2020 Form 941 Instructions

2020 Form 941 Instructions - Web see the instructions for schedule d (form 941) to determine whether you should file schedule d (form 941) and when you should file it. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. How should you complete form 941? Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Part 2:tell us about your deposit schedule and tax. Part 1:answer these questions for this quarter. Web instructions for form 941(rev. Web form 941 employer's quarterly federal tax return. File your initial form 941 for the quarter in which you first paid wages that are subject to social security and medicare taxes or subject to federal income tax withholding. Web instructions for form 941(rev.

How should you complete form 941? Web see the instructions for schedule d (form 941) to determine whether you should file schedule d (form 941) and when you should file it. Instructions for form 941, employer's quarterly federal tax return created date: Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Part 2:tell us about your deposit schedule and tax. Web instructions for form 941(rev. Web instructions for form 941(rev. Adjustment of tax on tips. File your initial form 941 for the quarter in which you first paid wages that are subject to social security and medicare taxes or subject to federal income tax withholding. Web form 940 (2020) employer's annual federal unemployment (futa) tax return.

Instructions for form 940 (2020) pdf. Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax. File your initial form 941 for the quarter in which you first paid wages that are subject to social security and medicare taxes or subject to federal income tax withholding. Web instructions for form 941(rev. The july 2020 revision of form 941 will be used to report employment taxes beginning with the third quarter of 2020. Web instructions for form 941(rev. Web form 940 (2020) employer's annual federal unemployment (futa) tax return. Part 2:tell us about your deposit schedule and tax. January 2020) employer's quarterly federal tax return department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted.

How to Fill out IRS Form 941 Simple StepbyStep Instructions YouTube

April 2020) employer's quarterly federal tax return department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Part 1:answer these questions for this quarter. Employer s quarterly federal tax return keywords: Adjustment of tax on tips. Form 941 has been revised to allow employers that defer the withholding and payment of the.

New 941 form for second quarter payroll reporting

April 2020) employer's quarterly federal tax return department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Employer s quarterly federal tax return keywords: How should you complete form 941? Web.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

What about penalties and interest? Web purpose of form 941. January 2020) employer's quarterly federal tax return department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Web changes to form.

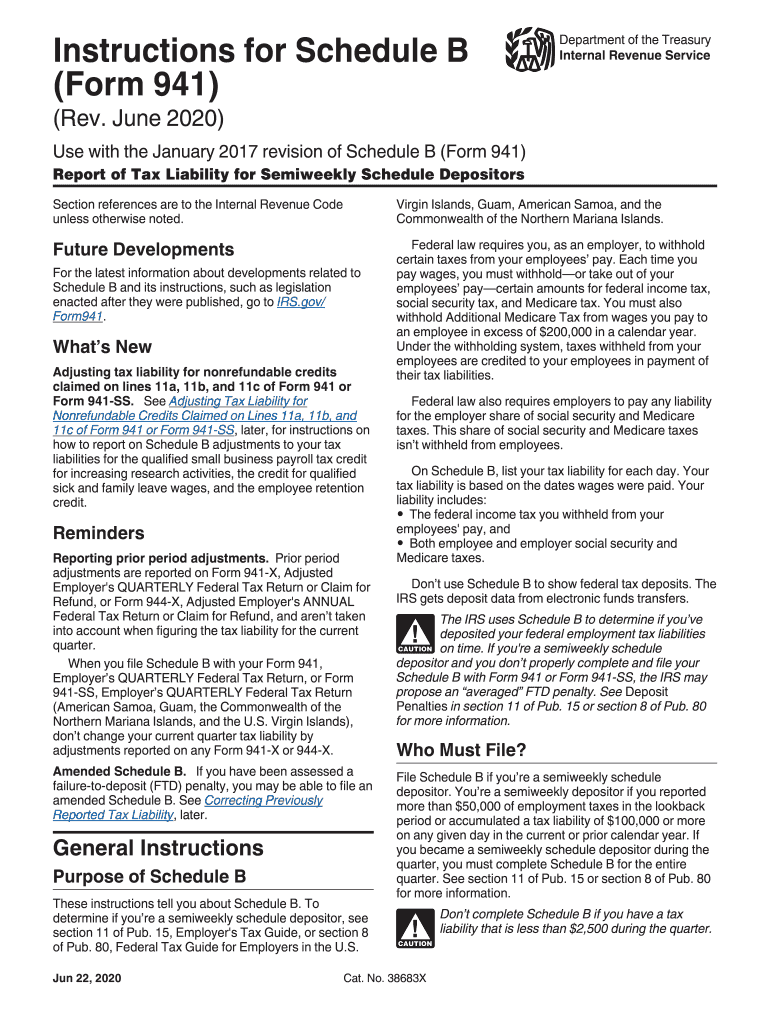

Fillable Online Instructions for Schedule B (Form 941) (Rev. June 2020

Web changes to form 941 (rev. Who must file form 941? Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web see the instructions for schedule d (form 941) to determine whether you should file schedule d (form 941) and when you should file it. Form 941 has.

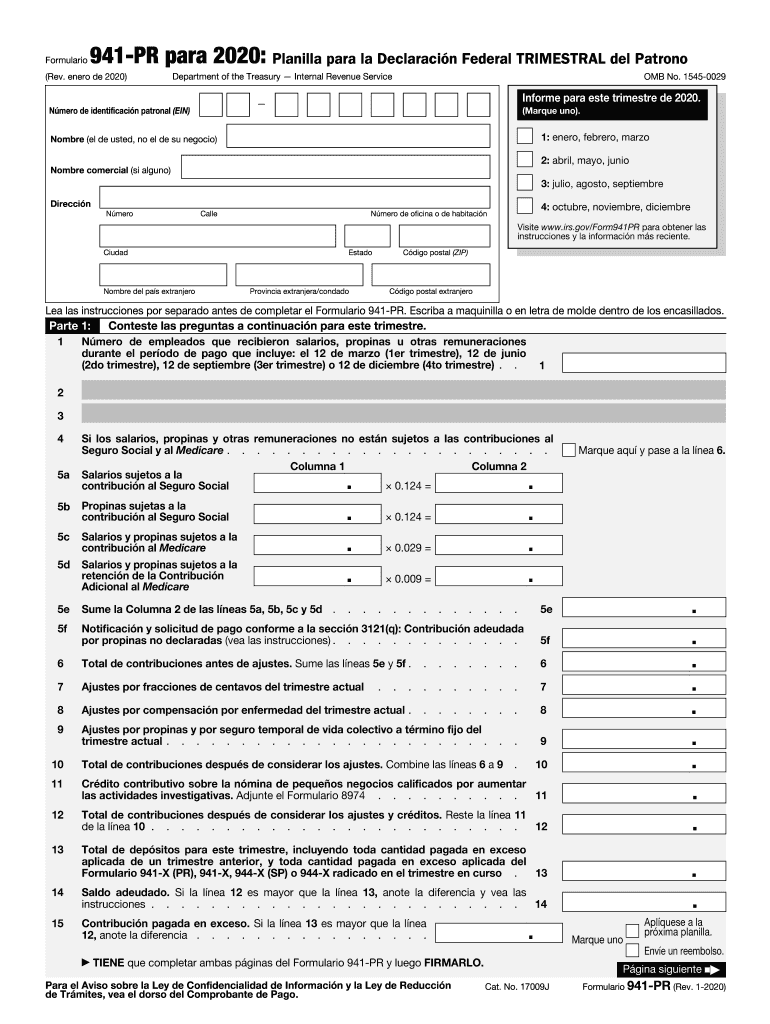

2020 Form IRS 941PR Fill Online, Printable, Fillable, Blank PDFfiller

Instructions for form 941, employer's quarterly federal tax return created date: Part 1:answer these questions for this quarter. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security.

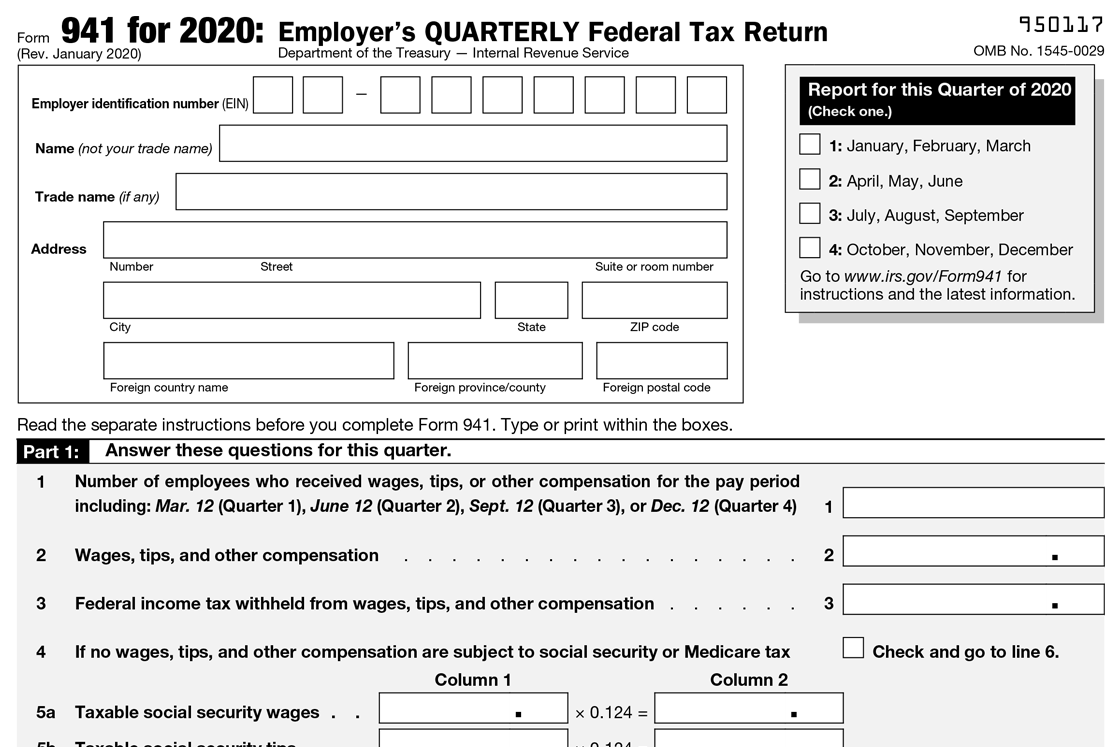

Form 941 for 20 Employer's Quarterly Federal Tax Return

Employer s quarterly federal tax return keywords: Who must file form 941? The july 2020 revision of form 941 will be used to report employment taxes beginning with the third quarter of 2020. How should you complete form 941? Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security.

What is the IRS Form 941? Form 941 Instructions and Information

Web form 940 (2020) employer's annual federal unemployment (futa) tax return. Part 2:tell us about your deposit schedule and tax. Instructions for form 941, employer's quarterly federal tax return created date: Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. How should.

What Is Form 941 and How Do I File It? Ask Gusto

Employer s quarterly federal tax return keywords: What about penalties and interest? Web instructions for form 941(rev. January 2020) employer's quarterly federal tax return department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web form 941 employer's quarterly federal tax return.

IRS 941SS 2020 Fill and Sign Printable Template Online US Legal Forms

Instructions for form 941, employer's quarterly federal tax return created date: Web changes to form 941 (rev. File your initial form 941 for the quarter in which you first paid wages that are subject to social security and medicare taxes or subject to federal income tax withholding. Web purpose of form 941. Instructions for form 940 (2020) pdf.

Draft of Revised Form 941 Released by IRS Includes FFCRA and CARES

Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Instructions for form 940 (2020) pdf. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. File your initial form 941 for.

Form 941 Is Used By Employers Who Withhold Income Taxes From Wages Or Who Must Pay Social Security Or Medicare Tax.

Part 1:answer these questions for this quarter. Employer s quarterly federal tax return keywords: Part 2:tell us about your deposit schedule and tax. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax.

April 2020) Employer's Quarterly Federal Tax Return Department Of The Treasury Internal Revenue Service Section References Are To The Internal Revenue Code Unless Otherwise Noted.

What about penalties and interest? Instructions for form 940 (2020) pdf. How should you complete form 941? Adjustment of tax on tips.

Web Information About Form 941, Employer's Quarterly Federal Tax Return, Including Recent Updates, Related Forms, And Instructions On How To File.

January 2020) employer's quarterly federal tax return department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. The july 2020 revision of form 941 will be used to report employment taxes beginning with the third quarter of 2020. File your initial form 941 for the quarter in which you first paid wages that are subject to social security and medicare taxes or subject to federal income tax withholding. Web instructions for form 941 (rev.

Web Instructions For Form 941(Rev.

Who must file form 941? Instructions for form 941, employer's quarterly federal tax return created date: Web see the instructions for schedule d (form 941) to determine whether you should file schedule d (form 941) and when you should file it. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax.