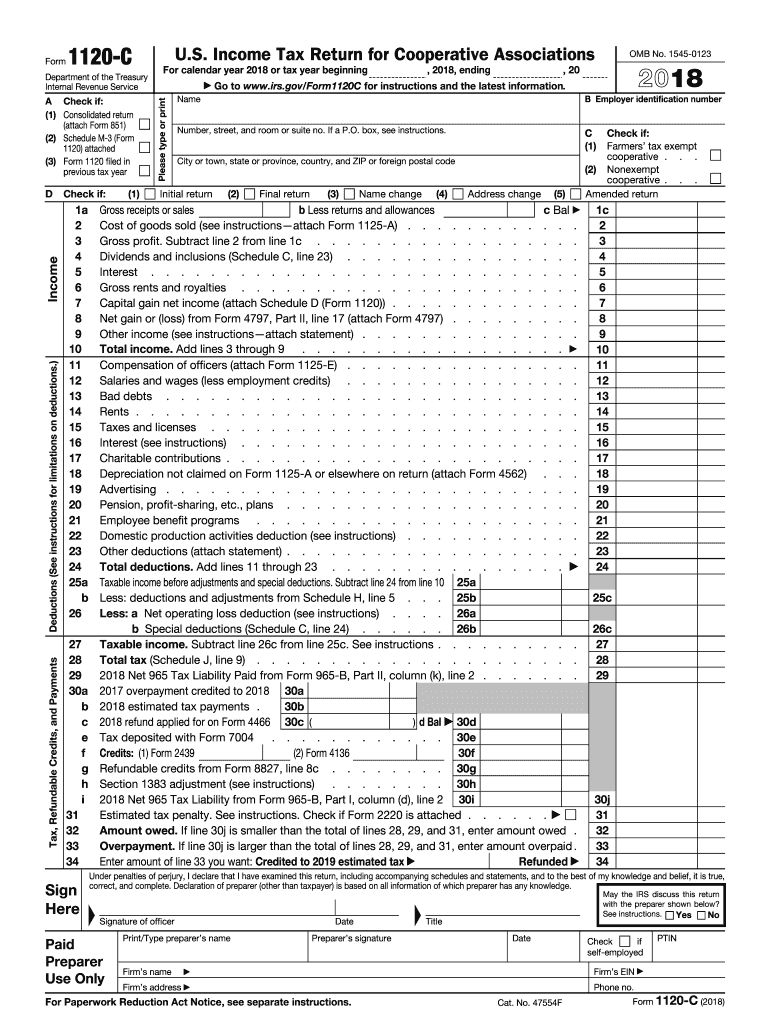

2018 Form 1120

2018 Form 1120 - It is also called the u.s. For instructions and the latest information. American corporations use this form to report to the irs their income, gains, losses deductions and credits. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Corporation income tax return, is used to report corporate income taxes to the irs. Corporation income tax return, for federal purposes, write “irc 965” at the top of form 100, california corporation franchise or income tax return. Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Go to www.irs.gov/form1120s for instructions and the latest information. Web information about form 1120, u.s. And forms 940, 941, and 944 (employment tax returns).

Web information about form 1120, u.s. Corporation income tax return, is used to report corporate income taxes to the irs. Web a 1120 tax form is an internal revenue service (irs) form that corporations use to find out their tax liability, or how much business tax they owe. Number, street, and room or suite no. Number, street, and room or suite no. Corporation income tax return for calendar year 2018 or tax year beginning, 2018, ending, 20. For instructions and the latest information. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Web form 1120 department of the treasury internal revenue service u.s.

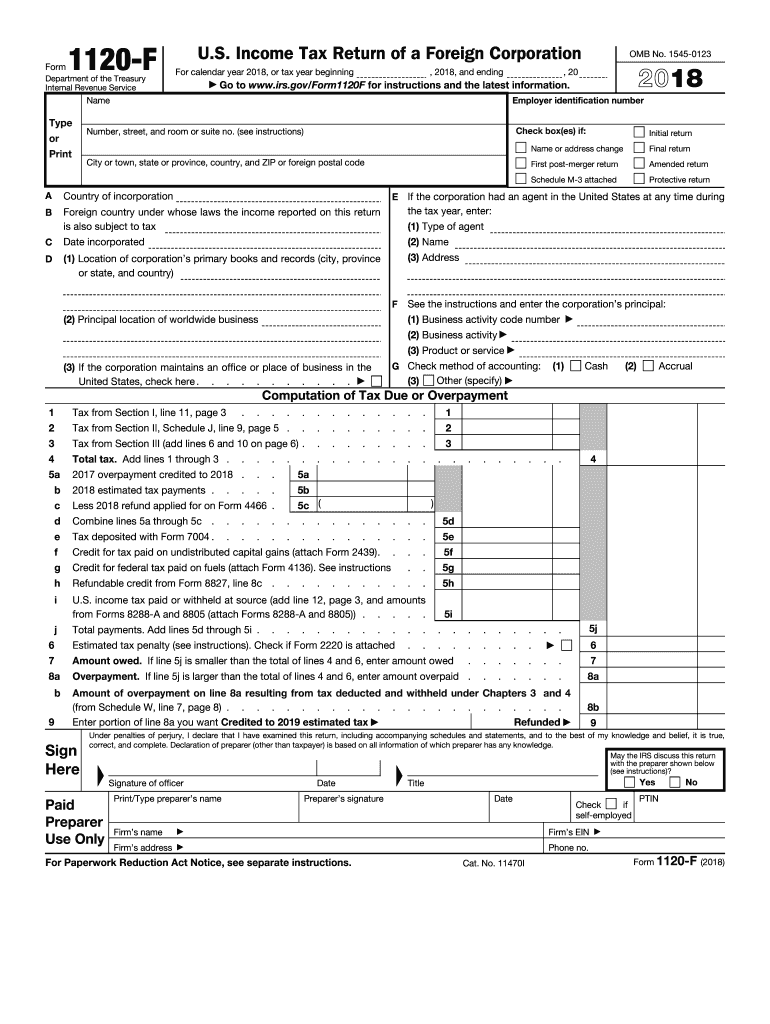

For instructions and the latest information. Income tax return of a foreign corporation for calendar year 2018, or tax year beginning, 2018, and ending, 20. Number, street, and room or suite no. Web irs form 1120, the u.s. It can also be used to report income for other business entities that have elected to be taxed as corporations, such as an llc that has filed an election to use this tax option. Web form 1120s department of the treasury internal revenue service u.s. Go to www.irs.gov/form1120s for instructions and the latest information. Corporation income tax return, is used to report corporate income taxes to the irs. Web a 1120 tax form is an internal revenue service (irs) form that corporations use to find out their tax liability, or how much business tax they owe. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation.

Form 1120 Schedule J Instructions

Corporation income tax return, is used to report corporate income taxes to the irs. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Corporation income tax return for calendar year 2018 or tax year beginning, 2018, ending, 20. American corporations.

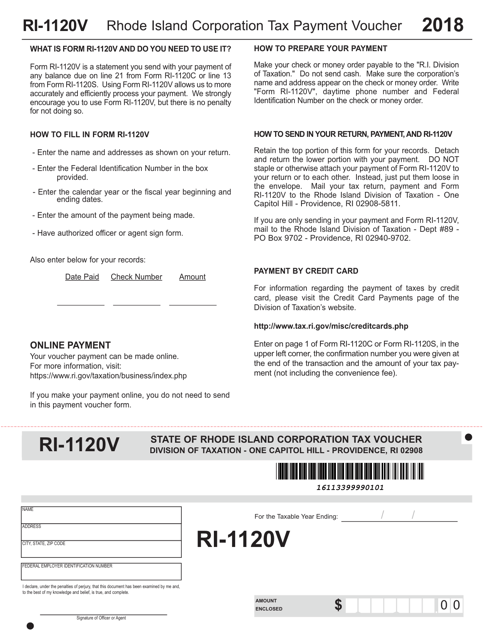

Form RI1120V Download Fillable PDF or Fill Online Corporation Tax

Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. For instructions and the latest information. Income tax return of a foreign corporation for calendar year 2018, or tax year beginning, 2018, and ending, 20. American corporations use this form to.

IRS Form 1120F Schedule M1 & M2 2018 2019 Fill out and Edit

Go to www.irs.gov/form1120s for instructions and the latest information. Form 7004 (automatic extension of time to file); Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. It can also be used to report income for other business entities that have elected to be taxed as corporations, such as.

2018 Form 1120 Federal Corporation Tax Return YouTube

Number, street, and room or suite no. Web irs form 1120, the u.s. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. It can also be used to report income for other business entities that have elected to be taxed.

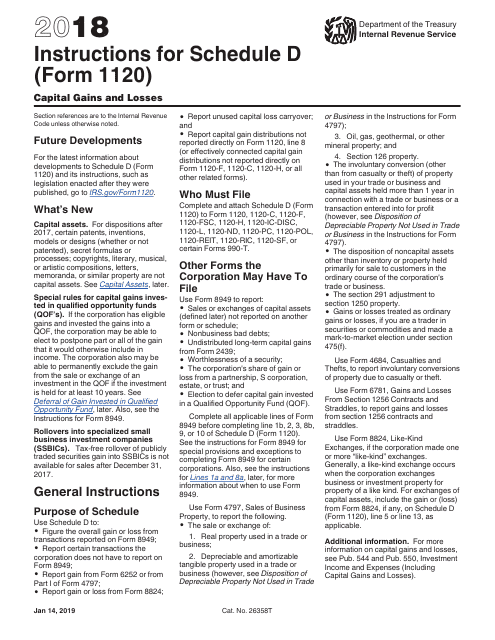

Download Instructions for IRS Form 1120 Schedule D Capital Gains and

For instructions and the latest information. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Go to www.irs.gov/form1120s for instructions and the latest information. Web irs form 1120, the u.s. Income tax return of a foreign corporation for calendar year.

Irs Non Filing Statement Form Fill Out and Sign Printable PDF

Corporation income tax return, including recent updates, related forms and instructions on how to file. Corporation income tax return, for federal purposes, write “irc 965” at the top of form 100, california corporation franchise or income tax return. Corporation income tax return, is used to report corporate income taxes to the irs. Number, street, and room or suite no. Number,.

1120 Fill Out and Sign Printable PDF Template signNow

Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Corporation income tax return, including recent updates, related forms and instructions on how to file. It is also called the u.s. Web if the corporation reported irc section 965 inclusions and.

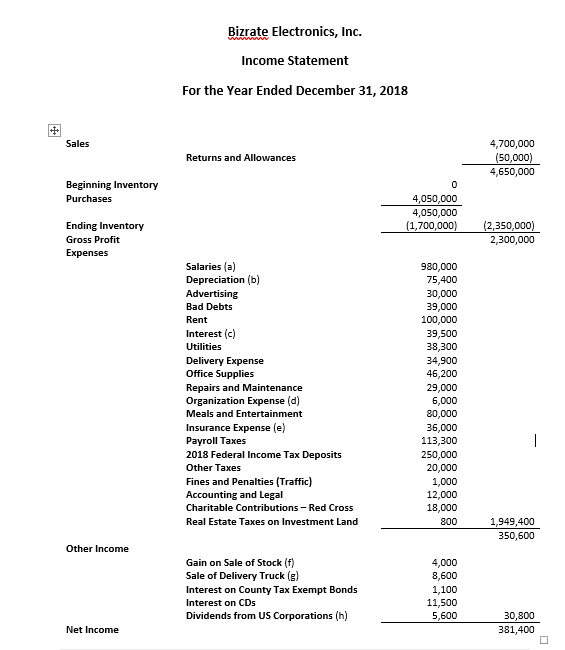

Based on the given information (Links to an external

Web information about form 1120, u.s. Corporation income tax return, for federal purposes, write “irc 965” at the top of form 100, california corporation franchise or income tax return. Web a 1120 tax form is an internal revenue service (irs) form that corporations use to find out their tax liability, or how much business tax they owe. Income tax return.

Instructions for IRS Form 1120w Estimated Tax for Corporations

Income tax return of a foreign corporation for calendar year 2018, or tax year beginning, 2018, and ending, 20. Corporation income tax return for calendar year 2018 or tax year beginning, 2018, ending, 20. Form 7004 (automatic extension of time to file); It can also be used to report income for other business entities that have elected to be taxed.

IRS Form 1120W 2018 2019 Fillable and Editable PDF Template

Go to www.irs.gov/form1120s for instructions and the latest information. Web irs form 1120, the u.s. It can also be used to report income for other business entities that have elected to be taxed as corporations, such as an llc that has filed an election to use this tax option. For instructions and the latest information. Web a 1120 tax form.

Income Tax Return Of A Foreign Corporation For Calendar Year 2018, Or Tax Year Beginning, 2018, And Ending, 20.

Number, street, and room or suite no. For instructions and the latest information. Web if the corporation reported irc section 965 inclusions and deductions on form 1120, u.s. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation.

Web Form 1120S Department Of The Treasury Internal Revenue Service U.s.

Web information about form 1120, u.s. Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Web a 1120 tax form is an internal revenue service (irs) form that corporations use to find out their tax liability, or how much business tax they owe. Corporation income tax return for calendar year 2018 or tax year beginning, 2018, ending, 20.

Corporation Income Tax Return, Is Used To Report Corporate Income Taxes To The Irs.

Number, street, and room or suite no. And forms 940, 941, and 944 (employment tax returns). It can also be used to report income for other business entities that have elected to be taxed as corporations, such as an llc that has filed an election to use this tax option. Web irs form 1120, the u.s.

It Is Also Called The U.s.

Go to www.irs.gov/form1120s for instructions and the latest information. Form 7004 (automatic extension of time to file); Corporation income tax return, including recent updates, related forms and instructions on how to file. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation.