Where To Report Ira On Form 706

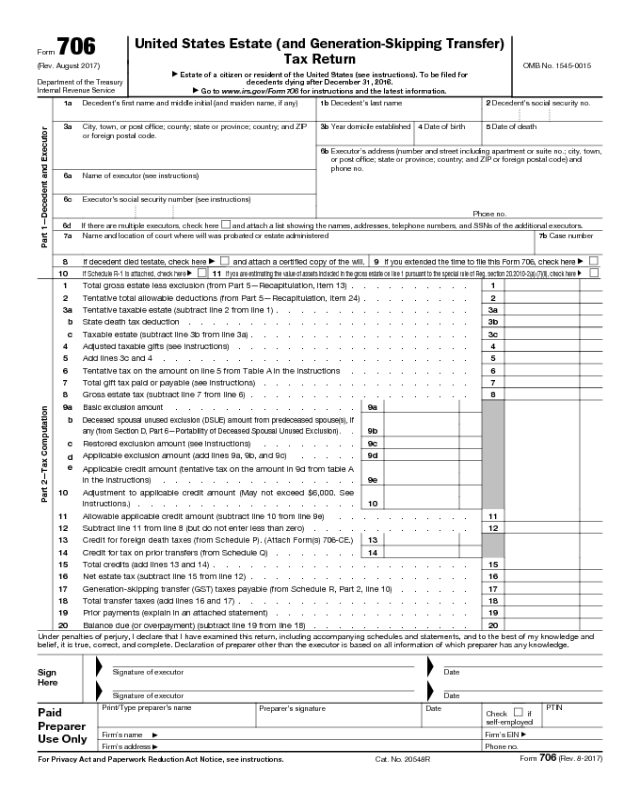

Where To Report Ira On Form 706 - Consistent basis reporting estates are required to report to the irs and the recipient the estate tax value of each. Web form 706 is filed with the internal revenue service center for the state in which the decedent was domiciled at the time of his or her death (§6091(b)(3)). This holds true even if a return would otherwise not be required. Payment due with return (07061) payment on a proposed assessment (07064) estimated payment (07066) payment after the return was due and filed (07067) payment. Web i believe that the line you're referring to refers to exclusion amounts for annuities, including ira's in annuities. So, for annuities that are in an ira's, that's. Web i sent my form 706 filing package last week using a private delivery service (pds) designated by the irs to meet the “timely mailing as timely filing” rule under. That’s why we created a form 706 example. Generally, no exclusion is allowed for. Other miscellaneous property not reportable.

Web i believe that the line you're referring to refers to exclusion amounts for annuities, including ira's in annuities. This holds true even if a return would otherwise not be required. Web nationally renowned tax expert, robert s. And zip or foreign postal code) and. Web form 706 that corresponds to the date of the decedent's death. Answered in 52 minutes by: All estates that exceed the exemption amount must file. An heir files this form to report the. Where do i report 401k and ira on the form 706. Web form 706 is filed with the internal revenue service center for the state in which the decedent was domiciled at the time of his or her death (§6091(b)(3)).

So, for annuities that are in an ira's, that's. Web form 706 that corresponds to the date of the decedent's death. Web iras, both traditional and roth, are reported on form 706 schedule i, annuities. Other miscellaneous property not reportable. Web form 706 is filed with the internal revenue service center for the state in which the decedent was domiciled at the time of his or her death (§6091(b)(3)). All estates that exceed the exemption amount must file. Generally, no exclusion is allowed for. Web form 706 for an estate tax return is an often misunderstood form. Web i sent my form 706 filing package last week using a private delivery service (pds) designated by the irs to meet the “timely mailing as timely filing” rule under. Web i believe that the line you're referring to refers to exclusion amounts for annuities, including ira's in annuities.

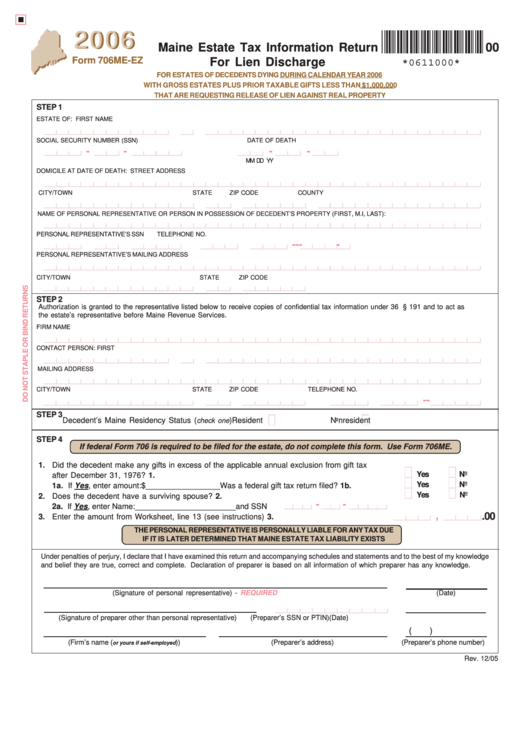

Form 706 Me Ez Maine Estate Tax Information Return For Lien Discharge

Answered in 52 minutes by: Web form 706 for an estate tax return is an often misunderstood form. Web where do i report 401k and ira on the form 706. And zip or foreign postal code) and. Web i sent my form 706 filing package last week using a private delivery service (pds) designated by the irs to meet the.

Form 706 Edit, Fill, Sign Online Handypdf

Web form 706 is filed with the internal revenue service center for the state in which the decedent was domiciled at the time of his or her death (§6091(b)(3)). Web form 706 for an estate tax return is an often misunderstood form. And zip or foreign postal code) and. City, town, or post office; Generally, no exclusion is allowed for.

IRA Government Report / 5498 Format

Web nationally renowned tax expert, robert s. And zip or foreign postal code) and. So, for annuities that are in an ira's, that's. Other miscellaneous property not reportable. Answered in 52 minutes by:

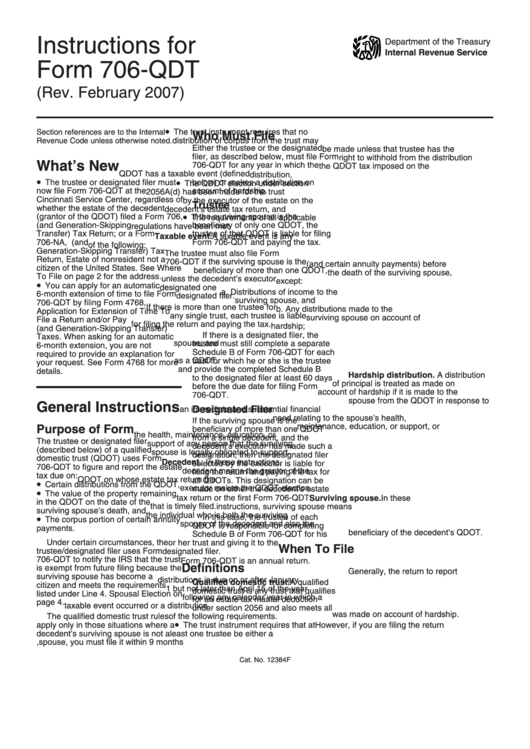

Instructions For Form 706Qdt Department Of The Treasury printable

Web deceased (died in late 2020) held stocks, etf's, and mutual funds in his traditional and roth ira's. Web where do i report 401k and ira on the form 706. Web form 706 that corresponds to the date of the decedent's death. Web form 706 is filed with the internal revenue service center for the state in which the decedent.

Fixing Backdoor Roth IRAs The FI Tax Guy

Outside of annual rmd's (although he did not take rmd in. Payment due with return (07061) payment on a proposed assessment (07064) estimated payment (07066) payment after the return was due and filed (07067) payment. Web 1 executor’s address (number and street including apartment or suite no.; An heir files this form to report the. Generally, no exclusion is allowed.

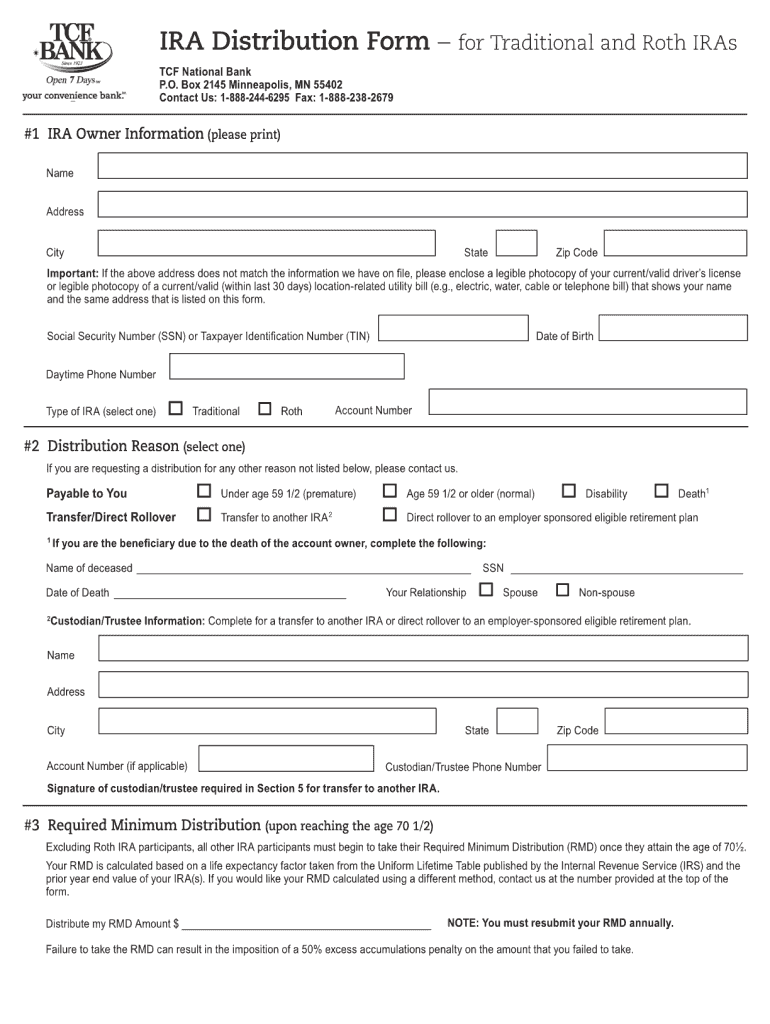

Bank Ira Distribution Form Fill Online, Printable, Fillable, Blank

Web form 706 for an estate tax return is an often misunderstood form. That’s why we created a form 706 example. Where do i report 401k and ira on the form 706. Other miscellaneous property not reportable. And zip or foreign postal code) and.

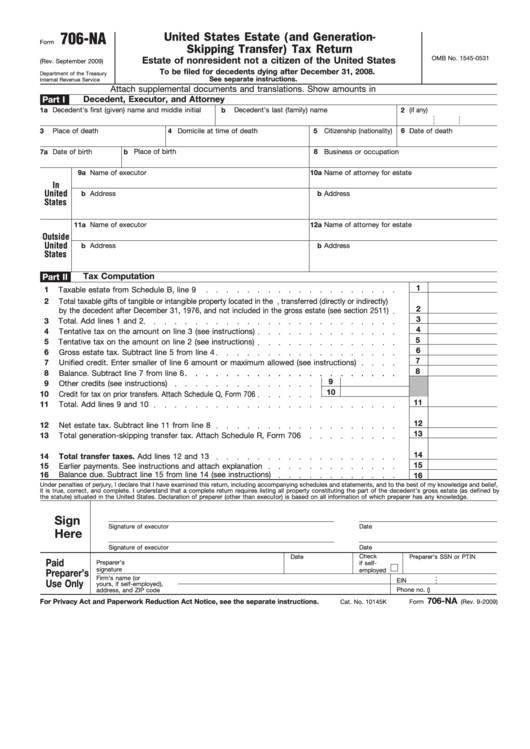

Fillable Form 706Na 2009 United States Estate (And

See the note at the top of schedule i: Where do i report 401k and ira on the form 706. Web i believe that the line you're referring to refers to exclusion amounts for annuities, including ira's in annuities. This holds true even if a return would otherwise not be required. Web i sent my form 706 filing package last.

Form 706QDT U.S. Estate Tax Return for Qualified Domestic Trusts

Web form 706 for an estate tax return is an often misunderstood form. That’s why we created a form 706 example. Payment due with return (07061) payment on a proposed assessment (07064) estimated payment (07066) payment after the return was due and filed (07067) payment. See the note at the top of schedule i: This holds true even if a.

Form 706A United States Additional Estate Tax Return (2013) Free

Web form 706 is filed with the internal revenue service center for the state in which the decedent was domiciled at the time of his or her death (§6091(b)(3)). Consistent basis reporting estates are required to report to the irs and the recipient the estate tax value of each. And zip or foreign postal code) and. Web deceased (died in.

Form 706 Na Instructions

Web i believe that the line you're referring to refers to exclusion amounts for annuities, including ira's in annuities. So, for annuities that are in an ira's, that's. Where do i report 401k and ira on the form 706. Payment due with return (07061) payment on a proposed assessment (07064) estimated payment (07066) payment after the return was due and.

Web Deceased (Died In Late 2020) Held Stocks, Etf's, And Mutual Funds In His Traditional And Roth Ira's.

Web where do i report 401k and ira on the form 706. Payment due with return (07061) payment on a proposed assessment (07064) estimated payment (07066) payment after the return was due and filed (07067) payment. All estates that exceed the exemption amount must file. Web nationally renowned tax expert, robert s.

Web Form 706 Is Filed With The Internal Revenue Service Center For The State In Which The Decedent Was Domiciled At The Time Of His Or Her Death (§6091(B)(3)).

Web i believe that the line you're referring to refers to exclusion amounts for annuities, including ira's in annuities. So, for annuities that are in an ira's, that's. Web form 706 that corresponds to the date of the decedent's death. Web iras, both traditional and roth, are reported on form 706 schedule i, annuities.

Where Do I Report 401K And Ira On The Form 706.

Web i sent my form 706 filing package last week using a private delivery service (pds) designated by the irs to meet the “timely mailing as timely filing” rule under. This holds true even if a return would otherwise not be required. And zip or foreign postal code) and. Web form 706 for an estate tax return is an often misunderstood form.

City, Town, Or Post Office;

An heir files this form to report the. Other miscellaneous property not reportable. Web 1 executor’s address (number and street including apartment or suite no.; See the note at the top of schedule i: