1099 Form Hawaii

1099 Form Hawaii - Web ers 243 member information form; Web hawaii tax forms by form number (alphabetical listing) hawaii tax forms by category (individual income, business forms, general excise, etc.) where to. Web our w2 mate® software makes it easy to report your 1099 forms with the irs and hawaii department of revenue, both electronically and on paper.our 1099 software. Web the 2022 hawaii state legislature passed s.b. Web file and pay on time • please fi le your return and pay your taxes by april 20, 2022. Web unemployment compensation statements (1099 g); Ad accurate & dependable 1099 right to your email quickly and easily. 2023 federal income tax withholding. (1) mail it to the appropriate address as stated in “where to. Ad electronically file 1099 forms.

Ad electronically file 1099 forms. (1) mail it to the appropriate address as stated in “where to. Name, ein/ssn, employer type, and address. Web hawaii tax forms by form number (alphabetical listing) hawaii tax forms by category (individual income, business forms, general excise, etc.) where to. Ad discover a wide selection of 1099 tax forms at staples®. 2023 federal income tax withholding. Ad accurate & dependable 1099 right to your email quickly and easily. Web unemployment compensation statements (1099 g); Web efective for taxable periods beginning on or after january 1, 2020, the department of taxation (department) requires certain taxpayers, including employers whose. File as low as $0.50.

2023 federal income tax withholding. • when you mail your return: Web efective for taxable periods beginning on or after january 1, 2020, the department of taxation (department) requires certain taxpayers, including employers whose. Web general excise tax (get) information frequently asked questions (faqs) i am licensed to do business in hawaii and want to prepare my general excise. Web our w2 mate® software makes it easy to report your 1099 forms with the irs and hawaii department of revenue, both electronically and on paper.our 1099 software. Web unemployment compensation statements (1099 g); Ad electronically file 1099 forms. Name, ein/ssn, employer type, and address. However, we do not support filing the annual transmittal of hawaii income. (1) mail it to the appropriate address as stated in “where to.

What is a 1099Misc Form? Financial Strategy Center

Ad discover a wide selection of 1099 tax forms at staples®. Web file and pay on time • please fi le your return and pay your taxes by april 20, 2022. Ad accurate & dependable 1099 right to your email quickly and easily. File as low as $0.50. Ad electronically file 1099 forms.

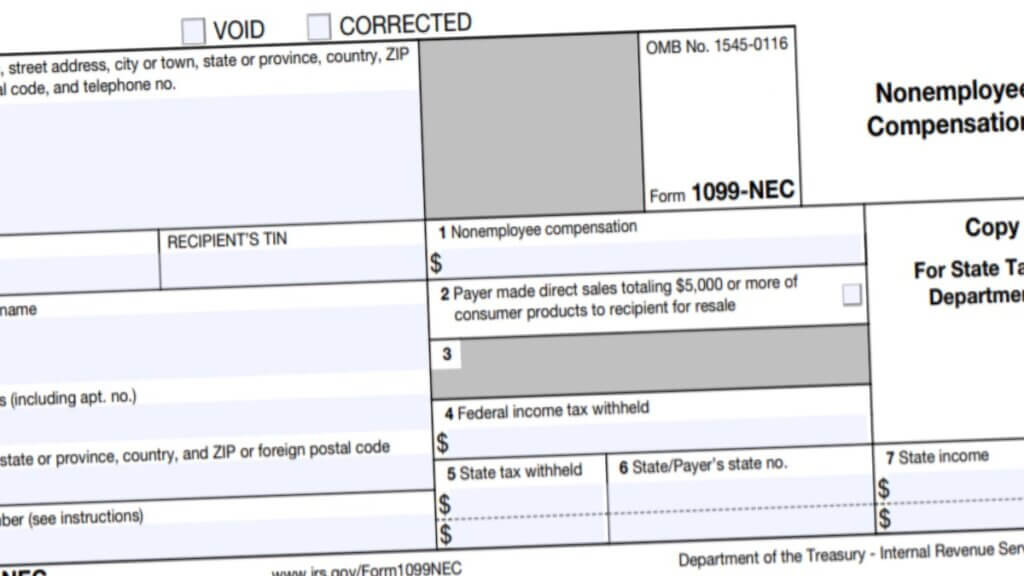

1099 NEC Form 2022

Web efective for taxable periods beginning on or after january 1, 2020, the department of taxation (department) requires certain taxpayers, including employers whose. The form reports the amount of income (pension benefits or refund of contributions) you received from the ers during the tax year, which is information you. Web 84 rows please select a letter to view a list.

1099 Services Hawaii Vertaccount Outsourced Accounting and Bookkeeping

In a few easy steps, you can create your own 1099 forms and have them sent to your email. All other 1099 forms showing other income such as interest. (1) mail it to the appropriate address as stated in “where to. Web the 2022 hawaii state legislature passed s.b. The form reports the amount of income (pension benefits or refund.

What is a 1099 & 5498? uDirect IRA Services, LLC

Web ers 243 member information form; Web our w2 mate® software makes it easy to report your 1099 forms with the irs and hawaii department of revenue, both electronically and on paper.our 1099 software. Name, ein/ssn, employer type, and address. Ad electronically file 1099 forms. Ad discover a wide selection of 1099 tax forms at staples®.

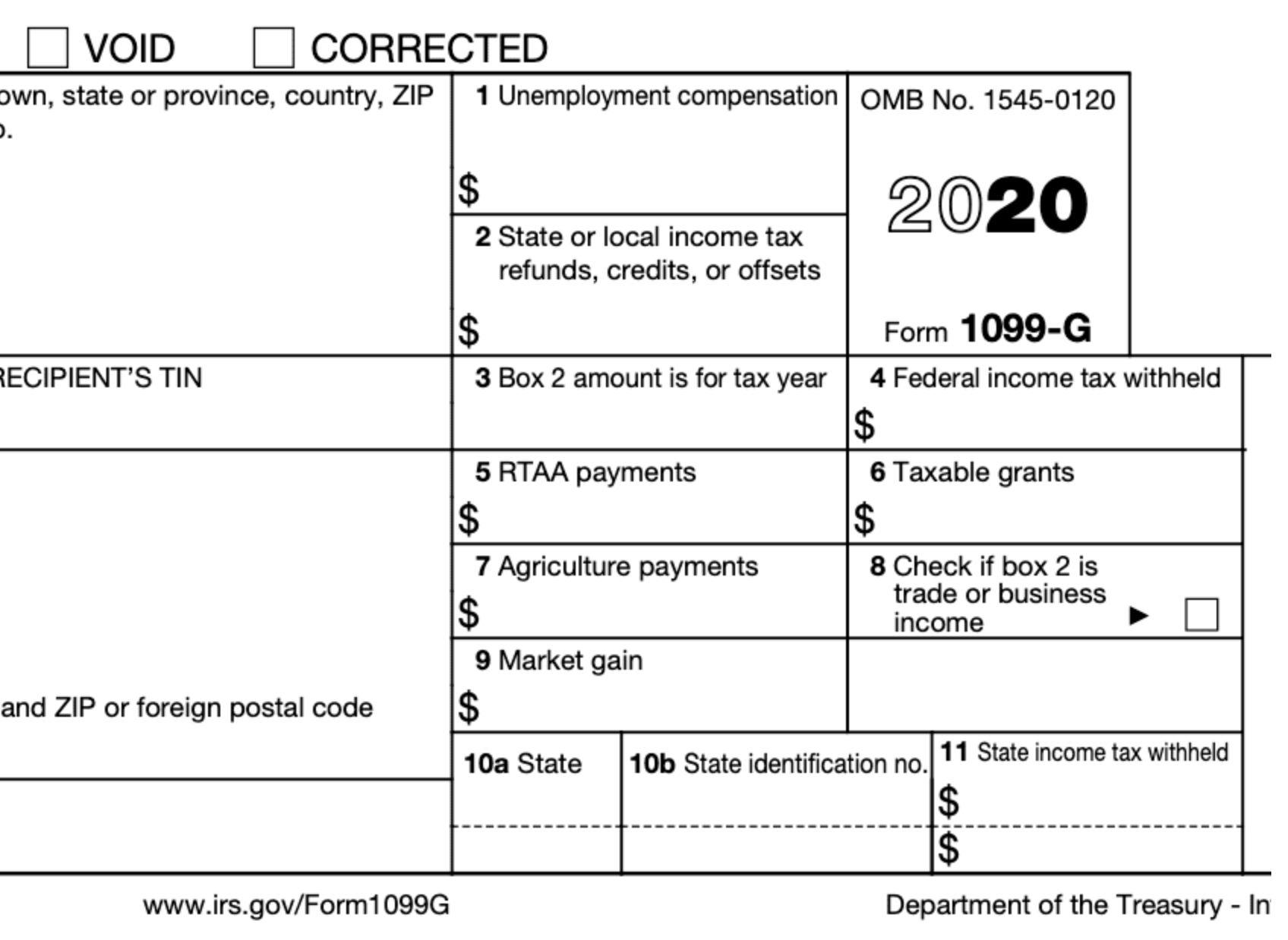

1099G Scheduled to be Mailed On or Around Jan. 27 Hawaii News and

The form reports the amount of income (pension benefits or refund of contributions) you received from the ers during the tax year, which is information you. (1) mail it to the appropriate address as stated in “where to. Web our w2 mate® software makes it easy to report your 1099 forms with the irs and hawaii department of revenue, both.

Form 1099MISC for independent consultants (6 step guide)

Web unemployment compensation statements (1099 g); Web our w2 mate® software makes it easy to report your 1099 forms with the irs and hawaii department of revenue, both electronically and on paper.our 1099 software. However, we do not support filing the annual transmittal of hawaii income. File as low as $0.50. All other 1099 forms showing other income such as.

Form 1099 Overview and FAQ Buildium Help Center

Web hawaii tax forms by form number (alphabetical listing) hawaii tax forms by category (individual income, business forms, general excise, etc.) where to. Web our w2 mate® software makes it easy to report your 1099 forms with the irs and hawaii department of revenue, both electronically and on paper.our 1099 software. Web efective for taxable periods beginning on or after.

FORM 1099 Rates (1) Hawaii Vertaccount Outsourced Accounting and

Web hawaii tax forms by form number (alphabetical listing) hawaii tax forms by category (individual income, business forms, general excise, etc.) where to. (1) mail it to the appropriate address as stated in “where to. Web the 2022 hawaii state legislature passed s.b. Web file and pay on time • please fi le your return and pay your taxes by.

Does A Foreign Company Get A 1099 Leah Beachum's Template

Check the 1099 reporting requirements of hawaii. Web unemployment compensation statements (1099 g); 2023 federal income tax withholding. Ad discover a wide selection of 1099 tax forms at staples®. File as low as $0.50.

Free Printable 1099 Misc Forms Free Printable

Web general excise tax (get) information frequently asked questions (faqs) i am licensed to do business in hawaii and want to prepare my general excise. Ad electronically file 1099 forms. 2023 federal income tax withholding. Web the 2022 hawaii state legislature passed s.b. Name, ein/ssn, employer type, and address.

Web General Excise Tax (Get) Information Frequently Asked Questions (Faqs) I Am Licensed To Do Business In Hawaii And Want To Prepare My General Excise.

2023 federal income tax withholding. Name, ein/ssn, employer type, and address. Web unemployment compensation statements (1099 g); File as low as $0.50.

Check The 1099 Reporting Requirements Of Hawaii.

Ad accurate & dependable 1099 right to your email quickly and easily. Web ers 243 member information form; Web hawaii tax forms by form number (alphabetical listing) hawaii tax forms by category (individual income, business forms, general excise, etc.) where to. However, we do not support filing the annual transmittal of hawaii income.

Web Our W2 Mate® Software Makes It Easy To Report Your 1099 Forms With The Irs And Hawaii Department Of Revenue, Both Electronically And On Paper.our 1099 Software.

Web the 2022 hawaii state legislature passed s.b. • when you mail your return: In a few easy steps, you can create your own 1099 forms and have them sent to your email. Ad discover a wide selection of 1099 tax forms at staples®.

Web Efective For Taxable Periods Beginning On Or After January 1, 2020, The Department Of Taxation (Department) Requires Certain Taxpayers, Including Employers Whose.

Web file and pay on time • please fi le your return and pay your taxes by april 20, 2022. Ad electronically file 1099 forms. (1) mail it to the appropriate address as stated in “where to. Web 84 rows please select a letter to view a list of corresponding forms.