Wr 30 Form

Wr 30 Form - Companies must get approval from the new jersey division of revenue if they develop: The paper document will be scanned and imaged using automated character The paper document will be scanned and imaged using automated character recognition technologies to input the information you supply. Press done after you fill out the document. Web make use of the sign tool to create and add your electronic signature to signnow the wr 30 pdf form. It may be submitted electronically, or if there are 4 or less employees, by paper. Now you can print, download, or share the form. Use this option to fill in and electronically file the following form (s): It may be submitted electronically, or if there are 4 or less employees, by paper. For the first section, you will need to enter the names and social security numbers for each of your employees, along with their base week and salary information.

Press done after you fill out the document. Failing to file this form can result in fines and other penalties, so it's important to understand what it is and how to complete it. Address the support section or contact our support crew in the event you've got any concerns. Now you can print, download, or share the form. It may be submitted electronically, or if there are 4 or less employees, by paper. For the first section, you will need to enter the names and social security numbers for each of your employees, along with their base week and salary information. This form is used by employers in the state of new jersey to reconcile their withholding taxes for each employee. Web employer payroll tax electronic filing and reporting options. The paper document will be scanned and imaged using automated character Use this option to fill in and electronically file the following form (s):

For the first section, you will need to enter the names and social security numbers for each of your employees, along with their base week and salary information. Now you can print, download, or share the form. It may be submitted electronically, or if there are 4 or less employees, by paper. This form is used by employers in the state of new jersey to reconcile their withholding taxes for each employee. Failing to file this form can result in fines and other penalties, so it's important to understand what it is and how to complete it. Address the support section or contact our support crew in the event you've got any concerns. Web employer payroll tax electronic filing and reporting options. Use this option to fill in and electronically file the following form (s): Companies must get approval from the new jersey division of revenue if they develop: The form is due to the new jersey department of treasury by the end of february of the following tax year.

Form 30

This form is used by employers in the state of new jersey to reconcile their withholding taxes for each employee. Web make use of the sign tool to create and add your electronic signature to signnow the wr 30 pdf form. The paper document will be scanned and imaged using automated character Press done after you fill out the document..

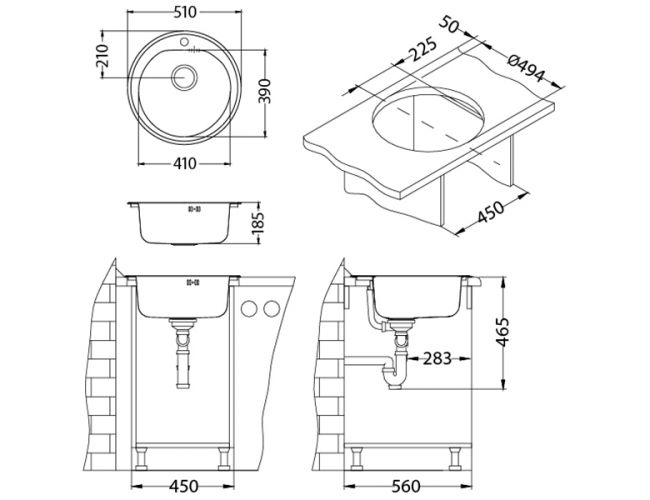

Form 30 Alveus

Use this option to fill in and electronically file the following form (s): For the first section, you will need to enter the names and social security numbers for each of your employees, along with their base week and salary information. The paper document will be scanned and imaged using automated character Address the support section or contact our support.

Southern California Aquatics SCAQ Swim Club January 2011

It may be submitted electronically, or if there are 4 or less employees, by paper. Press done after you fill out the document. Web make use of the sign tool to create and add your electronic signature to signnow the wr 30 pdf form. Web employer payroll tax electronic filing and reporting options. This form is used by employers in.

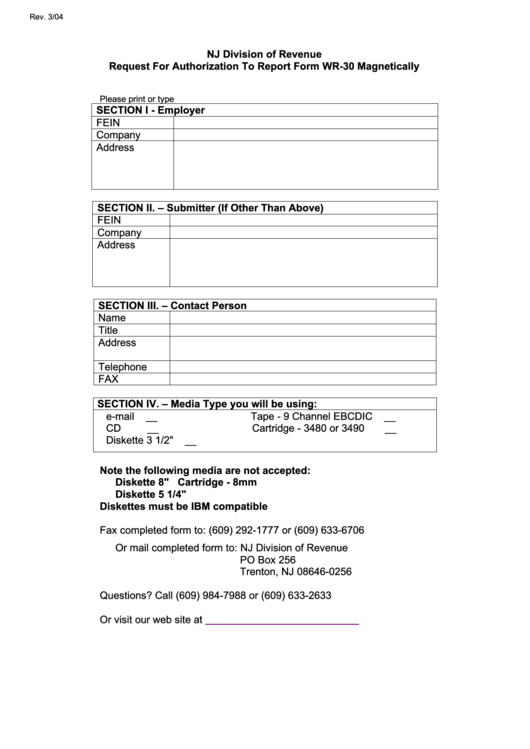

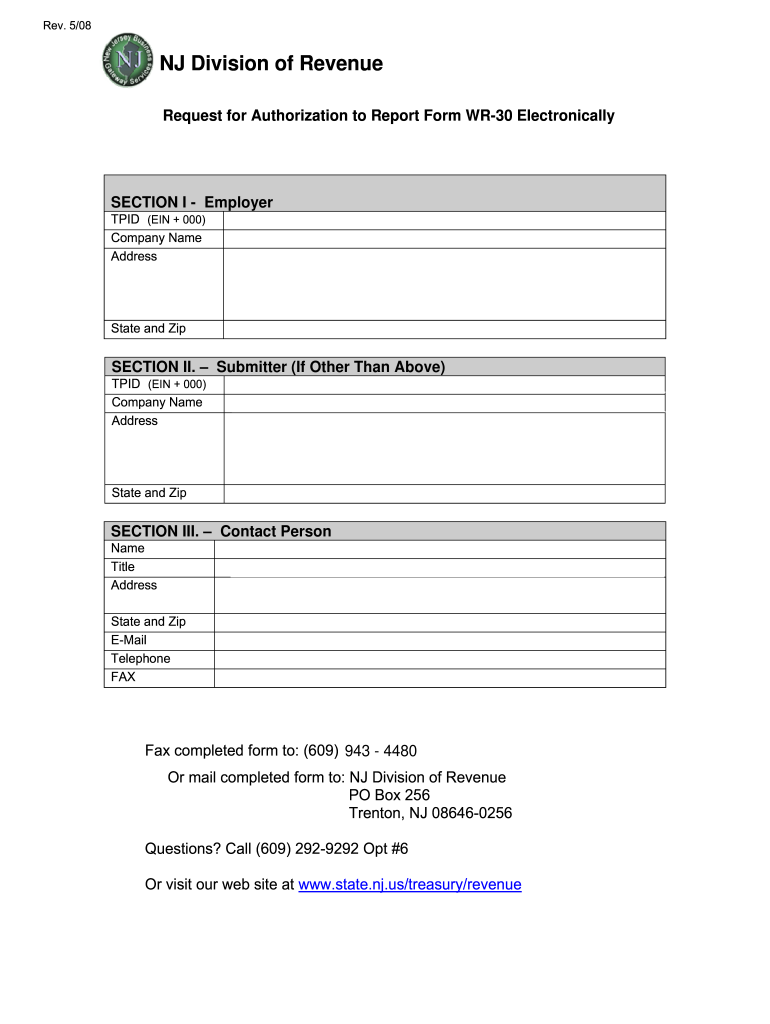

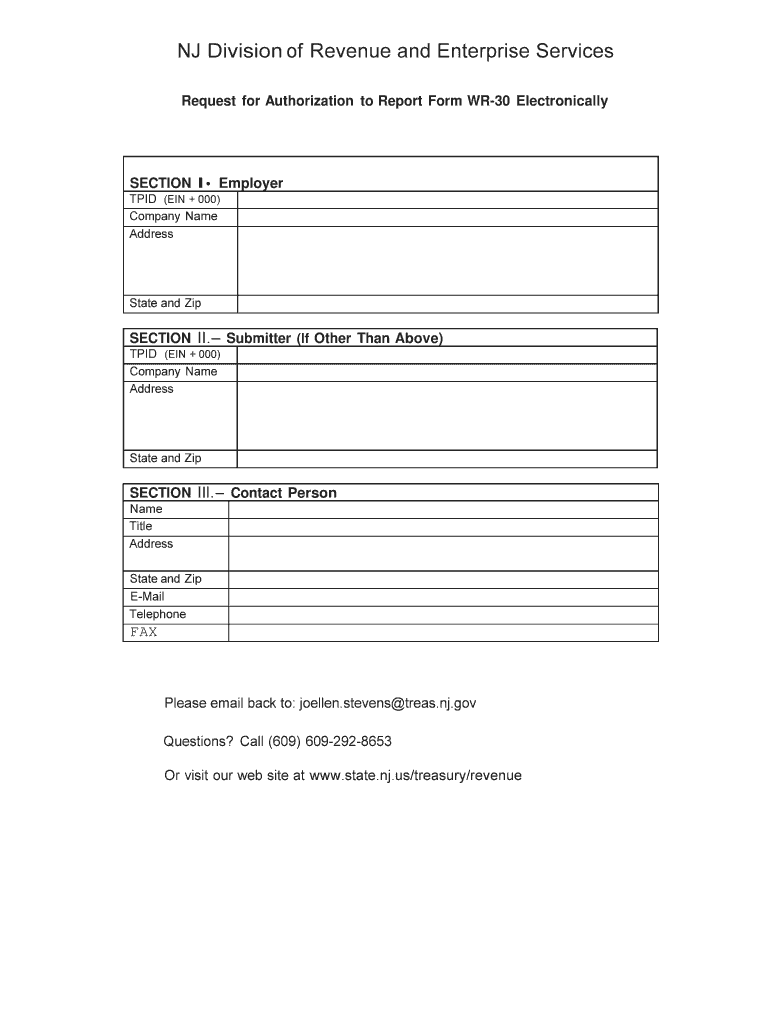

Fillable Request For Authorization To Report Form Wr30

It may be submitted electronically, or if there are 4 or less employees, by paper. Web make use of the sign tool to create and add your electronic signature to signnow the wr 30 pdf form. For the first section, you will need to enter the names and social security numbers for each of your employees, along with their base.

PPT New Jersey Department of Labor and Workforce Development Return

Failing to file this form can result in fines and other penalties, so it's important to understand what it is and how to complete it. The paper document will be scanned and imaged using automated character Press done after you fill out the document. The paper document will be scanned and imaged using automated character recognition technologies to input the.

Wr30 Form Fill Out and Sign Printable PDF Template signNow

The paper document will be scanned and imaged using automated character It may be submitted electronically, or if there are 4 or less employees, by paper. Web make use of the sign tool to create and add your electronic signature to signnow the wr 30 pdf form. Press done after you fill out the document. It may be submitted electronically,.

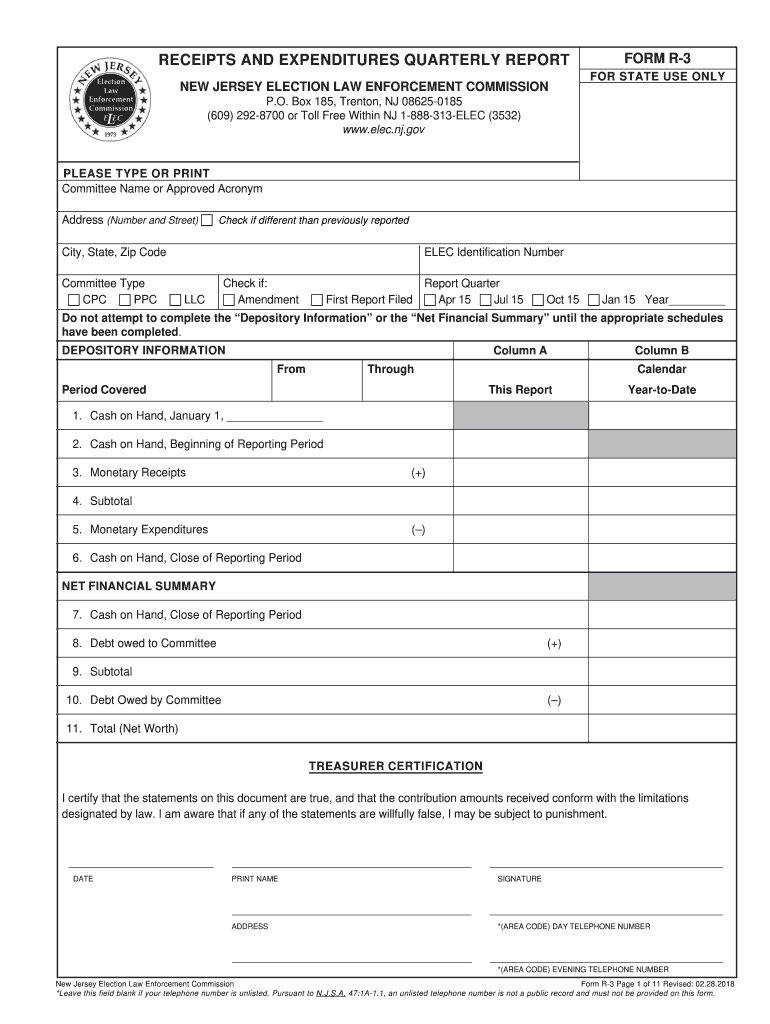

Nj Elec Fill Out and Sign Printable PDF Template signNow

This form is used by employers in the state of new jersey to reconcile their withholding taxes for each employee. Failing to file this form can result in fines and other penalties, so it's important to understand what it is and how to complete it. Web make use of the sign tool to create and add your electronic signature to.

Nj Wr 30 Form Fill Out and Sign Printable PDF Template signNow

Address the support section or contact our support crew in the event you've got any concerns. Web make use of the sign tool to create and add your electronic signature to signnow the wr 30 pdf form. The paper document will be scanned and imaged using automated character The paper document will be scanned and imaged using automated character recognition.

20202023 Form NY DTF ET30 Fill Online, Printable, Fillable, Blank

Web employer payroll tax electronic filing and reporting options. This form is used by employers in the state of new jersey to reconcile their withholding taxes for each employee. The paper document will be scanned and imaged using automated character recognition technologies to input the information you supply. Now you can print, download, or share the form. Press done after.

2014 Form OR ORWR Fill Online, Printable, Fillable, Blank pdfFiller

Failing to file this form can result in fines and other penalties, so it's important to understand what it is and how to complete it. It may be submitted electronically, or if there are 4 or less employees, by paper. Use this option to fill in and electronically file the following form (s): Now you can print, download, or share.

Press Done After You Fill Out The Document.

Now you can print, download, or share the form. It may be submitted electronically, or if there are 4 or less employees, by paper. The form is due to the new jersey department of treasury by the end of february of the following tax year. The paper document will be scanned and imaged using automated character recognition technologies to input the information you supply.

Failing To File This Form Can Result In Fines And Other Penalties, So It's Important To Understand What It Is And How To Complete It.

Use this option to fill in and electronically file the following form (s): Web employer payroll tax electronic filing and reporting options. The paper document will be scanned and imaged using automated character Web make use of the sign tool to create and add your electronic signature to signnow the wr 30 pdf form.

Companies Must Get Approval From The New Jersey Division Of Revenue If They Develop:

This form is used by employers in the state of new jersey to reconcile their withholding taxes for each employee. Address the support section or contact our support crew in the event you've got any concerns. It may be submitted electronically, or if there are 4 or less employees, by paper. For the first section, you will need to enter the names and social security numbers for each of your employees, along with their base week and salary information.