpeos must complete schedule r (form 940) when filing an aggregate form 940. Web 22 rows addresses for forms beginning with the number 9. Line by line form 940 instructions for 2022 tax year. Where to mail form 940 for 2022 & 2021 tax year? Use form 940 to report your annual federal unemployment tax.

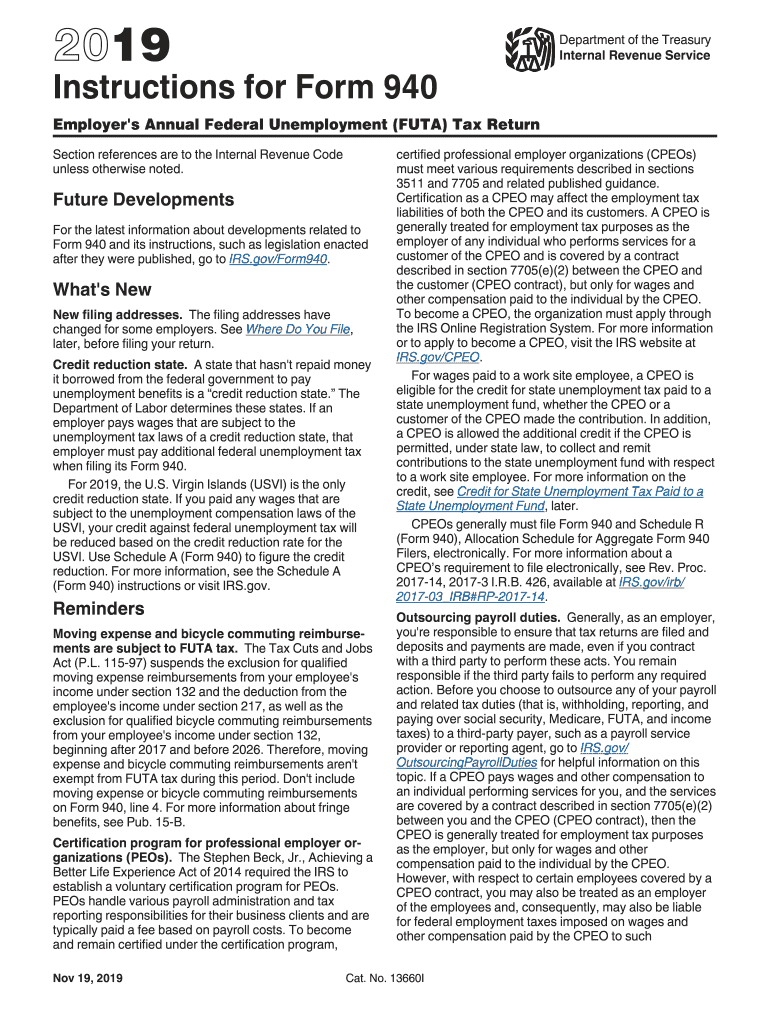

Form 940 Instructions 2019 Fill Out and Sign Printable PDF Template

Line by line form 940 instructions for 2022 tax year. Use this address if you are not enclosing a payment use this. Box 409101 ogden, ut 84409 if you are in the above states and. Mail these, along with your payment, to the address listed for your state. Identify the irs processing center location based on your current resident.

What Is Form 940? When Do I Need to File a FUTA Tax Return? Ask Gusto

Where to mail form 940 for 2022 & 2021 tax year? It is secure and accurate. Use form 940 to report your annual federal unemployment tax act (futa). Web puerto rico or u.s. 940, 941, 943, 944 and 945.

Form 940 Who Needs to File, How to File, and More

Web aggregate form 940 filers. Web the document is intended to assist small businesses and the irs in reaching an agreement on the amount of federal unemployment tax (futa) payable. ( for a copy of a form, instruction, or. Use this address if you are not enclosing a payment use this. Employers must submit the form to the irs.

How to File 940 Form with ezPaycheck Payroll Software

Irs form 940 reports your federal unemployment tax liabilities for all employees in one document. Web if your employees are household workers—that is, employees who perform household work in a private home, college club, or fraternity or sorority chapter—you’ll be. 940, 941, 943, 944 and 945. Use this address if you are not enclosing a payment use this. ( for.

940 2002 Fill Out and Sign Printable PDF Template signNow

940, 941, 943, 944 and 945. Employers must submit the form to the irs. ( for a copy of a form, instruction, or. Web keep track of your payments because you’ll need them to complete your form 940 correctly. Web form 940 instructions.

Form 940B Request For Verification Of Credit Information Shown On

Use this address if you are not enclosing a payment use this. Web puerto rico or u.s. Web however, if you deposited all of your federal unemployment tax act (futa) when it was due, you may have 10 additional days until feb. Web keep track of your payments because you’ll need them to complete your form 940 correctly. ( for.

Form 940 Annual FUTA Tax Return Workful Blog

Web if you’ll be mailing the complete form, the irs address you’ll use depends on where you’re located and whether you’re including a payment with your form along. Web form 940 instructions. It is secure and accurate. Web 8 rows 1. Use form 940 to report your annual federal unemployment tax act (futa).

Use Form 940 To Report Your Annual Federal Unemployment Tax Act (Futa).

( for a copy of a form, instruction, or. 10, 2022 to file form 940. Web puerto rico or u.s. Mail these, along with your payment, to the address listed for your state.

It Is Secure And Accurate.

Web the document is intended to assist small businesses and the irs in reaching an agreement on the amount of federal unemployment tax (futa) payable. Web if your employees are household workers—that is, employees who perform household work in a private home, college club, or fraternity or sorority chapter—you’ll be. Where to mail form 940 for 2022 & 2021 tax year? When filing paper copies, employers must mail.

Box 409101 Ogden, Ut 84409 If You Are In The Above States And.

Web about form 940, employer's annual federal unemployment (futa) tax return. Web if you are sending via united states postal service select the addresses listed below by state. Web if you’ll be mailing the complete form, the irs address you’ll use depends on where you’re located and whether you’re including a payment with your form along. Web form 940 instructions.

Virgin Islands And Are Not Submitting A Payment Mail The Form To Internal Revenue Service, P.o.

Web irs form 940 instructions. Web keep track of your payments because you’ll need them to complete your form 940 correctly. Web 22 rows addresses for forms beginning with the number 9. Line by line form 940 instructions for 2022 tax year.