Where To Mail Form 941-X

Where To Mail Form 941-X - Fill out your company info. Web mailing addresses for forms 941. Mail your return to the address listed for your location in the. Apply for an ein by faxing or. Check out the irs’s “ where to file your. Connecticut, delaware, district of columbia, georgia,. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. The mailing address you use depends on your business’s location. Web if you file a paper return, where you file depends on whether you include a payment with form 941. The irs recommends checking any preprinted envelopes used to.

Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Mail your return to the address listed for your location in the. There are two different department of the treasury. The irs recommends checking any preprinted envelopes used to. Check out the irs’s “ where to file your. Connecticut, delaware, district of columbia, georgia,. Web mailing addresses for forms 941. Apply for an ein by faxing or. The mailing address you use depends on your business’s location. Web if you file a paper return, where you file depends on whether you include a payment with form 941.

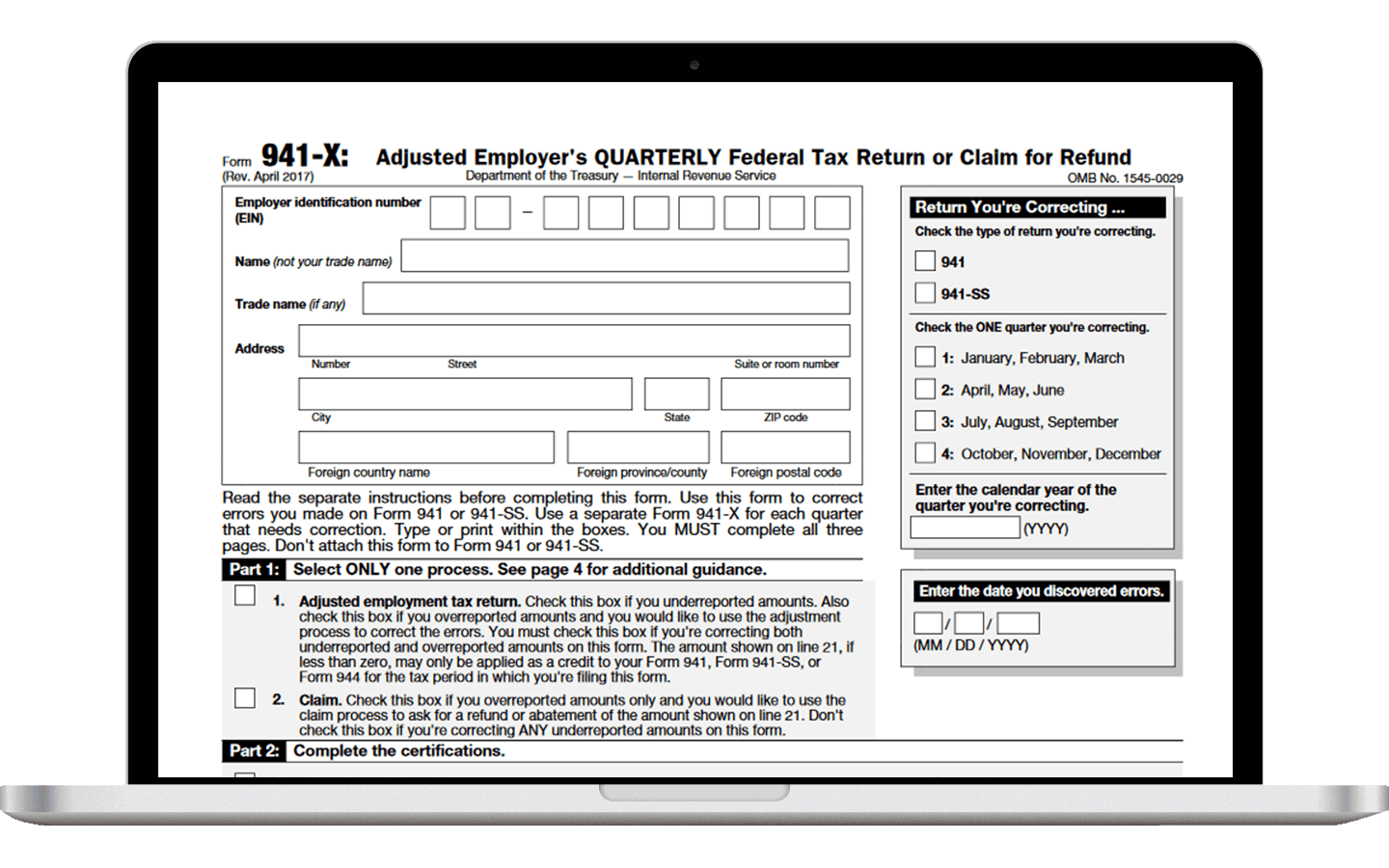

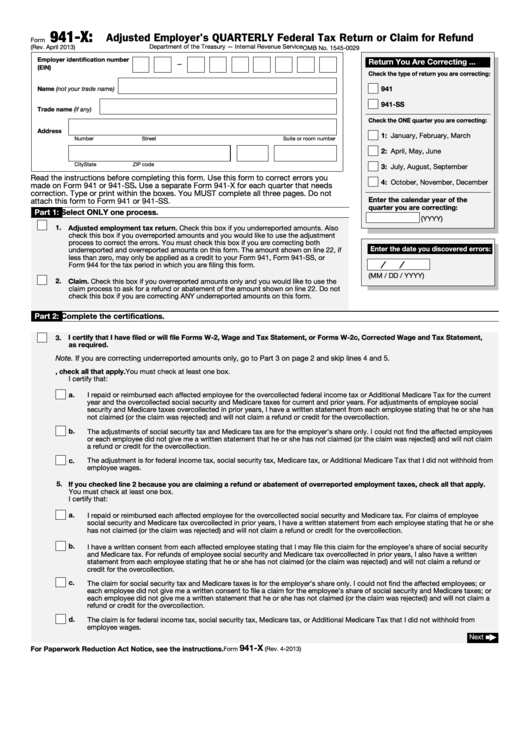

The mailing address you use depends on your business’s location. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Connecticut, delaware, district of columbia, georgia,. The practitioner can change the overpayment amount to $100 ($500 erc less the $400 that is still owed. Mail your return to the address listed for your location in the. Web mailing addresses for forms 941. Check out the irs’s “ where to file your. There are two different department of the treasury. Apply for an ein by faxing or.

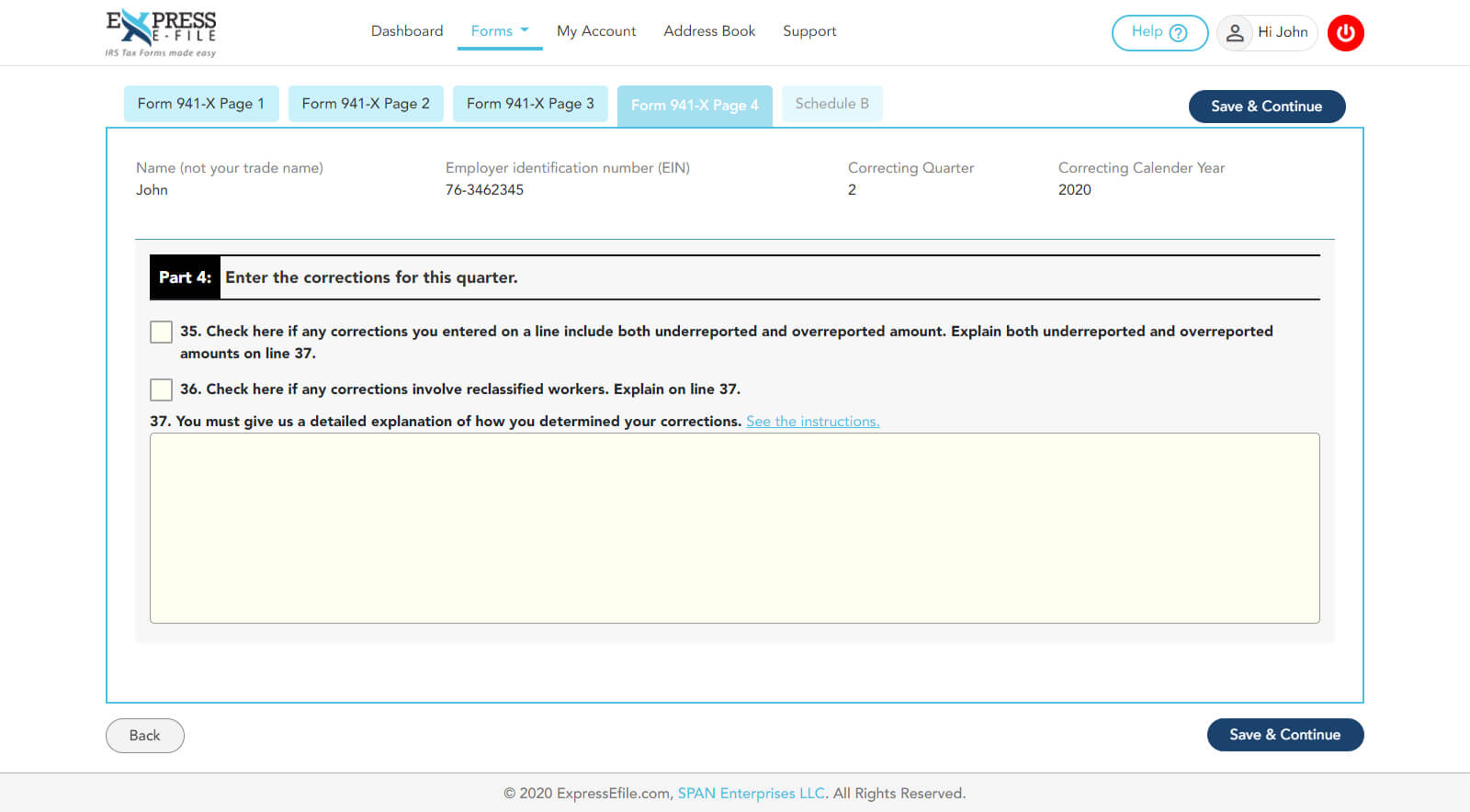

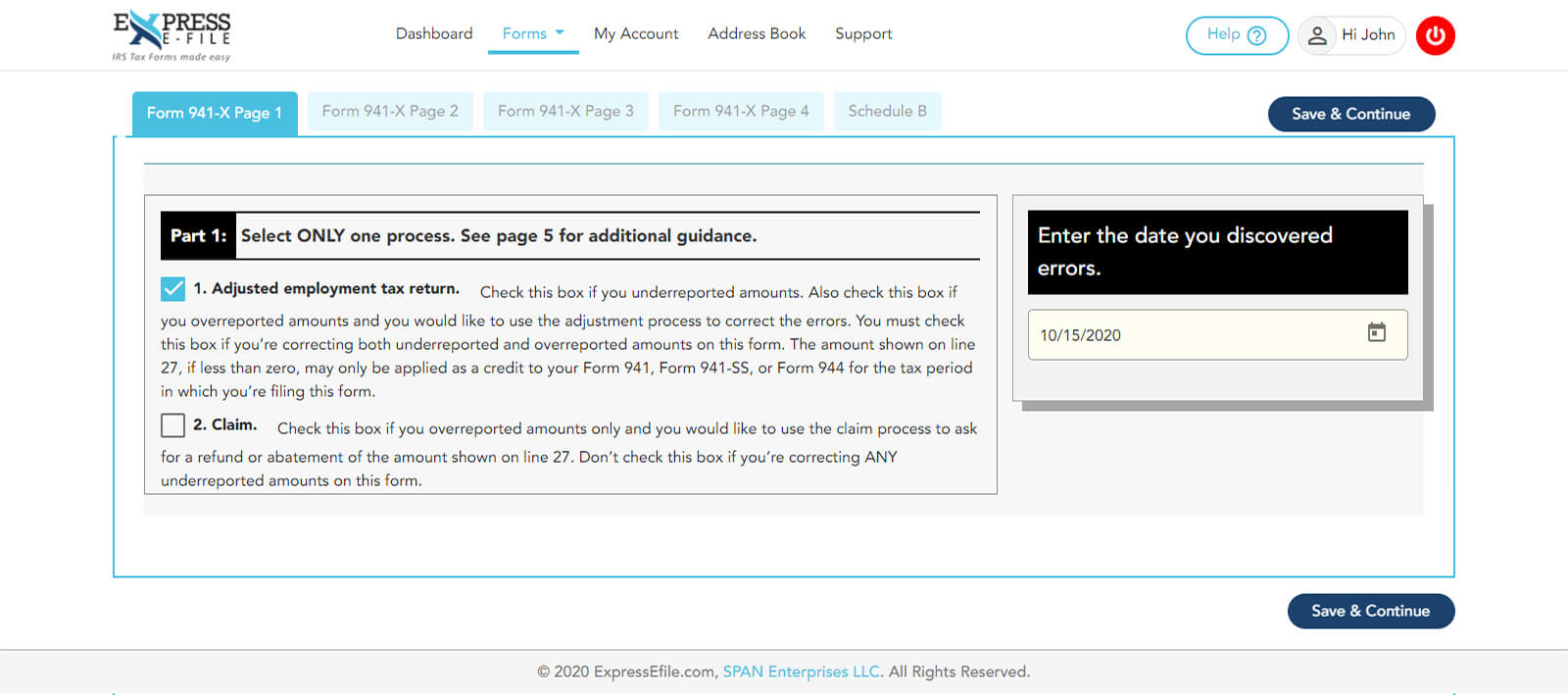

How to Complete & Download Form 941X (Amended Form 941)?

Mail your return to the address listed for your location in the. Web the irs announced that, effective immediately, the addresses where paper forms 941 are mailed have changed. Connecticut, delaware, district of columbia, georgia,. There are two different department of the treasury. Web if you file a paper return, where you file depends on whether you include a payment.

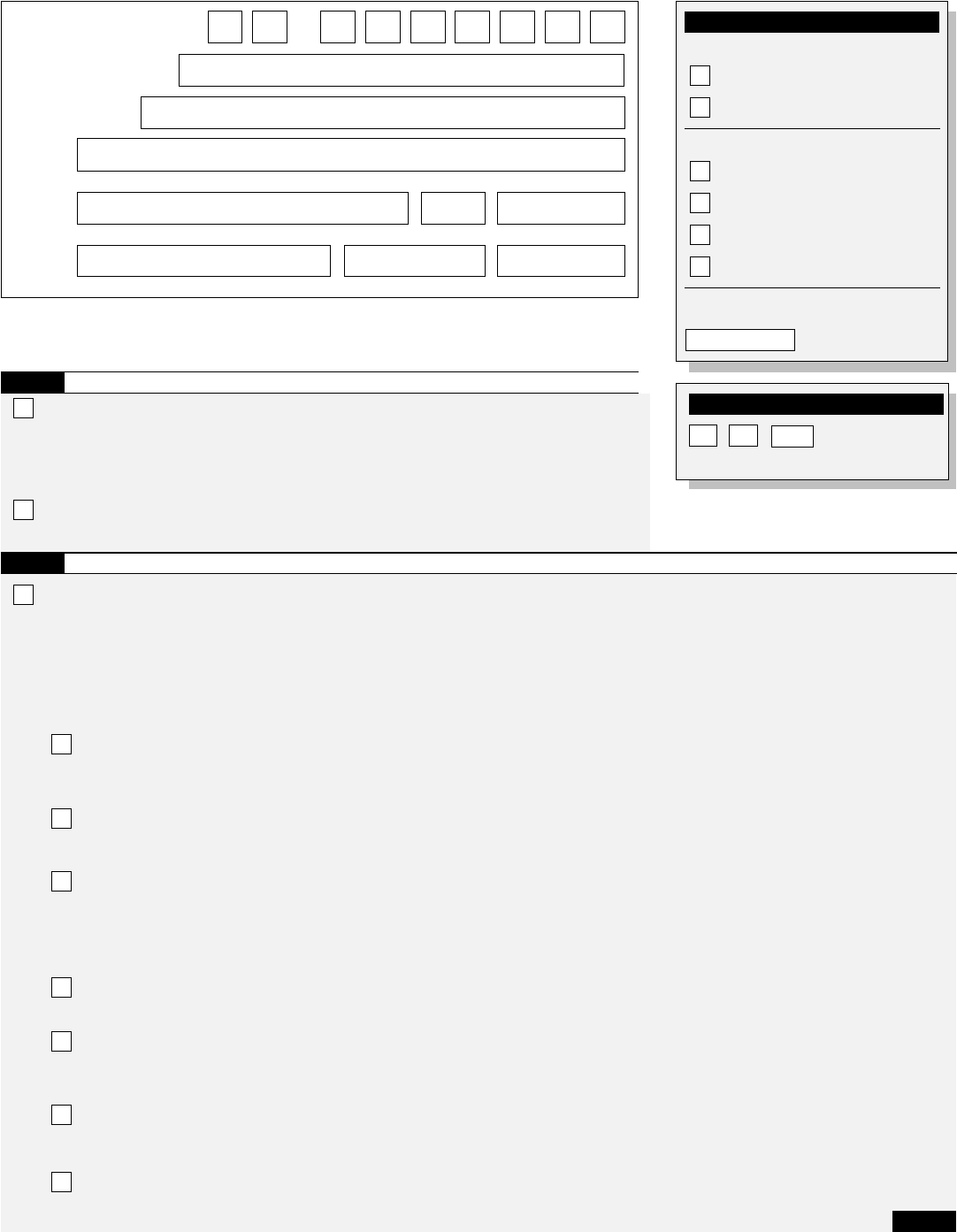

Form 941X Edit, Fill, Sign Online Handypdf

The practitioner can change the overpayment amount to $100 ($500 erc less the $400 that is still owed. Mail your return to the address listed for your location in the. Web the irs announced that, effective immediately, the addresses where paper forms 941 are mailed have changed. Check out the irs’s “ where to file your. There are two different.

IRS Fillable Forms 2290, 941, 941X, W2 & 1099 Download & Print

Web if you file a paper return, where you file depends on whether you include a payment with form 941. Mail your return to the address listed for your location in the. Check out the irs’s “ where to file your. Connecticut, delaware, district of columbia, georgia,. The irs recommends checking any preprinted envelopes used to.

Create and Download Form 941 X Fillable and Printable 2022 941X

The practitioner can change the overpayment amount to $100 ($500 erc less the $400 that is still owed. Web mailing addresses for forms 941. There are two different department of the treasury. Fill out your company info. Apply for an ein by faxing or.

Form 941 instructions for 2022 Employer’s Quarterly Federal Tax Return

Apply for an ein by faxing or. There are two different department of the treasury. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Fill out your company info. Mail your return to the address listed for your location in the.

Solved Complete Form 941 for the 2nd quarter of 2019 for

There are two different department of the treasury. Web if you file a paper return, where you file depends on whether you include a payment with form 941. The practitioner can change the overpayment amount to $100 ($500 erc less the $400 that is still owed. Mail your return to the address listed for your location in the. The irs.

Fillable Form 941X Adjusted Employer'S Quarterly Federal Tax Return

Connecticut, delaware, district of columbia, georgia,. There are two different department of the treasury. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web mailing addresses for forms 941. Web if you file a paper return, where you file depends on whether you include a payment with.

Internal Revenue Service Address Ogden Ut 84201 runyondesigns

Web the irs announced that, effective immediately, the addresses where paper forms 941 are mailed have changed. Apply for an ein by faxing or. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. The mailing address you use depends on your business’s location. There are two different department of.

How to Complete & Download Form 941X (Amended Form 941)?

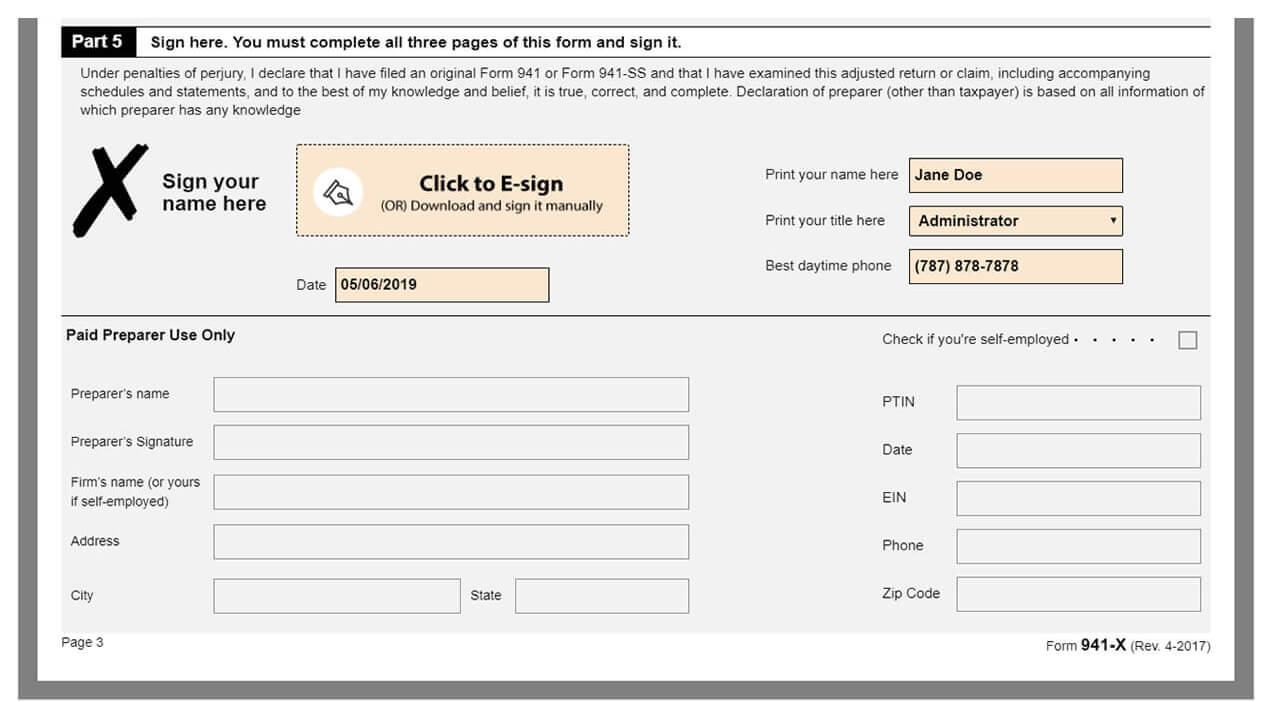

The mailing address you use depends on your business’s location. Mail your return to the address listed for your location in the. Fill out your company info. Web the irs announced that, effective immediately, the addresses where paper forms 941 are mailed have changed. The practitioner can change the overpayment amount to $100 ($500 erc less the $400 that is.

Form 941 X mailing address Fill online, Printable, Fillable Blank

Fill out your company info. Web if you file a paper return, where you file depends on whether you include a payment with form 941. Connecticut, delaware, district of columbia, georgia,. The mailing address you use depends on your business’s location. Apply for an ein by faxing or.

Mail Your Return To The Address Listed For Your Location In The.

Web the irs announced that, effective immediately, the addresses where paper forms 941 are mailed have changed. Fill out your company info. The mailing address you use depends on your business’s location. The practitioner can change the overpayment amount to $100 ($500 erc less the $400 that is still owed.

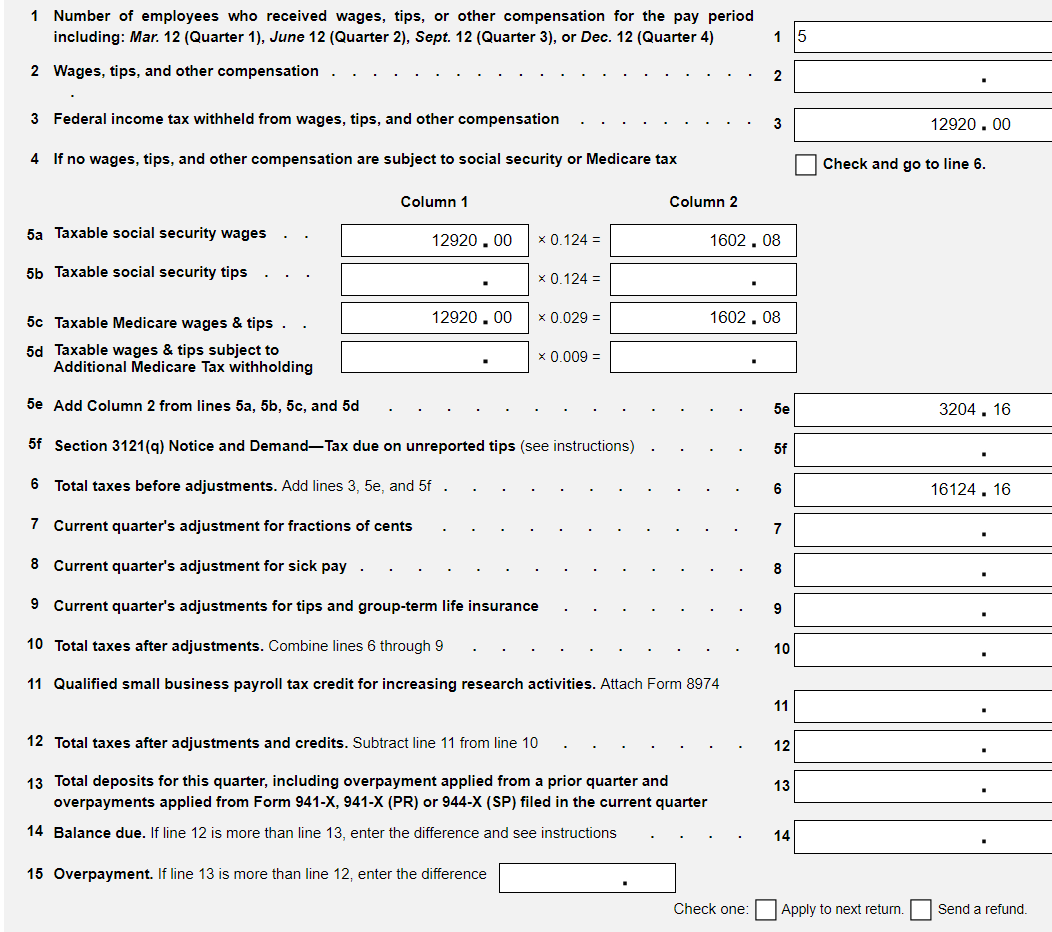

Employee Wages, Income Tax Withheld From Wages, Taxable Social Security Wages, Taxable Social Security Tips, Taxable Medicare Wages And Tips,.

Apply for an ein by faxing or. Web if you file a paper return, where you file depends on whether you include a payment with form 941. Connecticut, delaware, district of columbia, georgia,. The irs recommends checking any preprinted envelopes used to.

There Are Two Different Department Of The Treasury.

April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Check out the irs’s “ where to file your. Web mailing addresses for forms 941.