Where To File Form 941X

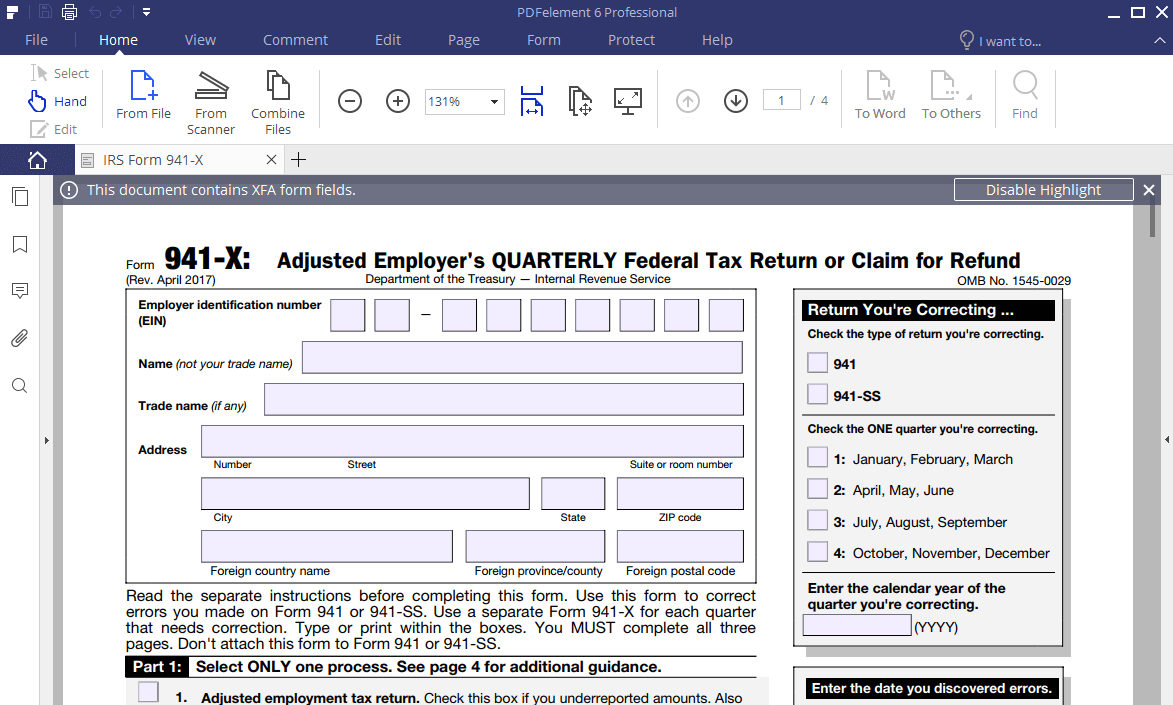

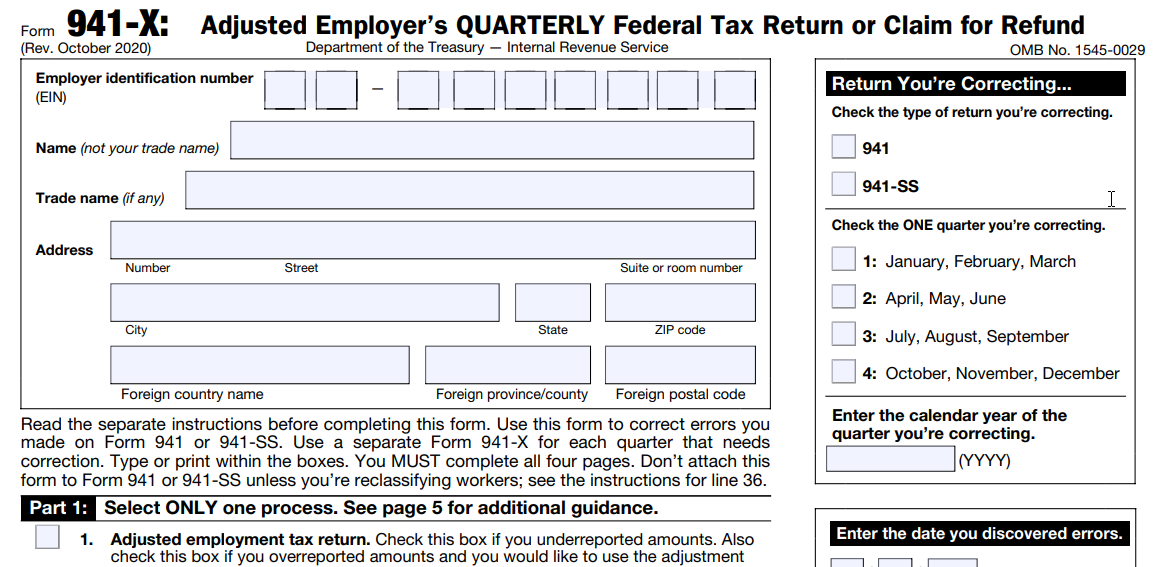

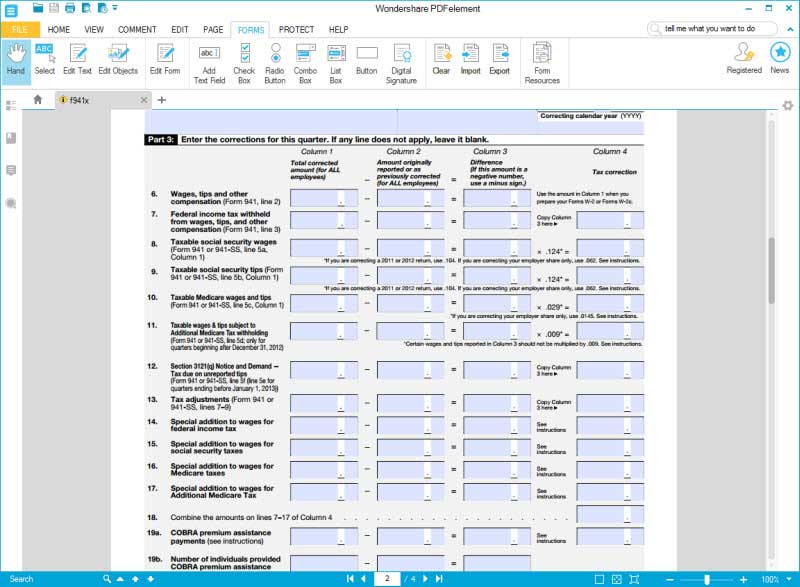

Where To File Form 941X - If you are located in. The adjustments also entail administrative errors and alterations to employee retention tax credits. Web limitations wages reported as payroll costs for ppp loan forgiveness or certain other tax credits can't be claimed for the erc in any tax period. Employer identification number (ein) — name (not your trade name) trade name (if. An employer is required to file an irs 941x in the event of an error on a previously filed form 941. Determine which payroll quarters in 2020 and 2021 your business qualifies for. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. After march 12, 2020, and before jan. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding.

Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. An employer is required to file an irs 941x in the event of an error on a previously filed form 941. If you are located in. How to claim follow guidance for the period when qualified wages were paid: See section 13 of pub. Employer identification number (ein) — name (not your trade name) trade name (if. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Web limitations wages reported as payroll costs for ppp loan forgiveness or certain other tax credits can't be claimed for the erc in any tax period. Determine which payroll quarters in 2020 and 2021 your business qualifies for. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no.

Determine which payroll quarters in 2020 and 2021 your business qualifies for. An employer is required to file an irs 941x in the event of an error on a previously filed form 941. After march 12, 2020, and before jan. Employer identification number (ein) — name (not your trade name) trade name (if. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. See section 13 of pub. The adjustments also entail administrative errors and alterations to employee retention tax credits. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips, taxable wages and tips subject to additional medicare tax withholding. How to claim follow guidance for the period when qualified wages were paid:

StepbyStep How to Guide to Filing Your 941X ERTC Baron Payroll

Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Determine which payroll quarters in 2020 and 2021 your business qualifies for. The adjustments also entail administrative errors and alterations to employee retention tax credits. Employee wages, income tax withheld from wages, taxable social security wages, taxable social.

Worksheet 1 941x

An employer is required to file an irs 941x in the event of an error on a previously filed form 941. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web limitations wages reported as payroll costs for ppp loan forgiveness or certain other tax credits can't.

941x Worksheet 1 Excel

April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web limitations wages reported as payroll costs for ppp loan forgiveness or certain other tax credits can't be claimed for the erc in any tax period. Determine which payroll quarters in 2020 and 2021 your business qualifies for..

EFile Form 941 for 2022 File 941 Electronically at 4.95

April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. After march 12, 2020, and before jan. Determine which payroll quarters in 2020 and 2021 your business qualifies for. Web limitations wages reported as payroll costs for ppp loan forgiveness or certain other tax credits can't be claimed.

ERTC REFUND DEADLINE How to get ERTC Tax Credit 2021 [ERC 2020] IRC

How to claim follow guidance for the period when qualified wages were paid: The adjustments also entail administrative errors and alterations to employee retention tax credits. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Determine which payroll quarters in 2020 and 2021 your business qualifies for..

How to Apply for the Employee Retention Tax Credit with Form 941X

Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Determine which payroll quarters in 2020 and 2021 your business qualifies for. See section 13 of pub. Web limitations wages reported as payroll costs for ppp loan forgiveness or certain other tax credits can't be claimed for the.

Worksheet 2 941x

If you are located in. Employer identification number (ein) — name (not your trade name) trade name (if. How to claim follow guidance for the period when qualified wages were paid: Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. April 2023) adjusted employer’s quarterly federal tax.

Updated Form 941 Worksheet 1, 2, 3 and 5 for Q2 2021 Revised 941

Employer identification number (ein) — name (not your trade name) trade name (if. How to claim follow guidance for the period when qualified wages were paid: See section 13 of pub. After march 12, 2020, and before jan. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no.

Form 941x Due Date [How Long to File Form 941X] How Long to File for

How to claim follow guidance for the period when qualified wages were paid: If you are located in. An employer is required to file an irs 941x in the event of an error on a previously filed form 941. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced.

IRS Form 941X Learn How to Fill it Easily

April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. The adjustments also entail administrative errors and alterations to employee retention tax credits. After march 12,.

April 2023) Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund Department Of The Treasury — Internal Revenue Service Omb No.

The adjustments also entail administrative errors and alterations to employee retention tax credits. Web limitations wages reported as payroll costs for ppp loan forgiveness or certain other tax credits can't be claimed for the erc in any tax period. How to claim follow guidance for the period when qualified wages were paid: Determine which payroll quarters in 2020 and 2021 your business qualifies for.

Employee Wages, Income Tax Withheld From Wages, Taxable Social Security Wages, Taxable Social Security Tips, Taxable Medicare Wages And Tips, Taxable Wages And Tips Subject To Additional Medicare Tax Withholding.

After march 12, 2020, and before jan. Employer identification number (ein) — name (not your trade name) trade name (if. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. If you are located in.

An Employer Is Required To File An Irs 941X In The Event Of An Error On A Previously Filed Form 941.

See section 13 of pub.

![ERTC REFUND DEADLINE How to get ERTC Tax Credit 2021 [ERC 2020] IRC](https://i.ytimg.com/vi/8McDcwKoEGg/maxresdefault.jpg)

.jpg)

![Form 941x Due Date [How Long to File Form 941X] How Long to File for](https://i.ytimg.com/vi/qyMsYQmVJhk/maxresdefault.jpg)