Where To Mail Form 1310 Irs

Where To Mail Form 1310 Irs - If a personal representative has been appointed, they must sign the tax return. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Web you'll mail form 1310 to the same internal revenue service center where the original tax return was filed. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund that was due to the taxpayer at the time of death. Web where do i mail form 1310? Statement of person claiming refund due a deceased taxpayer. If you had mailed it. See instructions below and on back. A new check will be issued in your name and mailed to you. Tax year decedent was due a refund:

December 2021) department of the treasury internal revenue service. Web internal revenue service p.o. How do i fill out form 1310? If you’re a surviving spouse, you’ll mail form 1310 to the same internal revenue service center where you filed your return. A new check will be issued in your name and mailed to you. If a personal representative has been appointed, they must sign the tax return. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund that was due to the taxpayer at the time of death. Web you'll mail form 1310 to the same internal revenue service center where the original tax return was filed. Tax year decedent was due a refund: Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file.

Web line a check the box on line a if you received a refund check in your name and your deceased spouse's name. If you checked the box on line b or line c, then you can either send the completed form to the irs center where you filed the original tax return, or follow the. If a personal representative has been appointed, they must sign the tax return. If you had mailed it. Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. Web you'll mail form 1310 to the same internal revenue service center where the original tax return was filed. Web internal revenue service p.o. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund that was due to the taxpayer at the time of death. Statement of person claiming refund due a deceased taxpayer. If you aren’t the surviving spouse, then you’ll mail the form to the same internal revenue service center where the original return was filed.

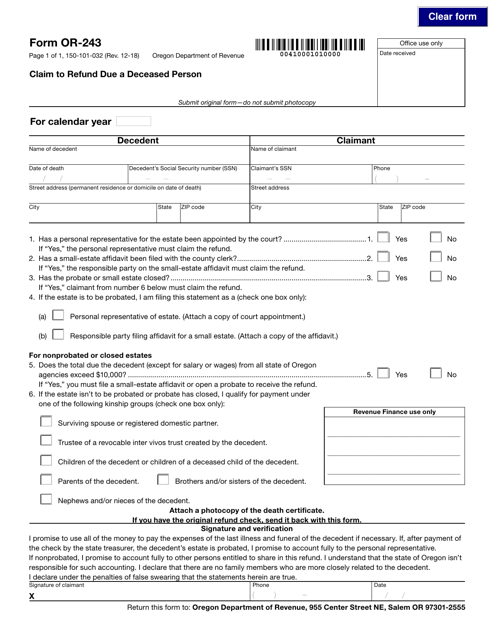

Form 1310 Instructions 2022 2023 IRS Forms Zrivo

December 2021) department of the treasury internal revenue service. See instructions below and on back. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual is a surviving spouse filing a joint return or a court appointed personal representative. If you.

Form 1310 Instructions 2021 2022 IRS Forms Zrivo

If a personal representative has been appointed, they must sign the tax return. If you checked the box on line b or line c, then you can either send the completed form to the irs center where you filed the original tax return, or follow the. Web internal revenue service p.o. Web you'll mail form 1310 to the same internal.

Irs Form 1310 Printable Master of Documents

How do i fill out form 1310? Web internal revenue service p.o. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual is a surviving spouse filing a joint return or a court appointed personal representative. Web line a check the.

IRS Form 1310 Claiming a Refund for a Deceased Person YouTube

Statement of person claiming refund due a deceased taxpayer. If you had mailed it. Use form 1310 to claim a refund on behalf of a deceased taxpayer. See instructions below and on back. Web you'll mail form 1310 to the same internal revenue service center where the original tax return was filed.

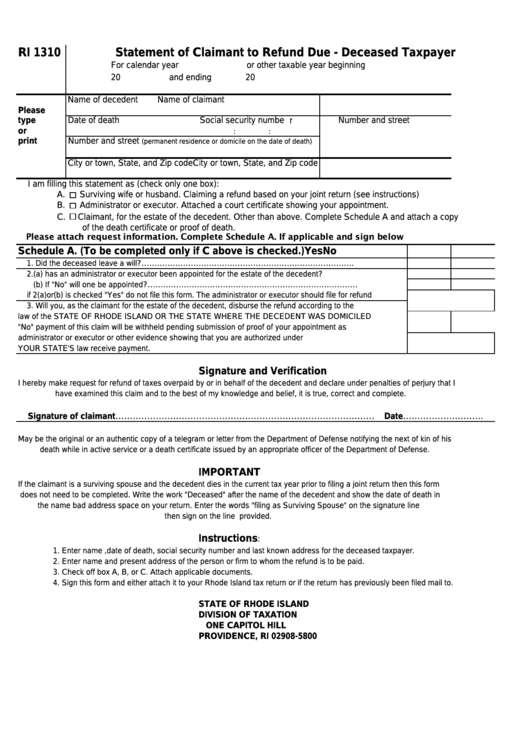

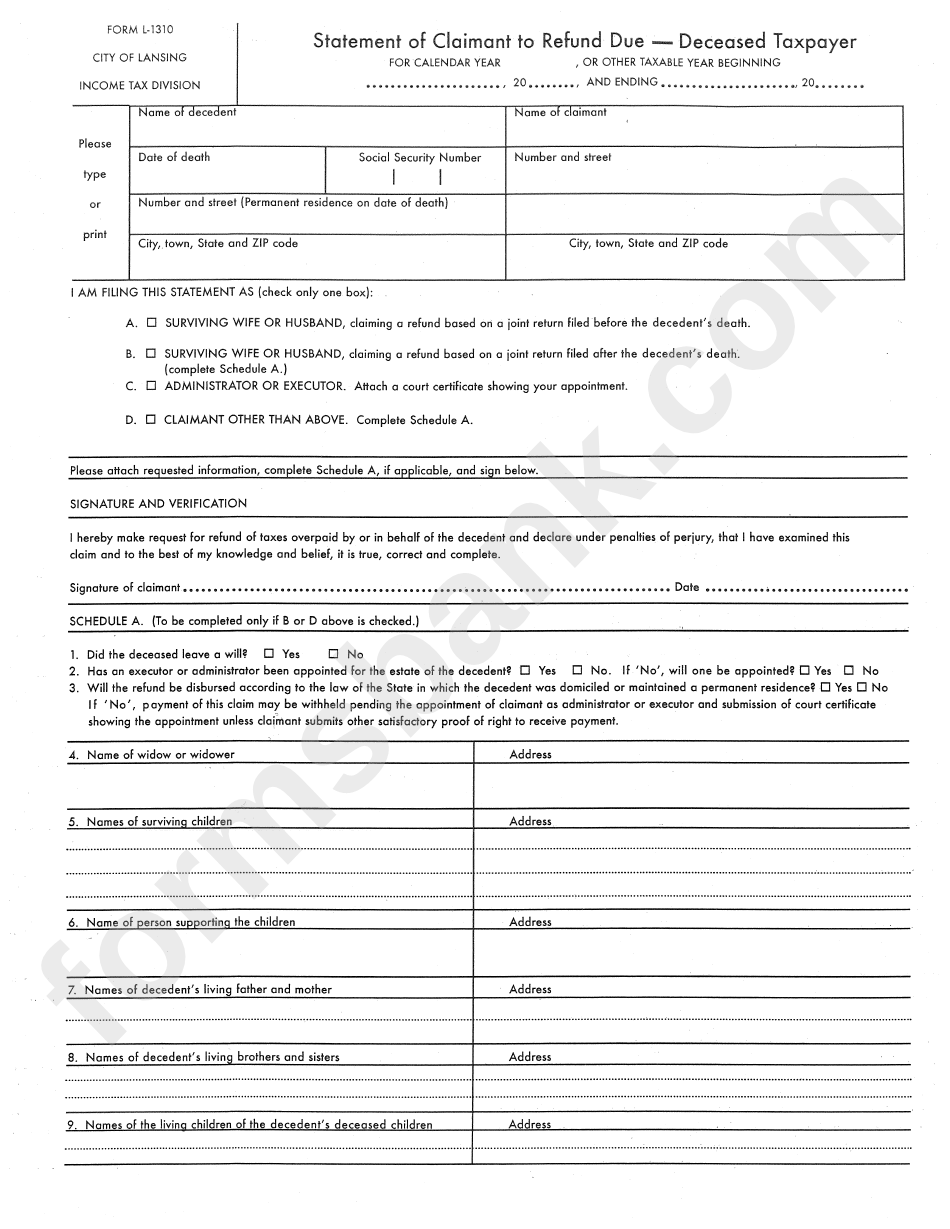

Form L1310 Statement Of Claimant To Refund Due Deceased Taxpayer

Statement of person claiming refund due a deceased taxpayer. See instructions below and on back. Use form 1310 to claim a refund on behalf of a deceased taxpayer. If you’re a surviving spouse, you’ll mail form 1310 to the same internal revenue service center where you filed your return. If you had mailed it.

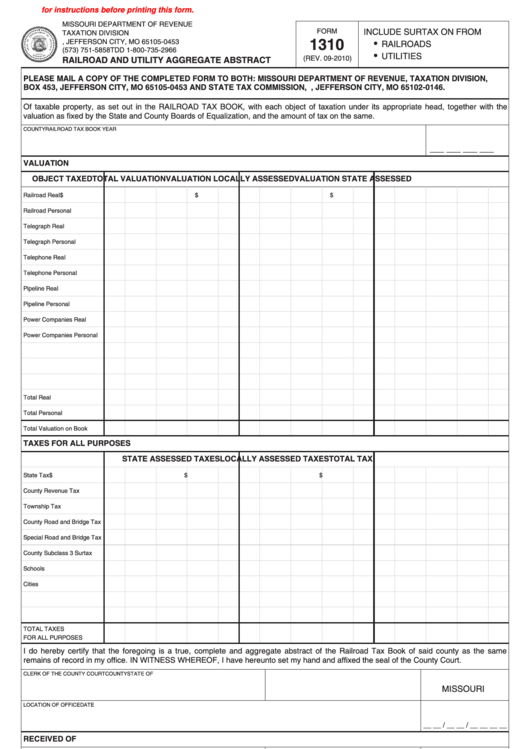

Fillable Form 1310 Railroad And Utility Aggregate Abstract 2010

If you had mailed it. Web where do i mail form 1310? A new check will be issued in your name and mailed to you. If you aren’t the surviving spouse, then you’ll mail the form to the same internal revenue service center where the original return was filed. December 2021) department of the treasury internal revenue service.

2021 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

December 2021) department of the treasury internal revenue service. Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. Web where do i mail form 1310? Web line a check the box on line a if you received a refund check in your name and.

2021 Form IRS 1310 Fill Online, Printable, Fillable, Blank pdfFiller

If you’re a surviving spouse, you’ll mail form 1310 to the same internal revenue service center where you filed your return. If you had mailed it. Use form 1310 to claim a refund on behalf of a deceased taxpayer. If you checked the box on line b or line c, then you can either send the completed form to the.

Breanna Form 2848 Irsgov

Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. Use form 1310 to claim a refund on behalf of a deceased taxpayer. If a personal representative has been appointed, they must sign the tax return. December 2021) department of the treasury internal revenue service..

Form Ri 1310 Statement Of Claimant To Refund DueDeceased Taxpayer

If a personal representative has been appointed, they must sign the tax return. December 2021) department of the treasury internal revenue service. See instructions below and on back. Then, yes, you will need to mail form 1310 with that court certificate to the same address where you'd mail the tax return; If you aren’t the surviving spouse, then you’ll mail.

Statement Of Person Claiming Refund Due A Deceased Taxpayer.

See instructions below and on back. Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to file. Tax year decedent was due a refund: Web where do i mail form 1310?

If A Personal Representative Has Been Appointed, They Must Sign The Tax Return.

Web you'll mail form 1310 to the same internal revenue service center where the original tax return was filed. If you aren’t the surviving spouse, then you’ll mail the form to the same internal revenue service center where the original return was filed. If you had mailed it. Web if a tax refund is due, the person claiming the refund must fill out form 1310 (statement of person claiming refund due to deceased taxpayer) unless the individual is a surviving spouse filing a joint return or a court appointed personal representative.

Web Internal Revenue Service P.o.

December 2021) department of the treasury internal revenue service. How do i fill out form 1310? Use form 1310 to claim a refund on behalf of a deceased taxpayer. If you checked the box on line b or line c, then you can either send the completed form to the irs center where you filed the original tax return, or follow the.

Web Line A Check The Box On Line A If You Received A Refund Check In Your Name And Your Deceased Spouse's Name.

If you’re a surviving spouse, you’ll mail form 1310 to the same internal revenue service center where you filed your return. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund that was due to the taxpayer at the time of death. A new check will be issued in your name and mailed to you. Then, yes, you will need to mail form 1310 with that court certificate to the same address where you'd mail the tax return;

/1310-RefundClaimDuetoDeceasedTaxpayer-1-292bd14843c94bf4abf09ea5d6eb9a4b.png)