Who Needs To Fill Out A California Form 590

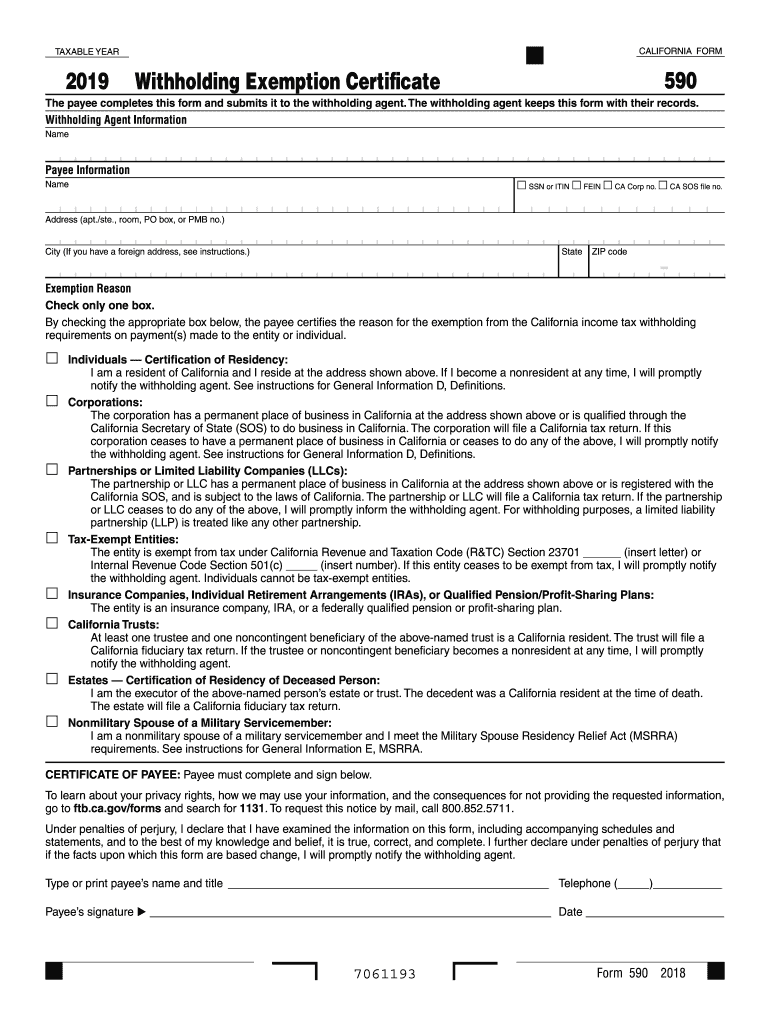

Who Needs To Fill Out A California Form 590 - Web withholding exemption certificate (this form can only be used to certify exemption from nonresident withholding under california r&tc section 18662. You're a resident if either apply: The payee is a resident of california, or is an s corporation, a partnership, or an llc that has a permanent place of business in california. This form should be completed after. Web the payment is for goods. Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments. If i become a nonresident at any time, i will promptly notify the. Ftb form 590, withholding exemption. Web c who certifies this form form 590 is certified (completed and signed) by the payee. This form is used by california residents who file an individual income tax return.

California residents or entities exempt from the withholding requirement should. Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments. The payee is a resident of california, or is an s corporation, a partnership, or an llc that has a permanent place of business in california. Web individuals — certification of residency: Ftb form 590, withholding exemption. Web the most common california income tax form is the ca 540. Web california formtaxable year2021withholding exemption certificate590the payee completes this form and submits it to the withholding agent. This form should be completed after. You're a resident if either apply: This form is used by california residents who file an individual income tax return.

Present in california for other than a temporary or transitory purpose. (a) a party aggrieved by an order or decision may, within 30 days of service of such order or decision, petition the appeals. Ftb form 590, withholding exemption. This form should be completed after. Web california formtaxable year2021withholding exemption certificate590the payee completes this form and submits it to the withholding agent. The payee is a resident of california, or is an s corporation, a partnership, or an llc that has a permanent place of business in california. The withholding agent keeps this form with their records. California residents or entities exempt from the withholding requirement should. Web california form 590 the payee completes this form and submits it to the withholding agent. Web california residents or entities should complete and present form 590 to the withholding agent.

Ca590 Fill Out and Sign Printable PDF Template signNow

California residents or entities exempt from the withholding requirement should complete. Web individuals — certification of residency: Form 590 is certified (completed and signed) by the payee. Web because your organization is located outside of california, please return one of the following forms along with your executed contract: Web the most common california income tax form is the ca 540.

How To Fill Out A Fax Sheet FILL OUT A SCORE SHEET River City

The withholding agent is then relieved of the withholding requirements if the. Web because your organization is located outside of california, please return one of the following forms along with your executed contract: Web c who certifies this form form 590 is certified (completed and signed) by the payee. Form 590 is certified (completed and signed) by the payee. Web.

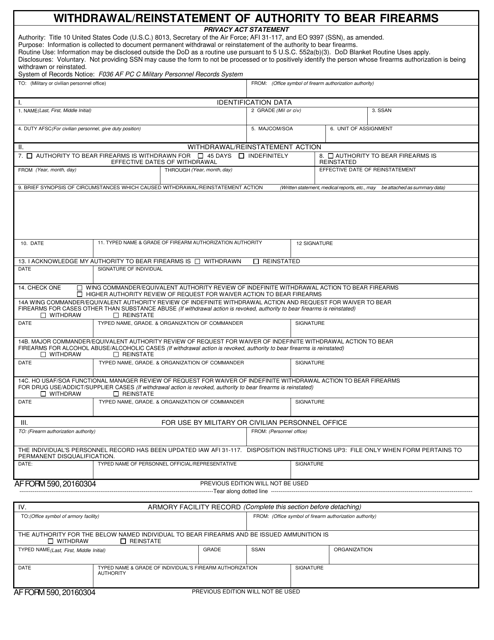

AF Form 590 Download Fillable PDF or Fill Online Withdrawal

Web california form 590 the payee completes this form and submits it to the withholding agent. Web because your organization is located outside of california, please return one of the following forms along with your executed contract: Web withholding exemption certificate (this form can only be used to certify exemption from nonresident withholding under california r&tc section 18662. This form.

Hot 10+ California Franchise Tax Board, Model Dresses Paling Dicari!

Web because your organization is located outside of california, please return one of the following forms along with your executed contract: Web individuals — certification of residency: The withholding agent keeps this form with their records. This form should be completed after. Present in california for other than a temporary or transitory purpose.

2016 Form 590 Withholding Exemption Certificate Edit, Fill, Sign

Domiciled in california, but outside california for a temporary or. California residents or entities exempt from the withholding requirement should complete. Web who needs to fill out a ca form 590? Ftb form 590, withholding exemption. If i become a nonresident at any time, i will promptly notify the.

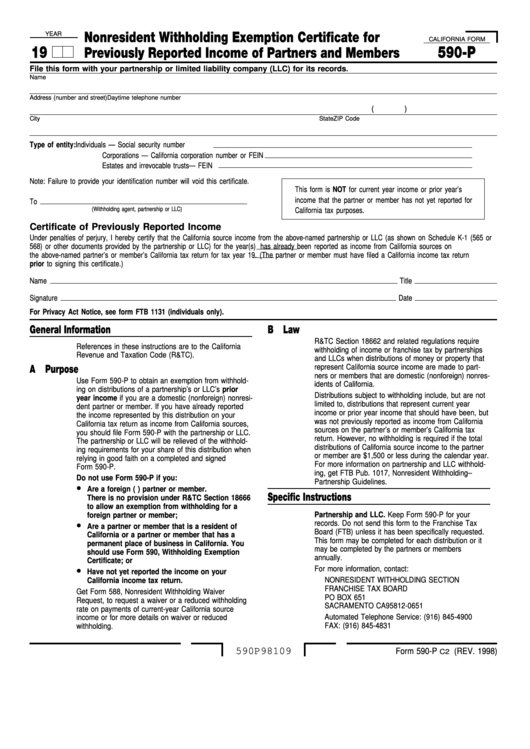

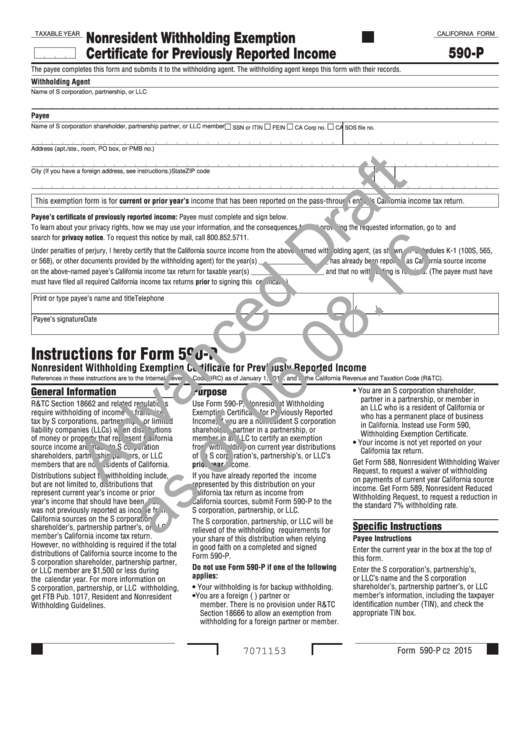

Fillable California Form 590P Nonresident Witholding Exemption

Web one of our clients is asking me to fill out a form 590 withholding exemption. The payee is a resident of california, or is an s corporation, a partnership, or an llc that has a permanent place of business in california. Am a resident of california and i reside at the address shown above. Web individuals — certification of.

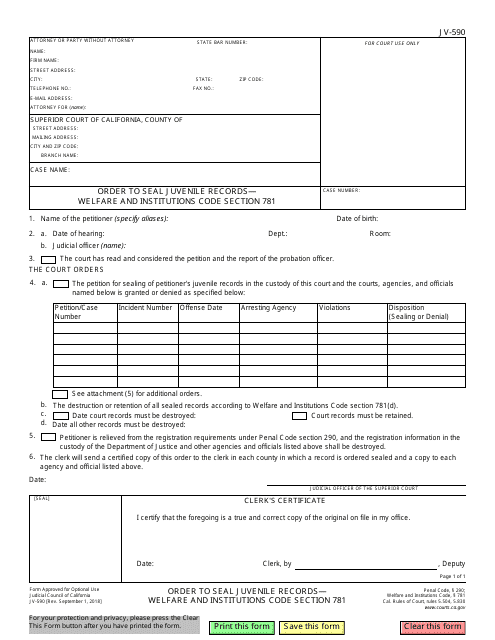

Form JV590 Download Fillable PDF or Fill Online Order to Seal Juvenile

Web the payment is for goods. You're a resident if either apply: Web no withholding is required. California residents or entities exempt from the withholding requirement should complete. Web california form 590 the payee completes this form and submits it to the withholding agent.

California Form 590P Draft Nonresident Withholding Exemption

Web because your organization is located outside of california, please return one of the following forms along with your executed contract: Web who needs to fill out a ca 590? Am a resident of california and i reside at the address shown above. The payee is a resident of california, or is an s corporation, a partnership, or an llc.

2016 Form 590 Withholding Exemption Certificate Edit, Fill, Sign

You're a resident if either apply: Domiciled in california, but outside california for a temporary or. The withholding agent is then relieved of the withholding requirements if the. Web no withholding is required. Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments.

2021 Form CA FTB 590P Fill Online, Printable, Fillable, Blank pdfFiller

Filing of petition and answer. Web the payment is for goods. California residents or entities exempt from the withholding requirement should complete. All required california income tax returns are filed. The withholding agent is then relieved of the withholding requirements if the.

This Form Is Used By California Residents Who File An Individual Income Tax Return.

All required california income tax returns are filed. Domiciled in california, but outside california for a temporary or. (a) a party aggrieved by an order or decision may, within 30 days of service of such order or decision, petition the appeals. If i become a nonresident at any time, i will promptly notify the.

You're A Resident If Either Apply:

Web withholding exemption certificate (this form can only be used to certify exemption from nonresident withholding under california r&tc section 18662. The payee is a resident of california, or is an s corporation, a partnership, or an llc that has a permanent place of business in california. Web california form taxable year 2022 withholding exemption certificate 590 the payee completes this form and submits it to the withholding agent. Web c who certifies this form form 590 is certified (completed and signed) by the payee.

This Form Cannot Be Used.

Present in california for other than a temporary or transitory purpose. Web california formtaxable year2021withholding exemption certificate590the payee completes this form and submits it to the withholding agent. Web who needs to fill out a ca form 590? Web who needs to fill out a ca 590?

Filing Of Petition And Answer.

This form should be completed after. Web california residents or entities should complete and present form 590 to the withholding agent. Web the payment is for goods. The withholding agent keeps this form with their records.