2022 Form 592

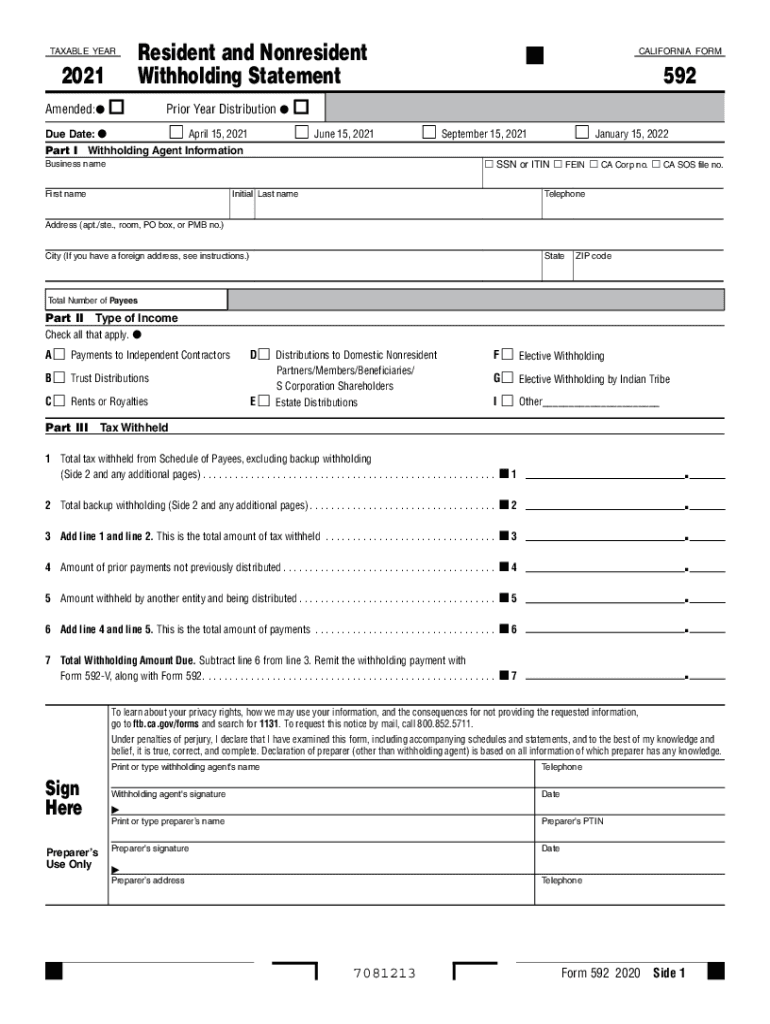

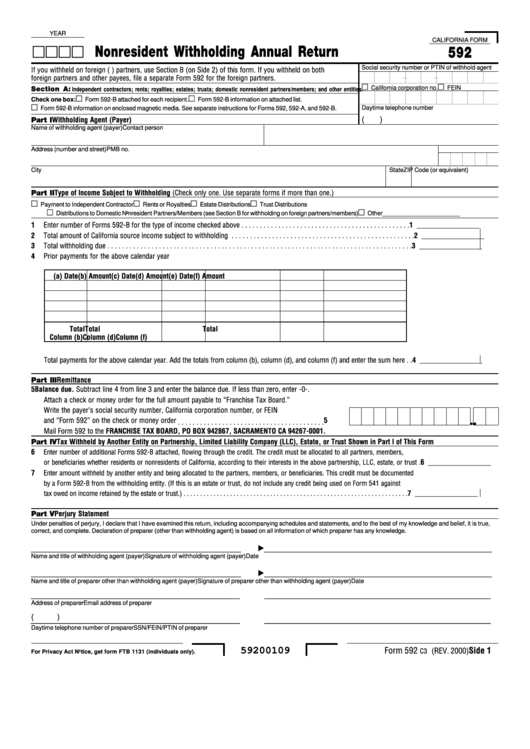

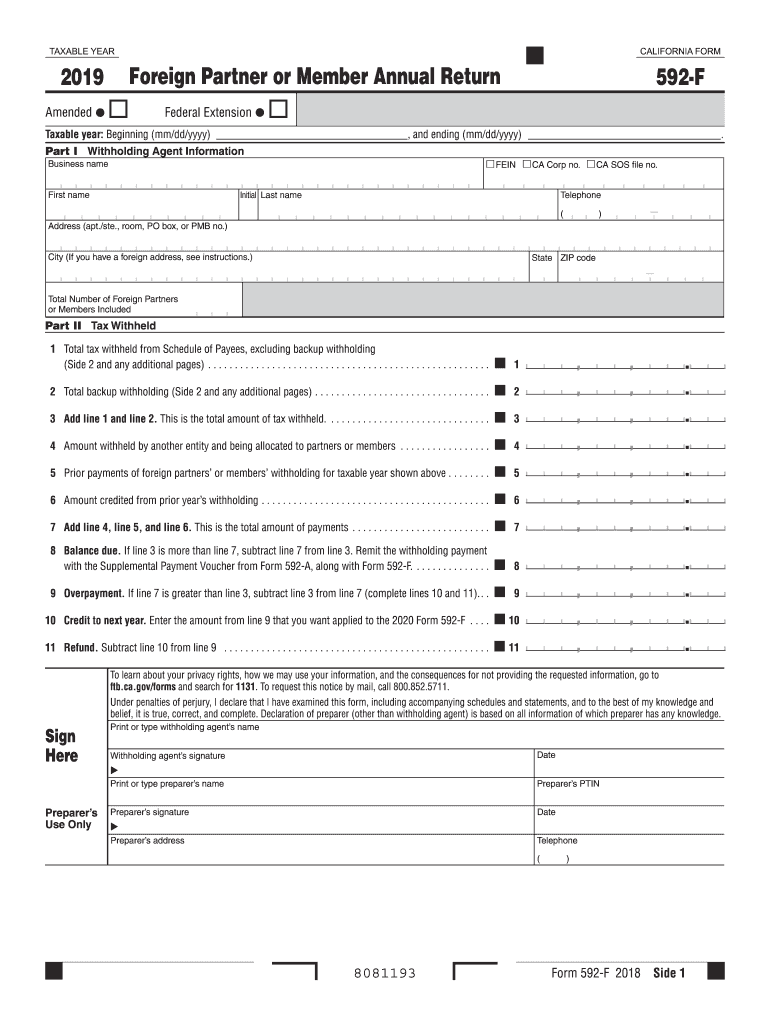

2022 Form 592 - This schedule will allow the ftb to allocate the withholding payments to the payee upon receipt of the completed form 592. First name initial last name telephone address (apt./ste., room, po box, or pmb no.) city (if you have a foreign address, see instructions.) state zip code Ultratax cs will complete all necessary forms for domestic partners and calculate the total tax due. Web more about the california form 592 individual income tax nonresident ty 2022 this form asks for the withholding agent's information along with the type of income they have the estimated total of tax being withheld from the schedule of payees. This schedule will allow the ftb to allocate the withholding payments to the payee upon receipt of the completed form 592. Web form 592, resident and nonresident withholding statement can be added to the return by marking the 592 withholding checkbox in file > client properties > california tab. Web form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding amounts. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. Web form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding amounts. Business name ssn or itin fein ca corp no.

First name initial last name telephone address (apt./ste., room, po box, or pmb no.) city (if you have a foreign address, see instructions.) state zip code This schedule will allow the ftb to allocate the withholding payments to the payee upon receipt of the completed form 592. Ultratax cs will complete all necessary forms for domestic partners and calculate the total tax due. Web form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding amounts. Web form 592, resident and nonresident withholding statement can be added to the return by marking the 592 withholding checkbox in file > client properties > california tab. Web more about the california form 592 individual income tax nonresident ty 2022 this form asks for the withholding agent's information along with the type of income they have the estimated total of tax being withheld from the schedule of payees. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. This schedule will allow the ftb to allocate the withholding payments to the payee upon receipt of the completed form 592. Web form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding amounts. Business name ssn or itin fein ca corp no.

Web more about the california form 592 individual income tax nonresident ty 2022 this form asks for the withholding agent's information along with the type of income they have the estimated total of tax being withheld from the schedule of payees. Business name ssn or itin fein ca corp no. Web form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding amounts. Web form 592, resident and nonresident withholding statement can be added to the return by marking the 592 withholding checkbox in file > client properties > california tab. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. This schedule will allow the ftb to allocate the withholding payments to the payee upon receipt of the completed form 592. Web form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding amounts. Ultratax cs will complete all necessary forms for domestic partners and calculate the total tax due. First name initial last name telephone address (apt./ste., room, po box, or pmb no.) city (if you have a foreign address, see instructions.) state zip code This schedule will allow the ftb to allocate the withholding payments to the payee upon receipt of the completed form 592.

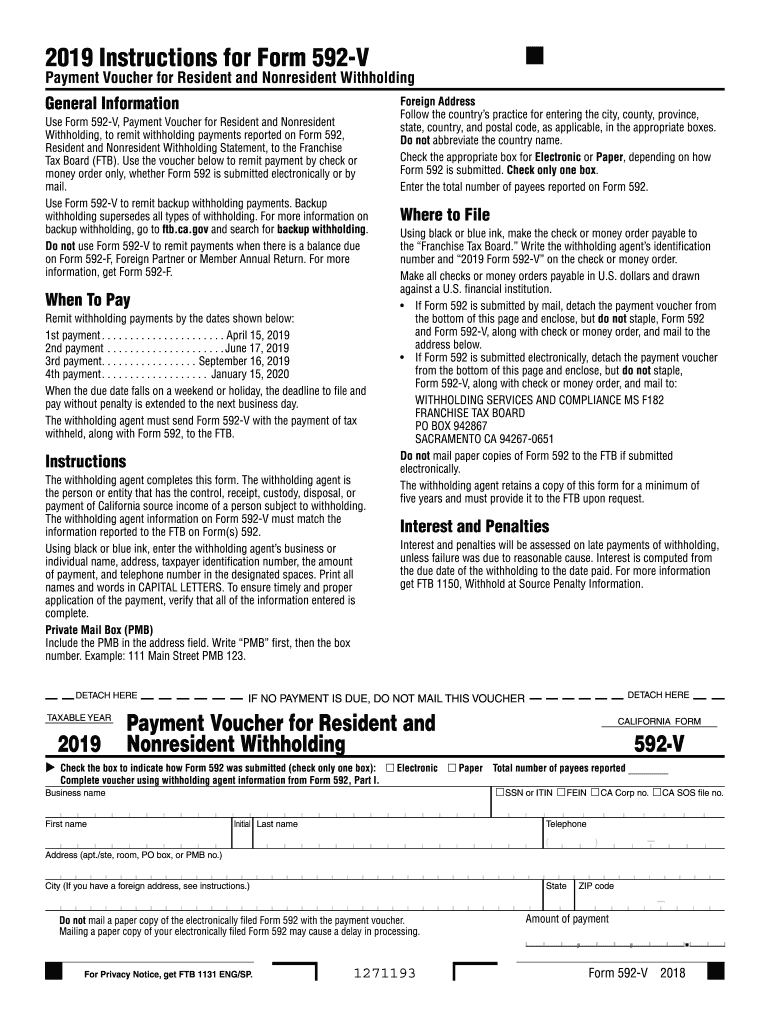

California form 592 v 2019 Fill out & sign online DocHub

Web more about the california form 592 individual income tax nonresident ty 2022 this form asks for the withholding agent's information along with the type of income they have the estimated total of tax being withheld from the schedule of payees. This schedule will allow the ftb to allocate the withholding payments to the payee upon receipt of the completed.

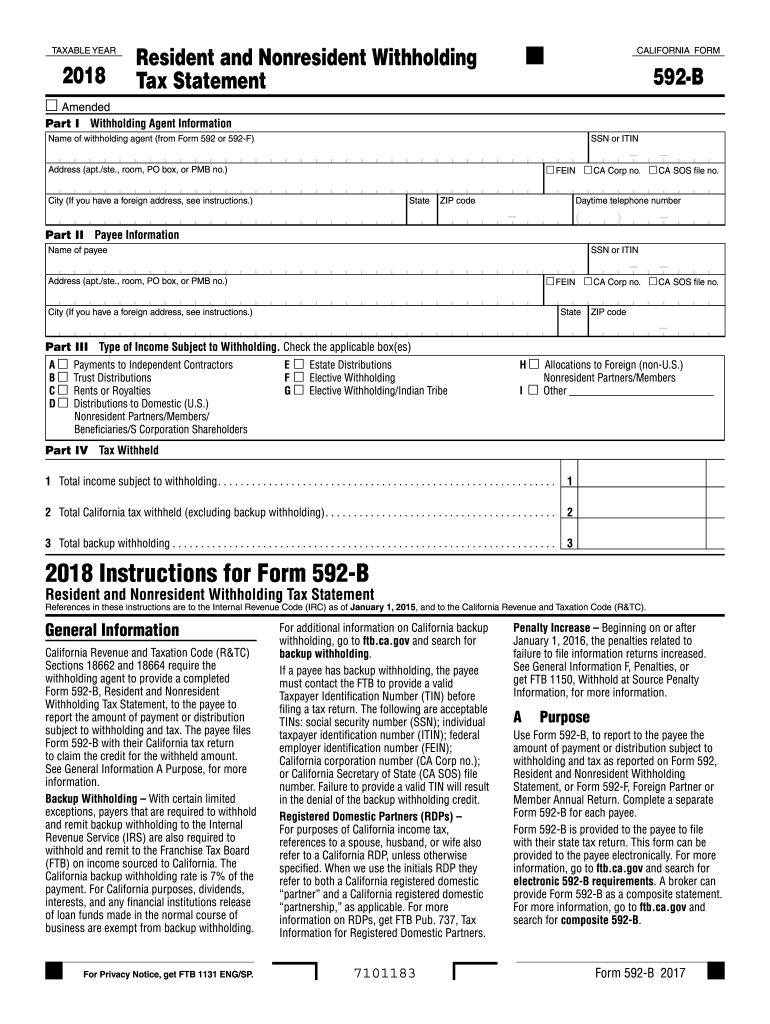

592B Form Franchise Tax Board Edit, Fill, Sign Online Handypdf

Web form 592, resident and nonresident withholding statement can be added to the return by marking the 592 withholding checkbox in file > client properties > california tab. Ultratax cs will complete all necessary forms for domestic partners and calculate the total tax due. Web form 592 includes a schedule of payees section, on side 2, that requires the withholding.

2018 form 592B Resident and Nonresident Withholding. 2018, form 592B

• april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. This schedule will allow the ftb to allocate the withholding payments to the payee upon receipt of the completed form 592. Web form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income amounts, and the.

Form 592 Pte Fill Online, Printable, Fillable, Blank pdfFiller

First name initial last name telephone address (apt./ste., room, po box, or pmb no.) city (if you have a foreign address, see instructions.) state zip code Web more about the california form 592 individual income tax nonresident ty 2022 this form asks for the withholding agent's information along with the type of income they have the estimated total of tax.

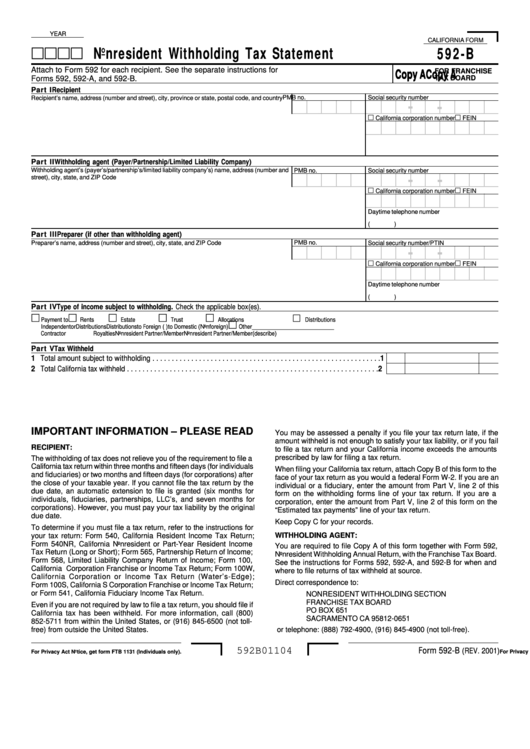

Form 592B Nonresident Withholding Tax Statement 2001 printable pdf

Web form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding amounts. Business name ssn or itin fein ca corp no. This schedule will allow the ftb to allocate the withholding payments to the payee upon receipt of the completed form 592. Ultratax cs.

ftb.ca.gov forms 09_592v

Web form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding amounts. This schedule will allow the ftb to allocate the withholding payments to the payee upon receipt of the completed form 592. Ultratax cs will complete all necessary forms for domestic partners and.

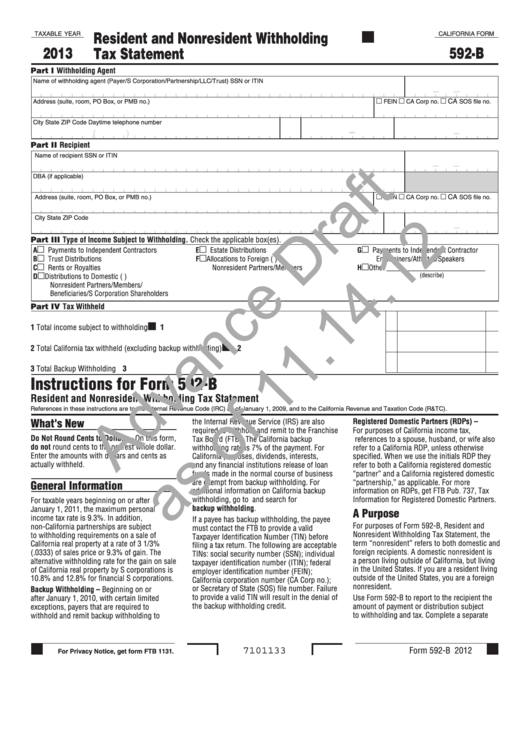

California Form 592B Draft Resident And Nonresident Withholding Tax

Web more about the california form 592 individual income tax nonresident ty 2022 this form asks for the withholding agent's information along with the type of income they have the estimated total of tax being withheld from the schedule of payees. First name initial last name telephone address (apt./ste., room, po box, or pmb no.) city (if you have a.

Ca 592 form Fill out & sign online DocHub

Ultratax cs will complete all necessary forms for domestic partners and calculate the total tax due. Web form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding amounts. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. Web form 592.

California Form 592 Nonresident Withholding Annual Return printable

Web form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding amounts. Ultratax cs will complete all necessary forms for domestic partners and calculate the total tax due. Web form 592, resident and nonresident withholding statement can be added to the return by marking.

592 F Fill Out and Sign Printable PDF Template signNow

Web form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding amounts. This schedule will allow the ftb to allocate the withholding payments to the payee upon receipt of the completed form 592. First name initial last name telephone address (apt./ste., room, po box,.

• April 18, 2022 June 15, 2022 September 15, 2022 January 17, 2023.

First name initial last name telephone address (apt./ste., room, po box, or pmb no.) city (if you have a foreign address, see instructions.) state zip code Business name ssn or itin fein ca corp no. Web form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding amounts. Web form 592, resident and nonresident withholding statement can be added to the return by marking the 592 withholding checkbox in file > client properties > california tab.

Web More About The California Form 592 Individual Income Tax Nonresident Ty 2022 This Form Asks For The Withholding Agent's Information Along With The Type Of Income They Have The Estimated Total Of Tax Being Withheld From The Schedule Of Payees.

This schedule will allow the ftb to allocate the withholding payments to the payee upon receipt of the completed form 592. Ultratax cs will complete all necessary forms for domestic partners and calculate the total tax due. This schedule will allow the ftb to allocate the withholding payments to the payee upon receipt of the completed form 592. Web form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding amounts.